AGGRESSIVE ETF PORTFOLIO UPDATE

SUMMARY

It's Friday and the Aggressive ETF portfolio is reflecting the market volatility as the ETFs represent the S&P 500, Nasdaq 100 and the inverse VIX with Treasuries. When the market panics, all instruments fall and sizable volatilities have been the norm for the week.

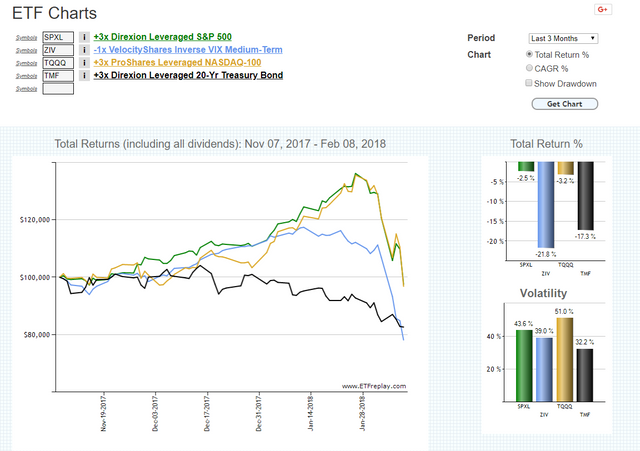

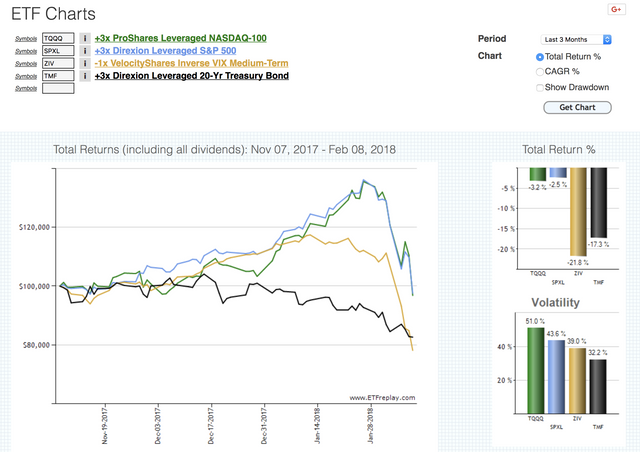

Regardless, I'm following my disciplined approach of identifying which ETF is the new receiver of the funds. The below chart shows that all ETFs are negative as is often the temporary case during a market sell off. Since treasuries are not 1:1 inversely correlated with the equities; they too can decline along with equities during market sell offs. Given the least decline value, SPXL has received the funds. I also did not make any adjustments until Friday and as market had recovered quite a bit from earlier in the week, the discipline to maintain the same Friday timing is of value.

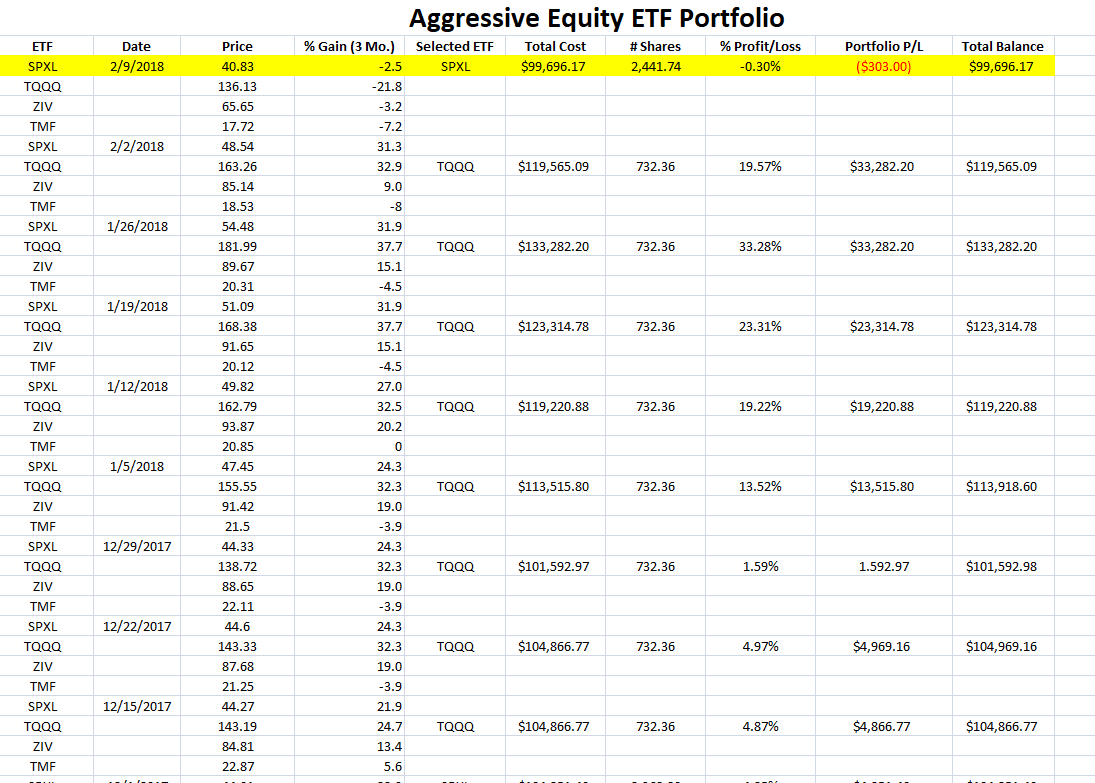

The below Excel layout shows that the portfolio is at -$303 or 0.30% loss. When emotions run the show, many will grudge the decline and pine for the profits or panic sell. This portfolio, however, is designed to follow the trend and avoid panic or FOMO temptations. Let's see what next week brings.

Given these are leveraged ETFs, the drawdowns are heavier; but so are the upsides. Still, these ETFs are NOT designed to withstand the level of market wide sell offs such as the 2008 financial crisis. I have placed a 20% stop limit on the portfolio. In other words, at $80k portfolio balance drawdown; this portfolio will be stopped out into 100% cash or TMF should it be the most positive in return. I find this event to be unlikely, but a stop loss setup has been placed as a de-risk attribute.

Legal Disclaimer: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.

Please consider reviewing these Tutorials on:

Elliott Wave Counting Tutorial #1

Elliott Wave Counting Tutorial #2

Elliott Wave Counting Tutorial #3

Laddering and Buy/Sell Setups.

Laddering Example with EOS

Tutorial on the use of Fibonacci & Elliott Waves

@haejin's Trading Nuggets

Essay: Is Technical Analysis a Quantum Event?

Follow me on Twitter for Real Time Alerts!!

Follow me on StockTwits for UpDates!!

--

--

If this blog post has entertained or helped you to profit, please follow, upvote, resteem and/or consider buying me a beer:

BTC Wallet - 1HMFpq4tC7a2acpjD45hCT4WqPNHXcqpof

ETH Wallet - 0x1Ab87962dD59BBfFe33819772C950F0B38554030

LTC Wallet - LecCNCzkt4vjVq2i3bgYiebmr9GbYo6FQf

Uncertainty in the stock market is causing money to migrate from stocks back into cryptos. This more than anything is lifting the price in the space.

Stop Loss = Smart Move :)

TGIF!!!

Totally cool idea, then he can use the 80k to buy the dip (crash/sell off) and make profits regardless

exactly! losing $33k in 2 weeks is cringe worthy.

missing Stop Loss for BTS

Feels like your ass handed out to police every day

You are a detail oriented person, Good Work. Keep it up.

Thanks.

Hey what you think!!

Wow ,Thanks! For The Info Men :3

Hi Haegin, how do you sell and buy them fast? Sale only settles at the end of day right. So you try to sell on Friday and buy on Monday lets say?

Nice. What's your take on Silver btw? Looks kinda ready to take off from here in my view

Another great post!

I really appreciate the time you take when writing something!

감사합니다^^ 즐거운 주말 보내세요

You too.

Chart with TMF

what up what you think minnow student here!?

Thanks! I also have a non-leveraged portfolio with EDV rather than TMF.

Good to see the market recovering. Thanks Haejin.

Can u please update Tron, and verge ?