Cryptocurrency trading (Part 1) - Everything you need to know about crypto trading!

Cryptocurrency trading seems to be becoming more and more popular. And that's not that crazy. The internet provided freedom of information, but blockchain provides freedom of value. Freedom of value simply means that, thanks to blockchain, we are completely free in dealing with everything that has value. We are even free to make our own (crypto) coins instead of banks that can only do this. Companies start their own mini-economies where you can only pay with their cryptocurrency issued . And all these coins all have a value to each other and to Bitcoin, the digital gold. It seems that it becomes increasingly important to get well into crypto trading, ie cyptocurrency trading.

Profit from the cryptocurrency trading hype

At present, the cryptohype has far away from the 2008 poker hype. Out of nowhere the whole world was in the ban of poker. Everybody seemed to play it and the best poker players of that time became their heroes. For 95% of the players, poker was a game in which, in particular, lucky was whether you would go home with profit or not, but the other 5% thought differently. Who knew that poker was pure chance calculation and benefited from the other 95% beginner mistakes, and could easily become rich in their hobby in a simple way. Handling in cryptocurreny seems to be the same. The huge returns make sure everyone walks into the market and gambling everyone but the price will keep up. Most people often do not know what cryptocurrency they are making for their money and they do not know which other promisingcryptocurrency there are. You as a reader of this website have at least the advantage that you know what the most cryptocurrency means, but if you really want to become rich in crypto, it's definitely no harm to get cryptocurrency trading well. Therefore, read section 1 about cryptocurrency trading.

Bitcoin's timeline

First, it is important to get a small history lesson about Bitcoin's value. In this article, Bitcoin 's timeline is discussed in more detail. Bitcoin has gone through 4 significant bubbles in total :

- 2010: from $ 0.01 to $ 0.80 to $ 32 (!) Back to $ 2, -

- 2013 (start): from $ 13.30 to $ 260 back to $ 50, -

- 2013 (end): from $ 125, - to $ 1242, back to $ 238, -

- 2017: from $ 650 to $ 4950, - or higher ?? back to ??

The question of whether or not we are in a bubble let's just drop this article, but Bitcoin's history shows that it is certainly not impossible. This is mainly because it is a completely new technology and the market seems to have a lot of trouble in determining what the value of this technology is now.

Cryptocurrency trading: the most important guidelines

The whole deal in cryptocurrency is still very new. This means that there are very many coins in which very little is traded. Few trading means you can make a lot of profit on this crypto currency, but you also take a big risk to trade in this. The value of the cryptocurrency and hence your investment can just go into smoke.

The most important general guidelines for cryptocurrency trading that you can keep when you're new are:

- Trade only in cryptocurrency that have a significant volume (more than 10 to 50 BTC). This is very important because small crypto markets can be easily manipulated by whales (traders who hold a significant share of the crypto currency), insiders, pumps, dumpers and all kinds of other characters that you can not win, how good you as a crypto dealer are.

- Trade only in cryptocurrency that has a large community behind it.

- Trade only in cryptocurrency that are clearly innovative compared to existing coins. Read all about other cryptocurrency .

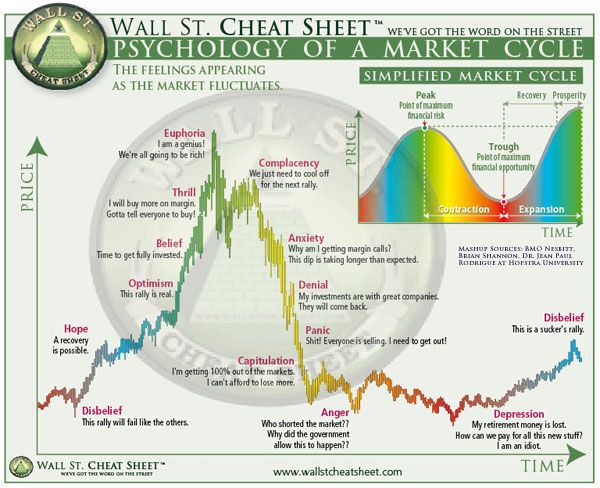

The most important (and most underestimated) part in cryptocurrency trading: emotions, emotions and emotions

Trade in itself is not necessarily difficult. You do not need to be a mathematician or highly educated person here. What can make the biggest difference between a successful trader and someone who repeatedly blames himself is that the successful trader has his emotions completely under control. This seems easy, but it is not. If there is only one thing that you get from this article then it must be this: take care that your emotions do not affect your decisions in cryptocurrency trading!

The 6 emotions that (crypto) traders most suffer from are:

1. Fear (and especially Fear Of Missing Out (FOMO) 2. Greed (Very long nothing.) 3. Hope 4. Excitement / Delivery 5. Boredom (less applicable in cryptocurrency trading) 6. Frustration

The easiest way to keep all this under control? Or to find out if your emotions do not affect your decisions? Keep a logbook . Write for each trade you make on why you make this trade. If you write at a trade: "Because I'm afraid to miss the boat," it's clear that emotions have made that decision for you and not common sense. You can also look back in this way which reason has most often led to profit and especially what trades (and your accompanying thoughts) have caused loss.

Compared with how important emotions are for success or not, this is a very short paragraph on this. That's why I would like to mention again that this is the most important thing to focus on in order to succeed in cryptocurrency trading: make sure your emotions do not put you in the way. This is the hardest of trades and this is why you can distinguish yourself as a successful crypto trader.

What should you consider as a crypto trader?

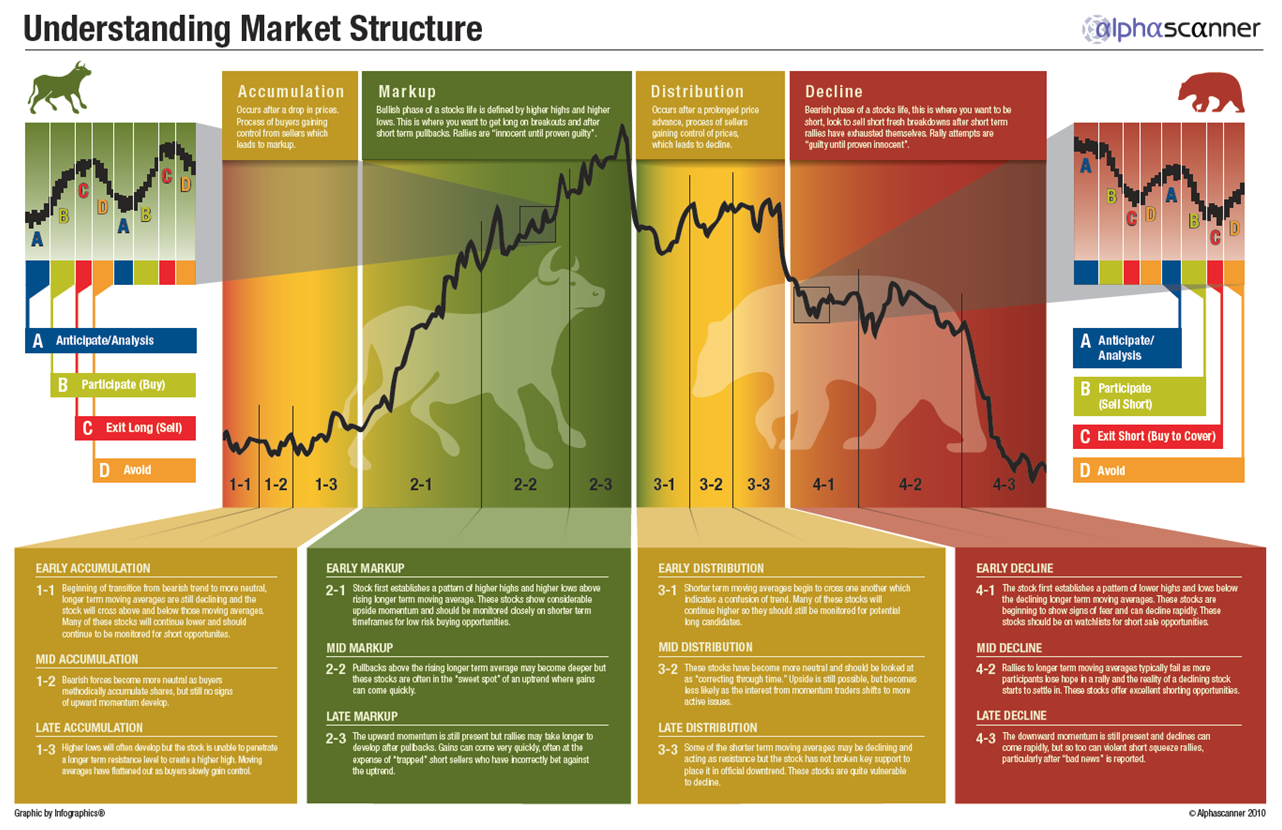

How can you become a better trader now? This depends on a combination of many different things: the success of the market cycle and the associated emotional cycle, analyzing price action and understanding price structures during a crash cycle, such as accumulation, distribution, pumping, dumping and how all of them are looks.

However, acting is not as difficult as it seems and to keep things simple, you have to look at 2 things: price action (watching candlesticks) and volume. Of course, the context is also very important: what cryptocurrency is it going to be, what are its recent developments, what are the developments of the entire crypto market, etc. But before we begin, it is important to get some insight into the market forces.

The market and crash cycle

It is impossible to behave well if you are not aware of what stage of the market you are heading for. In the world of trades 2 animals are world famous: the bull (bull) and the bear (bear). The biggest difference between these 2 animals is the way they fight. A bull comes from below and strikes his horns upwards to damage his enemy, while a bear with his claws strikes from top to bottom. For example, the names for the bull and bear markets were created:

- Bull market: this means that the market is rising (a bull is striking with its horns from bottom to top)

- Bear market: this means that the market is falling (a bear strikes with his claws from top to bottom)

Thus, in the market structure there are 2 overarching periods: a bullish period and a bearish period containing each of the two different phases which are then divided into three time phases (early, middle and late):

Bullish

- Accumulation

- Markup

Bearish

- Distribution

- Decline

Accumulation

This phase is called this because it is the phase in which many investors are expanding their portfolio. However, it is not clear at this stage that the trend from bearish to bullish will go. This is the phase in which large portfolios can be built in a very cheap way.

Markup (price increase)

In the final phase of the accumulation phase, price increases are already visible and these are confirmed in the market up phase. During this phase, more and more new investors and traders are attracted who want to get along in the way. In the cryptocurrency market, many traders in the final markup phase suffer from FOMO (Fear of Missing Out), while this is the most risky phase to enter the market.

Distribution

After the biggest hype is over and more and more people do not dare to stop money in the market, a free fall of the price often follows. This fall is being continued by the distribution phase. At this stage, many traders allow their profits to be paid, while other traders hope that the price is still in the bullish phase.

Decline

After the distribution phase, the big money is often out of the market and there is insufficient support for the price to rise again. Increasingly fewer traders are confident that the market continues to fall until the accumulation phase is reached again.

For now, it's important that you understand these cycles properly and you can analyze this timeline again (by looking closely at each bubble) how Bitcoin has gone through all these phases a couple of times. Part 2 will go deeper into the technical analysis and explanation, for example, how candlesticks can predict which side the course is.

Thanks for reading, I hope you liked it!

Steem's Popularity Is Incredible!

Share the joy by inviting others!

Get More Exposure On The Chats!

It is a best way to get more exposure through private messages and in the chat rooms. These are some of the best places to get more exposure & makes Steem friends.

- Official Steemit.chat

- SteemSpeak.com @fyrstikken (24/7 Voice chat)

- Peace, Abundance, Liberty @aggroed @canadian-coconut @ausbitbank @teamsteem and More (Minnow Support Project)

For new & best authors to move forward!

http://curiesteem.com @curie

https://steemvoter.com @steemvoter @thecryptodrive @cryptomancer

My Latest Posts:

- Pregorexia - Pregnant women who find themselves too fat

- Pillars of Eternity Complete Edition Review - Performs the impossible

- The astrologer - Famous people can afford the eccentricity that would immediately suspect ordinary people.

- Nintendo Classic Mini SNES Review - A classic in a new jacket

- In the bus....Something nice on the early morning you do not come up everyday

- Game Review: Rayman Legends Definitive Edition - Complete to the Switch

- Insane over the centuries: admired and feared

- Mouthflora: Good and bad bacteria in your mouth...

- Marvel vs Capcom Infinite Review - Shovel ass with your favorite dream team

- Slow thyroid (hypothyroidism): treatment + symptoms

- The box with insight, human knowledge & dilemmas... Funny STORY!!

- 💖💗💘💕 LOVE talks and funny sayings about love 💕💘💗💖

- Super Mario Odyssey Preview - The trip of your life

the part 2 was good so i needed to see part 1, upvoted,followed and resteemed both :) looking forward for more smart posts like this

Great post, very interesting to read. I'm on the boat for part 2 🤗 Would love to hear more in specific how to spot good coins for short term trading, like how to recognize pump and dump schemes to get on board and when is the best time to exit. Do you exit after getting 100% return or does it depend what signs of the candlesticks or volume are given?

Greetings @ddot

You will get everything in part 2, So stay tuned mate.

Awesome!!

This post received a 1.6% upvote from @randowhale thanks to @braini! To learn more, check out @randowhale 101 - Everything You Need to Know!