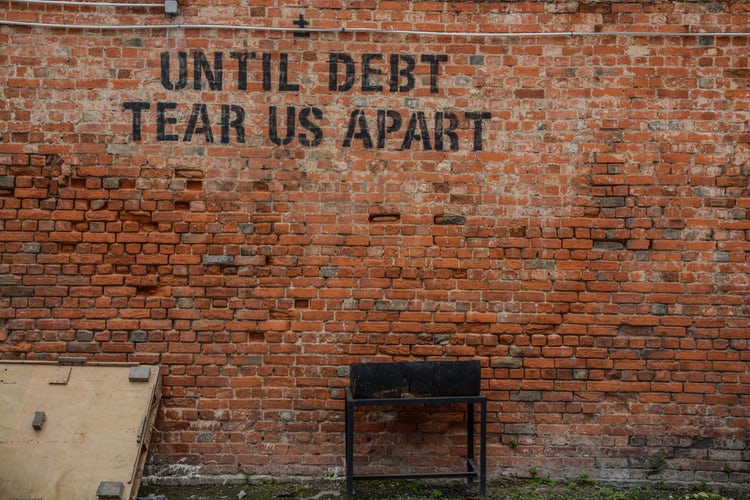

Bankruptcy - My Top Tips for Recovery and Staying Debt Free

My top tips to recovering after bankruptcy and staying debt free!

About 6 years ago, I had to go bankrupt. It was one of the hardest times of my life. It not only affected me financially, but emotionally, physically and mentally too. I don’t know how some people do it every 7 years, it is something I literally never want to experience ever again for the rest of my life. It has made me extremely conscious of the fact that I don’t ever want to get back into debt, not even for a few hundred pounds!

We all (or majority of us) have to borrow money at some point in our lives. The most obvious one is taking out a mortgage.

I was lucky that when I went bankrupt, the house was in negative equity due to the housing market collapse, so the bank didn’t take our house away and we managed to keep our home. This was probably the only thing that kept me semi-sane.

Apart from that, they took everything. All the credit cards were taken and cancelled; these had always been my safety nets in case of emergencies cropping up like broken boilers, washing machines, car repairs etc. So not having these really panicked me.

My bank account was taken away. I had to open a prepay type basic account where I couldn’t use online banking, mobile banking and I didn’t have access to emergency money like an overdraft or borrowing facilities. Again, panic!

All our cash was taken away too (not that we had much). They assessed everything in our house to sell off to recover some of the money, but we had nothing of value so there was really nothing to take.

We had to literally start again and hope that nothing went wrong before building up an emergency fund.

The actual process in court was fairly straightforward, apart from making you feel like a criminal. It was the after effects and the build up of pressure before-hand that was worse.

After the bankruptcy had been filed, I started to look into ways of managing our money in better ways.

The following are the steps that I took to help us avoid this ever happening again...

1 Cancel all subscriptions, even mobile phones. We only have PAYG mobiles now and it really has saved us hundreds over the years.

Cable and TV licence - TV was pretty crap viewing anyway, so I cancelled the TV licence and sky. We just don’t watch TV now, unless it is something we really want to see, then we download it and watch it through the laptop, or go to the cinema for a treat.

White Goods Insurance – Half the time, I was paying for a service that would have probably bought me a new washer 3 times over! The one time I did make a claim, it didn’t cover us for parts anyway and it was cheaper to buy a new one than to pay for the parts, so the insurance was pretty useless.

2 Only pay for things with cash – I realise that this may be a little controversial on a cryptocurrency site, however this literally saved our financial lives. I withdrew all the money that didn’t need to be left in the bank account to cover bills, and separated it into various envelopes labelled food, school dinners, petrol etc. If we didn’t have cash in the envelope, we couldn’t buy the resource.

3 Plan weekly meals and stick to the plan. At the beginning of each week, I would write a list of the foods I needed to make each day’s meals, then only buy the ingredients on the list. No deviating from the list was allowed. Everything was made from scratch and there were no pre-processed foods. I managed to cut the weekly shop down from £150 to £70!

4 Sell one of the 2 cars. As we both worked full time before the bankruptcy, we both needed a car. But the pressure of the debt was so immense that it caused me to have a mental breakdown and I was forced to quit my job. Having 2 cars was no longer essential, so we sold one of them. It wasn’t worth much but the amount saved in road tax and insurance soon adds up.

5 Keep a spreadsheet of every penny spent and earned. This helped me to figure out if there was anywhere else I could cut down on expenditure. It is amazing what you can spend when you aren’t looking!

Six years down the line and we are back on our feet. I have a semi normal bank account now, but I still don’t have an overdraft as I don’t want to have to rely on one. It is a basic account because I chose to keep it that way. The things that scared me at first are now my comfort blankets. The fact that my finances cannot run away with themselves makes me feel more in control.

I still deal with cash from envelopes, however i don’t withdraw it all; I just take out my weekly amounts and leave the rest in the bank. This way I have been able to build up an emergency fund from the money that we have managed to save bit by bit.

My mobile phone is still a PAYG and I only have an iPhone 4s, not an up to date model. It does what I need it to do, and that is fine.

We only have the 1 car and we cope very well with it. We don’t need 2 cars as we tend to go out together or one of us stays home while the other uses the car.

Our TV is still disconnected and I haven’t missed watching all the crap that has been on since I stopped watching! I am sure it was the same old drivel anyway!

We were very lucky not to lose our house and for that I am grateful. There are some people who literally lose everything. So we do still have a mortgage, but my aim is to reduce the term by overpaying where I can. I hate owing money to anyone now, especially banks as they have so much power over you.

Many people work on improving their credit rating after bankruptcy by using credit cards, however I am not a fan of this as the risk outweighs the benefit.

In 1 more year, the bankruptcy should be removed from my credit file, but it will never be removed from my memory and has shaped my financial habits for the better. You can take bankruptcy as a negative, or you can learn from it and turn it into a positive and put all your debts behind you. I choose the latter :)

Thank you to unsplash.com for the free images and thank you for reading, @beautifullbullies xx

Congratulations! In addition to the vote from @randowhale, you also received a vote from @randowhaletrail!

That is just one amazing story !

I had no idea how that process goes, but the way you dealt with it is seriously inspiring.

And thanks for those tips, I'm sure many would benefit from them !

It was an awful time, but I was determined to take something positive from it. I hope the tips will help people, even if they aren't in trouble financially. They have really worked for me and I wish someone had told me these things at the time, it would have been so much easier lol but we learn from our mistakes, and I have made plenty along the way, but have now come out the other side :)

I think your plan is solid and is how we live our life now for well over 10 years. We have no bank accounts, credit cards, line of credit or anything like that. Everything is cash! It also helps that we have no bills as we live off grid, grow our own food, etc. We live on anywhere from $500 to $750CDN per month. That covers our phone, internet, fuel and other incidentals that we cannot produce for ourselves. It is more work, but not having the stress of bills and debt is a stress I don't ever want to see again. The value we store is now in the food in the pantry, wood in the shed, etc. All those are far more valuable than money in a bank! By a million times! Bravo for sharing your journey! I went through it in 2001. I can relate completely!

Thank you :) It is a hard story to tell, but it also makes me realize how much I have learnt from it. I also teach my son to buy things only once he has saved enough money up, or to trade for it. He is quite the little entrepreneur! He picked strawberries from my allotment one year. Every weekend morning, he got up early, picked them, washed them, cut them up and sold them on the front to the neighbours! He made enough money after a few weeks to buy the bmx he had been dreaming of! I hope he takes these lessons into adulthood as I hate the thought of him being trapped by the system like I was.

Bravo! It is a hard lesson for sure. Our journey living off grid was a lesson in recognizing the differences between needs and wants. We just had to say good bye to a lot of the 'stuff' that we wanted so that we can focus on what we needed. In the end, we don't miss all the stuff and found out that being self sufficient met our needs and fed us physically, emotionally, mentally and spiritually. It is very enriching and rewarding. I pray your kids learn that lesson and take it with them for the rest of their life. Bravo!

Hello beautifulbullies, I am a simple vote scheduling service for randowhale so that you can always catch it awake and get an upvote from them. For a full description of how to use me, check out my guide post.

This post is upvoted by Polsza for 52 %.

If you want help us growing upvote this comment.

Thanks !

This post has received a 18.53 % upvote from @lovejuice thanks to: @beautifulbullies. They love you, so does Aggroed. Please be sure to vote for Witnesses at https://steemit.com/~witnesses.

This post has received a 28.06 % upvote from thanks to: @beautifulbullies.

thanks to: @beautifulbullies.

For more information, click here!!!!

The Minnowhelper team is still looking for investors (Minimum 10 SP), if you are interested in this, read the conditions of how to invest click here!!!

This post has received a 1.11 % upvote from @booster thanks to: @beautifulbullies.

This post has received a 5.53 % upvote from @buildawhale thanks to: @beautifulbullies. Send at least 1 SBD to @buildawhale with a post link in the memo field for a portion of the next vote.

To support our daily curation initiative, please vote on my owner, @themarkymark, as a Steem Witness