My Crypto Portfolio Revealed: 10 CryptoCurrencies I Truly Believe In for the Long Term

Ok, so, as I promised in my previous post, I will reveal my current coin portfolio, which is subject to change if and only if any new coin will rise from the crowd and make me invest. However, no coin will disappear from my list, until it reaches at least 100x its current value. I said I am a long-term investor in cryptocurrency and I’ll stick to my word.

I currently have a list of 10 crypto coins that I truly believe will have a big impact on the future of the Internet, economy and technology, 3-5-10 years from now.

I am keeping track of my portfolio and its value using a mobile app called Blockfolio (https://www.blockfolio.com/). This is NOT a mobile wallet. I repeat: not a mobile wallet. As I mentioned in my previous post, I am strongly against using mobile wallet apps. I won’t go over the reasons why – just check out the “12 Steps to Improve the Security of your Cryptocurrency Holdings” post to find out the security implications of using such an app to store your cryptocurrency holdings.

My goal is to list all the crypto coins I’ve invested in and explain the reason behind each decision. You should follow a similar judgment whenever you decide whether to put your money in a coin or not.

In the following posts, I will log and document the evolution of each coin and the project behind it (relevant news, software releases, new features, roadmap implementation) and I will also monitor the value of my portfolio, based on the market conditions at the time of publishing each post. I should mention I have invested a 5-figure USD amount, which may seem either small or large to you, but remember one thing: always invest money that you can afford to lose! Live by this principle and you’ll be fine.

One more thing here – please note that this post and the ones that follow are not professional financial advice. You should always research the projects and cryptocurrencies on your own and make an educated decision based on your findings. I cannot advise you what to do with your money. I’m only tracking my journey through the world of crypto and hoping to learn from both my successes and my failures. And I really hope you will learn alongside me, as well.

For any coin I am planning to invest in, I have 10 points or criteria I look for, before making the decision. If the coin does at least 7 / 10 at the end of the evaluation, then “Yeey! Welcome, new coin!”. If the result is 5 or 6, then I add it to the “keep an eye on” list. Everything below 5 points is not of any interest to me. Quite straightforward, right?

Let’s see the 10 items on my list of criteria before diving into my portfolio:

*A. The whitepaper. Is it clear and describes the project in detail?

*B. Do I feel like this technology will solve an existing issue?

*C. Are there any founders / developers / special advisors with a solid background?

*D. Is there a well-established and active community? (Slack, Telegram, Discord, Twitter and so on)

*E. Is the current price low enough to believe in a future 100x return?

Additional parameters I look at:

*F. How high is the circulating supply of coins? The higher the circulating supply, the more trading volume the coin needs in order to have a considerable rise in price.

*G. Are there any current or announced partnerships with big names in the industry?

*H. Is there any existing product/prototype/alpha version for this technology?

*I. Does the technology solve a particular issue or tries to be the jack of all trades? (to not be confused with point B. Here, it’s very important to me if the team tries to address a particular problem and do it well, rather than trying to build X apps and platforms all at once, which can be counterproductive, especially when having a small team or budget)

*J. Does the Fibonacci retracement technique reveals a good entry point to buy right now? (More about Fibonacci retracement here: goo.gl/qqSZfC)

Without further ado, here’s the list. The order is not in any way important, so don’t consider this a classification of some sort.

- Ripple (XRP) - https://ripple.com/

A. 1 point - Ripple’s whitepaper (goo.gl/xJYqAL) is very clear and accurate regarding the purpose of this technology. Simply put, Ripple aims to build a decentralized, global network that banks can use to exchange payments with low fees and almost real-time speeds. Ripple will be targeting banks in the first place and has a huge potential to become a standard for cross-border transactions. Read more about Ripple, XRP and the ILP (Interledger Protocol) in the whitepaper.

B. 1 point – Definitely yes. Ripple will create the Internet of Value (IoV), by rapidly facilitating global transactions, in an era where information travels within seconds, however a payment from the US to Europe can take 3 to 5 days to complete.

C. 1 point - Brad Garlinghouse, Ripple’s CEO, has a strong background, having served as CEO of Hightail, CEO of Dialpad Communications and Senior VP of Yahoo! David Schwartz is the tech brain of Ripple and Chief Cryptographer. He developed encrypted cloud storage and enterprise messaging systems for organizations like CNN and the National Security Agency (NSA).

D. 1 point – Ripple’s forum (goo.gl/wEsyFd) is very active and packed with a lot of people. Also, XRPChat is a great place to stay up-to-date with the latest Ripple news (goo.gl/2UT8iR). Ripple is also very active on Twitter, where it has almost 140k followers.

E. 1 point – Yes, at the time of this writing, Ripple’s price is at 18.5 cents.

F. 0 points – Very high total supply of 99,994,523,265 XRP. Addition read on the topic and Ripple’s plans for this supply: goo.gl/7vwi7w

G. 1 point – Yes, a lot of banks all over the world have already adopted or tested Ripple’s solution. A few examples are UniCredit, BBVA, Santander, ReiseBank. You can check out all of them on goo.gl/RLKKpa

H. 1 point – Yes, as I said, some banks are already using or testing Ripple’s solution.

I. 1 point – Yes, although Ripple’s technology is comprised of several working parts, the end goal is very clear and to the point.

J. 1 point – At the time of writing this post, XRP seems to have found a support level around the 78.6% line and tends to go back up towards the previous support level at 61.8%, so around 20 cents. Is it a good time to buy now (09/18/2017)? Yes, it is.

TOTAL POINTS: 9 / 10

- TenX (PAY) - https://www.tenx.tech/

A. 1 point – Although a rather long whitepaper (goo.gl/MVxQkn), it manages to explain all the details behind the TenX debit card and wallet. What TenX does is “it enables users to spend their blockchain assets through their smartphone or a physical debit card at over 36 million points of acceptance online and offline.”. Basically, you can order a physical debit card and use it to pay across millions of stores, using your BTC, ETH, DASH and other altcoins. The difference from similar services, like TokenCard, is that the annual fee is 0 if you spend more than $1000 in the course of a year. Also, domestic exchange and foreign exchange fees are 0. Please find a great comparison inside the whitepaper. The card is already available for ordering and I will order mine very soon. Also, it’s important to mention that the TenX card allows users to spend their cyrptocurrency anywhere where VISA or Mastercard are accepted.

B. 1 point - Yes, it solves the issue of having a diverse portfolio of cryptocurrencies, but not having a simple and cheap way of spending them whenever and wherever. It is especially useful if you’re getting paid in Bitcoin.

C. 1 point - Toby Hoenisch, the founder and CEO of TenX is a Computer Science graduate, with a degree in Artificial Intelligence and has been a CEO in a few other companies before starting this project. The main TenX investor is Vitalik Buterin itself, the founder of Ethereum, so having him on board provides a high-level confidence.

D. 1 point – Although their Slack channel is currently not accessible, I still give them 1 point for an active Twitter account (over 37k followers), a Reddit community of almost 6000 members and a weekly Q&A session on their YouTube channel (almost 10k subscribers there).

E. 0.5 points – At the moment, the price for 1 PAY is about $2.16, which is actually not that bad, considering the potential of TenX in the long run. The price dropped to about $1.7 during the last market crash, which was a great time to buy some more. Which I did 😊

F. 1 point – The total supply of PAY tokens is 205,218,256, which is pretty decent, compared to the one Ripple has.

G. 1 point – As partners, we can mention Fenbushi Capital (the first Chinese venture capital firm that exclusively invests in Blockchain-enabled companies) and TaaS (according to this post: goo.gl/oDY53t). Also, TenX was part of PayPal’s start-up incubator in Singapore, which shows their potential once again (goo.gl/H5ey9a).

H. 1 point - Yes, the TenX Android, iOS and Web wallets are available, as well as the card I already mentioned.

I. 1 point – TenX solves a particular issue indeed and it does it very well, it seems.

J. 1 point – As I’m writing this post, the Fibonacci retracement indicates a good time to buy PAY tokens, because we see a support line being created around the 78.6% mark, so most probably (if no other market crash occurs) the price will start going up towards the 61.8% level. TenX (PAY) has the potential of reaching the $5-6 price at some point in the near future, but 1 or 2 years from now, who knows, maybe way higher. It definitely has the technology, the team and the investors on their side.

TOTAL POINTS: 9.5 / 10

- Civic (CVC) - https://www.civic.com/

A. 1 point – Definitely an interesting read, Civic’s whitepaper (goo.gl/1N34Az) is short (18 pages only) and provides a very good overview of the current identity management and verification landscape, as well as the solution it provides for making these processes easier and avoids identity theft and fraud, in general.

B. 1 point – Yes, as I mentioned, identity management, verification, and fraud.

C. 1 point - Vinny Lingham. Should I say more? Google him to find out more about his background and why he’s one of the top cryptocurrency influencers.

D. 1 point – Civic has a Telegram group with almost 5.5k members, a Reddit page with over 3.3k members and a very active Twitter page with almost 30k subscribers, so it gets 1 point for all of this.

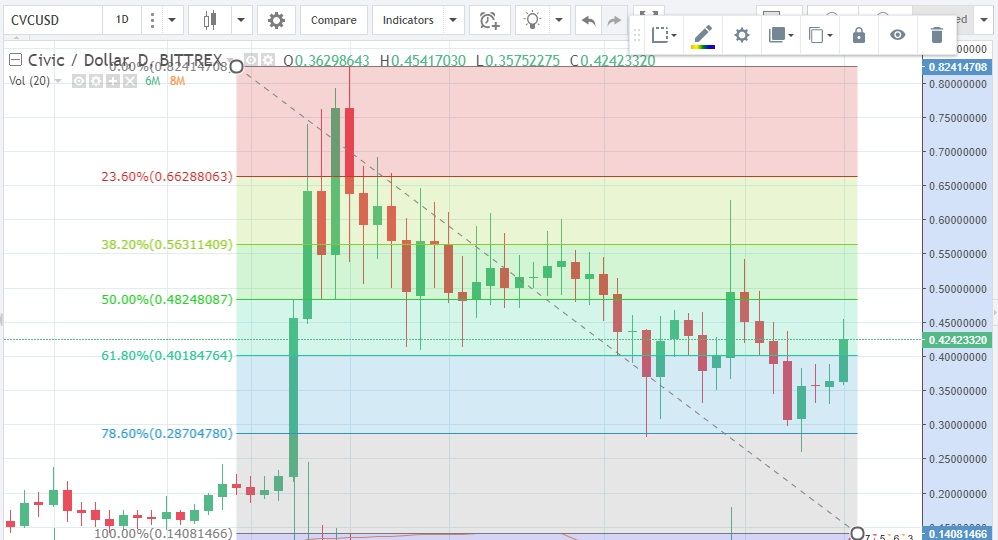

E. 1 point – Given its potential for growth, CVC is at a great price right now, $0.423.

F. 0.5 points – There is a rather high total supply of CVC: 1,000,000,000, but still less than Ripple’s supply. I’ve seen coins with a lot more 0s than CVC, so this is quite decent, IMHO.

G. 1 point – Civic definitely has a lot of partners on its side, mainly due to Vinnie Lingham’s reach, experience, and presence in the online world. Check out the entire list at https://www.civic.com/partners

H. 1 point – Yes, the Civic app is already downloadable on both Google Play Store and Apple Store and to be honest, it looks pretty good. I haven’t had the chance to fully test it, but this is definitely on my list for next week.

I. 1 point – Civic is entirely focused on what we’ve discussed so far and doesn’t try to be a jack of all trades, but a master of one. So this is certainly a plus for them.

J. 1 point – CVC recently spiked through the 61.8% level, which was a resistance point in the last few days, but, given its price, I still think that it’s a good buying point, if and only if you’re committed to a long-term investment and really believe in its potential to become a giant (as I do).

TOTAL POINTS: 9.5 / 10

- Aventus (AVT) - https://aventus.io/

A. 1 point – Another pretty short, but well-designed whitepaper belongs to Aventus. Aventus is a decentralised protocol creating a less fraudulent and tout-filled event ticketing industry. And boy, do we need this! Considering the level of fraud in the industry, a blockchain-based solution is more than welcome to address this issue.

B. 1 point – Yes, without a doubt, if the implementation will be right, Aventus will nail this.

C. 1 point – Alan Vey and Annika Monari seem to be very dedicated to making this a huge success and are definitely well-suited for their roles, from a technological standpoint. The project also has a lot of (technical, economic, financial and business) advisors and the first that stands out from the crowd is Prof. Will Knottenbelt, Director of the Cryptocurrency Research and Engineering Centre, Imperial College.

D. 0.5 points – Although it’s pretty new, Aventus does have over 5k followers on Twitter and a Slack community of over 5k very active members. Lately, Alan and Annika became more active on the Slack channel, but there is room for improvement. Furthermore, I heard they’re looking to hire a Community Manager, which would definitely enforce the connection to the investors and drive the social media following up.

E. 0.5 points – The price is currently at $2.21 (under the ICO price, by the way), which can seem pretty high. Also, the AVT token isn’t yet available for trading on the big exchanges like Bittrex, Poloniex, Bitfinex or Liqui, but given the fact that the project is very new, this is only a matter of time. However, I think the price will go up when the trading volume will grow, so you have the chance to buy now, while AVT hasn’t hit the above-mentioned exchanges. Although I don’t personally like EtherDelta, it’s one of the few places you can purchase AVT from.

F. 1 point – The total supply of AVT is only 10,000,000 tokens, so this is a big plus for Aventus.

G. 0.5 points – No major partnerships just yet, from what I know. However, Aventus announced an agreement with Joy Records, a record label and event-promotion brand in Tel Aviv, Israel and with Blue Horizon Entertainment, a US-based venue management, and live entertainment optimization firm. So that’s something, for sure.

H. 0 points – Aventus doesn’t yet have a working product, but the public beta version is announced for Q4 2017 (so pretty soon) and the production version launch is set for Q2 2018.

I. 1 point – Yes, the Aventus solution does solve a particular issue and it’s 100% focused on attaining its goal.

J. 1 point – Unfortunately, being such a new coin on the market and not hitting the big exchanges, I cannot provide a Fibonacci retracement chart, due to the lack of data. However, given the fact that AVT is currently under the ICO price, it’s definitely a good entry point. Of course, if and only if you read all about the project and the team and you consider it to be a potential superstar a few years from now.

TOTAL POINTS: 7.5 / 10

- Stratis (STRAT) - https://stratisplatform.com/

A. 1 point – The whitepaper of Stratis (goo.gl/bhwWyd) is certainly a well-crafted document, describing in detail the architecture, the features and the benefits of the Stratis platform. Basically, quoting the whitepaper itself, Stratis is a powerful and flexible blockchain Development Platform designed for the needs of real-world financial services businesses and other organizations that want to develop, test and deploy applications on the blockchain. Stratis blockchain apps can be developed in pure C# and can also utilize the Microsoft .NET framework. Simply put, Stratis allows companies to develop C# applications in a secure and distributed environment.

B. 1 point – Yes, definitely. Stratis provides solutions for development, testing, and deployment of native C# blockchain applications on the .Net framework. So it does offer a complete, end-to-end solution for companies interested in application development.

C. 1 point – Stratis does have a strong team, led by Chris Trew, who has a large experience in enterprise technology, C#, .NET and blockchain. Furthermore, developers like Nicolas Dorier, Dan Gershony and Pieterjan Vanhoof are .NET ninjas and that really adds value and expertise to the project. Cesar Castro is the main advisor of Stratis and he adds a whole new level of credibility, being a Harvard Business School graduate and a strategic driver of corporate expansion for over 20 years with extensive experience in multiple high-change environments.

D. 1 point – The Stratis project does have an impressive community with over 45k followers on Twitter and more than 10k members on their Slack channel.

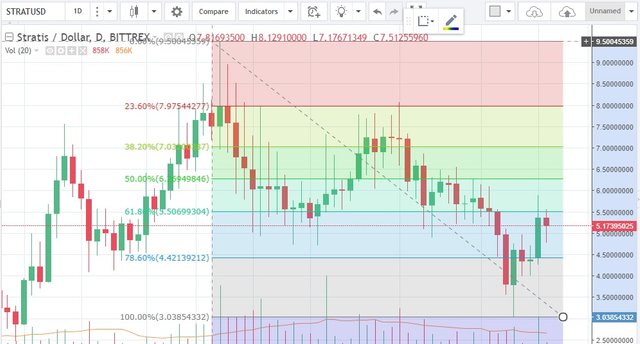

E. 0.5 points – The current price for 1 STRAT token is rather high at $5.1, however, it’s nowhere near it’s all-time max of $10.85. Given its high potential, there is definitely room for a 100x return or higher, if the project will be executed as planned.

F. 1 point – The circulating supply is 98,548,994 STRAT, which is very decent compared to one coin I’ve seen recently, which has about 8.000.000.000.000 tokens available. Pretty crazy, right?

G. 0.5 points – Stratis has signed a partnership with Escalate Group (goo.gl/GvWHqk), the company lead by Cesar Castro and also has been in contact with C-level executives of quite a few companies in Fortune 500 (more details here: goo.gl/7KFEpu).

H. 1 point – On the token side of things, Stratis does have a very well-built wallet, the Stratis Electrum. They also have another wallet meant for staking, called the Staking Wallet. Stratis has a mobile app as well, which is currently in beta and available for Android only – Stratis Identity. Moreover, you can find more details about their nStratis platform right here: goo.gl/5pVJpW and goo.gl/XoAahK. One thing to mention here is that you can use a Raspberry Pi device for staking STRATIS tokens (more about staking and setting up a STRATIS daemon and wallet on your Pi: goo.gl/1xXNCp).

I. 1 point – Stratis is trying to integrate several solutions and features in their platform, but the end-goal is clearly defined.

J. 1 point – Considering the recent market fluctuations and crashes and the latest highs and lows the STRAT token has gone through, the Fibonacci retracement (on a 1 day interval chart) shows that Stratis is now spiking through the 61.8% line. This means it’s not a bad time to accumulate some tokens. I think chances are (if no other market crashes occur) that soon STRAT will go towards the 50% line, creating a support line at 61.8%.

TOTAL POINTS: 9 / 10

- Bitquence (BQX) - https://bitquence.com/

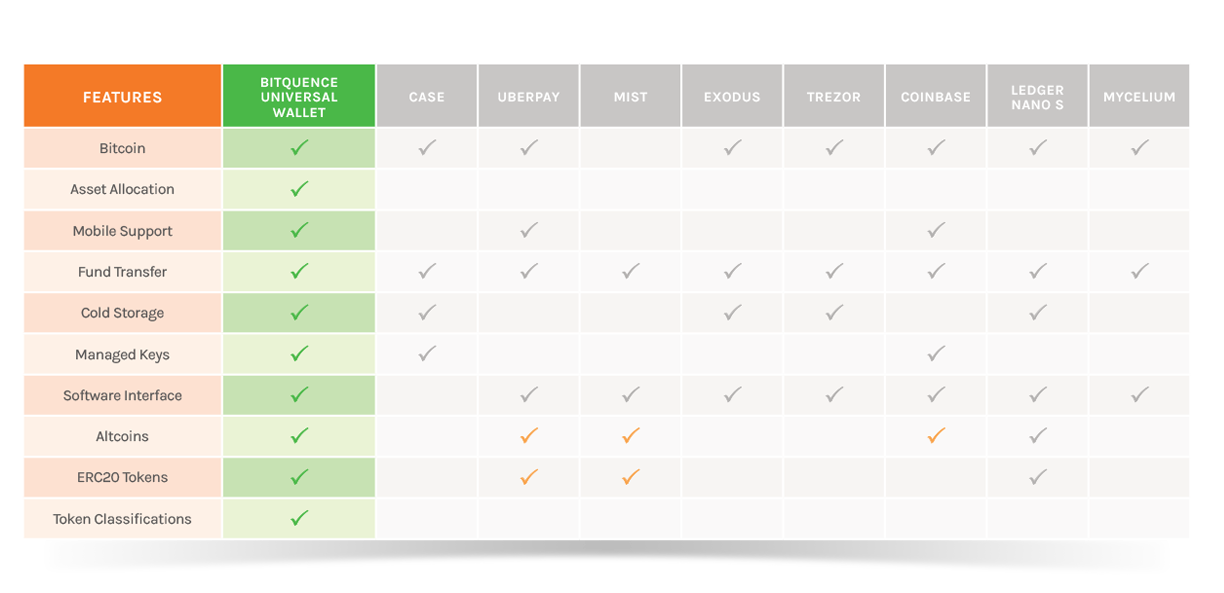

A. 0.5 points – The Bitquence whitepaper (goo.gl/awjdHL) is pretty basic, but covers the main principles and features behind the project. Bitquence aims to build an Universal Wallet for not only BTC, ETH, LTC or Dash, but also for Golem or SiaCoin. Universal Wallet means there’s no need to keep track of multiple wallets and private keys. Comparing Bitquence with other wallets (source: bitquence.com) …

B. 1 point - Yes, Bitquence solves the need for a universal cryptocurrency wallet, especially considering the growth of the crypto world and more and more people being interested in investing in and storing multiple types of coins.

C. 1 point – Shingo Lavine, the brain behind Bitquence, is a young, talented Bitcoin investor and a computer science and finance student at Brown University. Among other amazing team members, Shingo recruited Yu-Jen Dennis Chen, aka the “SQL-God”, a data guru with 5 granted patents to his name and ex-CTO of Funmobility and Maurice Herlihy, who holds an A.B. in Mathematics from Harvard University, and a Ph.D. in Computer Science from M.I.T. So, a great team behind Bitquence, indeed.

D. 1 point – Bitquence has an active and growing community on Twitter (over 11k followers and daily news and updates), Slack (almost 2k members) and Telegram (over 2.6k members).

E. 1 point – Yes, yes, yes. At $0.85, BQX is still at a great price for purchasing, although it went down to $0.54 on Friday, September 15th. But still, 85 cents? Considering its potential, I think it’s still pretty low.

F. 1 point – There is a total supply of 222,295,208 BQX, which is a fairly decent amount.

G. 0.5 points – Bitquence has an ongoing partnership with iValley FinTech, which is a startup

incubator located in California, but I think there are a lot more partnerships to come in the near future, given the project and the team building it.

H. 0 points – Being very new on the market (crowdsale closed on 16. Jul 2017), Bitquence does not have a working application yet, but their website claims that we should see the first product release in late 2017 or early 2018.

I. 1 point – Bitquence aims to solve a single and very crucial need in the market and seems to be focused on delivering the best solution to meet this need.

J. 1 point – The only Fibonacci retracement analysis I was able to perform was using coinigy.com, based on the BQX/ETH ratio on the HitBTC exchange. The chart shows BQX is current just above the 61.8% line and seems to have created a support line at this level. I would definitely buy more BQX now, given its low price and low trading volume which are due to BQX being listed on EtherDelta, HitBTC and CoinExchange only. As soon as the token will be listed on Bittrex or Poloniex and the volume will grow exponentially, I expect BQX to become more and more expensive.

TOTAL POINTS: 8 / 10

- Steem (STEEM) - https://steem.io/

A. 1 point – Steem’s whitepaper is a very detailed description of the technology, reward system and features of the Steem environment and paints a complete and clear picture of the entire project. Assuming you are reading this article on steemit.com, I won’t get into any details about what Steemit.com and Steemit.chat and DTube.video and Dsound.audio are. You can explore all of them by yourself and draw a conclusion.

B. 1 point – Yes. If we’re talking about Steemit.com alone, it definitely solves the need for a decentralized, content curation and reward-driven blogging platform, a new Reddit, Quora or Wordpress, if you wish. At least this is how I see it. And with a grain of Twitter on top, I almost forgot.

C. 1 point – The CEO and co-founder of Steemit is Ned Scott, who has a fairly poor LinkedIn profile but seems like a smart guy nevertheless. However, the main star of Steemit’s team is Daniel Larimer, the founder of BitShares and ex-CTO of block.one’s EOS project, so a very experienced guy in the cryptocurrency world.

D. 1 point – As far as I know, there are over 373k users of Steemit.com at the moment, but the social media community numbers are far lower. There are over 2.5k steemians on Reddit and almost 32k Twitter followers, which is actually quite impressive.

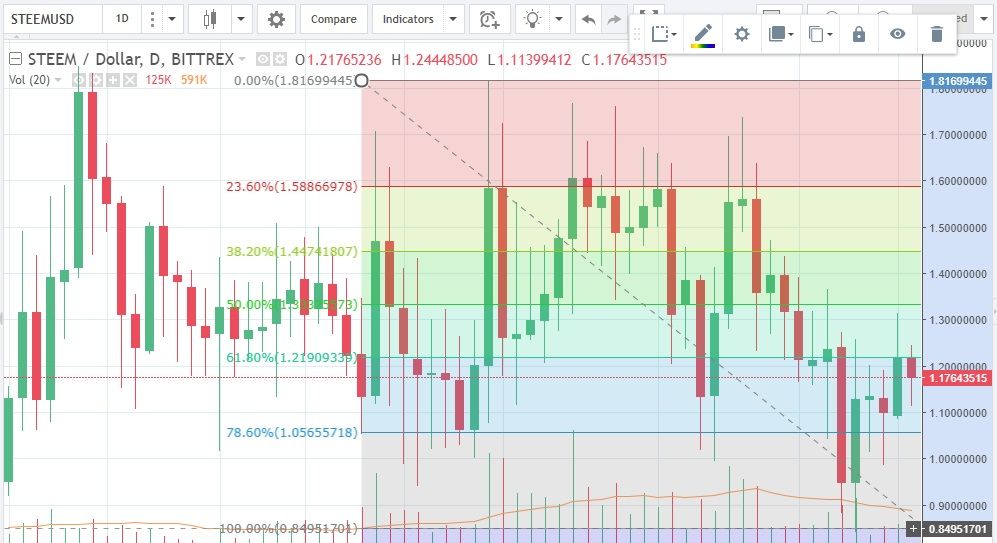

E. 1 point – Yes, I really do think that the STEEM price is still very low, given its huge growth potential. 1 STEEM token is worth $1.17 at the time of this writing, but the max price was over $3 a few months ago, so there is definitely room to grow.

F. 1 point – There is a total supply 258,936,546 STEEM, which is a decent amount.

G. 0 points – I haven’t found any noticeable news about any partnerships, but I’ll be happy to change my rating here is someone will correct me on this.

H. 1 point – Yes. Check out steemit.com, dtube.video, dsound.audio. You can check out all of them here: goo.gl/gj7JHR

I. 0.5 points – Steem does try to solve a lot of issues all at once (blogging, video, audio, chat and others), but they really do seem to do a hell of a good job with most of them. So only half a point here, for not really focusing on one thing at a time only.

J. 1 point – The STEEM token is currently just under the resistance level of 61.8%, which was formerly a support line. If it breaks through this line and turns the resistance into support, we shall see, but my prediction is that soon it will start gravitating towards the 38.2% level and hopefully create a support line there once again. Of course, that’s an amateur prediction and I may be painfully wrong, who knows?

TOTAL POINTS: 8.5 / 10

- Golem (GNT) - https://golem.network/

A. 1 point – What I like the most about Golem’s whitepaper, besides the use cases and the vision for building a Web 3.0, is the clear roadmap they have. I must say I think this is one of the most detailed roadmaps I’ve seen in a whitepaper. Quoting the document, “Golem is the first truly decentralized supercomputer, creating a global market for computing power and connects computers in a peer-to-peer network, enabling both application owners and individual users ("requestors") to rent resources of other users’ ("providers") machines.”. So, Golem aims to be a global, online network of processors, under an Infrastructure-as-a-Service (IaaS), as well as Platform-as-a-Service (PaaS) model. You basically can rent your CPU/GPU’s unused power in exchange of GNT tokens and use the network’s processing capacity for your own projects.

B. 1 point – Yes, without any doubt, this is a revolutionary approach to building a supercomputer using the idle resources of the community.

C. 1 point - Julian Zawistowski, the CEO of Golem, is specialized in Economics (Warsaw School of Economics) and also held two previous CEO positions, which makes him a good fit for this role. On the tech side of things, Piotrek 'Viggith' Janiuk and Aleksandra Skrzypczak both have degrees in Mathematics and Computer Science and worked as a Senior Software Engineer for various companies.

D. 1 point – The Golem Slack community has more than 8k members and is quite active. Furthermore, there are more than 12.5k readers on the GolemProject reddit page and over 53k Twitter followers, so quite an impressive community, to be honest.

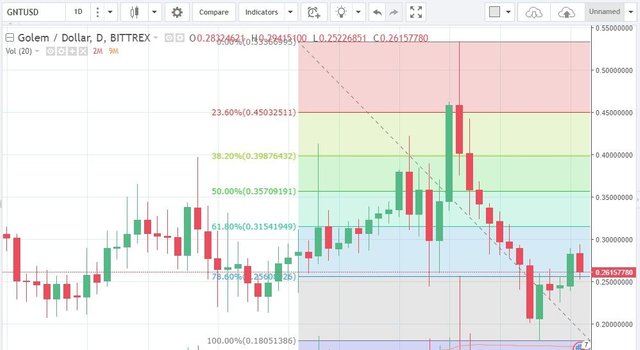

E. 1 point – At slightly over 26 cents, the GNT token is very accessible for buying right now and has a lot of potential to grow in price, when the technology will become widely adopted. And I truly believe it will, some day.

F. 0.5 points – There is currently a total supply of 1,000,000,000 GNT, which can be considered quite a lot.

G. 0.5 points – Golem does have a partnership with Streamr (goo.gl/rVNMg8), which provides a “complete system to create unstoppable real-time data apps, even without writing code.”. Also, there are rumors and discussions about a partnership with OmiseGO, but I haven’t found an official announcement yet.

H. 1 point – Yes, there is an alpha version available for testing (goo.gl/kKYXLg).

I. 1 point – Yes, Golem addresses a particular issue – building the world’s next supercomputer. That’s actually why I chose Golem over MaidSafe, which aims to build a very broad range of technologies under the SAFE Network (messaging, apps, email, social networks, data storage, processing, video conferencing, and much more.). I really think MaidSafe is a great project, but for now it seems a bit out-of-focus.

J. 1 point – As you can see, GNT is currently at the 78.6% level and seems to establish a support line here (maybe, we shall see). The previous low was due to the market crash of last week, but even now, at this moment, there is a great entry point for accumulating GNT.

TOTAL POINTS: 9 / 10

- Sia (SC) - https://sia.tech/

A. 0.5 points – To be honest, I don’t really like the format and structure of Sia’s whitepaper (goo.gl/3ELrok). Also, the fact that it dates back to 2014 doesn’t seem very enticing. However, the document explains the purpose and technology behind the project pretty good, so no reasons to complain there. What does Sia accomplish? “Sia is a decentralized cloud storage platform that intends to compete with existing storage solutions, at both the P2P and enterprise level. Instead of renting storage from a centralized provider, peers on Sia rent storage from each other.”. So, basically, Sia aims to (and I really hope it will) replace, at some point, centralized, unsecured and expensive services like Google Drive, Dropbox or OneDrive.

B. 1 point – Too bad I can’t give Sia 2 points here, but yes, it definitely can become a better solution than the ones I mentioned above.

C. 0.5 points – Sia is developed by David Vorick and Luke Champine, both of them being graduates of the Rensselaer Polytechnic Institute and colleagues at Nebulous Inc, a VC-funded startup in Boston. According to their LinkedIn profiles, they don’t seem to have a very solid technical background, but this doesn’t mean they don’t have a lot of talent and potential.

D. 0.5 point – Sia has a great Twitter following (over 35k people), but a not-so-active Discord group. Moreover, they have a forum with thousands of posts, where you can learn a lot more about the project (goo.gl/jVRDWd). They also recently promised monthly community updates, so they seem to be on the right track regarding user interaction.

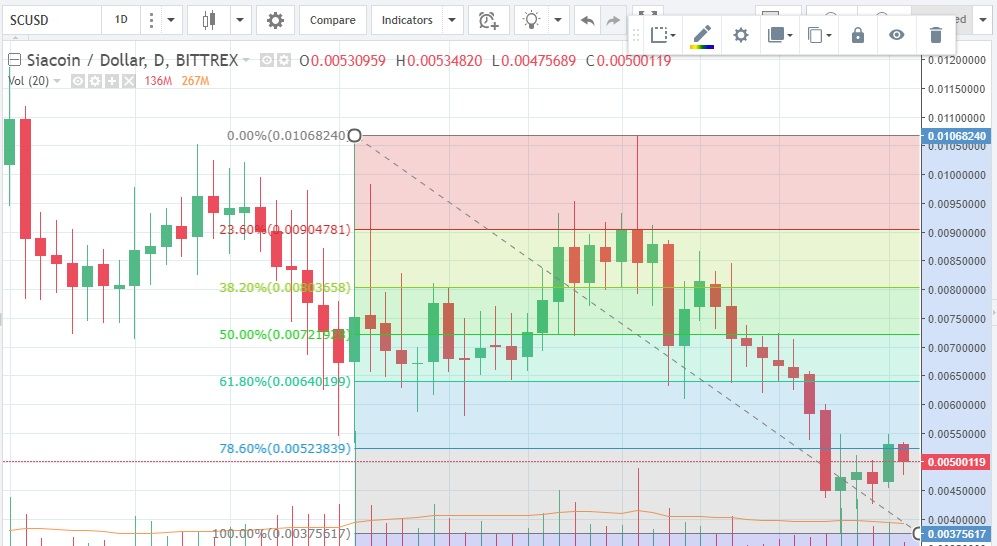

E. 1 point – The SC token is currently priced at 4.99 cents, so this is a very reasonable value to consider investing, especially if you truly believe in this project.

F. 0 points – The current circulating supply of Sia coins is 29,479,132,422 SC, which can prove to be a downside when expecting huge spikes in its price. So 0 points here.

G. 0 points – Apart from a partnership with The Crypti Foundation, which seems to be supporting Lisk, as they say on their website, I couldn’t find any other partnerships of Sia. So no points here, sorry!

H. 1 point – Yes, Sia has released the Sia-UI and Sia Daemon software (Windows, Linux and MacOS versions), which acts both as an SC wallet and as a means to upload or host files in the Sia network. During my use of the Sia-UI on Windows 10, I encountered errors after the first block synchronization and the UI wouldn’t load anymore, making the software useless and having to re-download and run it again. This should be fixed! Sia also released two GPU miners and there are also some apps already build on top of Sia, like Minebox (goo.gl/5VV4rQ).

I. 1 point – Yes, Sia is definitely focused on solving one particular issue – decentralized, encrypted and distributed online storage. Their roadmap is over here: goo.gl/GbpLQA

J. 1 point – The Sia token (SC) seems to have hit a resistance point at 78.6% and it’s definitely a good time to buy if you care for this project. If not, maybe my last coin will prove to be more interesting to you.

TOTAL POINTS: 6.5 / 10

(I know I said a coin must score at least 7 / 10 in order to be a good investment, however I really believe in Sia, hoping the team will grow this project exponentially during the next few years.)

- Storj (STORJ) - https://storj.io/

A. 1 point – Storj has a very detailed and well-structured whitepaper (goo.gl/YC1fof), so it definitely gets 1 point for that. Quoting the document, “Storj is a protocol that creates a distributed network for the formation and execution of storage contracts between peers. The Storj protocol enables peers on the network to negotiate contracts, transfer data, verify the integrity and availability of remote data, retrieve data, and pay other nodes.”. So, seems like Storj is very similar to Sia. Discussions about differences between the two can be found here: goo.gl/n8pRMw

B. 1 point – As with Sia, the answer is a big YES.

C. 1 point – Storj definitely has a large team of developers and community members. Shawn Wilkinson, the founder of Storj, has a degree in Computer Science, just like the CTO of Storj, Philip Hutchins, does. Moreover, on the advisory board of the project, we see Warren Weber of webereconomics.com, Economist, PhD, Carnegie-Mellon University, which can prove to be a great asset for the team.

D. 1 point – Storj has a huge and active Twitter profile (almost 37k followers) and more than 3.7k readers on Reddit. The Storj team is also active on Facebook and Medium, which is a big plus for the community.

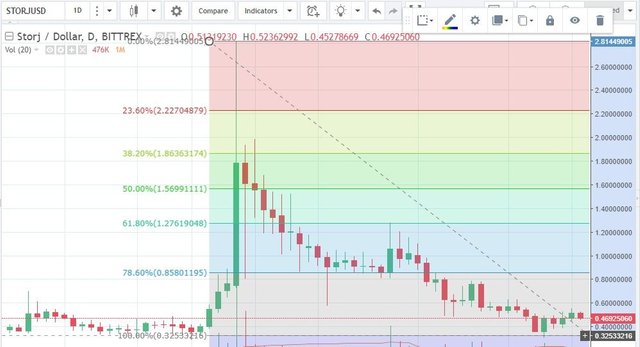

E. 1 point – The STORJ token is currently at $0.482, which is a great price for purchasing.

F. 1 point – The total supply is under half a billion tokens, 424,999,998 STORJ to be more accurate, which is a reasonable amount.

G. 0.5 points – Storj currently has a partnership with FileZilla (according to goo.gl/MesxCw) and also partnered with Heroku, implementing the Platform-as-a-Service in the cloud (according to goo.gl/87hGbQ). So definitely more than Sia has.

H. 1 point – Yes, Storj already has a fully functional software application for desktop (goo.gl/y2xtmU), with which you can rent your drive space and earn STORJ tokens in return. I am already using the app (for testing purposes, for now) and have rented 50GB of my hard drive on one of my idle laptops. The app is available for Windows, Linux and MacOS. And it looks really great, it’s very easy to use and has a low impact on your computer’s resources.

I. 1 point – Yes, as stated above.

J. 1 point – Storj is currently under the 78.6% Fibonacci level, so this is definitely a great moment to buy some tokens. Check out the chart below, in case you don’t believe me.

TOTAL POINTS: 9.5 / 10

Ok, finally, I finished this section of the article. Boy, was that a long one! 😊

One additional criterion I’m considering each time I look at a coin is if the token is an ERC-20 token or not. Why? Because I am always thinking of storing it in MEW and then to my Ledger Nano S (soon), instead of installing separate wallets for each coin, which is time-consuming and pretty risky (high number of private keys, seeds, passwords and so on). Keep this in mind for your next investments, it might prove to be way easier to own ERC-20 tokens only. More about this at goo.gl/gVTxD5.

Now, I must confess, I’m also keeping my eye on:

- OmiseGO (OMG)

- PivX (PIVX)

- district0x (DNT)

- Iconomi (ICN)

- IOTA (MIOTA)

…and a coin (ICO) that just launched recently, which I’m very excited about.

But more on these 5 coins + the groundbreaking ICO in a future post, as soon as I will do more research on each of them. Remember: research is a must, before deciding to invest even $1 in a project.

Having that said, I hope you find this useful and stay tuned for the next post!

By the way? What coins do you own in your portfolio and why?

Price and coin supply data taken from coinmarketcap.com

Charts created using trandingview.com and coinigy.com

Gonna get myself so SIA..Thanks..great info and work...

Thank you and good luck!

Not sure about golem was so tempted...Still think AWS, AZURE, Google, Oracle to name a few are already and actively selling resources.. There's alot of competition in the marketplace...Also if i'm a layperson my qn would be (Someone is using my cmputer is it safe?)..

At some point in the future, long-term speaking, I would definitely see Golem adopted if it'll offer much lower fees than Amazon or Microsoft or others.

No one is using your computer, the idle processing power of your computer will be used in the network. These are two different things.

i really thing bmaidsafe will lead

We shall see. If they do manage to build all the things they promised, then yes, it can be profitable.

This is my concern with SC, Storj and Golem. True, its a great idea and since is decentralized, its gonna be really cheap vs the private competition, but, as a coin its gonna be cheap, too.

With time people are gonna sell storage/computing power for cheaper and cheaper till forever, unless there is a capped amount of coins to trade for, if so, the price will go up but because of coin scarcity but space/CPU time will still remain cheap.

It's a valid point, indeed! Thank you!

That's a lot of work you have done. Please have an upvote (I'm listening to DSound in the background right now, I wasn't aware of this project!).

I really liked your format where you explain your reasoning for each pick.

I currently have BTC, ETH, STEEM, TenX & BAT, & about to purchase K.IM tokens in the upcoming ICO (I have an interest in projects with an actual product that are planning some sort of passive income/dividend).

Thank you!

"I have an interest in projects with an actual product that are planning some sort of passive income/dividend"

Yes, I totally agree on that! I don't believe in BAT, though. But nice portfolio, anyway! :)

Yeah what's great is that we can all make our own portfolios & still x100 if we get a few winners (even if a few turn out to be duds)

Most % is in the BTC & ETH, I'll only feed more into the tokens if they show commercial success.

I have altcoins only and I really believe at least one of them is going to be a success :) Good luck to you!

Very thoughtful assessment. I'm pleased to find someone who takes the time to establish criteria, follows that criteria, invests for the long term and sets goals. If you continue your discipline, and not get caught up in the emotional rollercoaster that comes with such a volatile market as cryptos, you deserve your 100K rewards. I hold:

NEO (bought it at $0.13 US)

Storj

Steam Power,

XRP,

Peerplays (PPY)

Monero

Lykke (LKK)

& about 1/2 dozen others

Yes, I am definitely here long-term. The market is volatile, yes, no doubt about that, however, I will not be tempted to sell a coin for a 5x profit or similar. As I said, I'm here for huge ROIs.

You have a nice portfolio. I will take a look at PPY and LKK.

factom

maidsafe

ripple

bitcoin

ethereum

auger

Augur and Factom, don't know to much about them. Maidsafe, a good project, but tries to do too many things all at once for quite some time now, and the results didn't impress me that much.

Maidsafe is very different its true and the primary reason is the development roadmap is orders of magnitude more complex than that of most crypto. Building a new internet is barely comparable to constructing a decentralised exchange or storage - sure the latter is a component of the SAFE network but thats like saying Facebook is an aspect of the internet. SAFE will be so much more than just decentralised storage and way more robust than Sia or Storj anyway. Maidsafe just moved to Alpha 2 I believe so there is progress and a lot of the infrastructure is built now so I'd expect things could go quicker from here but there is still lots of work to do. So yep it can all look a bit diffuse as a prospect when compared to every other coin - but then the internet is diffuse when compared to a single website. Full disclosure - I'm a hodler - of course 😁

Great thoughts on Maid, I must admit. And I totally agree, it's only that they seem to work on too many things simultaneously. If I will see some actual progress, maybe I will change my mind and throw it 1 Eth at MAID. Thanks for your comment!

MAID does take a long time to produces results. They really need to get something out there to grab the public before they are surpassed on a few fronts.

Yes, I totally agree. People want to see tangible results.

Sounds like a "Palm Beach Confidential" portfolio.

I know you like, admit it :P

Thank you very much for sharing your portfolio and the detailed explaination! I agree with you on most points, as i hold some

neo,

miota,

golem,

tenx,

quantum,

XRP,

NEM and stratis.

I don't really believe in Civic, i was actually thinking about buying in during the recent sale, but i don't see a wide adoption in the near future.

I got rid of my siacoin, i feel like they are making a good development progress but they're advertising their product way too little, so other coins with similar ideas overtook them.

I will get rid of my XRP too as soon as i can make some profit, as i really really dislike Ripple. Don't get me wrong, i don't think it is a bad investment, but i really think a private blockchain owned by banks is not worth supporting. (Most people hardly get the difference between XRP and the Ripple project anyway)

All in all I am not aiming for a 100x gain, my personal goal is something between 5x and 10x.

In the recent ICOs i put some ETH to ENJIN-Coin and i also participated in the Kick-ICO. I am very excited about enjin coin because in my opinion, gamers will be the first "real" cryptocurrency users when it comes to actual shopping.

Great insight into your portfolio, thanks! I respect your opinion, although I do not fully agree.

For example, you said "a private blockchain owned by banks is not worth supporting". I disagree here. I'm not only about the principle, the banks vs crypto argument. If XRP can bring me a 100x profit some day (and I believe it will), I don't really care that banks are the ones "supporting" it.

Great visions for the future @mihaiteodosiu ! and also a nice portfolio! I also use Blockfolio for tracking my cryptocurrency investments. It's a must thing for every crypto trader out there.

Also I would definitelly recommend you to keep an eye on IOTA and 0x project as you mentioned in your posts, because these are very promising peaces of technology. Invested in them myself early on - they still did not have their major "boom" so it's not late for you as well ;)

Upvoted, commented and followed by @lifipp a.k.a Hash Courier - author of weekly articles about cryptocurrency world.

Thank you! Yes, I am keeping an eye on IOTA and 0x and probably will invest soon, after some research.

Thank you for sharing your portfolio and reason for choosing the coins you hold. I currently hold btc and steem. @rkz check out this article there is good info we need to look at to invest in

Thanks. I will!

Great Article!

Thank you!

Dude, this was seriously awesome. Thank you for this article. I only wish others were half as articulate and thorough as you!

Personally, I'm in on XRP, CVC, BQX, Steem, SC; and DNT, & IOTA from your "to research" list. And now I want in on all the others, too :)

I know you're not supposed to invest on emotion, but I can't help but root for SC too because they're remotely local to me, and I can't help but get psyched about that and want a little more than usual for them to succeed because of it. That's fair right?

Thanks again for this killer contribution. I hope you're rewarded appropriately for it!

Thank you so much for your words, I really did put a lot of effort into this article. I like your portfolio, but always be careful and invest as much as you are comfortable losing. And do your own research for each and every coin. I will release a new article soon, about the coins I am keeping an eye on. Maybe I will invest in them before writing the article, even. Who knows? :)

this is great info and i love the way you lay it out and simplify. it takes out the emotion! gonna take a few of your moves and work them into my own strategy

Thank you so much! This is my thought process when it comes to investing in crypto. Don't take it as professional advice, though! :)

i am taking for many sources to build my mind. i just like the 10 point system very much! the dude from the youtube channel DATA DASH has similar ways of doing such

Don't know him, but I'll have a look. No matter the type of system, you should definitely have one before deciding to invest.

this is the data dash page:

https://www.youtube.com/channel/UCCatR7nWbYrkVXdxXb4cGXw

smart guy!

and yes! a plan. the cool thing is this shit is in my blood. my father and grandfather where traders on the floor at the Chicago Board Of Trade. i feel it in my blood!

Thanks! Yup, it seems you're made for this :) Good luck!

thanks! hope so! here we go!