【翻译】Thoughts on Tokens by Balaji S. Srinivasan (CEO of 21.co)

Thoughts on Tokens

Tokens are early today, but will transform technology tomorrow.

加密数字货币在今天还很早,但是将来会改变技术。

原文链接:https://medium.com/@balajis/thoughts-on-tokens-436109aabcbe

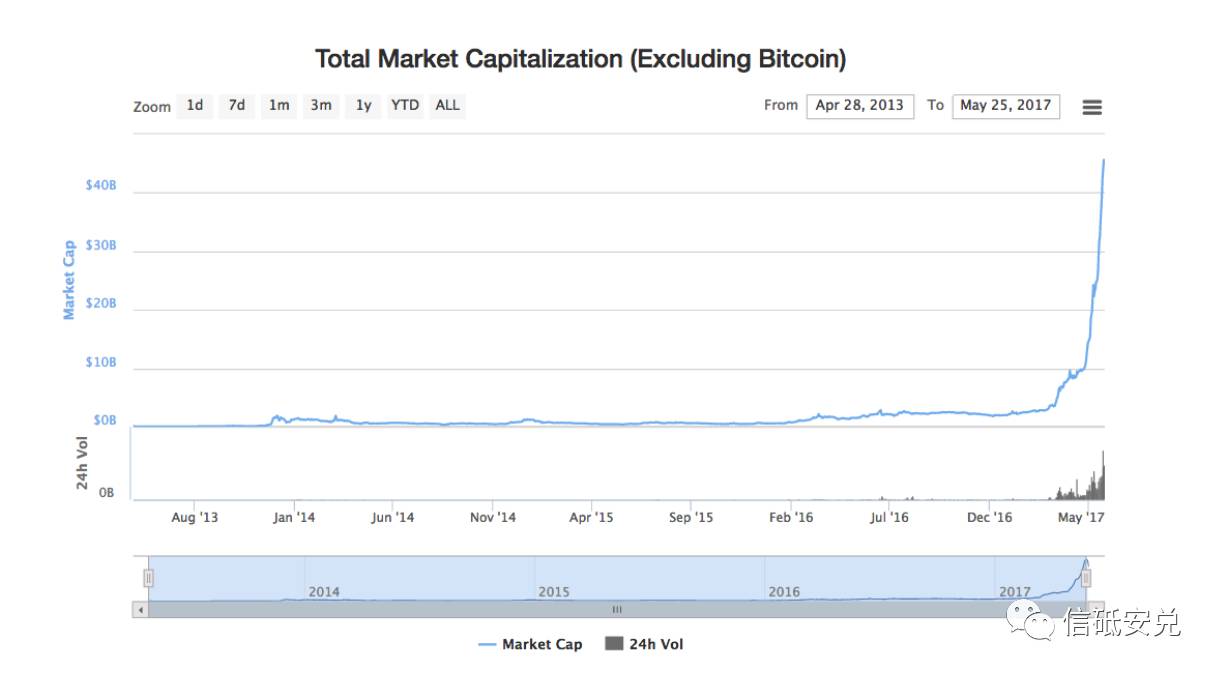

The exponential rise of non-Bitcoin tokens prior to the coming correction. Data from

coinmarketcap.com/charts

在即将到来的市场纠正之前,非比特币的币种会指数增长。

数据来源:coinmarketcap.com/charts

In 2014, we wrote that “Bitcoin is more than money, and more than a protocol. It’s a model and platform for true crowdfunding — open, distributed, and liquid all the way.”

2014年,我们写过“比特币不仅仅是钱,更多的是一份协议。它是一个真实用来集资的模式和平台——以开放的,去中心化的,流动的形式存在着。”

That new model is here, and it’s based on the idea of an appcoin or token: a scarce digital asset based on underlying technology inspired by Bitcoin. While indisputably frothy, as of this writing the token sector sits at a combined market cap in the tens of billions. These new “fat protocols” may eventually create and capture more value than the last generation of Internet companies.

这个模式基于应用软件上的一种币或者数字加密代币:受比特币影响在底层技术的基础上的一个稀缺的数字资产。虽然这样的资产无可争议的有些空洞,但在这期间,数字加密代币的研发者们正处于综合市值数百亿美金的阶段。这些新的“fat protocols“可能最终会创造并获得比上一代互联网公司更多的市值。

Here we discuss many concepts related to tokens, beginning with the basics for folks new to the space and then moving to advanced ideas.

在这里,我们讨论一下很多跟数字加密代币相关的许多概念,从刚进入这个领域的人不熟悉的基础概念开始然后再转向更进阶的概念上去。

The most important takehome is that tokens are not equity, but are more similar to paid API keys. Nevertheless, they may represent a >1000X improvement in the time-to-liquidity and a >100X improvement in the size of the buyer base relative to traditional means for US technology financing — like a Kickstarter on steroids. This in turn opens up the space for funding new kinds of projects previously off-limits to venture capital, including open source protocols and projects with fast 2X return potential.

最重要的是数字加密代币并不是股权,而是更类似于API开发密钥这样的东西。但是,它们在时间成本与流动性上可能会超出1000倍,购买者数量比起传统的美国技术公司的融资手段也会有一个近100倍的提升,简直就是一个上了激素的Kickstarter(译者注:Kick-starter是全球著名的众筹网站)。这反过来为开创新型风险投资的新项目提供了空间,包括开源协议和具有原本2倍回报的潜力的项目。

But let’s start with the basics first. Why now?

让我们现在就从基础的开始说吧。

- Tokens are possible because of four years of digital currency infrastructure

1.数字加密代币的发展得益于四年来数字货币的基础建设的发展

The last time the public at large heard much about digital currency was in late 2013 to early 2014, when the Bitcoin price last touched its then all-time high of $1242 dollars. Since then, several things happened:

上一次大众听到很多关于数字货币的消息应该是在2013年底到2014年初,当时比特币的价格飚至历$1242的历史新高。

从那时起,发生了好几件事情:

*Bitcoin experienced a massive multi-year crash and recovery all the way down to $173 and back up to the recent all-time highs of $2800+

- 比特币经历了多年的大规模崩溃和复苏,一路下跌至$173,又反弹到最近的$2800+

*Dozens of exchanges arose in many countries to facilitate the conversion of fiat currencies like dollars or yen into digital currencies like Bitcoin and Ethereum

十余所交易所在很多国家建立起来,为的是将像美元或者日元这样的法定货币转化成数字货币,比如比特币和以太坊

Major financial institutions began exploring the blockchain technology underpinning Bitcoin to build so-called “private blockchains” or distributed ledgers for internal or consortium use

主要金融机构开始探索区块链技术来构建所谓的“私有链和联盟链”或是分布式账簿用于内部或联盟的使用

The programmable Ethereum blockchain launched, endured its own major crises, brought on major corporate support, and surged in value in early 2017

以太坊作为可编程区块链被发布,遭受了重大的危机后,获得了世界重要企业的支持,并在2017年初市值获得激增。

In 2013, the legality of digital currency was still in question, with many predicting death and others going so far as to call Bitcoin “evil”. Those kneejerk headlines eventually gave way to Satoshi billboards in Davos and the Economist putting the technology behind Bitcoin on its cover.

在2013年,数字货币的合法性依然存在问题,许多人预测终将覆灭,还有人甚至称其为“邪恶”。那些讽刺的头条最终让位于在达沃斯的Satoshi广告牌,而《经济学人》则把比特币背后的区块链技术放在了封面上。

By 2017, every major country has a digital currency exchange and every major financial institution has a team working on blockchains. The maturation of infrastructure and societal acceptance for digital currencies has set the stage for the next phase: internet-based crowdfunding of novel Bitcoin-like tokens for new applications.

到2017年,每个主要的国家都有数字货币兑换,每个主要的金融机构都有一个专注于区块链的工作团队。数字货币的基础设施和社会接受度的成熟为下一个阶段奠定了基础:基于互联网新型比特币式数字加密代币的新兴应用。

- Tokens vary in their underlying blockchains and codebases

2.数字加密代币的底层区块链和代码库有所不同

To first order, a token is a digital asset that can be transferred (not simply copied) between two parties over the internet without requiring the consent of any other party. Bitcoin is the original token, with bitcoin transfers and issuances of new bitcoin recorded in the Bitcoin blockchain. Other tokens also have transfers and changes to their monetary base recorded in their own blockchains.

首先,数字加密代币是一种数字资产,可以通过互联网在双方之间传输(不是简单的复制,并且不许要任何其他方的同意)。比特币是最原始数字加密代币,其中比特币转账和新比特币的发行都记录在比特币区块链中。其他的数字加密代币也有自己的货币基础的转移和流通在它们自己的区块链上。

One key concept is that a token’s codebase is different from its blockchain database. As an offline analogy, imagine if the US banking infrastructure was repurposed to manage Australian dollars: both are “dollars” and have a shared cultural origin, but a completely different monetary base. In the same way, two tokens may use similar codebases (monetary policies) but have different blockchain databases (monetary bases).

一个关键概念是数字加密代币的代码库不同于它的区块链数据库。做一个线下概念的类比,想像一下如果美国银行业基础设施被重新利用来管理澳元:两者都是“dollar”,并且有共同的文化起源,但却是完全不同的货币基础。同样的方式,两个数字加密代币可能可以用类似的代码库(货币政策)但是有不同的区块链数据库(货币基础)。

The success of Bitcoin inspired several different kinds of tokens:

比特币的成功启发了几种不同的数字加密代币:

Tokens based on new chains and forked Bitcoin code. These were the first tokens. Some of these tokens, like Dogecoin, simply changed parameters in the Bitcoin codebase. Others like ZCash and Dash innovated on privacy-preserving features. Still others like Litecoin also began as simple tweaks to Bitcoin’s code, but eventually became test grounds for new features. All of these tokens initiated their own blockchains, completely separate from the Bitcoin blockchain.

基于新链接和分叉比特币代码的数字加密代币。这些是第一种数字加密代币。其中一些数字加密代币,比如dogecoin,只是改变了比特币代码库中的参数。其他像ZCash和 Dash在隐私保护功能上做了创新。还有一些 像Litecoin也开始像比特币代码一样做简单的调整,但最终成为新功能的测试田。所有这些数字加密代币有它们自己的区块链,完全与比特币区块链区分开来。

Tokens based on new chains and new code. The next step was the creation of tokens based on wholly new codebases, of which the most prominent example is Ethereum. Ethereum is Bitcoin-inspired but has its own blockchain and was engineered from the ground up to be more programmable. Though this comes with an increased attack surface, it also comes with new capabilities.

基于新链接和新代码的数字加密代币。下一步是创建基于全新代码库的数字加密代币,其中最突出的例子就是以太坊。以太坊是从比特币灵而来的,但它拥有自己的区块链并从头到尾重新建立,使得区块链增加了可编程性。虽然这随之增加攻击面,但它也带来了全新的性能。

Tokens based on forked chains and forked code. The most important example here is Ethereum Classic, which was based on a hard fork of the Ethereum blockchain that occurred after a security issue was used to exploit a large smart contract. That sounds technical, but essentially what happened is that a crisis caused the Ethereum community to split 90/10 with two different go-forward monetary policies for each group. A real world example would be if all the citizens of the US who disagreed with the 2008 bailouts changed in their dollars for “classic dollars” and adopted a different Fed.

基于分叉链和分叉代码的数字加密代币。最重要的例子就是“经典以太坊”,它是基于以太坊区块链的一个硬分叉,一个大型的智能合约的安全问题被利用之后发生的。这听起来太技术,但是实际上发生的就是一场危机导致以太坊社区分割成了90/10,每个组对今后货币政策有不同的坚持。一个真实世界的例子就好像如果所有不同意2008年的美国政府救市的美国公民,会产生“经典美元”和另一个美联储。

*Tokens issued on top of the Ethereum blockchain. Examples include Golem and Gnosis, all based on ERC20 tokens issued on top of Ethereum.

- 在以太坊区块链之上形成的数字加密代币。包括Golem和Gnosis,都是基于以太坊区块链之上发行的ERC20-tokens数字加密代币。

In general, it is technically challenging to launch wholly new tokens on new codebases, but much easier to launch new tokens through Bitcoin forks or Ethereum-based ERC20 tokens.

总体来说,在新的代码上推出全新的数字加密代币是技术上的挑战,但通过比特币分叉或者是以太坊基础上的ERC20数字加密代币来推出新的数字加密代币会简单得多。

The latter deserves particular mention, as Ethereum makes it so simple to issue these tokens that they are the first example in the Ethereum tutorial! Nevertheless, the ease with which Ethereum-based tokens can be created does not mean they are inherently useless. Often these tokens are a sort of public IOU intended for redemption in a future new chain, or some other digital good.

需要特别提一下后者,因为以太坊使得发布数字加密代币如此之简单,以至于它们是以太坊教程里的第一个例子!然而,轻轻松共地就能创建以太坊上的数字加密代币并不代表着它们就是没用的。这些数字加密代币是常常是一种面相公众的欠条,用于在未来新链的代币的赎回或者兑换其他的数字商品。

- Token buyers are buying private keys

3.数字加密代币购买者买的是私钥

When a new token is created, it is often pre-mined, sold in a crowdsale/token launch, or both. Here, “pre-mining” refers to allocating a portion of the tokens for the token creators and related parties. A “crowdsale” refers to a Kickstarter-style crowdfunding in which internet users at large have the opportunity to purchase tokens.

当一个新的数字加密代币产生的时候,它经常会被预先挖掘,以众筹或发布数字加密代币启动方式销售,或者两者的结合。在这里,“预先挖掘”指的是为数字加密代币创建者和关联者分配一部分数字加密代币。一个“众筹销售”指的是一个Kickstarter式的众筹,意味着互联网用户有机会购买数字加密代币。

Given that tokens are digital, what do token buyers actually buy? The essence of what they buy is a private key. For Bitcoin, this looks something like this:

鉴于数字加密代币是数字的,那么买家实际购买的到底是什么呢?他们购买实质是私钥。对于比特币来说,看起来像这样的:

5Kb8kLf9zgWQnogidDA76MzPL6TsZZY36hWXMssSzNydYXYB9KF

For Ethereum, it looks something like this:

对于以太坊来说,看起来像这样的:

3a1076bf45ab87712ad64ccb3b10217737f7faacbf2872e88fdd9a537d8fe266

You can think of a private key as being similar to a password. Just like your private password grants you access to the email stored on a centralized cloud database like Gmail, your private key grants you access to the digital token stored on a decentralized blockchain database like Ethereum or Bitcoin.

你可以把私人密钥看成类似于密码一样的东西。就像你的私人密码一样,你可以访问存储于集中式云数据库中(比如Gmail)的电子邮件,你的私人密钥也可以访问存储在以太坊和比特币这样的分散式数据库中的数字加密代币。

There is one major difference, however: unlike a password, neither you nor anyone else can reset your private key if you lose it. If you have the private key, you have possession of your tokens. If you do not, you have lost access.

然而,有一个主要的不同就是:与密码不同,如果你丢失密钥,无论是你还是别人都不可以重置你的私钥。如果你有你的私钥,你就拥有你的数字加密代币。如果你没有,你就失去了访问权限。

- Tokens are analogous to paid API keys

4.数字加密代币类似于付费API密钥

The best existing analogy for tokens may be the concept of a paid API key. For example, when you buy an API key from Amazon Web Services for dollars, you can redeem that API key for time on Amazon’s cloud. The purchase of a token like ether is similar, in that you can redeem ETH for compute time on the decentralized Ethereum compute network.

数字加密代币最好的类比可能就是付费API密钥的概念。例如,当你从亚马逊网站上购买美元的API密钥的时候,你可以在亚马逊的云端上兑换该API密钥。购买像ether这样的数字加密代币也是类似的,因为你可以在分散的以太坊计算网络上兑换以太坊网络的计算时间。

This redemption value gives tokens inherent utility.

这种数字加密代币价值给予数字加密代币固有的功用。

Tokens are similar to API keys in another respect: if someone gains access to your Amazon API keys, they can bill your Amazon account. Similarly, if someone sees the private keys for your tokens, they can take your digital currency. Unlike traditional API keys, though, tokens can be transferred to other parties without the consent of the API key issuer.

数字加密代币和另一个方面的API密钥有点类似:如果有人获取对你的亚马逊API密钥的访问权限,则可以对花你的的亚马逊账户的钱。同样地, 如果有人看到你数字加密代币的私钥,则可以使用你的数字货币。然而,与传统的API密钥不同,数字加密代币可以转移到其他地方,而不需要API密钥发行者的同意。

So, tokens are inherently useful. And tokens are tradeable. As such, tokens have a price.

所以,数字加密代币本身是有用的。数字加密代币是可以交易的。因此,数字加密代币就有了价格。

- Tokens are a new model for technology, not just startups

5.数字加密代币是技术的新模式,不仅仅是创业公司

Because tokens have a price, they can be issued and sold en masse at the inception of a new protocol to fund its development, similar to the way startups have used Kickstarter to fund product development.

由于数字加密代币有价格,因此可以在新协议开始时对其大量发行和出售来开发,类似于初创公司使用Kickstarter资助产品开发的这种方式。

The money is typically received in digital currency form and goes to the organization issuing the tokens, which can be a traditional company or an open source project funded entirely through a blockchain.

这笔钱通常是以数字货币的形式收到,然后发放给组织,该组织可以是一个传统公司或者是一个通过一个区块链而创建起来的一个开源项目。

In the same way that boosting sales is an alternative to raising money, token launches can be an alternative to traditional equity-based financings — and can provide a way to fund previously unfundable shared infrastructure, like open source. A word of caution, though: read these three posts and consult a good lawyer before embarking on a token launch!

以同样的方式促进销售是筹资的一种可替代方案,token launch可以代替传统的基于股权的融资方式,并且提供了一种能以前无法融资的共享基础构架(如开源)融资方式。谨记一句话:好好阅读这三篇文章,并在token launch之前咨询一位好律师!

译者注:文中所指文章链接如下

- https://www.coinbase.com/legal/securities-law-framework.pdf

- https://coincenter.org/entry/could-your-decentralized-token-project-run-afoul-of-securities-laws

- https://coincenter.org/entry/is-your-cryptotoken-a-security-this-new-tool-will-help-you-find-out

(请复制到浏览器阅读)

- Tokens are a non-dilutive alternative to traditional financing

6.数字加密代币是传统融资的非稀释性替代品

Tokens aren’t equity, because they have intrinsic use and because they are non-dilutive to the company’s capitalization table. A token sale is more similar to a Kickstarter sale of paid API keys than equity crowdfunding.

数字加密代币不是股权,因为他们具有内在的使用,并且因为它们对公司的股权结构表而言是不可稀释的。一个数字加密代币销售更类似于 Kickstarter销售的付费API密钥而不是股权众筹。

However, when considered as an alternative to classic equity financing, token sales yield a >100X increase in the available base of buyers and a >1000X improvement in the time to liquidity over traditional methods for startup finance. The three reasons why: a 30X increase in US buyers, a 20–25X increase in international buyers, and a 1000X improvement in time-to-liquidity.

然而,如果把购买token当成是经典股票融资的替代品时,数字加密代币销售可以超过原本买家基数的100倍,而对一个传统的初创的融资方式而言,在投资所需退出时间上提高了至少1000倍。以下有这三个因素:美国买家增长30倍,国际买家增长20-25倍,流动性效率上升了1000倍。

- Tokens can be bought by any American (>30X increase in buyers)

7.任何美国人都可以买到数字加密代币(买家增加了30倍以上)

A token launch differs from an equity sale — the latter is regulated by the 1934 Act, while the former is more similar to a sale of API keys.

数字加密代币发行与股权销售不同——后者受“1934年法”的管制,前者更类似于API密钥的销售。

While equities can only be sold in the US to so-called “accredited investors” (the 3% of adults with >$1 million in net worth), the US could not restrict the sale of API keys to accredited investors alone without crippling its IT industry. Thus, if tokens (like API keys) can be sold to 100% of the American population, it would represent an increase of 33x in the available US buyer base relative to a traditional equity financing for a US startup.

虽然股票只能在美国出售给所谓的“获许投资者”(占比约为3%的成年人的净资产>100万美元),但美国无法保证只允许将API密钥出售给获许投资者之后,其IT行业不受重创。因此,如果数字加密代币(如API密钥)可以出售给100%的美国人口,相对于美国创业公司的传统股权融资,美国买家基数将增加33倍。

Do note, however: some people might want to issue a token and explicitly advertise it as a way to share in the profits of their efforts as a company. For example, the issuer might want to make token holders entitled to corporate dividends, voting rights, and the company’s total ownership stock may be denominated in these in tokens. In these cases, we really are talking about tokenized equity (namely securities issuance), which is very different than the appcoin examples we’ve discussed. Don’t issue tokenized equity unless you want to be limited to accredited investors under US securities laws. The critical distinction is whether the token is simply a useful and tradable digital item like a paid API key. Again: read these three posts and consult a good lawyer before embarking on a token launch!

但请注意:有些人可能想发行数字加密代币并且明确宣传它是作为可以分享公司红利的利润的一种凭证。例如,发行人可能想要让数字加密代币持有人有权获得公司股权,投票权,并且公司的总所有权股票可以以这些数字加密代币来表示。在这种情况下,我们真的正在讨论代币化的股权(即证券发行),这与我们讨论的appcoin的性质不同。除非你不介意受限于根据美国证券法的获许投资者的限制,否则不要发行标记的权益。关键的区别是数字加密代币是否为一个有用的像API密钥并且可交易的数字项目。再强调一遍:阅读之前提到的三篇文章,并咨询一个优秀的律师,然后开始启动一个数字加密代币!

- Tokens can be sold internationally over the internet (~20–25X increase in buyers)

8.数字加密代币可以通过互联网在国际上销售(买家增加约20-25倍)

Token launches are typically international affairs, with digital currency transfers coming in from all over the world. New bank accounts receiving thousands of wires from all over the world in minutes for millions of dollars would likely be frozen, but a token sale paid in digital currency is always open for business. Given that the US is only ~4–5% of world population, the international availability provides another factor of 20–25X in the available buyer base.

数字加密代币的发行通常是国际性,数字货币的转移也能应用于全世界。接收数千笔电汇的几百万美金的新的银行账户可能会被冻结,但以数字货币支付的数字加密代币总是开放的。鉴于美国只是世界人口的4-5%,国际适用性使得买家基础上提供了又提供了另外20-25倍的人口。

- Tokens have a liquidity premium (>1000X improvement in time-to-liquidity)

9.数字加密代币有流动性溢价(流动性上升至1000倍以上)

A token has a price immediately upon its sale, and that price floats freely in a global 24/7 market. This is quite different from equity. While it can take 10 years for equity to become liquid in an exit, you can in theory sell a token within 10 minutes — though founders can and should cryptographically lock up tokens to discourage short-term speculation.

一个数字加密代币在销售的时候立刻就有价格,这个价格在全球7/24的市场上自由浮动。这与股权截然不同。虽然股权的出口流动可能需要10年的时间,但理论上你可以在10分钟内卖掉一个数字加密代币,尽管创始人可以并且应该锁定数字加密代币并且尽量阻止短期投机。

Whether or not you choose to sell or use your tokens, the ratio between 10 years and 10 minutes to get the option of liquidity is up to a 500,000X speedup in time, though of course any appreciation in value is likely to be larger and more sustainable over a 10 year window.

无论你是否选择出售或使用你的数字加密代币,10年—10分钟之间的比例可以获得流动性的期权,在时间上达到500,000倍的提速,虽然价值升值在10年的窗口期可能更大,更具可持续性。

This huge liquidity premium alone would cause tokens to predominate whenever they are legally and technically feasible, because the time to liquidity enters inversely in the exponent of the compound annual growth rate. Fast liquidity permits reinvestment in new tokens permits faster growth.

只有在法律和技术可行的情况下,这种庞大的流动性溢价就会导致数字加密代币占主导地位,因为流动性反而添加了以复合年增长率的指数。快速的流动性允许再投资新的数字加密代币,促进更快速的增长。

- Tokens will decentralize the process of funding technology

10.数字加密代币会使得融资技术更去中心化

Because token launches can occur in any country, the importance of coming to the United States in general or Silicon Valley / Wall Street in particular to raise financing will diminish. Silicon Valley will likely remain the world’s leading technology capital, but it will not be necessary to physically travel to the United States as it was for a previous generation of technologists.

因为数字加密代币发放可能发生在任何一个国家,特别到美国或者硅谷/华尔街筹集资金的这种重要性将会削弱。硅谷可能仍然是世界领先的技术资本,但是没必要像前一代技术那样做全国路演。

11.数字加密代币启用新的商业模式:比免费做得更好

- Tokens enable a new business model: better-than-free

Large technology companies like Google and Facebook offer extremely valuable free products. Despite this, they have sometimes come under fire for making billions of dollars while early adopters only receive the free service.

Google和Facebook等大型科技公司提供极具价格的免费产品。尽管如此,大家还是会诟病他们获利数十亿美金而早期用户的回报只有免费的服务。

After the early kinks are worked out, the token launch model will provide a technically feasible way for tech companies (and open source projects in general) to spread the wealth and align their userbase behind their success. This is a better-than-free business model, where users make money for being early adopters. Kik is the first example of this, but expect to see more.

在早期出现的问题解决后,数字加密代币发行模式将为技术公司(以及普遍性的开源项目)提供技术上可行的方式来分散财富,并使其用户群在他们的成功利益一致。这是一个比免费更好的商业模式,用户可以为了成为早期用户而赚钱。KIK是这个的第一个例子,但是将来会看到更多这样的案例。

- Token buyers will be to investors what bloggers/tweeters are to journalists

12.数字加密代币买家之于投资者会成为博客主与记者的关系

Tokens will break down the barrier between professional investors and token buyers in the same way that the internet brought down the barrier between professional journalists and tweeters and bloggers.

数字加密代币将以互联网阻碍博主和专业记者之间障碍的同样方式打破专业投资者和数字加密代币买家之间的障碍。

This will have several implications:

这将有几个意义:

- The internet allowed anyone to become an amateur journalist. Now, millions of people will become amateur investors.

- 互联网允许任何人成为业余记者。现在,数百万人将成为业余投资者。

As with journalism, some of these amateurs will do extremely well, and will use their token-buying track-record to break into professional leagues.

和新闻一样,这些业余爱好者中的一些将做得非常好,他们的数字加密代币回报率会逼近职业级别。

Just like it eventually became a professional requirement for journalists to use Twitter, investors of every size from seed funds to hedge funds will get into token buying.

就像最终记者也需要使用Twitter的一样,从种子基金到对冲基金的各种规模的投资者也将开始进行数字加密代币投资。

New tools analogous to Blogger and Twitter will be developed that make it easy for people to use, buy, sell, and discuss tokens with others.

- 和为Blogger和Twitter开发出来的新工具一样,为了让使人们可以轻松地与他人一起使用,购买,销售和讨论数字加密代币,也会新工具开发出来。

We don’t yet have a term for this, but perhaps it will be “commercial media” by analogy to “social media”.

- 我们目前还没有这个术语,但可能会类似于从“商业媒体”到“社交媒体”的转变。

- Tokens further increase the primacy of the technologist over the traditional executive

13.数字加密代币进一步提高技术专家对传统执行官的首要地位

Since the rise of Bill Gates in the late 70s, there has been a trend towards ever more tech-savvy senior executives. This trend is going to accelerate with token sales, as folks who are even more predisposed to the pure computer science end of the spectrum end up founding valuable protocols. Many successful token founders will have skillsets more similar to open source developers than traditional executives.

自从盖茨在七十年代后期兴起以来,一直有技术精湛的高级管理人员越来越多的趋势。这种趋势将随着数字加密代币销售而加速,因为甚至更倾向于纯粹的计算机科学终端的人们最终能够建立了有价值的协议。许多成功的数字加密代币创始人将具有开源开发人员相似的技能而非传统高管。

- Tokens mean instant custody without intermediaries

14.数字加密代币意味着及时保管而没有中间人

Because token buyers need only hold private keys to guarantee custody, it changes our notion of property rights. For tokens, the final arbiter of who possesses what property is not a national court system but an international blockchain. While there will be many contentious edge cases to work through, over time blockchains will provide “rule-of-law-as-a-service” as an international, programmable complement to the Delaware Chancery Court.

因为数字加密代币买家只需要持有私钥来保证保管,所以它改变了我们对产权的看法。对于数字加密代币,谁拥有财产的最终仲裁者不是国家法院制度,而是国际区块链。虽然将有许多有争议的边缘案例要经历,但随着时间的推移,区块链将提供一种可编程的“以法治作为一种服务”,补充到作为特拉华州法院。

- Tokens may be generalizable to every tech company through paid logins

15.数字加密代币可能会通过付费登陆向各大科技公司推广开来

Can the token model can be extended beyond pure protocols like Bitcoin, Ethereum, or ZCash? It’s not hard to imagine selling tokens as tickets — for access to logins, to car-rides, to future products. Or distributing them as rewards to the authors who power social networks and the drivers who power ride-sharing networks. Eventually, tokens can be extended to hardware as well: every time someone buys a slot in line for a Tesla Model 3 or re-sells a ticket, they’re exchanging a primitive token. But the model will need to work for protocols first before being generalized.

数字加密代币模型可能向像比特币,以太坊或者是ZCash这样的纯协议外发展吗?不难想象将销售数字加密代币作为门票 - 访问登录,乘车,以及未来的产品。或者将他们作为奖励分发给为社交网络提供力量的作者和推动共享骑行网络的驾驶员。最终,数字加密代币可以扩展到硬件:每当有人为特斯拉模型3购买插槽或重新销售门票时,他们正在交换原始数字加密代币。但是,在广泛使用之前,该模型将需要先为协议服务。

Conclusion

总结

The token space is very early, and is likely to experience a dramatic correction over the next few weeks. To deal with the coming profusion of tokens we will need review sites like Coinlist, portfolio management tools like Prism, exchanges like GDAX, and many other pieces of supporting technical and legal infrastructure.

数字加密代币未来发展空间巨大,可能会在接下来的几个星期内经历一个戏剧性的修正。为了应对即将到来的各种各样的数字加密代币,我们将需要像Coinlist这样的网站来审查和评论数字加密代币,像Prism这样的投资组合管理工具,像GDAX这样的交易所,以及许多支持技术和法律基础设施的部分。

But the world has changed. Tokens represent a 1000X improvement over the status quo, and those don’t come around very often.

但世界已经改变了。数字加密代币代表了超过现状1000倍的改善,而这些改善并不常见。

PS: If you thought this post was interesting, go join the list at 21.co/digital-currency/join. You’ll get notified of several upcoming token launches.Thanks to my friend and colleague Naval Ravikant for helping think through many of the ideas in this post! Go follow him on Twitter at @naval.

Congratulations @qjwang! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard!

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes

Congratulations @qjwang! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!