Investment Language 101 Series: TERM OF THE DAY: -- What Is: ' Stop Order ' | E.127 | Trading Candle Cheat Sheet Incl. Each Episode.

A series designed to help all the new people flooding into & entering Crypto/Investments daily who get thrown into the rabbit hole so to speak and everything is new to them.

Bitshares 101 Focus/Resources Section for New Crypto Folks now included near the end of each post - starting just prior to Christmas 2017. BTS is a Decentralized Exchange and much more. Very undervalued!

It is a TLDR / Short Form Series, covering ONLY one thing each episode in blue collar, easy to understand language to give a SHORT OVERVIEW of the term or lesson of the day.

It is specifically designed this way to keep it short and simple.

People can then search out extra info if they wish.

I've never seen a regular series or resource running on Steemit to continually address this basic need so I decided to do it.

TERM OF THE DAY:

What is....

' Stop Order ' ?

--

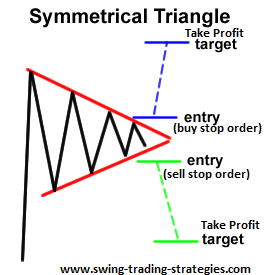

A stop order is an order to buy or sell a security when its price increases past a particular point, thus, ensuring a higher probability of achieving a predetermined entry or exit price -- limiting the investor's loss, or locking in his or her profit.

Once the price surpasses the predefined entry/exit point, the stop order becomes a market order.

Also referred to as a "stop" and/or "stop-loss order."

--

Breaking Down...

' Stop Order ' :

--

Investors and traders can execute their buy and sell orders using multiple order strategies to limit the chance of loss.

The basic market order fills an order at the ongoing market price of the security. For example, say on January 5, 2018, AAPL was trading for $175 per share at 1pm. A market order does not guarantee that an investor’s buy or sell price will be filled at $175. The investor may get a price lower or higher than $175, depending on the time of fill. In the case of illiquid or extremely volatile securities, placing a market order may result in a fill price that significantly differs from $175.

On the other hand, a limit order fills a buy or sell order at a price (or better) specified by the investor. Using our example on AAPL above, if an investor places a $177.50 limit on a sell order, and if the price rises to $177.50 or above, his order will be filled. The limit order, in effect, sets the maximum or minimum at which one is willing to buy or sell a particular stock.

A stop order is placed when an investor or trader wants an order to be executed after a security reaches a specific price. This price is known as the stop price, and is usually initiated by investors leaving for holidays, entering a situation where they are unable to monitor their portfolio for an extended period of time, or trading in volatile assets, such as cryptocurrencies, which could take an adverse turn overnight.

A buy stop order is entered at a stop price above the current market price. A sell stop order is entered at a stop price below the current market price. Let’s consider an investor who purchased AAPL for $145. The stock is now trading at $175, however, to limit any losses from a plunge in the stock price in the future, the investor places a sell order at a stop price of $160. If an adverse event occurs, causing AAPL to fall, the investor’s order will be triggered when prices drop to the $160 mark.

A stop order becomes a market order when it reaches the stop price. This means that the order will not necessarily be filled at the stop price. Since it becomes a market order, the executed price may be worse or better than the stop price. The investor above may have his shares sold for, say $160, $159.75, or $160.03. Stops are not a 100% guarantee of getting the desired entry/exit points. This could be a disadvantage since if a stock gaps down, the trader's stop order may be triggered (or filled) at a price significantly lower than expected, depending on the rate at which the price is falling, the volatility of the security, or how quickly the order can be executed.

Using this example, one can see how a stop can be used to limit losses and capture profits. The AAPL investor, if his order is filled at stop price of $160, still makes a profit from his investment: $160 - $145 = $15 per share. If price spiraled down past his initial cost price, he sure will be thankful for the stop. On the other hand, a stop-loss order could increase the risk of getting out of a position early. For example, let’s assume AAPL drops to $160, but goes on an upward trajectory right after to, say $185. Because the investor’s order is triggered at the $160 mark, he misses out on additional gains that could have been made without the stop order.

Your Friend in Liberty, Barry.

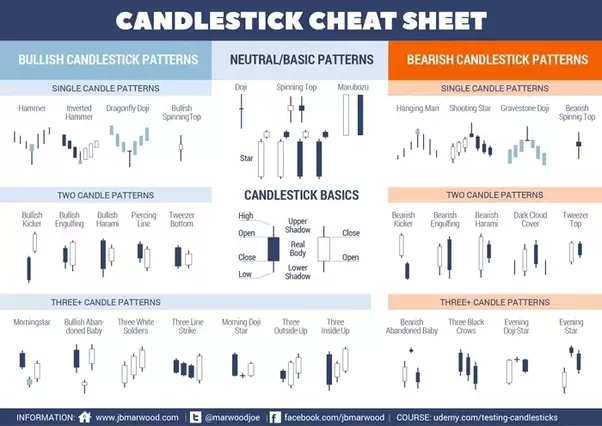

Trading Candle Cheat Sheet:

--

Further Reading/Source/Resources

Friend of the People -- Enemy of the State.

--

Bitshares 101 Focus/Resources Section:

for New Crypto Folks.

https://bitshares.org/

--

-- Bitshares is a Trading platform, and a LOT more.... designed by blockchain wizard here Dan Larimer - @dan / @dantheman.

I've blogged on him, and BTS many many times.

It's a place you can use that is decentralized, with an active community, to use trading lessons like this, that we are learning together.

Just a few of my past $BTS blogs....

to help you apply lessons today!

--

Thanks for reading, have a nice day.

PixaBay has tons of free pictures for us all to use!!!

Super Easy/Fast Picture Edits / Resizing at: http://www.picresize.com/ and also https://www298.lunapic.com/editor/

If you liked this blog post - please Resteem it and share good content with others!

--

Some of my recent blogs:

--

Most Images: Gif's - via Giphy.com , Funny or Die.com / Pixabay. Today:

If you feel my posts are undervalued or you want to donate to tip me - I would appreciate it very much.

--

LiteCoin (LTC) - LKdsnvSXk9JW99EiNicFMGKc1FXiBo9tUE

EOS (EOS) - 0xD37bEFf5bf07E3aa432de00cE0AaA8df603A4fB0

Ethereum (ETH) - 0x3Ad69Ff057C9533ca667B2d7E3E557F5eeFd4477

Ethereum Classic (ETC) - 0x5ab2b08d4ce8d454eb9d1ecc65c6d8b0c5f9784c

Bitcoin (BTC) - 18J6RRuzX4V7b2CDbx7tWZYNBLkkGWsvWX

DASH - XgZvsvSZgPkNbmGbRhc3S1Pt2JAc7QHwiS

PIVX - DA3azxQqJiX9t7EviuacpamfNhMi2zGAUh

Stratis (STRAT) - SNsJp6v1jXvKWy4XcXSXfNQ9zhSJJppJgv

ZCash (ZEC) - t1aCPEYELkGaf3GtgGTiCEDo7XfPm4QEwmL

Please note -- I will have limited internet access for awhile -- so PLEASE do not be upset that I cannot reply right away, or to everyone. I am dealing with some changes, and will have limited time online and will be happy if I get a few blog posts up a week.

This has really upset some people but I do not force my opinions on others, or need to communicate every detail of my life or issues, most people do not care anyways. I invested around 10 hours or more a day on Steemit most of my first 13 mths here, trying to build community, put out content and engage people, help and donate to people, and I just do not have that time in my life right now, and that includes for replies and voting/curation.

I have done my best, sorry if you do not understand like some are clearly having a problem with. It's a blogging platform, and I will do my best at everything, and to keep blogging.

Carry On.

A series designed to help all the new people flooding into & entering Crypto/Investments daily who get thrown into the rabbit hole so to speak and everything is new to them.

Bitshares 101 Focus/Resources Section for New Crypto Folks now included near the end of each post - starting just prior to Christmas 2017. BTS is a Decentralized Exchange and much more. Very undervalued!

It is a TLDR / Short Form Series, covering ONLY one thing each episode in blue collar, easy to understand language to give a SHORT OVERVIEW of the term or lesson of the day.

It is specifically designed this way to keep it short and simple.

People can then search out extra info if they wish.

I've never seen a regular series or resource running on Steemit to continually address this basic need so I decided to do it.

TERM OF THE DAY:

What is....

' Stop Order ' ?

--

A stop order is an order to buy or sell a security when its price increases past a particular point, thus, ensuring a higher probability of achieving a predetermined entry or exit price -- limiting the investor's loss, or locking in his or her profit.

Once the price surpasses the predefined entry/exit point, the stop order becomes a market order.

Also referred to as a "stop" and/or "stop-loss order."

--

Breaking Down...

' Stop Order ' :

--

Investors and traders can execute their buy and sell orders using multiple order strategies to limit the chance of loss.

The basic market order fills an order at the ongoing market price of the security. For example, say on January 5, 2018, AAPL was trading for $175 per share at 1pm. A market order does not guarantee that an investor’s buy or sell price will be filled at $175. The investor may get a price lower or higher than $175, depending on the time of fill. In the case of illiquid or extremely volatile securities, placing a market order may result in a fill price that significantly differs from $175.

On the other hand, a limit order fills a buy or sell order at a price (or better) specified by the investor. Using our example on AAPL above, if an investor places a $177.50 limit on a sell order, and if the price rises to $177.50 or above, his order will be filled. The limit order, in effect, sets the maximum or minimum at which one is willing to buy or sell a particular stock.

A stop order is placed when an investor or trader wants an order to be executed after a security reaches a specific price. This price is known as the stop price, and is usually initiated by investors leaving for holidays, entering a situation where they are unable to monitor their portfolio for an extended period of time, or trading in volatile assets, such as cryptocurrencies, which could take an adverse turn overnight.

A buy stop order is entered at a stop price above the current market price. A sell stop order is entered at a stop price below the current market price. Let’s consider an investor who purchased AAPL for $145. The stock is now trading at $175, however, to limit any losses from a plunge in the stock price in the future, the investor places a sell order at a stop price of $160. If an adverse event occurs, causing AAPL to fall, the investor’s order will be triggered when prices drop to the $160 mark.

A stop order becomes a market order when it reaches the stop price. This means that the order will not necessarily be filled at the stop price. Since it becomes a market order, the executed price may be worse or better than the stop price. The investor above may have his shares sold for, say $160, $159.75, or $160.03. Stops are not a 100% guarantee of getting the desired entry/exit points. This could be a disadvantage since if a stock gaps down, the trader's stop order may be triggered (or filled) at a price significantly lower than expected, depending on the rate at which the price is falling, the volatility of the security, or how quickly the order can be executed.

Using this example, one can see how a stop can be used to limit losses and capture profits. The AAPL investor, if his order is filled at stop price of $160, still makes a profit from his investment: $160 - $145 = $15 per share. If price spiraled down past his initial cost price, he sure will be thankful for the stop. On the other hand, a stop-loss order could increase the risk of getting out of a position early. For example, let’s assume AAPL drops to $160, but goes on an upward trajectory right after to, say $185. Because the investor’s order is triggered at the $160 mark, he misses out on additional gains that could have been made without the stop order.

Your Friend in Liberty, Barry.

Trading Candle Cheat Sheet:

--

Further Reading/Source/Resources

Friend of the People -- Enemy of the State.

--

Bitshares 101 Focus/Resources Section:

for New Crypto Folks.

https://bitshares.org/

--

-- Bitshares is a Trading platform, and a LOT more.... designed by blockchain wizard here Dan Larimer - @dan / @dantheman.

I've blogged on him, and BTS many many times.

It's a place you can use that is decentralized, with an active community, to use trading lessons like this, that we are learning together.

Just a few of my past $BTS blogs....

to help you apply lessons today!

--

Thanks for reading, have a nice day.

PixaBay has tons of free pictures for us all to use!!!

Super Easy/Fast Picture Edits / Resizing at: http://www.picresize.com/ and also https://www298.lunapic.com/editor/

If you liked this blog post - please Resteem it and share good content with others!

--

Some of my recent blogs:

--

Most Images: Gif's - via Giphy.com , Funny or Die.com / Pixabay. Today:

If you feel my posts are undervalued or you want to donate to tip me - I would appreciate it very much.

--

LiteCoin (LTC) - LKdsnvSXk9JW99EiNicFMGKc1FXiBo9tUE

EOS (EOS) - 0xD37bEFf5bf07E3aa432de00cE0AaA8df603A4fB0

Ethereum (ETH) - 0x3Ad69Ff057C9533ca667B2d7E3E557F5eeFd4477

Ethereum Classic (ETC) - 0x5ab2b08d4ce8d454eb9d1ecc65c6d8b0c5f9784c

Bitcoin (BTC) - 18J6RRuzX4V7b2CDbx7tWZYNBLkkGWsvWX

DASH - XgZvsvSZgPkNbmGbRhc3S1Pt2JAc7QHwiS

PIVX - DA3azxQqJiX9t7EviuacpamfNhMi2zGAUh

Stratis (STRAT) - SNsJp6v1jXvKWy4XcXSXfNQ9zhSJJppJgv

ZCash (ZEC) - t1aCPEYELkGaf3GtgGTiCEDo7XfPm4QEwmL

Please note -- I will have limited internet access for awhile -- so PLEASE do not be upset that I cannot reply right away, or to everyone. I am dealing with some changes, and will have limited time online and will be happy if I get a few blog posts up a week.

This has really upset some people but I do not force my opinions on others, or need to communicate every detail of my life or issues, most people do not care anyways. I invested around 10 hours or more a day on Steemit most of my first 13 mths here, trying to build community, put out content and engage people, help and donate to people, and I just do not have that time in my life right now, and that includes for replies and voting/curation.

I have done my best, sorry if you do not understand like some are clearly having a problem with. It's a blogging platform, and I will do my best at everything, and to keep blogging.

Carry On.

--

LiteCoin (LTC) - LKdsnvSXk9JW99EiNicFMGKc1FXiBo9tUE

EOS (EOS) - 0xD37bEFf5bf07E3aa432de00cE0AaA8df603A4fB0

Ethereum (ETH) - 0x3Ad69Ff057C9533ca667B2d7E3E557F5eeFd4477

Ethereum Classic (ETC) - 0x5ab2b08d4ce8d454eb9d1ecc65c6d8b0c5f9784c

Bitcoin (BTC) - 18J6RRuzX4V7b2CDbx7tWZYNBLkkGWsvWX

DASH - XgZvsvSZgPkNbmGbRhc3S1Pt2JAc7QHwiS

PIVX - DA3azxQqJiX9t7EviuacpamfNhMi2zGAUh

Stratis (STRAT) - SNsJp6v1jXvKWy4XcXSXfNQ9zhSJJppJgv

ZCash (ZEC) - t1aCPEYELkGaf3GtgGTiCEDo7XfPm4QEwmL

Thanx. I'm trying to learn this extremely complex world of trading. That's for explaining the term "stop" order. I hope I can wrap my head around all of what is needed to know.

It takes time, do not panic -- you could damage yourself trading if you force it too soon/too fast - and I mean wrekt financ. or emotionally.

Watch a lot of trading stuff, try it out with a dollar or 2 - get used to it, slowly.

Wallet transfers and such even to start.

Be careful and you will be more than fine.

Thanks a lot for such a sensible advice.