Trillionaire Fund Manager Martin Armstrong Was Framed By Our Corrupt Government

Martin Armstrong was advising on $3 trillion¹ of funds and inadvertently became entangled as the framed scapegoat to cover-up huge corruption in governments around the world.

Wrestling the Vampire Squid: Why Goldman Sachs Still Rules The World

¹ “an amount equal to about 50% of the total US National Debt in 1999”

Martin Armstrong Before 1999

Armstrong blogged:

When you have been a hedge fund manager trading billions, there is a culture shock you must get used to […] You can deal in billions, or in

my case advise even on trillion-dollar portfolios.

Armstrong blogged:

I had more than half the equivalent of the US National Debt under contract for advisory.I think I saw things no analysts has ever dreamed of no less understood.

Armstrong blogged:

To set the record straight, yes I had to close out positions early in 1998 in the public fund because we made way too much money. That may sound nuts, but in a public open fund you cannot post gains in the hundreds or percent for a two months. It would upset the entire industry cause all sorts of problems even with regulators. The model correctly forecast the Long-Term Capital Management Crash. I sold $1 billion worth of Japanese yen at 147 against the Yearly Bullish Reversal in addition to numerous other markets. They began calling me Mr. Yen for that trade.

In the share markets, I had even sold the S&P500 on the very day of the Economic Confidence Model peak – July 20th, 1998, which was the precise high in that market. Getting so many markets precisely correct presents a problem because most people do not comprehend that markets are (1) interlinked, and (2) precise. They immediately want to say you manipulate markets since the vast majority do not understand how the world economy functions and go back to instantly assuming manipulation. I was accused of manipulating the world economy because that is easier to assume than perhaps things do not work the way people believed.

Armstrong blogged:

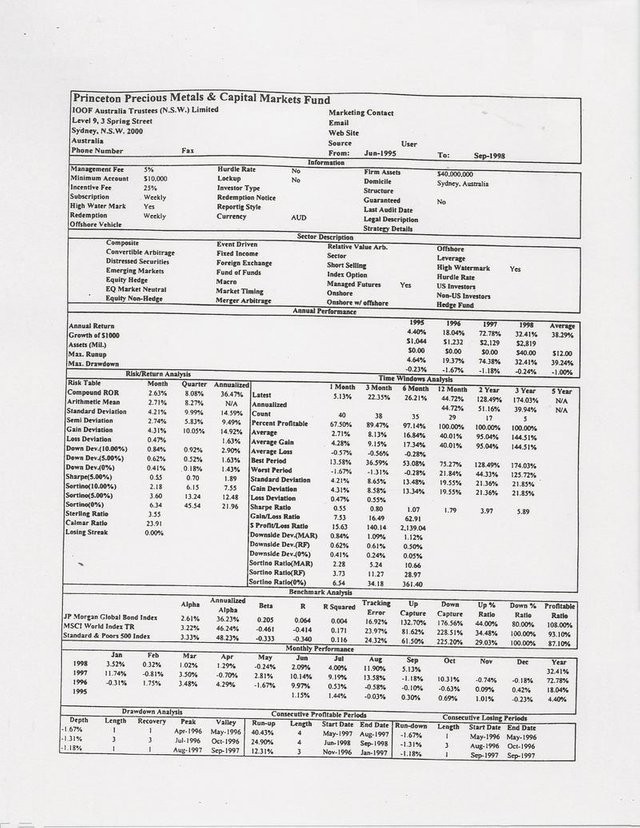

Martin Armstrong was named Hedge Fun Manager of the Year for 1998. He managed several hedge funds for different firms including Deutsche Bank. The most remarkable aspect of his public track record is perhaps the lowest draw-downs of any fund manager in history. Here is the public audited track record of that Deutsche Bank fund to illustrate the scope and depth of the models employed in forecasting that are unmatched […]

Wikipedia’s Lies

Many delusional, arrogant, and ignorant goldbugs prefer to regurgitate Wikipedia’s lies about Armstrong, because they want to discredit the truths Armstrong explained about precious metals.

Before discussing Armstrong’s work, first we need to debunk corrupt gatekeepers such as Wikipedia that routinely spread lies or cover-up key details about politically sensitive topics which could otherwise unmask great evil.

Epstein Didn’t Kill Himself

For example, Wikipedia obscures the deeper truth of Jeffrey Epstein’s autopsy by omitting (even footnote references to) the following details:

However the second pathologist, hired by Mr Epstein, came to a different conclusion, having viewed the body and been present at the autopsy the day after Epstein died.

“They rushed the body out of the jail, which they shouldn’t do because that destroys the evidence,” he said.

Dr Baden found that Epstein had

twofractures on the left and right sides of his larynx.He told the Miami Herald that it is

rare for any bones to be broken in a hanging, let alone for multiple bones to be fractured. [even Wikipedia cites only 16 of 264 hangings had even only one bone broken, and no mention of eye hemorrhages]

He added that there were

haemorrhages in Epstein’s eyesthat are also more common in strangulation than in hangings.He also claimed that the pathologist who actually conducted the autopsy, Dr Kristin Roman, also had trouble determining that Epstein hanged himself, and ruled that the manner of death was “pending.”

“The autopsy did not support suicide,” said Dr Baden. “That’s what she put down. Then Dr Sampson changed it a week later to manner of death to suicide.

“The brother has been trying to find out why that changed. What was the evidence?”

Reid Weingarten, Epstein's lawyer, told a court hearing on August 27 […] that Epstein's body had been moved before forensic analysis could be carried out, and demanded to know why the prison guards were reportedly refusing to testify about events on the night of his death.

He also wanted to know

why his team had not been able to view video camera footagefrom inside the jail.The footage, he said, was “corrupted”, and he wanted to know how long the system had been malfunctioning.

“What if the tapes only broke down when he died? Then we are in a whole different territory,” he said, saying that the whole case was full of “conspiracy theory galore”.

“I’ve not seen in 50 years where that occurred in a suicidal hanging case,” Baden told Fox News.

Baden, however, told Fox News that Epstein’s death was more consistent with a homicide, citing fractures in the financier’s neck that are typically associated with strangulation. He also said

bleeding in Epstein’s eyes were also typical of someone being strangled.“There’s evidence here of homicide that should be investigated, to see if it is or isn’t homicide,” Baden said.

And Attorney General William Barr covers it up claiming he is sure it was a suicide and terminates the investigation ostensibly without a full transparent and open investigation.

Additionally Wikipedia cites numerous footnoted sources that associate the word ‘pedophilia’ with Epstein. Epstein didn’t prey on pre-prepubescent girls. The correct term for someone sexually attracted to adolescents is ‘ephebophile’. This subtle deception is important because by blurring and thus conflating the significant distinction between pedophilia and ephebophilia, the attitude of the populace can be gradually shifted to associating all sexuality as a crime or all sexuality (including sexual assault of babies) as not a crime. Remember in many countries in the world the age of consent is still 12, 13, 14, or 15, but has been raised rapidly in recent decades. Eventually I guess the age of consent will be age 30 everywhere and humans will not procreate above the replacement rate (resulting in severe economic collapse). Seriously. The powers-that-be of course would like to criminalize everything that humans could otherwise do without being subject to tax and totalitarian control. Which is why our overlords promulgate the propaganda lies about man-made climate change that manipulates the populace to foist taxes and totalitarian control on all us.

Armstrong’s Case

Wikipedia lies about Armstrong’s plight w.r.t. to the corrupt New York courts.

There’s a detailed, thorough explanation of how Armstrong was abused by the corrupt legal system.

Armstrong was framed by the DEEP STATE (←click that link for details) in our corrupt government, to cover-up some of the fallout from their involvement in the Long-term Capital Management fraud and the manipulation of the Russian elections by bribing Yeltsin with a $7 billion IMF loan which forced Yeltsin to turn to former KGB Putin to mop up the problem. Make sure you watch the complete 2 hour 32 min version of THE MAGNITSKY ACT – BEHIND THE SCENES video even though Youtube et al delete the video every time it is uploaded:

There’s a concise overview, a bullet-point summary (that fails to note that Magnitsky was murdered), a more detailed summary, and an interview with the film’s director.

The Magnitsky Act – Behind the Scenes’ director Andrei Nekrasov Speaks Out summarizing and elaborating on the film’s plot and global implications:

Armstrong blogged Epstein is no Different than Magnitsky:

What is most curious (c.f. also) is the United States accused Russia of killing a man in prison Sergei Magnitsky because he would have revealed corruption in the Russian police. Here we have the USA accusing Russia and passing the Magnitsky Act because a Russian dies in a Russian prison which is exactly what takes place in the USA all the time – i.e. Jeffrey Epstein.

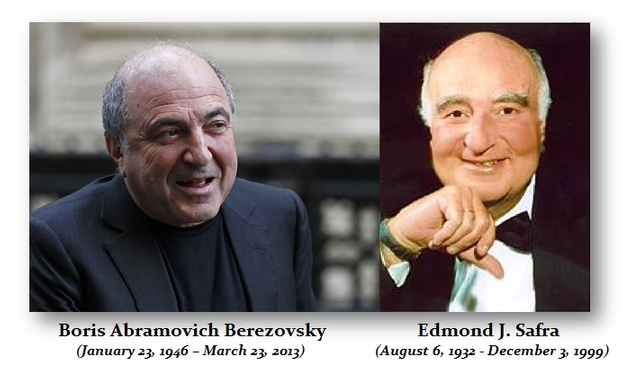

The real story is more likely that Western powers paid to have Magnitsky killed in a Russian prison for he would have exposed the attempt to blackmail Borris Yeltsin to step down which is how Putin gained office. They wanted to force Yeltsin to appoint their stooge Boris Berezovsky to run Russia on behalf of the New York bankers and the West where they could control the oil, gas, gold, and diamond markets. Magnitsky was the accountant for Hermitage Capital which was begun by Edmund Safra who was killed in Monaco and then Berezovsky apparently also felt remorse and hung himself in London after fleeing Russia.

Here we have the US accusing Russia of killing a Russian in prison before he was given a trial which is precisely the way they operate in the United States.

Armstrong blogged Jeffrey Epstein is Dead – Of Course on Schedule:

It did not take long – Epstein is dead as expected. No way would he be allowed to go to trial. He was denied bail after offering to pay for 24-hour guards and wearing a GPS bracelet. He was denied bail in order to ensure he would never go to trial. He was held in 10 South where they hid me with the terrorists so I could not talk to my lawyers either.

The story of suicide is really not believable. If he was suicidal he would have been on suicide watch and everything would have been removed to ensure he could not commit suicide. This is simply the way the government ensures high profiles never go to trial.

In my case, they used another inmate because a suicide story wouldn’t work. Everyone’s doors were locked except mine and my attacker and the officer on duty I never saw before or after. When my attacker came out he was bragging he killed me with my blood on his hands according to all the other inmates who were banging on their doors […]

I was in a coma for several days. To their dismay, I survived. My lawyers warned me about the different ways they might try to kill me. One way they put baby oil in the lightbulb. Turn on the light and it explodes on fire and you burn to death alive. Suicide is a favorite when they can claim you are remorseful and could not live with yourself.

This is the standard operating procedure. Any high-profile who will be able to expose things others have done will NEVER make it to trial.

https://d33wjekvz3zs1a.cloudfront.net/wp-content/uploads/2019/08/Maria-Republic-Accounting.mp3?_=1

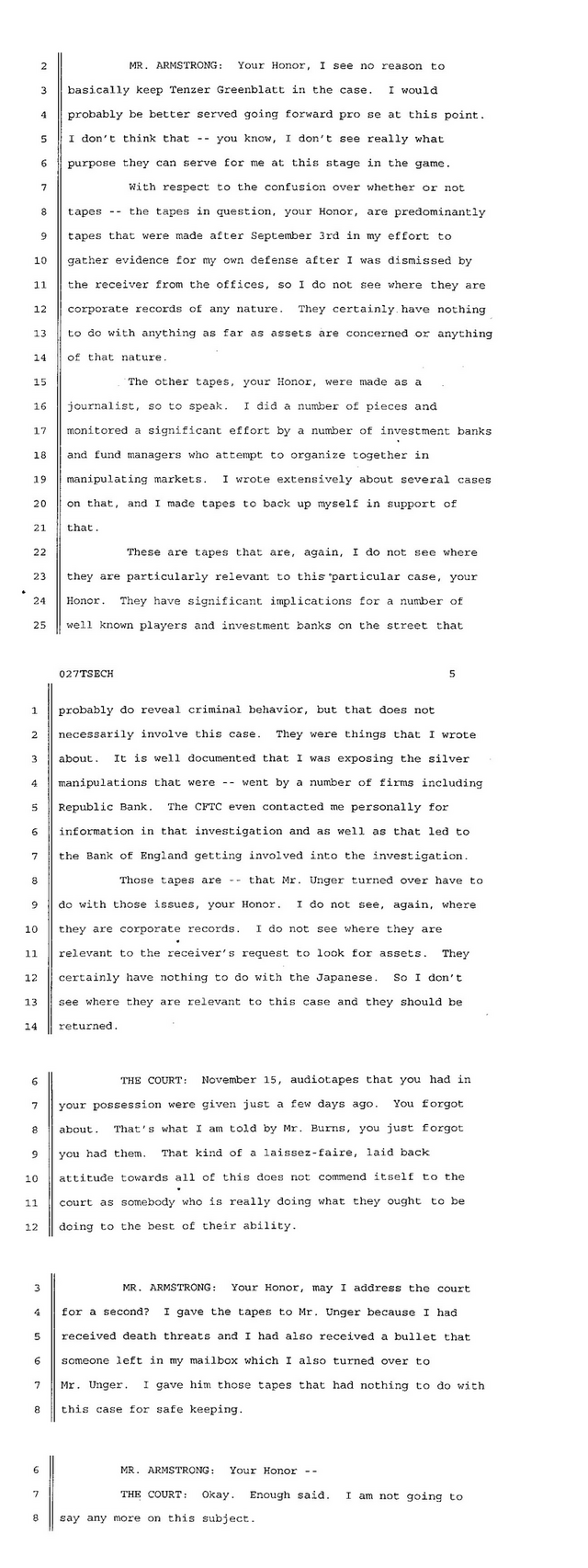

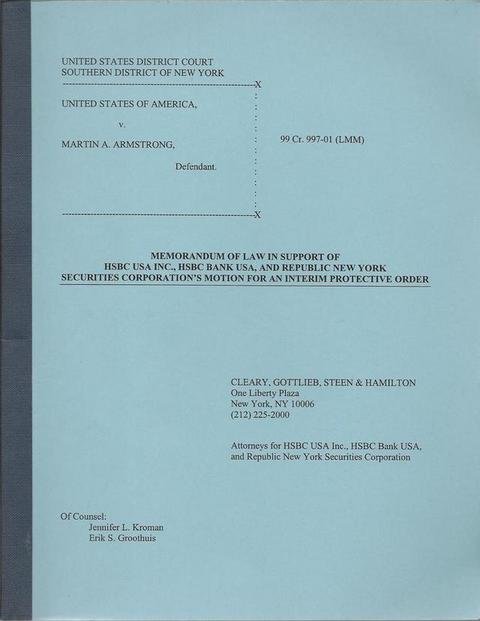

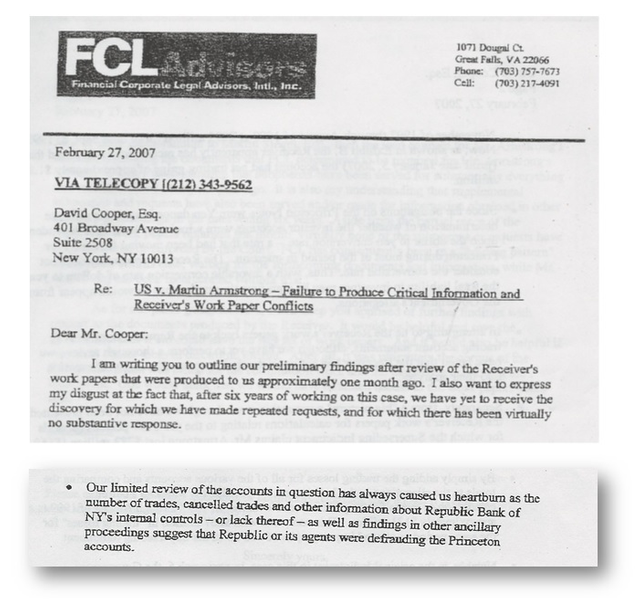

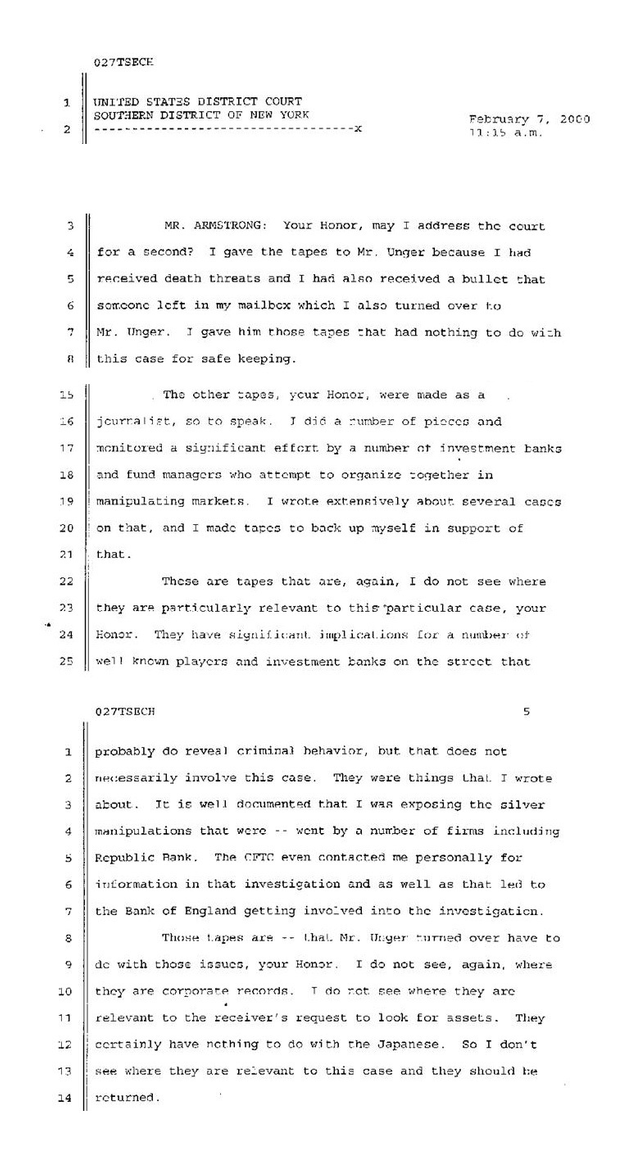

In my case, I had tapes which in a real system would have put many New York Bankers in prison if they did not own the Justice Department, SEC, CFTC, and the courts. Republic National Bank/HSBC had to plead guilty only because I did an interview with the Japanese press and told my clients they had better come to file a suit against HSBC or they would never see a dime.

When my clients and I began to work together against HSBC, then HSBC told the government to gag me, which they did. I have a lifetime gag order placed on me denied the right to help my own clients.

The bank was parking illegal trades in my accounts and covertly using my money the same as MF Global for their own trading. Here is an exculpatory tape they withheld from the courts and the public where $50 million was in an account sitting in Fannie Maes and there was no trading. This tape by itself proved all their allegations were false and they deliberately violated the civil rights of myself, my clients, and everyone in the company.

When we went to check the balance on a new account where not a single trade took place, all the money had vanished. When I called Bill Rogers, President of the Securities Division, he slipped and said oh they probably put the notes back in the wrong account. When I asked what was going on since they were not supposed to be touching the notes, they did all sorts of backflips.

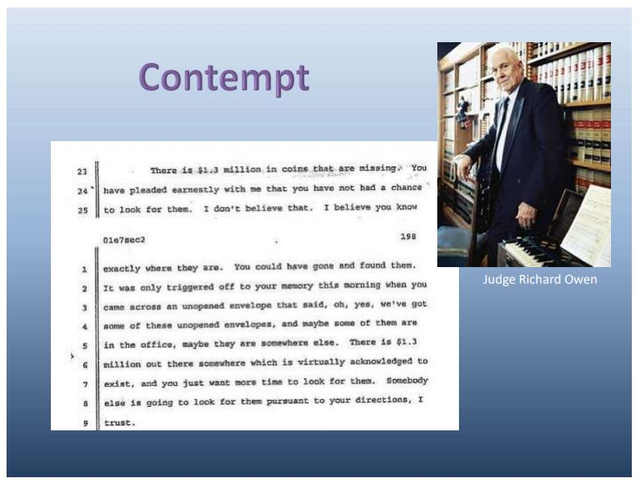

Judge Richard Owen threatened to throw all my lawyers in contempt if they did not hand over all the tapes. I argued they had nothing to do with the allegations. The judge naturally ruled in favor of the government and said maybe they would reveal where the assets were for the bank was claiming they had no idea where $1 billion had gone.

It was absolutely a joke. You either wire out the money, write a check, or you take a truck and crash into the vault assuming they even had $1 billion in cash not collecting interest. You cannot beam it out like Star Trek. The absurdity of the allegation was indicative of the corruption in New York. There is no way $1 billion vanishes.

At the preview of the film the Forecaster in Amsterdam, the third night was attended by all the top bankers in Europe. When they heard the HSBC’s allegations that $1 billion was missing and they had no idea where it went, the entire room began to laugh at such an impossibility. But the US press never asked if such a thing was possible just repeating whatever the government said.

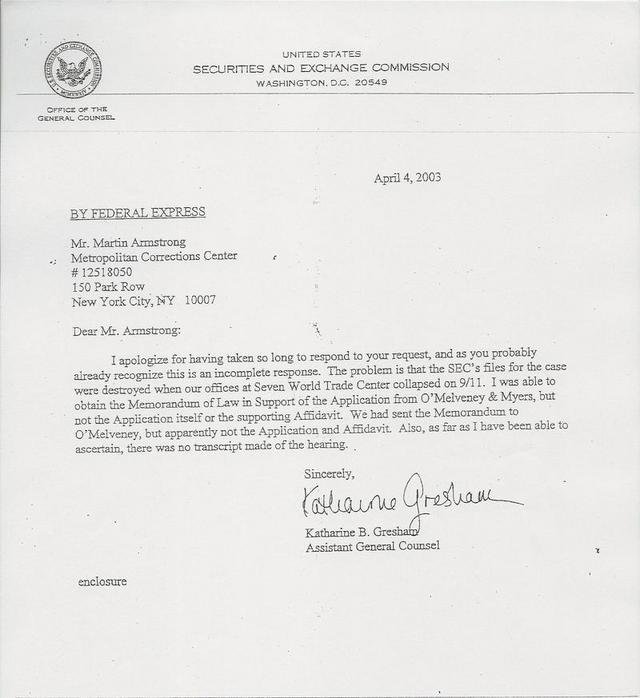

They refused to provide discovery to even put on a defense. They claimed all my documents were destroyed in the World Trade Center attack. I found this tape in my mother’s basement where I had a copy but did not discover it until my ordeal was finished.

The Judge and the government’s prosecutors knew exactly what to do. They had to seize all the tapes that proved the numerous market manipulations that even involved paying bribes to foreign officials not much different from the Malaysian 1MDB scandal. I had tapes asking me to join a manipulation of Platinum where they admitted paying bribes to Russian ministers to recall their platinum to take an inventory.

In my case, I believe the bankers were given the green light to interfere in the Russian 2000 elections blackmailing Yeltsin and they were supported by the Clintons. In this case, the stories of Epstein and Clinton are far too numerous to allow such a case to go to trial not to mention others. He had to die.

Welcome to American justice. Anything they will never allow to go to trial always ends up with the defendant dead, or in my case, I survived after being in a coma […] In this case, Epstein was to be silenced for they did not want him to testify against anyone else. This is what happens in America when you know too much.

Armstrong blogged:

In the case of [my former company] Princeton Economics, MOF issued a letter saying that $30 billion in notes had been sold and $10 billion was supposed to be on deposit at Republic Bank in New York. They sent their letter to the Federal Reserve many believe intentionally for retaliating against our forecast delivered live in Tokyo that the LDP would lose power and that meant also MOF. When MOF lost power in 1998, it appears they deliberately lied to the Federal Reserve and then tried to pretend it was a mistake. For an agency in charge of manipulating the yen, it was not plausible to have made a decimal error in a calculation of this magnitude. They caused Republic to panic, who then stole about $1 billion grabbing what they thought they could and ran to the US authorities who simply filed charges without ever picking up the phone to speak to a single note-holder. To then find out that MOF then said sorry, they made a mistake on the calculation of the yen to the dollar and it was off on a decimal place was not plausible. They turned $3 billion in notes into $30 billion – 3 time the value of Republic National Bank that was sold to HSBC for $10 billion. When the dust settled, it turned out to be $3 billion sold, only $1 billion outstanding, and HSBC/Republic grabbed that, had to plead guilty and return the funds to receiver 100% immunity from the US government.

It was widely believed among our clients in Japan that MOF was deliberately trying to stop Princeton forecasts that they too did not like in retaliation for our forecast that the LDP would lose & MOF with it. Just as the government got caught manufacturing evidence in the trial of Ozawa, they did the same claiming MOF simply made a calculation error. If that is true, then MOF is in charge to manipulating the yen. Unbelievable that such incompetence could ever exist that high up in the bureaucracy (see [images below in the] Appendix).

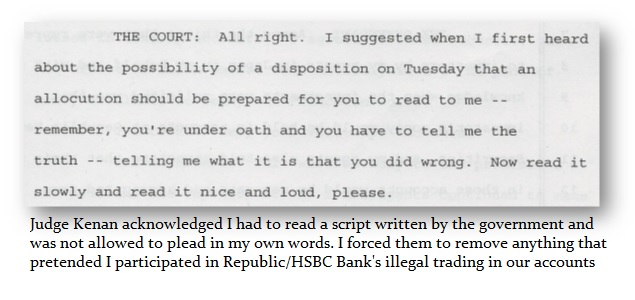

Armstrong blogged Abuse of Contempt of Court – Far more Common than People Realize that he was forced to read an unconstitutional scripted plea that in his opinion admitted no wrong doing on his part:

Scripted pleas are actually totally unconstitutional. You are supposed to plead in your own words and the judge is legally bound to accept your plea ONLY if he believes it and it is voluntary. That is just fiction for the justice system has become so corrupt, all they care about now is form, never substance. Here is Judge Kennan stating in my case that I must read from a script written by the government and not allowed to explain anything in my own words. They NEVER want the truth, for that will disrupt their nice little pretend judicial system with its 98.5% conviction rate – some have to die in the process after all.

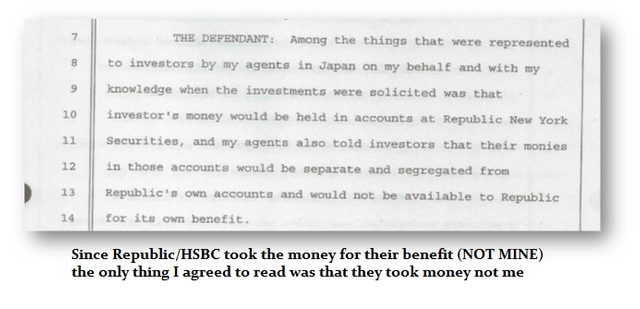

What I agreed to read was that the bankers took money for their “own benefit” for I refused to all along to plead to taking my own money for we were never managing Japanese money, we bought the portfolios. I fail to see where the words I read even constituted anything close to a crime since the accounts were ours to begin with when all we did was buy their distressed portfolios and liquidated them agreeing to pay their original cost making up the 50% loss in 10 years since interest rates was 8.5%.

This is how the courts work. There is no difference between some terrorist organization handing a script to some captive to read on TV condemning his country and agreeing with his captors and the way the US legal system operates. The king’s lawyers (prosecutors) write the words to pretend to match the law and it is all a dog and pony show. This is the ultimate face of corruption.

They illegally and unconstitutionally held Armstrong in prison for 7 years with a bogus contempt-of-court charge and refused to go to trial, because the government had no case. They got him to plea bargain because they were intent on keeping in prison forever without a trial, and were trying to suicide him in prison.

Armstrong blogged Due Process & New York – The End of Reason:

To make this as simple as possible, let’s say they arrest you for raping a girl. They fill the headlines that you are guilty. Then it turns out it was someone else who worked in a bank. They then refuse to release you until they then ask every woman in the country if she was ever raped by you. This is precisely what Alan Cohen of Goldman Sachs told the court that I should never be released even tough there was NO DESCRIPTION of any crime.

So yes. Goldman Sachs was intimately involved to prevent my release and advocated

holding me until I died even though there was no crime, no description of a crime, no trial, not entitlement to lawyers, or anything that was supposed to be American. What took place in the IRS Scandal is standard operating procedure to shut people up when someone does not like what they say. They just pretend you violate some law like arresting Coxley for walking on the Grass when he led people to protest in Washington the economic decline after the Panic of 1893 – Coxley’s Army.Under Due Process of Law you are supposed to be advised what you are being accused of and you then enter your plea guilty or not guilty. I was NEVER advised of any such crime and this is what Alan Cohen of Goldman Sachs stood before the New York court loaded with the “free” press who NEVER would report a single word of truth if it ever went against Goldman Sachs, the government, or the court – especially Bloomberg when Goldman Sachs is a client. Welcome to America – the land of countless conflicts of interest and millions of laws that can be used to shut people up pretending they are enforcing that law to achieve your silence.

They could not find anything to charge me with so they just held me without any charges whatsoever – Civil Contempt – the prerogative of kings, and ministers.

Because they could not even describe a crime I might have done, Alan Cohen dispensed with the problem of even charging someone and providing notice to defend. His solution, just imprison me until I died knowing the NY Press will NEVER go against the NY boys. So much for liberty and justice for all and the land of the free except when you expose the New York Bankers and their destruction of the free markets and world economy. It is always about shutting people up to protect their illegal activities.

Alan Cohen even admitted HSBC pleaded guilty criminally, nobody went to jail, and they just gave back money they tried to pocket by blaming me. The bankers got away with precisely that in M.F. Global. The losses with illegal trading at the banks was covered by depositors at M.F. Global. That is precisely against the law. But law is like life. The only true facts remain you are born and you die. Everything in between is subject to their interpretation. They cannot see that the world they are creating is the destruction of everything that made civilization work. With no Rule of Law and in a land where only government wins, nothing have any real meaning or value. Your home is not your home for your possession of it is subject to the interpretation of a judge,

It came out early on that Alan Cohen somehow found out I had given audio tapes covering everyone I had spoke to about the manipulations on an ongoing basis. That would have been enough to shut down the New York manipulations. Phone calls with numerous dealing desks as we monitored their latest scams. It was not my intent to run to the authorities and say here is the evidence to shut down the bankers. The results of the LIBOR scandal demonstrate there will never be prosecutions, only civil fines. So there was no intent on my part to get involved in such a system. My job was to protect clients. That is why even advising on countless takeovers, not a single instance of inside trading could be found.

Nonetheless, that became Cohen’s target threatening to imprison my lawyers if they refused to turn over that evidence.

Armstrong blogged Can a Federal Judge Hold You Til you Die in a Civil Case?:

I survived even their attempt to kill me. I speak out because I can and because that is what they tried to stop. These people are the ultimate definition of evil.

In my case, to stop me from going to trial and to look at all my defense papers, they threw me into solitary confinement, took all my legal papers, told me if I wanted to go to trial it would be with absolutely nothing. After reviewing my defense, they came and admitted they did not want to go to trial. They knew I would call all the bankers to the stand […]

I refused to plead to any pretend conspiracy so the compromise was I failed to tell my clients the bank stole the money when I learned on Friday and went to my lawyers Monday morning. They said I should have told all institutions over the weekend the bank stole the money even if I was not 100% sure of the outcome and they might return it.

The government tried to kill me after the plea but before sentencing. They left one inmate’s door unlocked as they did mine. I was taken to the hospital in a coma for a few days, but survived to their dismay.

Armstrong blogged When There is no Justice – It is Time To Turnout the Lights:

The ONLY reason I was released was because I had been accepted by the Supreme Court. To prevent them from ruling, the prosecutors had no choice but to release me.

Someone had to say I would never comply in court in order to justify releasing me to prevent the Supreme Court from ruling. The real paradox is after I was released, the court had to rule I did not owe anything or else I would get a trial and I could start calling the bankers to the stand. They had no choice. How can you spend time in prison to turn over something for 7 years and then the court rules you do not owe anything? Anyone with common sense would ask what’s going on here? This was all about (1) having me turn over the code and (2) silencing me so the bankers could manipulate markets undisturbed.

When I attended the premier for the Forecaster in Amsterdam, the third night was all the bankers in Europe. The moderator wanted to appear impartial and asked me what happened to the $1 billion that was supposed to be missing and nobody knew where it was. I turned to the audience and asked: Is it possible for $1 billion to be missing from a bank and nobody knows where it is? The audience all laughed. You either wire it out, write a check, bust into the vault with a tank, or beam it out like in Star Trek. It was a totally ridiculous accusation and not a single member of the press even bothered to ask was that possible? How incompetent is that? It would be like reporting someone is standing trial for murdering his wife while she is present in the courtroom and is not allowed to be called as a witness.

The press always protected the establishment. They knew what was going on.

Take Bernie Madoff’s case and why did he plead guilty so fast? That was to shut down the investigation for he was protecting someone. The banks claimed they had no idea it was a fraud. Madoff was asked if the banks knew once he was in prison. He said of course. In fact, only a fool would believe the banks were not also involved. I was interviewed by a journalist at the NY Post. I was asked if the bank in my case claiming they had no idea where the $1 billion was, was in fact laundering money in my accounts for the Russian Mafia and Colombian drug cartels “as they were doing in Madoff?” She knew the truth, but that interview was never published.

Armstrong blogged Gag orders & Cover Ups:

QUESTION: Mr. Armstrong; I watched the film the Forecaster. I then read your plea. You simply said you failed to tell your clients that the bank took the money. How is that a crime? Then the bank pleads guilty, has to return the money, and you have no restitution.

ANSWER: Oh it gets better. First, you have to understand for them to do such a movie, they have to get insurance to cover any lawsuit claims. Everything in that movie had to be presented to Lyods of London to prove that all statements could be proven in a court in order to even get such insurance. They had to investigate the claims in detail on both sides or such a film would never be made. It was funded by the German TV station.

When it became clear that the receiver was trying to paint me as a rogue trader who conspired with the bank’s own people against my own clients, that would have allowed the bank to keep all the money. So I did an interview with the Japanese press and told all my clients to come to New York and file suits against the bank. They did. I met with their lead lawyer and I agreed to help them and testify against the bank. The bankers ran to the government and they escorted them into my case and placed a lifetime gag order on me to prevent me from helping my clients against the bankers. No lawyer I know of has EVER heard of such a gag order. This single action demonstrates that there is no rule of law in New York and you will NEVER win a lawsuit against a New York bank – PERIOD!!!!!!!!!!!!!!!!!

It is true that because I got my clients to file suits against the bank, there was no choice. My clients were public corporations and institutions – not individuals. They had the resources to go all the way. The bank had to return the money and walked away without even a fine. Republic/HSBC pleaded guilty and had to pay $640 million because they simply took the money. Because you have careers at stake who filed complaints without any investigation to protect the bankers, then it becomes all about covering everything up.

Armstrong recently blogged Supreme Court has Accepted My Petition Against the Government:

At the World Economic Conference, I announced that I had petitioned the Supreme Court after discovering in 2017 that despite the fact that the old company Princeton Economics International Ltd (PEI) had been closed back in 2009, the receivership was covertly continuing to take fees without my knowledge. How can a judge approve fees for 20 years when the bank pled guilty and repaid everyone back in 2002?

The Receiver, Alan Cohen, had been running PEI from inside Goldman Sachs. My objection that this was a conflict of interest was always ignored. Since Cohen left Goldman Sachs and became one of the top people in the SEC to ensure various legislation, he could no longer pretend to be the “impartial receiver.”

This merely illustrates the problem with New York. When I asked a New York lawyer why no banks are ever charged in New York, even when they blow up the entire world economy, he merely smiled and laughed. His response: “You don’t shit where you eat!”

The Supreme Court has made several rulings, bluntly ruling that what was done to me was illegal when carried out by a single court. In my case, they actually used a parallel court to invade the other and strip my lawyers to prevent any sort of a trial. They have been milking the excess funds in the receivership for 20 years. Instead of compelling the bank to return the money they illegally had taken, the receiver sold the notes to HSBC who then redeemed them and had to pay only $606 million due to the change in the Japanese yen. HSBC pocketed nearly $400 million in our profits as part of HSBC’s Criminal Restitution. Only when HSBC had to pay the criminal restitution did the government correctly inform the court the transactions were in yen and not dollars as they had told the press in my case. They always count on the press just repeating whatever they say and the press NEVER investigates or ever questions what the government prosecutors do. That is why they abuse the law for political gain and political persecutions because the press looks the other way and does not do its job.

The Supreme Court has ORDERED the government to respond by December 2nd. This is the first step to be granted Cert. The government has been ordered to respond to which they will no doubt request an extension. The last time I was in the Supreme Court, after ordering the government to respond, they suddenly released me from contempt and told the Supreme Court the case was then moot. This is EXTREMELY RARE to get into the Supreme Court even once, no less twice. I know of only one other time where the same case got to the Supreme Court twice and that was back in the 1950s.

If the Supreme Court grants cert this time, we are looking at a major case that will most likely vacate the rulings and hold that since it is illegal for a single court to strip you of your lawyers, then it will be illegal to use a parallel court to invade another court and do what it itself cannot do.

With respect to being held in contempt for $1.3 million for English and Scottish coins that I could not find, even that has come up with a new twist. The judge held me in contempt saying he did not believe me, claiming he thought I knew where they were. I had clients willing to put up the $1.3 million in cash for bail and he denied bail. To be held for $1.3 million on a billion-dollar case was .0013%. That was absurd, but they had to prevent a trial. There was no way they would allow a trial after the bank had taken the money. I had no restitution and the bank simply repaid the money. The contempt statute for civil contempt is 18 months. Judge Richard Owen kept rolling the contempt every 18 months and kept me there for nearly 7 years without any trial. Despite all of these facts, nobody in the mainstream press would ever report the truth and always supported the government no matter how outrageous they acted.

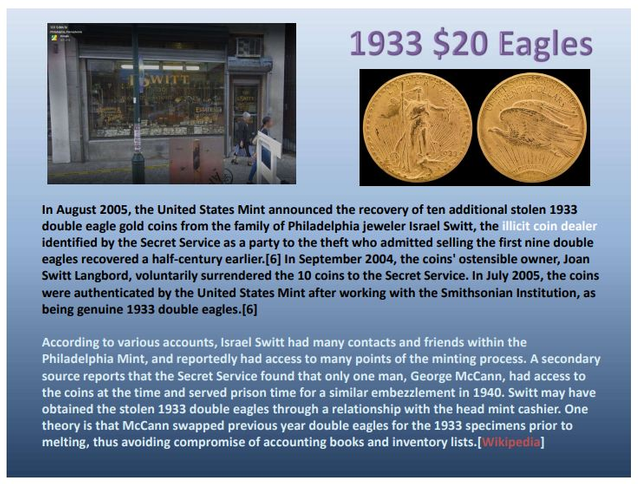

The coins I could never produce turned up when a dealer in Philadelphia bought the missing coins for $6,000 in cash over the counter and then tried to sell them through an auction house in Texas. This is the same firm that was involved in trying to sell the stolen 1933 $20 gold coins from the US Mint in Philadelphia, which the Court of Appeals ruled was the property of the US government all along. I was held in contempt to turnover these coins, and yet someone else had them. I could not have possibly produced them to restore my freedom.

Phase II: the Supreme Court should grant Cert after the government responds and they will probably hear the case in the spring of 2020.

Rampant Corruption in U.S. Just[ice]-Us System

Armstrong blogged The Truth About Solitary Confinement:

When my case first began, Judge Richard Owen kept making jokes about Steven Schiffer and how he was the first in an SEC case to be stripped of all lawyers. Judge Owen said he never “took it upstairs” meaning to the Appeal’s Court and then laughed in court. When I asked my lawyer, who Owen was trying to remove, what was so funny he said

“you don’t want to know.”I insisted – who was this Schiffer he was constantly joking about. I had never heard of Schiffer. It turned out Judge Owen caused him to commit suicide hanging himself stripped of counsel and harassed by government on every front. Some people just cannot endure this type of treatment. This is how they get their pleas – threats and torture.

When they then threatened my family as they did to Michael Milken, I wrote a letter to the SEC prosecutor Dorothy Heyl. I told her if they were trying to get me to commit suicide as they did to Schiffer so they never have to prove a case, I told her I would not go so quietly. If they touched my family a letter would be sent by friends around the world to state why I had to commit suicide to protect my family from really inhuman people lurking in the so-called Justice Department. They backed off. But that agency is full of people who are really worst than some of the criminals. They enjoy torturing people and there is something wrong when Judges make jokes about people they caused to commit suicide. That is why they are there – it’s a side perk. Some of these people are really sick. Granted, I saw some with compassion and a conscience. But they are far and few between.

Armstrong blogged It took the British Press to Defend the US Constitution:

My own attempts to stand up against the NY Bankers and their pervasive corruption that is destroying the world economy and has now led to massive tax increases and the hunting down of citizens for money like dogs, was met with bullets placed in my mailbox, and threats against my family. They even froze my mother’s bank accounts and social security without court orders. My lawyer Martin Unger had to threaten to hold a press conference because they almost killed my mother cutting off her access to all medicine.

Judge Richard Owen joked about how Steven Schiffer didn’t take it upstairs (appeal) when he took all his lawyers away in an SEC case for inside trading that the UNTOUCHABLE bankers do all the time. Because after stripping Schiffer of counsel and harassing the hell out of the guy, he committed suicide in a civil case. Then to joke about how they caused someone else to commit suicide was the ultimate revelation of the character of these type of people who have seized control of our government.

Armstrong blogged Aaron Swartz – A Voice of Freedom Silenced:

Swartz was found hanged on Friday in his Brooklyn, New York, apartment. While some people are spinning conspiracy theories because be was a champion of a free internet and not one of those dark figures who create viruses and try to track people for the government, he was being charged facing decades in prison for doing nothing but hacking into MIT computers causing no damage and doing nothing with anything. However, under US law, there is no requirement that you actually commit a crime, they charge conspiracy and argue you intended to do something you did not do,

Let me explain something that the American Press refuses to expose. The number of suicides among those charged by the Feds would shock the world. Their stories are never told and typically the government spins out the standard crap that they were overcome with remorse for their crimes. To set the record straight, the real criminals are never remorseful, are proud of what they did, and brag about their accomplishments in getting away with shit. The violent ones do to others what they fear themselves so you would be shocked to realize that the violent murderer is really more often than not a coward or just insane.

In the case of Steven H. Schiffer, the SEC brought charges of insider trading. When they could not defeat his lawyers, they petitioned Judge Richard Owen to remove all his lawyers. He did being a former prosecutor. They then proceeded to harass Schiffer to the point they too drove him to hang himself – something very common. The prosecutors then pat themselves on the back and tell themselves he was guilty anyway – job well done. When they were taking the lawyers away from Princeton Economics before Judge Owen, he joked and said “Schiffer never took it upstairs” for appeal laughing. So much for “feeling” your pain, compassion, or even any sense of humanity. Often the people who prosecute like this are indistinguishable from the criminal that enjoys inflicting pain on others – they are one in the same. The corruption with the SEC prosecution is off the wall as reported by Matt Taibbi in Matt Taibbi Breaks Major Story on the SEC's "Orwellian" Corruption.

The first suicide I became aware of was a kid who someone asked where a guy was, he pointed over there, and they killed him. The government charged him as part of the conspiracy. Before he committed suicide, he wrote a 20 some page letter explaining how his life was over facing life in prison for something he did not do. He used plastic straps to hang himself in NYC Federal Prison MCC. He died, but the plastic cut through his neck due to the weight of his body until he was decapitated.

The entire federal prosecution system went nuts because of John Ashcroft […] Ashcroft altered the rules so a prosecutor is not credited for just a conviction, the person must go to jail. There are people sent to federal prison for traffic violations on federal property because of Ashcroft since a prosecutor cannot advance his career unless every person goes to prison. This is one reason the USA has more people in prison than Europe, Russia, and China combined while only 4% are for violence. It costs almost $35,000 a year to hold one person.

So for those seeking answers, blame your politicians who with every law they pass include a criminal prosecution. They even had that if you didn’t have healthcare insurance it was up to 5 years in prison in Obamacare. He was forced to take that out but not the fines. Look at every bill and you will see “fine or imprisonment or both” for failing to obey their latest incantation to oppress society.

Armstrong blogged Goldman Sachs Control the SEC:

QUESTION: you spoke about trump draining the swamp, how would you drain the swamp, we agree it needs draining?

tgANSWER: The first thing you have to do is eliminate the control of the regulatory agencies by the bankers. Enough is enough. We must start there. We will NEVER see any hope for the future until we eliminate that control. We must also make it a criminal offense for any politician to use their power for a family member as Biden, Clintons, and countless others have done. They should also be prohibited from having any sort of charity they set up which is just a funnel for money to buy votes. Both Hillary did that as well as John McCain and they are not the only politicians to have used that ploy.

The Center for Economic Policy and Research in Nov. 2018 wrote about how Goldman Sachs controls the SEC: “How Goldman Still Holds Sway at the SEC” […]

Armstrong blogged SEC Lawyer confirm Gov’t Will Do Nothing to Big Institutions EVER!!!! American Corruption at its finest:

Retiring SEC (Securities and Exchange Commission) trial attorney James Kidney blasted the SEC telling the truth from the inside that his bosses were too “tentative and fearful” to bring many Wall Street leaders to heel after the 2008 credit crisis. This is what everyone knows, including journalists, but nobody will speak publicly about this mess. They OWN the regulators by every possible angle. They OWN the Department of Justice and they OWN Congress. We live in a world engulfed in corruption and NOBODY in Washington will do a damn thing for the people.

Armstrong blogged Supreme Court Holds that Judges in SEC & CFTC are Unconstitutional:

For decades, people have been complaining that Administrative Law Judges (ALJ) were unconstitutional. They are simply employees and they do not even have to have a law degree. Yet these people have been ruling against citizens and supporting their agencies, reducing any Due Process of Law to a joke. Previously, Administrative Law Judge, George Painter, recognized the corruption in his own court system of the Commodity Futures Trading Commission. Painter sent a scolding letter announcing his retirement that highlighted the corruption from an insider’s perspective. George Painter died at the age of 87. Yet his parting words still will be echoed down the halls of justice.

In the letter, Judge Painter announced his retirement as he exposed the internal corruption inside the court system. He stated bluntly that his fellow admin judges had

neverawarded a case to a plaintiff in 20 years, and that he did so at the urging of former CFTC Chair, Wendy Gramm. I do not take something as serious as corruption lightly.

The real meaning of this decision is that anyone who has ever been adjudicated by an ALJ was unconstitutionally adjudicated. This is why I say that the Supreme Court should be expanded and that EVERY new procedure and law that carries a fine or imprisonment should be tested to comply with the Constitution

BEFOREit is enforced. We have a legal system that is backwards. If people do not have the money to adjudicate their Constitutional Rights, then they do not have any. This is why the government prosecutors go after your lawyers so they then eliminate your ability to even receive due process of law. They can unconstitutionally treat you however they wish knowing full well that without the funds, you cannot be heard and are thus denied Due Process of Law. In this way, their thirst to win has destroyed the very principles that we ask our children to go to battle and die for. They have eliminated all your rights and you cannot be heard unless you have the money to fund it in the millions of dollars.

Armstrong blogged Entire Court in California Had to Step Down – All Judges:

The legal system in the United States is becoming so corrupt, this is exactly as Edward Gibbon wrote about the collapse of the rule of law in Rome.

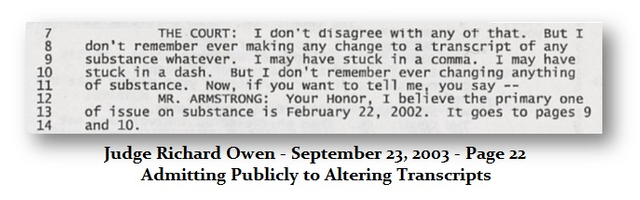

The legal system in the United States now seriously needs reform for nobody’s property, human rights, or civil rights remain safe when judges are government appointees for life. New York is, of course, out of control where judges are free to simply alter transcripts changing the words of witnesses after the fact, […] On page 97 of the opinion, the Court of Appeals admitted it was a “unique” practice and then said it lacked the power to tell judges to obey the law since it is a 5 year felony to alter such court documents. If the Appeals Court lacks power, then who possesses such power.

Frank Quatrone of First Boston found himself also before Judge Owen who was also changing the transcripts in his case. In fact, after I directly confronted Judge Owen publicly about changing my transcripts, no newspaper would report the confrontation. However, the New York Times journalist Andrew Ross Sorkin who wrote Too Big to Fail, came to see me about Judge Owen changing transcripts. The Appeals court directly criticized Sorkin claiming he improperly reported events but still recuse Judge Owen. I spoke to Sorkin and he told me Owen changed the transcript after he reported. . Still the NY Times would not publish the truth about Judge Owen changing transcripts.

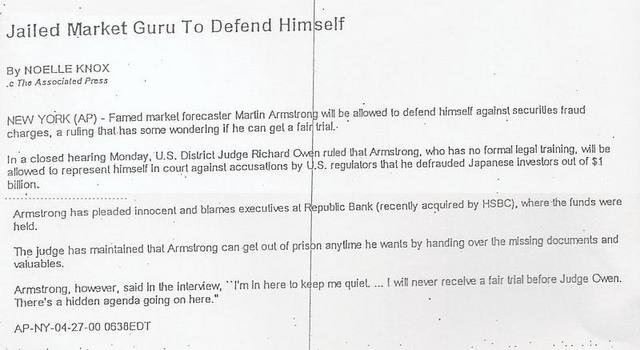

In my own case I forced Judge Owen to publicly admit he was changing my transcripts on September 23, 2003. Judge Owen had thrown the Associated Press out on April 27th, 2000 creating a closed secret court proceeding that is totally illegal. As an American citizen I was supposed to have a public trial – good one! The AP actually printed that it was a closed court proceeding.

The AP reported I had stated from the outset Republic stole the money. You cannot get $1 billion out of a bank and nobody knows where it is. That kind of money can only be wired, yet they pretended to be looking for something Republic had all the time. When Republic finally pleads guilty, they got no jail time in return for all the missing money.

Now, in California, some prosecutors have resigned because Eric Holder’s boys were fabricating evidence in order to confiscate property in the tens of millions of dollars. One former prosecutor Eric Overby stated:

“It’s called the Department of Justice. It’s not called the Department of Revenue.”Overby has stated that in his entire career,“I’ve never seen anything like this. Never.”The entire court has had to step aside because all judges are tainted. Just amazing.We are screwed as a nation without a legal system that is reliable. How can we have a ruling against the NSA or anything sensitive when judges are not really judges? You just cannot appoint career prosecutors as judges and no one should be there for life.

Even Warren Buffett Was Involved

Armstrong blogged Are Markets Manipulated All the Time?:

QUESTION: Mr. Armstrong; Some people say you will not admit markets are manipulated all the time. Yet you stood up and had all the evidence that would have damned the whole lot of the New York bankers for manipulating markets. This is very confusing how you can be against them in public yet people claim you refuse to admit the markets are manipulated all the time between the central banks and the New York bankers […]

ANSWER: I am a student of markets. I do not make up bullshit […] Why people put out this bullshit is amazing for if it was true then why buy gold at all for the system cannot ever collapse if it is all perfectly manipulated. This is just total gibberish from people who have ZERO experience inside the markets or behind the curtain. I had more than half the equivalent of the US National Debt under contract for advisory. I think I saw things no analysts has ever dreamed of no less understood. These people make up stuff to hide their inexperience – plain and simple. The banks told the government I manipulated the world economy BECAUSE they lost every time from Orange County, Solomon’s manipulation of US Treasury Auctions to the DOT.COM bubble and the 2007 Real Estate crisis. They ALWAYS blow up every time and run to government to get bailed out […]

You get mislead people swearing gold will rally to $10,000-$30,000 any day and when it falls out of bed they blame manipulation for being wrong […]

We always tracked manipulations. I knew ABSOLUTELY every single one they did. We monitored the manipulations very carefully. The various manipulators hated my guts just like the goldbugs who will not listen. They tried to get me to join them figuring that when they lost it was because I had more followers than they did and therein started the allegation of manipulating the world economy that I had to defend against a subpoena from the CFTC demanding I turn over all names of clients worldwide so they could prove I was more powerful that the banks they protect. I defeated them in court. My lawyer at the time Chris Lovel stood up and told the judge even if I did manipulate the world, where was the law that said I could not no less how was it the domain of the CFTC?

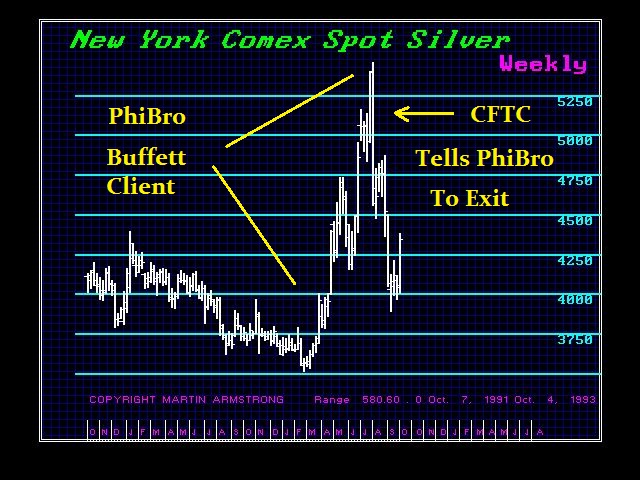

I have written that written publicly that first PhiBro silver manipulation took place in 1993. The client was Warren Buffet. The CFTC went to PhiBro demanding to know who they were buying silver for. PhiBro refused to give up Buffet’s name. The CFTC would have thrown anyone else in jail and out of business. The CFTC is owned by the big players and is corrupt as hell right to the core. The CFTC simply said ok, no name, then exist the trade. No fines – jail – sanctions for that manipulations

PhiBro and the “club” desperately tried to get me to join the second silver manipulation with Buffet. I have written about this stating publicly that PhiBro’s brokers walked across the COMEX pit and showed my floor brokers (Emerald Trading) Buffet’s orders and told me to join. They knew I would never trust these people for how would I know I was not the patsy to buy and they would use a another seller. I would never join them. Hence, PhiBro showed me the orders to convince me to join.

I then reported to our clients “they are back” knowing it was Buffett and PhiBro for a second time. They all got pissed-off at me even though I never mentioned names. The buying of silver was done in London. Therefore, they moved silver out of COMEX warehouses in USA and shipped the supply to London to pretend there was a shortage to justify the manipulation. The Wall Street Journal assisted in the rally.

The manipulators were steering the Buffett buying to London to avoid the 1993 problem with the CFTC. This is why AIG trading arm also set up in London. Buying silver in London justified moving it from the NY COMEX and this allowed them to get the manipulation going. COMEX supplies were reported in isolation. Moving the silver to London created the false image of a shortage to justify the higher prices. The Wall Street Journal was used to plant the story. On September 30th 1997 the stories appeared in headlines – “Silver Prices Hit Six-Month High On Steadily Declining Reserves, By PALLAVI GOGOI AP-Dow Jones News Service Updated Sept. 30, 1997 12:01 a.m. ET NEW YORK — Silver futures surged to a six-month high at the Comex division of the New York Mercantile Exchange, a move analysts said was triggered by steadily declining warehouse stocks. The rally was boosted by preplaced purchase orders around the $5-per-ounce level…” This was the news created for the manipulation that was constantly played out in the newspapers. The Wall Street Journal again reported on November 17, 1997, “Silver Futures Prices Leap On Hints of Tight Supplies”, and again on December 4, 1997 the Wall Street Journal from London reported “Silver Surges on Strength In Supply-Demand Status By NEIL BEHRMANN Special to The Wall Street Journal Updated Dec. 5, 1997 12:01 a.m. ET LONDON — Gold may be in the doghouse, but silver is soaring like a bird”. The reporting of shortages continued to fuel the rally. The Wall Street Journal reported again December 24, 1997 for the manipulators “Silver Futures Advance As Inventories Plunge”

The interesting point is the manipulators know that if they rally the metals, the retail goldbugs rush in and buy proclaiming its the bull market every time. The manipulators then routinely turn around and sell to goldbugs at the top and the markets crash. This has become standard procedure protected by the CFTC and the goldbugs buy the high every single time without fail.

The “club” was pissed-off that I would not join and I warned my clients they were back manipulating silver. A pretend analyst on the payroll I believe of PhiBro got a journalist from the Wall Street Journal to try to discredit me. The fake analyst told the WSJ I was short silver and trying to talk it down. The journalist accused me of this nonsense and we argued on the phone. It got quite heated and frankly I was not retail so could care less what they printed. My clients were the real deal who all knew the truth about journalism and how it was just a pawn of the “club”. In fact, my clients did not ever want me to give interviews about market forecasting to the press for their view was hey – we pay for that info.

Nevertheless, the WSJ journalist kept arrogantly taunting me and said if silver was being manipulated, then give him the name so I said fine, go ahead, let me see you print it, knowing he never would print Warren Buffett the saint of Wall Street – thanks to the press […] He laughed. Told me everyone knew Buffett did not trade commodities I told him that was how much he knew.

The Wall Street Journal published the article. The London newspapers were fed stories by the “Club” that I was now the largest silver trader in the world. This became all a joke to me. It demonstrated how bad the press really was. They were the pawns of the manipulators and probably didn’t even know it.

The mistake made by the “Club” by turning out the press against me, was they actually created such a worldwide story that silver was being manipulated the CFTC was forced to call me – it was public now and they had no choice. They knew I was not the source of the manipulation. Even the CFTC could look at positions and knew I was not the biggest player in silver. The CFTC then asked me, where was the manipulation taking place? I told them it was in London, out of their jurisdiction. The CFTC told me that they could pick up the phone and investigate London. I told them that they had to make that clear decision. I hung up. Never did I expect that they would really do anything. Yet, they never asked me who because the question was jurisdiction.

A few hours later, my phone rang. It was a good source in London who also was helping to monitor the “Club” actions. He told me that the Bank of England had called an immediate meeting of all silver brokers in London in the morning. I was shocked. The CFTC had made the call. But then again, I had given them no names so perhaps in their mind, this was fair game.

Within the hour, Warren Buffett made a press announcement. He admitted he had purchased $1 billion worth of silver, in London . He denied he was “manipulating” the market. Claimed the silver was a long – term investment. Everyone was shocked that Buffett was suddenly exposed as a commodity trader after all. The very next day the Wall Street Journal called me. The writer asked – “How did you know?” I told him it was my job to know! Silver thereafter declined and made new lows going into 1999. So much for Buffett’s long-term investment since he sold out.

When one trader from New York joined our firm, he called Goldman Sachs to ask about us. He has publicly stated on the record that their response was they had butted heads with me many times but I usually won.

Exposing the silver manipulation trying to turn the press against me was a huge mistake. The CFTC would have never called the Bank of England just because I reported the manipulation to our clients. That was private. Exposing the issue in the press forced them to respond. My brokers on the floor were Emerald Trading. I routinely traded AGAINST the manipulators and defeated them many times [c.f. also]. Just as the goldbugs do not like me, neither do the manipulators and it far too often seemed to coincide when they were trying to goose the metals markets UP – not down. Contrary to the bullshit, they need people to BUY the metals to create a pool of longs to bury. They are NOT interested in forcing a metal down to compel people to sell for goldbugs are notoriously stubborn. That is not very profitable for they want the emotional traders who buy highs. Of course the goldbugs will say I am wrong but have never been in the same circles and […]

There have been major manipulations of markets such as rhodium and then there was the manipulation of Platinum. I had recorded tapes and tons of documents on every manipulation. This was all seized by the court and I stood up instructing the court that these tapes Alan Cohen was demanding involved criminal activity on the part of the banks […] Alan Cohen then was made a board member of Goldman Sachs yet still remained as the court appointed person to run Princeton Economics. That is totally illegal and a conflict of interest. Law does not matter in New York City. (see Transcripts below).

To say I will not admit markets are manipulated is absurd. To claim they are always manipulated is impossible. Yet the real paradox is when the metals rally, they never seem to be manipulated – those are always “real” bull markets and the failures are the manipulations. Great propaganda! Amazingly, the metals are unique, They become manipulated only when they decline.

Armstrong blogged Market Manipulation Confusion:

The era of bank manipulations (proprietary trading) of numerous markets for SHORT-TERM plays began in 1981 and came to an end in 2013. Nobody documented market manipulations as I did. This was a huge issue in court; they threatened to throw all of my lawyers in prison unless they handed over those tapes. So, I find it ironic to claim I deny manipulations when they exaggerate everything to support their own failures.

[…] Here is a TAPED PHONE CALL that has survived on the silver manipulation before Buffett admitted to buying $1 billion in silver between himself and a dealer. The dealer was not part of the manipulation, which was ENTIRELY short-term and not perpetual.

http://armstrongeconomics-wp.s3.amazonaws.com/2015/11/Silver1998.mp3?_=1

It was on January 28, 1998, that a class action lawsuit was filed against the commodities firms that had been buying the silver. The lawsuit maintained that the price of silver was being manipulated because the price of silver was rising as gold was going down, which was an “unprecedented” occurrence. With accusations that silver prices were being manipulated and a CFTC announcement that it was looking into the accusations, Buffett’s Berkshire issued a press release on February 3, 1998, disclosing the purchase of $1 billion. Buffett denied that he was manipulating silver, yet silver still fell to new lows and the positions were sold. The professionals stepped aside. Who were the victims? Retail small investors, as always, who were sucked in by many of the same people. Ask them what their forecast was during this one. Were they analysts who said, “DON’T BUY it’s a manipulation!” or were they cheerleaders for every rally since 2011?

Armstrong blogged Is Buffett Just Wrong?:

That said, the answer to your question is Buffett wrong? The answer is YES!!!!! His little nitch was good from the ’80s for the market was UNDERVALUED and as such being a “value investor” was appropriate for that time period. The markets have shifted to capital preservation […]

Armstrong blogged Warren Buffett Loses Billions:

Anyone who simply bought stocks in 1985 made a fortune […] His buy & hold strategy fails because it ignores cycles. Anyone who bought stocks in 1985 and just held as the Dow rose from 1,000 to 21,000 beat even Warren Buffett.

That may not account for the compounding of Buffett’s preference for reinvested income.

I wrote in this blog:

Armstrong has blogged about this and the Qanon conspiracy theory:

Wow! That is incredibly bad. Reminds me of something William Binney once said, something to the effect that imagine the worst crime ever committed, then magnify it by 1000 and it still will not even come close to the evil committed by government.

Hey man, I've read your older posts and have some questions..

I'm trying to invest for my future and am not interested in trading.

I just wanna hodl TRB (legacy) the safest way through the next 5 years..

Can you write a quick tutorial on how to do that the safest way?

Is it already safe to just hodl one's btc on legacy (1....) addresses?

Or does one have to check that the btc one has were only on legacy (1...) addresses?

How can one do that on CEX, without DEX? (cuz there aint real yet..)

I guess one basically has to trade one's segwit btc to the exchange, trade them, withdraw and look into the coins history if they were on segwit addresses anytime? If yes, repeat until one has only coins which only were on legacy addresses..?

I hope I understood the most important stuff..

(by @lauch3d)

That was an excellent presentation with deep far reaching implications on a scale so enormous it's hard to quantify and yet I have a picture of a flower in my feed that got a better response. It's says quite a bit about the common mentality that pervades this place.

Thanks for taking the time to put all that together and pull back the veil. I'd read parts of this story before I'd never seen all the details presented in a such an articulate presentation.

Excellent work!

@tipu curate

Posted using Partiko Android

Upvoted 👌 (Mana: 15/20 - need recharge?)