Diving into DeFi: Part 1: What is DeFi in your mind?

Introduction to DeFi

There is a paradigm shift slowly shaping up in the financial domain and this time it is the DeFi that is in charge of such a shift. The individuals across the globe are keenly following this shift, engaging with DeFi sectors, with more than 8 billion worth tokens being locked in DeFi, yet this trend is still being considered at the very nascent stage by the experts. Potential is huge!

Flash loans, finance beyond geography/status/region is becoming a reality with this new trend of DeFi. Whilst the Blockchain fundamentally is trustless, the smart contract is further making its way to cater to sophisticated and complex financial use cases.

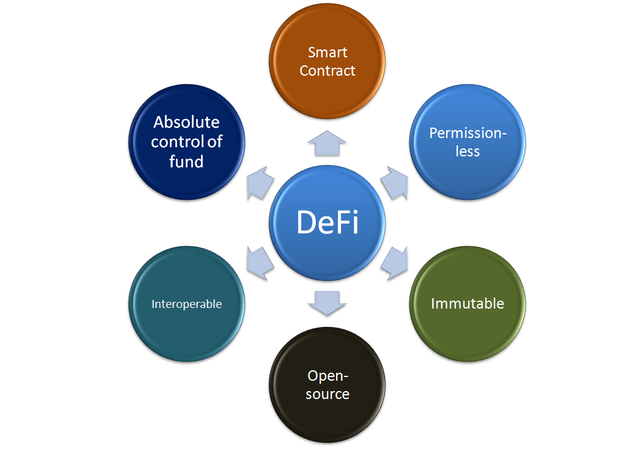

While the centralized finance is governed by the banks, regulatory body, etc who can easily get corrupt at times, the decentralized finance is governed by code to make it trust-less, permissionless.

The immutability feature of Blockchain makes it secure, auditable. The open-source code, distributed ledger makes it transparent. The programmable code can create new financial instruments, can execute an operation & agreement. Last but not the least, dapp enables users to interact with the DeFi market with absolute control of their fund.

What is DeFi?

Let's say there is a raw building where the main components are sub-structure and superstructure, with the underlying foundation(sub-structure) below the ground level, and the superstructure above it. We can introduce different floors to the top of it.

We can also go for a more sophisticated way to introduce modular components. A user depending on the needs can go for a simple to sophisticated architecture.

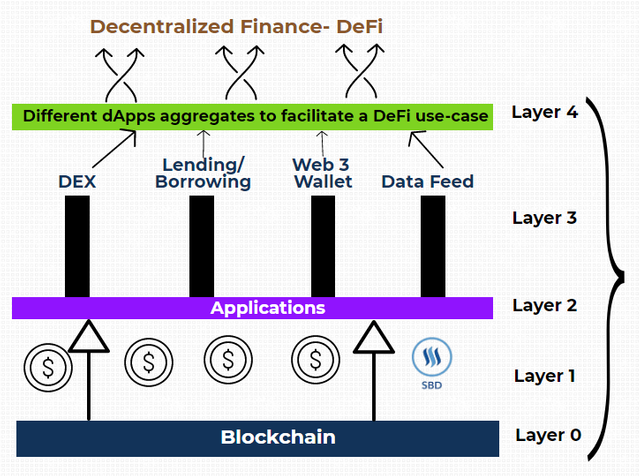

The DeFi ecosystem is somewhat similar to this with a complete stack of the financial framework in which the smart contract brings sophisticated use-case to this financial model. The simple to complex financial requirements and functions can be coded & executed without having to need "official approval" of a third party/intermediaries.

In the traditional banking method, we always require the official approval of a bank/third party for any financial use-case. But in Blockchain it is trust-less as the transaction happens p2p. It is decentralized, permissionless, distributed. We call it the Layer "0" of the DeFi stack.

So Layer 0 guarantees a trust-less network in the DeFi stack.

In Layer 1 of the DeFi stack, the financial instrument /functionalities are introduced. For example, SBD is a debt instrument(backed by STEEM) in Steem Blockchain.

In Layer 2, we can bring additional chains(develop 2nd layer solutions) and connect to the main chain to enhance interoperability.

In Layer 3, the decentralized applications are built to serve financial functionalities. It can go simple to more sophisticated and more complex. e.g Wallet, DEX, AMM, Lending/Borrowing, etc.

For example, in Layer 3, decentralized exchanges can be introduced to facilitate the exchange between native coin and 2nd layer coins. Similarly, Lending/Borrowing functions can be introduced, Automated Market Maker model can be introduced with a locking mechanism, etc.

Finally, in Layer 4, the different dApps of the chain aggregates, the different functions of the dapps are combined together, to facilitate a financial use-case in a trust-less manner.

For example, when you need to make an exchange in DEX, say, Steem-engine you also need to connect to your Steem wallet so as to trade with another 2nd layer coin.

Similarly, when you need to add to a liquidity pool/make an exchange in Justswap, you need to connect with the TronLink wallet.

Put simply, to serve the financial use-case of exchange/contributing to liquidity pool(or any other similar use-case), the dapps are being aggregated and their functions are combined together to facilitate a financial service.

From Layer 0 to Layer 4, linked with different DeFi protocols, all put together is known as DeFi.

What are the abilities of a user in DeFi?

- Being able to transfer an asset to anyone without any approval from a third party.

- Being able to lock/unlock the token at any time.

- Being able to lock an asset in a Lending/Borrowing platform.

- Being able to exchange one asset for another in a decentralized way.

- Being able to add/withdraw to/from a liquidity pool.

- and many other decentralized financial functions.

The De-Fi ecosystem is transparent(due to distributed ledger), peer-to-peer/trustless(does not require any third party), automated, low-fee network, open-source(anyone can use/contribute to the open-source code and/or bring a new app or better solutions), flexible, etc.

DeFi completely democratizes the financial system, goes beyond the geography, beyond the status/country/region. Anyone having access to the internet can access this ecosystem with a smartphone/laptop. Most importantly it goes beyond the regulatory obstacles & hurdles.

Examples of DeFi

Some of the popular examples of DeFi are:-

- DAO(Distributed Autonomous Organization)

- Lending/Borrowing

- DEX(Decentralized Exchange)

- Leveraged Trading

- Yield Farming

- Stablecoins

DAO

DAO, Distributed Autonomous Organization brings transparency in the administration and governance of a community. It also supports funding for development, marketing, fundraising, or anything that is considered good for the ecosystem. The programmable code entails the decentralized financial support and governance of the community.

Example- Steem DAO, Maker DAO, Compound DAO, etc.

Lending/Borrowing

With the decentralized p2p protocol, users can pool their assets to generate collateral. They earn interest based on the supply/demand of the pool of assets and can also borrow assets against collateral in such Lending/Borrowing platforms.

Example- Compound

DEX(Decentralized Exchange)

DEXs like Justswap(Tron family), Uniswap(Etherum family) are popular in the DEXs segment. They offer:-

- Liquidity to the trader who wants to exchange one coin for the other within the family.

- Opportunity for the Liquidity Providers to earn a commission from the trades/exchange(fees)

They are fully automated, open to all(even to create a new pair of exchange) & sustainable. Being DEX, the transaction happens peer-to-peer.

Example- Justswap, Uniswap

Leveraged Trading

With the non-custodial lending protocol, margin trading is also a viable use-case in the DeFi segment. The traders can now leverage their trading by borrowing an asset from the broker, a form of collateralized loan.

Example- dYdX

Yield Farming

Cryptos sitting idle in the wallets can be staked in the Liquidity Pools to earn a return(from the transaction fees in AMM based DEXs), so the crypto can be of productive use in yield farming. Liquidity Pools have better yields in the latest trend of DeFi.

Example- Justswap for coins in Tron Family, Uniswap for coins in Etherum family

Stablecoins

A decentralized stablecoin pegged to USD or Gold can be created using programmable code to offset the volatility of speculative coins. The stable coins are more significant in DeFi space when it comes to lending/borrowing.

Example- Maker DAI is a stablecoin project.

Conclusion

With Bitcoin, we get to know "store-in-value", with the "smart contract" we go beyond store-in-value, get the technology more flexible to bring other use-cases of Blockchain technology.

Now with DeFi, we begin to realize that the decentralized asset that we hold can further be extended from just "store-in-value" to value in "time", value in "transaction", value in "stake", value in "pool", and many other productive uses of the assets.

Thank you.

Cc:-

@steemitblog

@steemcurator01

@steemcurator02

Remember the simple days when Blockchain technology was just blockchain? lol Glad to see people being enthused about all this.

Yes, you are right, but still, many more to come.

Wonderfully written and explained 👍😊👏🏼👏🏼

Thank you.

Well detailed information,from Defi we getting good benefits but also there is lot of issues too.

Here we cont Barrow anything before collateral our funds, gas fee is very high nearly $20-$30 now.

For small investors it not suitable,for big whales only get good returns . If ETH 2.0 is launch we see good growth in this field also. Hope soon it available for us.

Thanks for your valuable post . Have a great Day Ahead.

#twopercent #india #affable

Yes, gas fee is too much in the ETH family right now, because so many DeFi dapps are there, competition is high. I will look forward to Tron family tokens in DeFi, it is cost-effective and with SUN now it's a lucrative opportunity.

Thank you.

Steem on.

Yes thats why i also dont participate any defi in Ether Blockchain.

The best part of defi is It also provides Decentralized insurance,interests,betting market,prediction market and many many other features. Because of its different projects on Ethereum it could be the best choice of crypto users after bitcoin in which they could earn Big stake of money.

Greatly explained and I too feel Glad while researching and participating in it :)

#twopercent #pakistan

You are right, the different use-cases and the features of DeFi is vast and it can very well fill the void wherever there is a scope for trustless finance.

Thank you.

Steem on.

Congratulations you are one of the winners of the Steem Crypto Challenge Month...

Thank you for taking part

The Steemit Team

Thank you so much.

You have been upvoted by rishabh99946 A Country Representative from INDIA I am voting with the Steemit Community Curator @steemcurator07 account to support the newcomers coming into steemit.

Follow @steemitblog for the latest update on Steem Community and other writing challenges and contest such as The diary game

Also join LUCKY 10S

Thanks for this post.

https://steemit.com/hive-133974/@oo7harv/cambyses-ii-the-mad-persian-shah-530-522-bc-part-2

Nice work! You're always so clear when it comes to explaining things to newbies in crypto like me, lol

Keep up with the good work, it's always a pleasure to read your posts!

It's a privilege to have you in the comment section as well. And thank you so much for recognizing my work. I will keep on trying my best to live up to the expectation of my readers.

Steem on.

#affable

Please ping me on discord,need to talk regarding deligation