1st Blood Analysis: Cup & Handle Bullish Pattern Still in Progress

SUMMARY

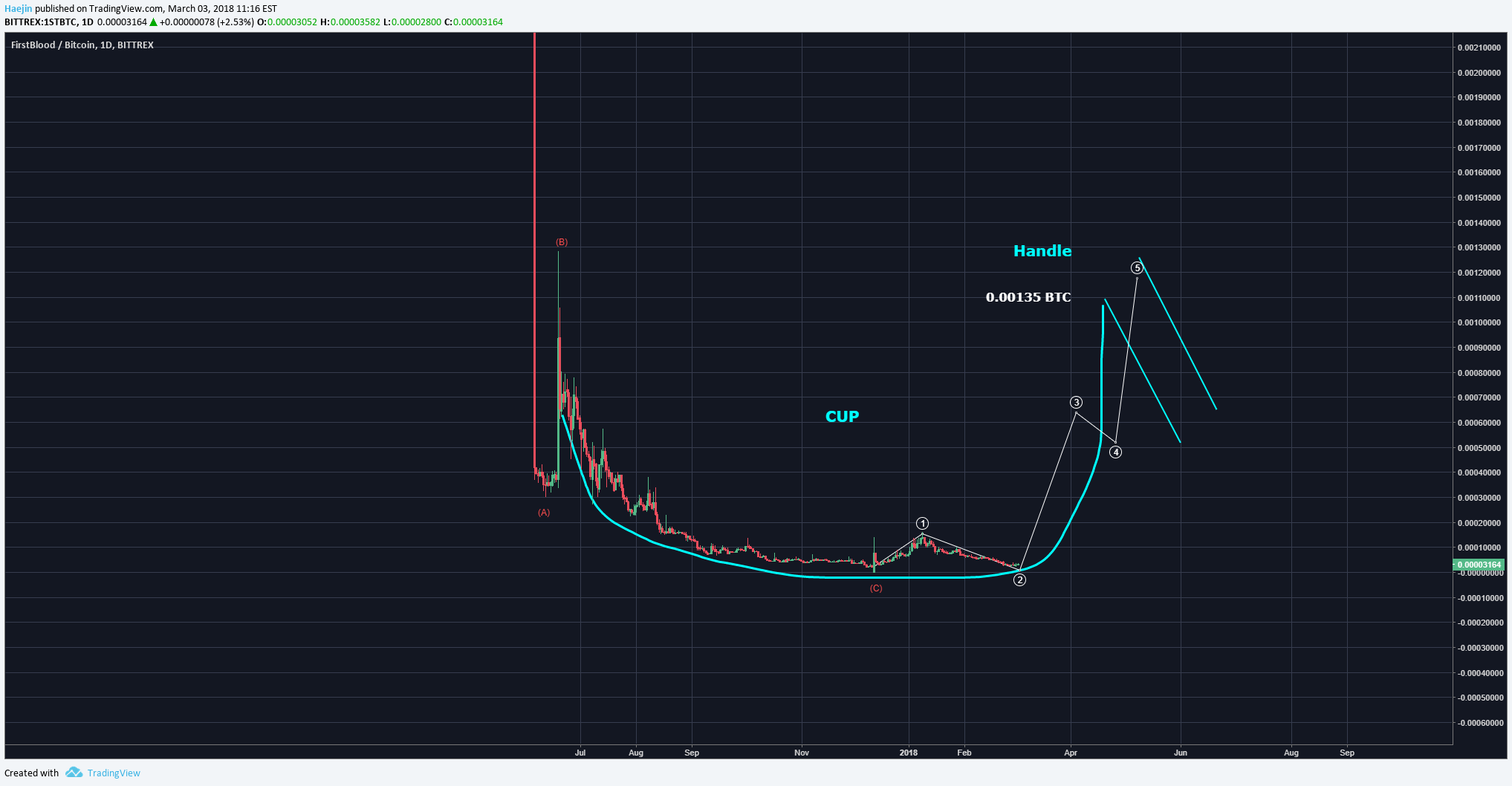

If you recall how long the Cup & Handle pattern for Steem took back last year, many sold and left out of frustration. When STEEM was sub $1, it seemed as if the pattern would never finish. Well, it's not so different for 1st Blood. And yes, these Cup & Handles take a very long time and often outlasts most investors' patience. But this is where discipline and the "Forest" view takes over so as not be lost in the "Trees". The pattern is still likely in progress as shown by the markings in below chart. The target still remains at 0.00135 BTC for the top of the handle formation. It's important to note that once the pattern is complete and confirmed; a lengthy bull run can be sustained.

The Elliott Waves could tentatively be placed as shown below. IF this is correct, then wave 5 should complete the cup formation. This would mean that the handle will probably coincide with the requisite retrace or wave 2's abc decline. IF the handle is wave 2, often the retrace is 50%. However, let's first see if price can climb the wall of the right side of the Cup formation.

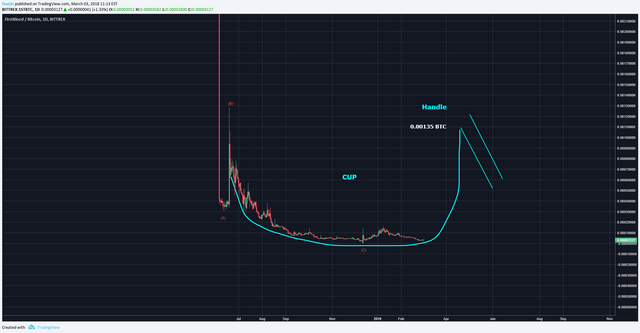

A closeup shows a downward wedge formation that could be complete soon. The EW shows abcd as likely done and wave e remains. It would be interesting to see if this wedge decides to breakout at wave d rather than finishing e.

Legal Disclaimer: I am not a financial advisor nor is any content in this article presented as financial advice. The information provided in this blog post and any other posts that I make and any accompanying material is for informational purposes only. It should not be considered financial or investment advice of any kind. One should consult with a financial or investment professional to determine what may be best for your individual needs. Plain English: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.

Please consider reviewing these Tutorials on:

Elliott Wave Counting Tutorial #1

Elliott Wave Counting Tutorial #2

Elliott Wave Counting Tutorial #3

Laddering and Buy/Sell Setups.

Laddering Example with EOS

Tutorial on the use of Fibonacci & Elliott Waves

@haejin's Trading Nuggets

Essay: Is Technical Analysis a Quantum Event?

Follow me on Twitter for Real Time Alerts!!

Follow me on StockTwits for UpDates!!

--

--

This is a very optimistic forecast, other then the TA, there are not many variables to support it.

Dear @haejin! a friend of mine sent me yesterday one of your recent posts. Today i am slowly reading your blog and i must admit that i am intimidated and, a little bit , frustrated:) I do not understand a lot from your posts (and there are plenty of them). Even though i would call myself an intelligent person.;) but i guess this is one of the reasons why investing and understanding market fluctuations is difficult. Anyway, i really hope that with time I will learn to understand your analysis more easily:) I am powering up everything i earn from my travel stories, but my aim is to become an independent "investor". Thank you for your work! cheers!:)

Start with the 7 tutorials linked at the bottom of each of his posts. Watch these repeatedly until you understand, then consider his daily posts. This point is critical: any bullish calls on altcoins remain dependent on BTC going up.

Also remember there will always be another opportunity down the road so don’t worry about missing one. I suggest you use you own research to determine which coins you think have value. Then follow Haejin and/or your own TA to determine entry and exit points.

I started following Haejin last summer with no knowledge of TA. I now successfully apply my knowledge not only to cryptos, but equities as well. You can also get the books he recommends as well.

thank you so much for this extensive comment and explications! 🥂 :) i will definitely do what you suggest! :)

It's not easy to learn! I've put quite a bit of work into learning. I've read several books about TA and Elliott Waves. If it was easy, everyone would do it. Plus, there's so much interpretation involved- it can be discouraging. There's only one way to learn, however, and that's by doing it! Start small, keep track of your successes and mistakes, and keep learning. I've found Haejin's posts to be very helpful when I get discouraged by my own inability to see the patterns. He has a "wealth" of knowledge, and he wants to help those who want to learn and who are willing to take responsibility for their decisions. Oh, and just "mute" the bots, haters, and spammers who are always trolling the Comments of his posts- it can be very frustrating. Best of luck to you!

HEY YOU! #Haejin does offer help with his MASTER COURSE WORK SESSIONS

1st is one of my biggest disappointments. I thought it had so much potential but it is not getting much press and progress seems really slow.

Are there any competitors in this industry?

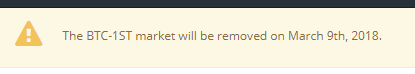

1ST got delisted from Bittrex...does that scare me...no...it's listed on HitBTC and it will go vertical soon...Patience~~~~

I am following your articles almost everyday in order to get a great analysis that could help me come with a strategy to 100X my investment, because actually I am tired of trding lool.

I get 6% to 15% from your signals before but It is hard to change something when trading with a small budget like me.

Keep It up

What about Bittrex Delisting it ?

Well delisting won't help. Delisted with Bittrex and poloniex deposit not working. Not good.

Man! thanks for warning! I'm moving now all my 1st to hitbtc..

Thanks

Thanks @haejin your information is very useful for evry one .thanks for sharing this information

Thanks for another interesting breakdown. I should really learn more about Elliot Waves so your tutorial links are very helpful!

I'm gonna check em out too,