THE BUDGET CHALLENGE: The anti-broke codes

I have always wondered the art of budgeting but I failed a couple of times. I literally suck at making a budget plan and actually sticking to it. And for six days after @smaeunabs published her new Budget Challenge, it made me think towards almost eternity on how do I really overcome this predicament to attain financial freedom. I initially thought that my previous entry about my budget principle would last but it broke my heart as I got broke and failed for the nth time. Well, budgeting from paycheck to paycheck was difficult given that I travel a lot and eat for distress almost all the time. So after six days, I created this anti-broke codes. And if you feel it in your heart and you understand me, keep reading as I unveil to you the new found secret codes on budgeting.

.png)

It is never always enough to say that

"Naah! I have done it before I'm pretty sure I'm gonna ace that again this time."

or

"I'm used to saving when I was a kid to enjoy some hours in the internet cafe."

Why not enough? Because whether we like it or not, we always change our lifestyle, wants and necessities. So doing some self-evaluation is a must and accepting your status on the matter is the first step to budgeting.

I hit rock bottom lately.

Hitting rock bottom isn't that bad at all. You get to realize a lot of things including a new found will to stick to a plan. As I have mentioned in my previous blog, I was devastated when I received my latest paycheck with nothing much to sustain my financial responsibilities for my self and for my siblings. I was not on an intermittent fasting then because the truth is I was just trying to survive until the next pay out. Now, after a couple of days of self-evaluation, I had finally figured out these rules:

1. Know your expenses

.png)

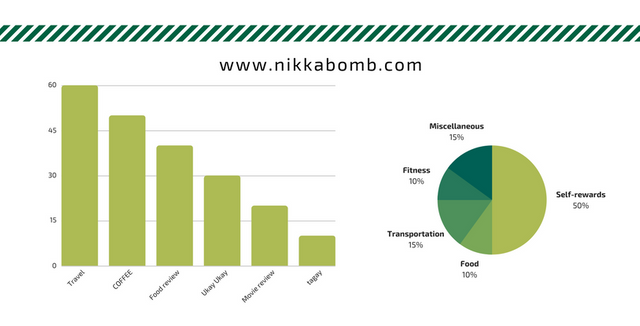

This is kinda difficult for me, to be honest. Please don't judge me. I love to travel and try new things, food and enjoy life because YOLO! Everyday, my expenses vary from mood to mood and travel to travel. In order to check this in my to-do-list, I follow some limits and having a computation basing on the variables like travel expenses. Here, I'm gonna show you something.

Some good news for me though, my younger sister just graduated from college while I just checked out from my apartment. That means, (insert drum rolls) SAVINGS! But oops not so fast. As I have to adjust with few things like a more allocated budget for self-rewards! I'm not being selfish, this is my way of keeping sane. And besides, as much as I can I make these self-rewards blog-worthy so while I enjoy I can earn, too.

Well, in connection with the graph, it is not an exaggeration that those items are applied in a daily basis. I call that a buffer system. I compute and anticipate larger expenses that I usually spend so as not to shock my wallet. For example, yesterday I did not have any expenses under the self-reward category so I saved 50% of my daily budget limit. And as for today, I made use of that category as I am back here in Bohol attending some personal matters while lessening my food expenses because I'm at home. You see, I expect more to save more. This isn't true to love tho because you know you shouldn't expect more to save your heart more. LOL!

Here's the thing, I don't have much for my daily budget limit so my #2 rule saves the ass of my #1 rule.

2. Keep track, adjust and re-compute

.png)

In an average, I get to travel at least once a month and I cannot rely on my daily budget limit for that planned getaway. I set 150 pesos or 3USD as my daily budget limit and the 50% of that isn't enough. So after I keep track of my expenses, all the self-reward points that aren't used on other days are saved after a just adjustment and computation and then used on the days to come. Sounds like save and spend, isn't it? Well, not really because I get the chance to blog it and earn a few bucks so I can never always go back to square one.

You may ask, how do we survive in this method?

Wait, there's more. What I told you was only the tip of the iceberg. Because here's rule #3...

3. Save up!

.png)

You may want to disagree as I had just introduced saving after spending but wait, please don't be so quick. It's not that. When we initially sworn to all the new and old gods to stick to our daily budget limit, it's a way of stating of saving first the 350pesos or 7USD given that you're earning at least 500pesos or 10USD per day. See? We already managed to save before we spend. Congrats to us, the almost-always-broke squad. LOL! But if you're too frugal and there are some ways of earning other than your main day job, then I suggest to put everything else into SAVINGS! Because the only way to save your ass from being broke is to save up!

And lastly,

4. STICK TO IT!

.png)

If he/she did not stick to you and the promise you shared with each other, then please don't do the same to your savings and budgeting! We may have different budget plans and limits depending on our lifestyle, but in the end we share the same mission which is to save. Because, Budgeting and sticking to it is your way to tell your money where to go instead of wondering where it went.

"Budgeting and sticking to it is your way to tell your money where to go instead of wondering where it went."

And if you or I fail again this time, then maybe we could do some adjustments in the daily budget limit and allowed budget expenses.

Wahaha as expected you always entertain in your post...self rewards is very imp to let the blood of energy recuperate..ngkatawaq s mga hugot lines😅😅😅 rock on with ur travels bec YOLO😊😊😊

thank you so much for appreciating this @orhem. Will always look forward to your posts, too. hahaha

Wen, YOLO!

Woah you amazed me by coming up with such realizations nik! I could feel the honesty and the sincerity to start all over in terms of strengthening your budgeting techniques.

Indeed, sticking to your budget is one of the most important skill to practice. yaaaaaay samot na kalabad akong ulo sa pagpili sa winners hahahahah

honest jd kay lisudan jd kos budgeting hahahahaha. mas lisud pas moving on LOL

bragging rights lang ako she. nice mn pd ilang mga entries tanan gd. hahaha. Good luck @smaeunabs sa pagpili sa mga winners. :*

Nagdugo akong ilong te tabang! Hahah btw well said👏🏼

a few typos nga karun pa nako na notice hahaha LOL anyways, thanks for dropping by @carlitojoshua. Your budget challenge is also amazing. 100 per week!! Wooaaah!

hehe thank you te :) di gyud tawn lalim 100 perweek ang akong gastoon ra kay 5 pesos everyday for water ahahah

I normally try to only spend 50% of what I earn.

that's a great way to make sure saving the other 50%. :)

Great.

I just got an email from rich dad poor dad that investing is better than saving. However, I agree that we should save something so that we can invest it in the future.

Hi @leeart, well, this is only the basics for those like me who always fail at budgeting. Soon, I'll get to that level and I will not miss to share it with you. Anyways, thanks for dropping by.

We have to find something that works. I once tried the doubling the amount you save the previous month. I could not sustain it. I tried the other way around and i got further and saved more but still could not sustain it tothe end lol!

when i tried last time to record all of my expenses day by day at the smallest cents, i was shock with what i saw at the end of the month, the biggest expense was actually on food..hahah.. bahala pod basta mukaon jud ko...:);)... pero ang the best nga formula nga proven and tested is income less savings=expense, and treat savings as an advance expense ..

Congratulations @nikkabomb! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @nikkabomb! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard!

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes

Congratulations @nikkabomb! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - The results, the winners and the prizes