Bitcoin Gold (BTG): MACD is SOOO Close to the Apex and Near Ready to Explode!!

SUMMARY

Note: For anyone who missed the BitcoinLive Information Webinar, here is the replay link: https://www.youtube.com/watch?v=32l40SNYOp4

As of June 4, ALL Crypto Analysis will be posted on the BitcoinLive channel and Steemit will be dedicated for Equity, Commodity and Options Analysis. To Signup for the BitcoinLive limited Founding Membership slots, use this link: https://get.bitcoin.live/haejin/

__

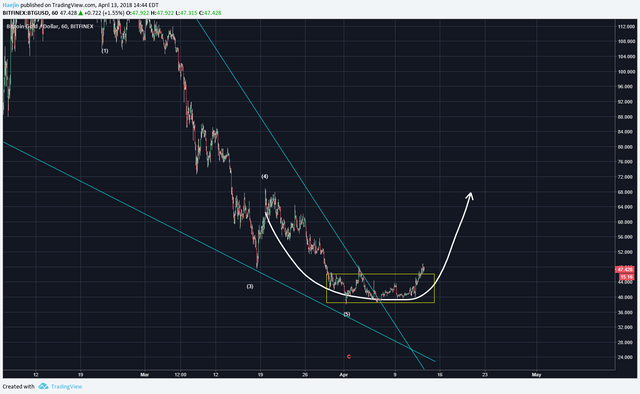

On April 13th, I had posted the below analysis of Bitcoin Gold stating that price was in the basin phase as marked by the white rectangle. The rounded price formation was about ready to build the right wall.

Here is the current chart with the near original markings. Price completed the rounded pattern but in the next chart, let's look more closely at the correction.

From a pattern perspective, a downard wedge can be traced out. Price should breakout of this pattern and turn up again.

Another potentila is a sequential rounded bottom formation as shwon below. Regardless of which pattern, the directional points upward.

Most importantly, look at that MACD! It's so close to the Apex! It has near zero mobility....the pressure has to be released and most likely it'll be to the upside!!

Legal Disclaimer: I am not a financial advisor nor is any content in this article presented as financial advice. The information provided in this blog post and any other posts that I make and any accompanying material is for informational purposes only. It should not be considered financial or investment advice of any kind. One should consult with a financial or investment professional to determine what may be best for your individual needs. Plain English: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.

Please consider reviewing these Tutorials on:

Elliott Wave Counting Tutorial #1

Elliott Wave Counting Tutorial #2

Elliott Wave Counting Tutorial #3

Laddering and Buy/Sell Setups.

Laddering Example with EOS

Tutorial on the use of Fibonacci & Elliott Waves

@haejin's Trading Nuggets

Essay: Is Technical Analysis a Quantum Event?

Follow me on Twitter for Real Time Alerts!!

Follow me on StockTwits for UpDates!!

--

--

I like Bitcoin gold it is holding true to gpu mining and crytpo roots.

I believe it uses the equihash algorithmn.

Bitcoin Private's a cool project too.

looks good

Thanks dearly for this post. but i hope its actually what you are reflecting in the post. i love trying and sticking by keeping it moving. Gonna try by this post 89%. good one there.

Coins mentioned in post:

BTC gold was hacked not recommending to buy.

What about dopebtc? I haven’t seen any recent chart on it and seems to be in it’s lowers maybe

very intresting thank you , i am kind of new in this cryptocurrencies wrold is there a way to exchange SBD for dollars or reuro directly instead of having to go through bitcoin or any types of other cryptocurrency first ?

Ripple CEO Brad Garlinghouse argued bitcoin, the flagship cryptocurrency, could soon stop influence the price of other cryptocurrencies.

This, as he sees the market highlight the differences various cryptocurrencies have.

For a period of time now, the prices of cryptocurrencies have been highly influenced by bitcoin – the first and most famous cryptocurrency among thousands. According to Ripple CEO Brad Garlinghouse, this influence may soon come to an end as crypto markets begin to understand the differences between different digital assets.

On CNBC’s “Power Lunch,” Garlinghouse stated:

"There's a very high correlation between the price of XRP and the price of bitcoin, but ultimately these are independent open-sourced technologies… It's early, over time you'll see a more rational market and behaviors that reflect that."

Brad Garlinghouse

It should be noted that San Francisco-based Ripple is a company that developed a network for faster global financial payments and the XRP token, which financial institutions on Ripple’s network can use to transact quickly.

Garlinghouse stated that Ripple had signed 20 production contracts with new firms in the first quarter. These included the largest bank in Kuwait and MoneyGram. Despite the company’s performance, during said time period its XRP token lost over 80% of its value, making it the worst performing coin among top cryptocurrencies. According to CoinMarketCap data, bitcoin lost over 50% of its value during the first quarter, and the entire cryptocurrency market dropped with it.

Garlinghouse added that “this is "still a nascent industry,” in which speculation dominates trading. Per his words, it’s a matter of time until people “better understand the different use cases." The chief executive officer predicted that about 99 percent of the over 1,500 cryptocurrencies in circulation won’t exist in 10 years as “there’s gonna be a bit of a correction along the way.” This correction, per Garlinghouse, is going to wash out “players in the space that don’t actually solve a real problem.”

The CEO added that while some cryptocurrencies do not have a proven use case, they have been accused of conning investors through initial coin offerings (ICOs). He said:

"The SEC is getting involved as they should because there have been frauds committed. We have been an advocate of yes the government should get involved, the government should be protecting investors and companies but there's also examples of real utility.”

Brad Garlinghouse

Garlinghouse made it clear that: "If you own XRP, you don't own rights to the profits or any dividends to the company, [because] XRP has real utility."

Dead coin walking. 51% attack much? Several attacks have happened over the last few weeks, wouldn't touch this with a very long pole!

Would new bottom change anything in this case?

Since it is very close to it...