The Economics Behind the Steem Dollar Arbitrage..

I have @cryptogee to thank for the subject matter of this post, although it remains to be seen whether I understood his request correctly;

From this comment, I've decided to talk about the Steem / Steem Dollar Arbitrage. There is a trade off between Time, Risk and Reward at play here, which is really interesting to analyse.

Steem Dollars

Holders of Steem Dollars can request them to be converted to $1 worth of Steem, at the Daily Medium Price, Averaged out over the following 7 days after request.

At the moment, Steem Dollars are trading $0.90.

Why are Steem Dollars Trading below $1?

There are 2 distinct reasons why Steem Dollars are (and have spent most of the time since the 4th July) trading below $1;

- The sellers are stronger than the Investors: Obvious I know, however more to the point, there are not enough users playing the arbitrage game, compared to users cashing in there Steem Dollar Rewards to Bitcoin.

- The Price of Steem has been falling. Because the conversion of Steem Dollars to Steem takes 1 week, and is based on the Average Price over that week, there is executional risk involved. Namely, if the price of Steem falls enough over the week, you could lose of this arbitrage.

How much would the price need to Fall, for a user to lose when buying Steem Dollars at $0.90?

10% right?

Well, this isn't as simple as it first appears. Let me give you a scenarios;

Daily Medium Price

Day1: $1.00

Day2: $0.60

Day3: $0.60

Day4: $0.60

Day5: $0.60

Day6: $0.60

Day7: $0.60

Average Daily Medium Price: $0.6571

As you can see here, (assuming the user could sell the Steem at $0.60) a fall of 40% has resulted in a small profit...

1SBD coverts to 1.5218 Steem

Steem can be sold @$0.60

1.5218 x 0.6 = $0.9131

SBD brought for $0.90 sold for 0.9131

However, let's reverse this scenario;

Daily Medium Price

Day1: $1.00

Day2: $1.00

Day3: $1.00

Day4: $1.00

Day5: $1.00

Day6: $1.00

Day7: $0.60

Average Daily Medium Price: $0.9428

As you can see here, (assuming the user could sell the Steem at $0.60) a fall of 40% has resulted in a large loss..

1SBD coverts to 1.0606 Steem

Steem can be sold @$0.60

1.0606 x 0.6 = $0.6364

SBD brought for $0.90 sold for 0.6364

As you can see, the executional risk is for heavy losses (in Steem Prices) to be incurred in the final days leading up to conversion. If the market fell in a linear fashion, the market would need to fall close to 20% over the week (Because the average would be 10%) before losses are realised on the arbitrage trade.

How can you make money from $0.90 Steem Dollars?

If the price of Steem remains Static, or Rose over the following 7 days post conversion request, you would benefit. A static price would result in Steem Dollars converting to $1.00 worth of Steem (Purchased at $0.90, Profit $0.10), and a price rise would extenuated these gains even further.

Day1: $1.00

Day2: $1.05

Day3: $1.10

Day4: $1.15

Day5: $1.20

Day6: $1.25

Day7: $1.30

Average Daily Medium Price: $1.15

1SBD coverts to 0.8695 Steem

Steem can be sold @$1.30

0.8695 x 1.30 = $1.1304

SBD brought for $0.90 sold for 1.1304

The Best Arbitrage Strategy

If you are interested in exploiting this arbitrage opportunity, then I believe the best strategy to be the following

Bear in mind that, by exploiting any opportunity in a market place, you are contributing towards making that economic system more efficient. I'm of the opinion that, the more currency that flows through Steem, the better. So I would be an advocate of this type of behaviour.

Let's say you have $70 Steem Dollars, or you can buy $70 SBD at $0.90. I believe the best strategy at playing this arbitrage game would be to Convert $10 per day, for the next 7days.

Why?

This will spread the execution risk and give you the best chance of hitting an average $1 return. You could go one step further and convert $5 per day for 14 days. The more your spread your execution risk the better.

When a conversion takes place a week later, if the Steem Dollar price is still well below a Dollar, Convert your Steem for SBD and start the cycle again..

Is this behaviour putting pressure on the Price of Steem?

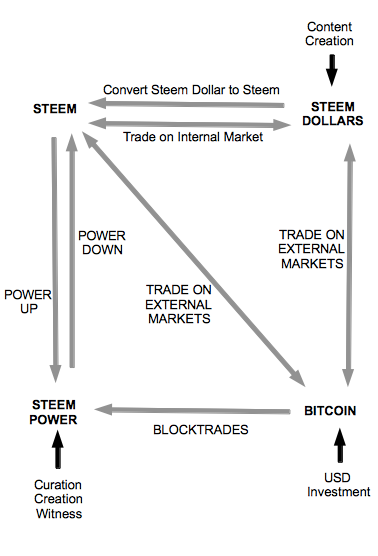

The Economics of the Steem Dollar Conversion

The quantity of Liquid Steem is ballooning, but this increase is mostly down to Powering Down activity, rather than this arbitrage..

Using data I have collected here, I can see that;

There is 2,217,145 SBD in Circulation (and growing...)

There is 5,548,086 Liquid Steem in Circulation (Up from 5,333,461 a week ago)

Internal SBD/Steem 24hr Volume of $18,443

External SBD 24hr Volume: $67,912

External Steem Volume: $327,628

These numbers suggest to me that, this arbitrage trade is not rife, and I would thus suggest that this is not impacting the Price of Steem currently. The increasing level of Liquid Steem (+60% Month on Month) is down to large accounts powering down.

Summary

There is a reason the Steem economic system is set up the way it is... The creators of this system designed it in a way to promote circulation. With circulation comes stability. The more active users we have closing arbitrage opportunities, the more we can move to a stable currency.

Happy to hear your thoughts...

Upcoming post on Steemit Promo at the RedBull 400 in Austria. Race Starts Tomorrow, here are some photo's from today..

A couple points, first is that SBD "peg" to 1 USD is not really backed by anything other than the one week average price of STEEM. So if the price of steem is volatile, then prudence suggest SBD should trade at a discount.

Second, the math is setup so that if >90% is in steem power, it is LOGICAL to power down. If <90% is in steem power it is LOGICAL to power up.

Third, the daily volume is far in excess of the daily powerdown, so while a 10% per day sell pressure is significant, an 80% downturn is an overreaction. However we did have a lot of speculators come in at large volumes when poloniex started trading. Big volumes cut both ways...

Until the poloniex traders have gotten STEEM in their portfolios where they are comfortable, they will likely keep selling so they can chase after the pump of the day.

Until SP is ~90% we will have powerdown sell pressure from the logical whales (most of them). How far? Well that is the big question everyone wants to know the answer to, but cant.

Only time will tell. However, the powerdown volumes will become less and less of a factor as more and more STEEM is created and as some of the whales cancel their powerdowns. But the primary down pressure is from traders liquidating, not power downs as your analysis shows

Certainly agree with your analysis @jl777. Good post

I guess what i don;t get is how the same people buying and selling [ thus providing liquidity, as abit used to do ] can actually help if there's no infusion of NEW capital. But yeah, not a trader and was wondering this as well as Cg.

They can help raise the price of SBD to $1, but only by lowering the price of STEEM. That's the tradeoff - when you convert SBD to STEEM, the SBD is destroyed and new STEEM is created.

Hello @biophil. I know you know this, just talking through my thoughts. When SBD is at $1, the incentive to covert diminishes.

This activity does increase the amount of Steem in Circulation, but from the numbers I have seen, I Don't believe significant volume would need to trade to support $1 SBD...and thus, not that much Steem is created from this activity.

Probably should spend a little more time drilling down on the numbers to prove or disprove this..

Yeah, if the price feed tracked the real-world price perfectly, there would be no incentive to convert at $1. You're probably right that it wouldn't actually take much to push SBD up to $1, but I don't know this offhand. You could get a lower bound on how much Steem it would take by looking at all 3 order books: steem internal, bittrex SBD/BTC, and poloniex SBD/BTC. It's only a lower bound, because people have reserves that aren't currently sitting on the books.

One massive problem is the mismatch between the feed price and the real-world price when Steem is changing in value rapidly. Last week I put in conversion requests for a total of about 500 SBD. But because real-world Steem dropped so fast in the past couple days, the STEEM I got from the conversions is now worth less than $400. So I'm more than 20% in the hole on what should have been a sure bet, and that's going to dampen my enthusiasm to support the peg in the future.

I think that's why there are gigantic sell walls in the external market right now. If the SBD gets closer to dollar parity, it will be much easier to maintain.

From there, I suppose it will provide some more stability to the Steem price action... but thats just instinct and I haven't done any modeling to prove it.

We can chat :)

What are your thoughts on the change in VEST conversion ratio? I just did a video talking about this, and I'd love to see it factored into these equations also. If your plan is to power up (instead of just increasing your SBD or BTC balance), how much do you lose out by buying later instead of buying now? If arbitrage gets you a higher total amount of Steem a month or two from now, you also have to factor in the ratio change and the decrease in the number of VESTs that Steem can purchase. Have you looked at it from that perspective? I'm looking for a historical change in the Steem / VEST ratio as well as a date-based historical price average for the various currencies (based on external and internal markets). Any idea where I can get that data?

Thanks as always for a great post!

This is also what I am interested in. Different to the people who power down I do not want to optimize my Bitcoin value instead I want to constantly optimize my Steem Power in order to become influential and thus more helpful for others. At the moment I only bring in small amounts as advised by @hisnameisollie spread over a period of several days. In may case it will spread over several years. However the more effectively I can do it the better. So look forward to any good advice.

https://steemit.com/steemit/@steempowerwhale/who-is-powering-up-or-am-i-alone-the-steemit-power-up-club

Thanks for the post @lukestokes Always nice to bump into you. I will take a good look into your post and maybe we should think about DMing and collaborating on a post.

Think we could work well together..

Expect to hear from me next week. Working from my phone in Austria ATM :)

@hisnameisollie - Good analysis as always.

What are your thoughts on providing real, significant incentives for remaining powered up? Right now there is no reason to NOT power down from what I can see, and since all the whales are doing it, rational actors are following suit and selling as soon as they can.

Now, I understand the reasoning for this is to accelerate the distribution, but it also damages confidence to see consistent declines in price. Speculators help the ecosystem almost as much as the content creators, since it attracts more of the latter when the valuation of the tokens are higher.

What say you?

Hello @blakemiles84 I can see your point of view.

I think this is the cost of natural distribution. Certainly a rising/stable Steem Price breeds confidence in the ecosystem, but we are so early here, this would take governmental levels of control to achieve.

As me and you have discussed before, the closer to we get to 90% Steem Power to Total Steem Supply, the less this incentive exists.

I think we've just got to hold out until we reach this scenario.

Thanks for the tip. I have been selling SBD for Steem on the market, because it seemed less risky than doing the one week conversation with the price continuing to go down. This seems like a good option too. I might try it out and see how it does 😀

Great post. In your studies did you figure out if the conversion rate is based on the median external pricing or internal pricing. Generally the internal market for Steem is 10-20% above bittrex though they do converge occasionally. I think the white paper says they use an external feed, so after all this work the difference between internal and external could still trip you up(or help you) . I posted here about how an external -Steem-sbd pair could help increase volumes and close the external sbd discount.

Also in this vein do you recieve interest on sbd during conversion process? I don't think you do.

tHanks again!

Thanks for your speedy post Ollie, reading it I realised that I didn't explain myself properly.

The arbitrage I was speaking of, arises from the delay between internal and external market feeds. According to this article ....

In fact, I've just done what I should have done in the first place and link you to the article.. https://steemit.com/steem/@sigmajin/this-biggest-reason-steem-prices-are-falling-the-arbitrage-sabotage-steem-dollar-teeter-totter

I have no idea if it's accurate or not, just wondering what you think?

Thanks again :-)

Cg

That post was inaccurate. Arbitrage doesn't cause prices to go in any direction. What happened in that case was that a huge amount of Steem was sold for Steem Dollars on the internal market at a price lower than the external market.

This resulted in a spike up of SD to BTC externally and a spike down in Steem externally. This isn't whats causing prices to drop, whats causing prices to drop is powering down from several large whale accounts. When these accounts power down they power down vests in equal payments. Which means that they receive more liquid steem each week.

What happened is that the markets figured this out and demand dried up, creating a snowball effect of selling pressure. It wasn't arbitrage that caused the move down, it could have worked in exactly the same way the opposite direction.

Ultimately a large amount of steem was sold internally, it's not arbitrageurs that caused the move down.... it's because a large amount of steem was sold internally..

Its not one particular case, it happens frequently. And no, its not triggered by a huge sell off of steem on the internal market. What always happens is huge Buy volume on the external market, followed by arbitrageurs creating huge sell volme on the external market and huge buy volume on the internal market.

Those ridiculous buy spikes are really shoddy trading, I've been trading around them, in every case the offers are wiped out and then met by sellers at some resistance point. As soon as I saw the pattern I started to trade the range buying at the low and selling at the spike high. I'm not trading the arbitrage just the range.

You can't expect to break out of a range in one clip, it needs to be squeezed out slowly. Whoever is buying in these aggressive spikes is showing their hand, the pattern is pretty clear, sell any aggressive spikes as the buyer never backs them up then buy back in lower.

It's taking advantage of someone who doesn't know how to trade a range. The only reason there's an arbitrage opportunity is because the buyer or buyers are too aggressive and frankly don't know what they're doing.

hm.

so youre saying:

some random dude (or dudes) comes along and unstrategically buys up a bunch of steem on the exchange

this casues an arbitrage and a bunch of volume, but thats not really doing anything except producing white noise.

Whats really bringing down the price down is savvy traders who see the opportunity to "skijump" past the downslope.

I will give you props that this is the only viable alternative explanation i have yet heard for the phenomenon i have actually seen.

read this one too and wondering as well.

See reply to @cryptogee Let me know if you want me to elaborate further

I had a feeling I might have misunderstood ;) I will have a look. Your giving me idea's nonetheless for which I thank you.

Hello @cryptogee

I have read it, and the main assumption in this article is completely false IMO.

The only thing that is happening is, some user working orders on the internal market are giving away edge. These users want to sell Steem, they are working an order on the internal market to do so. The market move dramatically so that, they could get a better price elsewhere, a middle man steps in and takes profit, and matches the sellers request

The Arbitator doesn't add to selling volume, they just match volume that is already there.

Let me know if that answers your question. If not, I will happily post something more comprehensive... I am an Oil Trader (who also plays Arbitrage games) by day, so this is something I like to think I know about..

big shock here.

As i explained in my post, the internal market is denominated in convertible notes, not cash. And that means the buy volume on the internal market won't effect the cash price, only the exchange rate between convertible notes and steem. As i also noted in my thread, you can actually watch the price getting pulled down on the external markets with no movement at all on the internal market.

Its unfortunate that the whales (and their cheerleaders) are so obsessed with either making a quick buck or projecting an image that everything is alright that they are willing to ignore/cover up an obvious flaw rather than acknowledge and correct it.

If you want to take Ollie's advice, obviously thats your option. Just like it would have been your option to take his advice to power up right before steem lost 75% of its value. But ask yourslef this-- how far down does the price have to drop before you quit believing the cheerleaders. According to @hisnameisolllie 70% is nothing to be concerned about. Is 80? 90?95?99? I gotta wonder at what point (if ever) most people will start to question the propaganda.

As i noted in Rok's thread, I am providing proof and a demonstration of this tomorrow afternoon. you can read the details of that below.

Your buying 5-10k Steem, and then selling it to see what happens..? You net affect on the market is zero in this case.

I don't see how this proves anything. When you buy, you either prop up the price , or force it up. When you sell, you either keep the price at a floor, or it falls..

My point is that, the net affect of you action is zero. The same way the net affect of an arbitration trader is.

Well, buying and selling it a bunch of times, but yeah effectively.

What youre saying is true if both of the markets are denominated in the same currency. ANd if one of the markets isnt based on a pegged convertible note.

WHat it comes down to is that in two properly functioning markets the buy and the sell will cancel each other out. If one of the markets is less responsive they will not.

WHat i'm going to prove is that theinternal market is less responsive.

The hilarious thing is that after I do this and tank the price by half of however much is left of it by this afternoon, you'll be right back on here (along with the usual suspects) calling it a coincidence. Because to do otherwise would be to admit a there was something wrong, and lets face it, thats not how you make money on this site.

side note -- if you want to watch, i think its about to happen right now. you should see prices drop dramatically in the next hour or so

What were the results of your market manipulation play? What happened?

It hasnt happened yet, and may have to wait till monday. I ended up severely underestimating the volume of client payouts for this week, so found myself with a several thousand dollar BTC shortfall that i had to make up on LBC (at an absurd 7% markup)

@hisnameisolllie Excellent article! I learned a lot from this. Still trying to make my first $1 on Steem. :)

Ok, just to boil this down ...

You are saying that the price of STEEM is nose-diving in a near-straight down trajectory 'because' the people that got rich off this shit see that it is in trouble, and are cashing out as much as possible, as quickly as possible, and that is why the place does not 'feel' like one with a rapidly growing and enthusiastic new membership, but more like a party where the DJ has stopped spinning, and everyone is standing around wondering what the fuck is going on!?

Is that about right?

this post gets an A+

Nope. That is certainly not what I'm saying.

Duering distribution phase (which we are in) there is a capital restructuring ongoing, increasing sell side volume and putting pressure on prices.

This is a short term phenomenon which will recorrect itself as we move toward the 90% Steem Power to Steem ratio, as jl777 posted above (whose analysis seems pretty good to me)

His name is Whaley....

Not for this one article but for others of yours - congrats you have found the right combination of "almost complete' analyses, appealing to the whales with just enough touch of brown nosing....

This one is pretty good actually, but then again because of that, it will not hit the magic $600/post point...

So my advice -keep to the same honest, semi decent research ones, with the right mix of lies appealing to whales/system users.

Still trolling, I see. :(

Where were the "right mix of lies" in the post?

:) Thanks @james-show I will.

lolz