Crypto Investing: Think Long-Term

Here's another reminder both to myself and to my readers to view cryptocurrency ownership as a long-term investment in the financial system of the future instead of a short-term speculation.

I wrote this post on May 25th: The Big Question: Should You Sell or Hold During a Market Correction, and it applies today as well.

Here's the total market capitalization at that time along with the market cap today:

As you can see, even with this massive correction, we're still trending upward over the long-term. My portfolio is down 50% since 2017-06-13, but up 390% since 2017-03-27. As I've mentioned before, I purchased my first bitcoin in 2013 at $20 each. I watched bitcoin go all the way to $1,200 and then crash down to around $250. I didn't sell. Because I didn't sell, I was later able to pay off my house.

This, I think, is the difference between those who accumulate wealth and those who are living paycheck to paycheck. If you have no "extra" to invest, then you may be forced to liquidate when you need funds instead of when you'll get the best returns. Getting out of debt is key along with increasing your income to build savings. The Dave Ramsey baby steps are a good place to start.

It's easy to get frustrated with cryptocurrency investing if you start your investing at the end of a bull market and only experience losses. Keep in mind, those losses are only "on paper" and not realized until you actually sell. If you can hold, it's usually a good plan (unless you're way better than me at timing the markets to get in and out perfectly to increase your holdings).

Many are promised great riches and "lambos" (Lamborghinis) falling from the sky to their own private island in a matter of days or weeks. That's not how reality works. Yes, some people get incredibly lucky, but they are the outliers. The crypto space has a lot of whales who will gladly squeeze margin positions and "weak hands" out so they can pick up cheap coins to further increase their wealth. This is how the game is played.

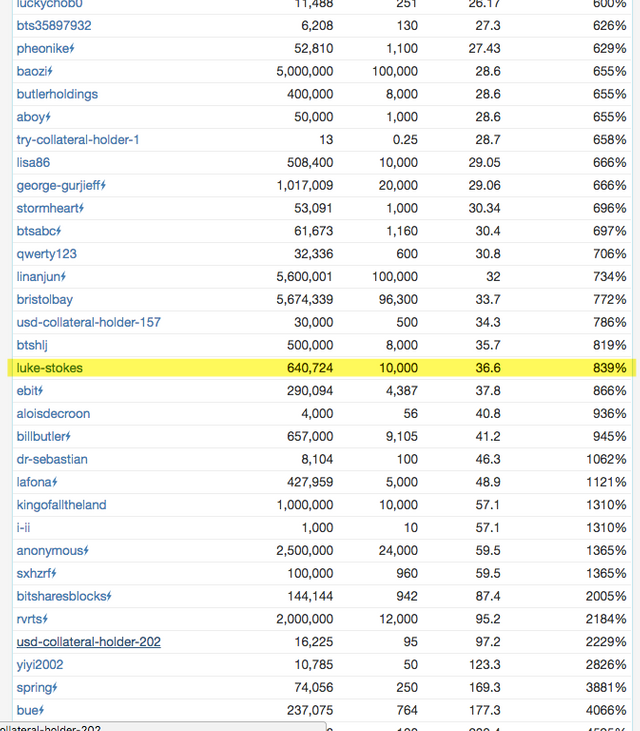

I posted recently about how my HERO margin was called. I also have an open margin with bitUSD, but this time, I hope, I can hold it until the market recovers. I'm watching the cryptofresh BitShares block explorer closely, specifically the "USD Debt Positions (Call Orders)" section. My Collateral Ratio is currently over 800% as you can see here:

Many others, I think, will be squeezed out and their holdings will be liquidated in the waiting hands of whales increasing their stacks. Others will sell for a loss due to fear of losing their principle. Those who win long-term will buy the dips.

Long story short:

- Get out of debt and build savings so you have extra to invest.

- Only invest what you're willing to lose.

- Think long-term.

- Lambos for everyone is not reality. Live in reality.

- HODL.

Don't take investment advice from random blog posts on the Internet, but continue to grow and learn from multiple sources to figure out what works best for you.

Luke Stokes is a father, husband, business owner, programmer, and voluntaryist who wants to help create a world we all want to live in. Visit UnderstandingBlockchainFreedom.com

Life changing wealth is created by holding investments over a period of years, not weeks or months. For those creating substantial wealth in crypto right now the current correction is a flash sale to be bought aggressively.

Like any other investment there is no loss until you sell. Assuming the investor has done their due diligence and has invested based on fundamentals there is nothing about these types of market movements (coordinated dumping by whales) that alters the fundamentals behind the original investment. Ie. you don't sell because some rich jerks are pushing price around for their benefit.

At this point my advice is to look at crypto as a 2-3 year hold and the only reason for selling is re-balancing (ie. BTS spikes 1000% and suddenly is 90% of your portfolio) or new tech replacing old (EOS replaces ETH). Otherwise just ignore the ups and downs as noise/entertainment. There are a few very wealthy individuals who are manipulating the shit out of the crypto market. Every time you panic sell you make them wealthier and give them more power.

Hodl and prosper.

Very well said. A 1337 comment, if you will. ;-)

Why 7h4nk y0u

It's important to find what investment is going to be relevant and worthy in 2-3 years. Maybe you will reevaluate your decision once in a while. But it will come to your analysis, and understanding of what to pick in the beginning how to adjust in time.

Well said.

Lol..this is extremely hilarious! "Where is the fucking lambos my brother?!" Lolz . That pic got me cracking!

True Flip [ICO] - Already running a transparent blockchain lottery! Bomb! Bonus 20%! Hurry! :)

The platform is already working and making a profit :)

https://steemit.com/ico/@happycoin/true-flip-ico-already-running-a-transparent-blockchain-lottery-bomb-bonus-20-hurry

long story short, I read this phrase alot!

Yes agreed that part is fantastic.

Congratulations @lukestokes! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPWow! Nice

This right here is key

"Get out of debt and build savings so you have extra to invest."

Thank you!

Resteeming.

You've got some nice voting power... How about doing @steemerite a favor by giving him a 100% upvote and a follow for his "Lotus Flower" posting... Thanks...

I would love to upvote 100% and I do good content and good profiles that contribute in a meaningful way to the STEEMIT platform.

@steemerite does not follow anyone nor is being followed by anyone. Also this profile only has only 3 posts and no comments on any post.

I may have missed something so can you please justify to me why I should follow or upvote?

@steemerite is very new to Steemit... I was hoping someone could open his eyes to the possiblilities... My 2 cents won't do it, so I've been searching for someone to give him a little bump to get him going... Thanks...

Thats cool and I appreciate your thoughts. I will take another look at his profile and engage with @steemerite.

Thanks.

Update: I commented and upvoted his post and suggested he engage more with community.

Thank you for the suggestion.

Thanks for taking a second look... I hope this is what it takes... I don't think he noticed anything yet... Time will tell... Thanks again...

@pocketechange

@lukestokes " Lambo isn't for anyone" is truly a spot on. I mean come on! wake up people, reality don't work that way. I like the way you convey your views along with some proofs on it. So the thing about investing is that, it's about how to see it in a long term and investing is never ever a quick buck scheme.I mean if it was, everyone would have been rich by now. Upvoted :)

👍👍

Thank you! :)

When we automize most of the work (mining, smithing the metal, building houses), maybe there will be a day for "lambo for everyone".

Excellent crypto investment advice here, friend. I am envious of how early you got into bitcoin and bought. Smart move. Much love.

Thanks Sterlin!

There's a new guy on Steemit calling himself @steemerite ... Could you pay his site a visit and give him a very needed 100% upvote and a follow...??? Thanks...And please don't mention I messaged you...

In my brief forays into the stock market, definitely one of the things I learned was trading on margin is tough. It's nice in that you get a solid multiplier for your efforts, but it's far more dangerous, in that you can get completely blown out of the market, and driven to zero, if you're not careful.

In my opinion, trading on margin is Beast Mode, and you should not do it unless you're prepared to lose everything.

If you want to be in the market and can stomach 'mere' 2x-4x-8x gains? Then simply buying your currency of choice makes the most sense. There's no margin calls to deal with. You own your currency, and its value may fluctuate - but you will still have it.

I think with Steem, if you're actually putting real money into it, it could make sense to hedge your own bet by buying SBD's as well. If the market goes down and your STEEM loses a ton of value, at least your SBD's will end up maintaining their dollar-amount. And if you're going long term, you can sell your SBD's on a downswing to keep driving your position upward - if you're long-term long on cryptocurrency.

I haven't figure out if I am yet :)

Thanks for commenting, Brady. Have you read my posts on BitShares? I link to them in the margin call HERO one. It's interesting because your own collateral via many multiples is used, so it's somewhat different than traditional margin setups where it's true debt. Also, the historical long-term trend of fiat verses cryptocurrency has been very, very good. So, on a long enough timescale, if you're betting against fiat, it's (so far) been a pretty safe bet (though a very volatile one).

If you can get a margin call, I'm pretty sure you are, in some way, dealing in debt. You borrow something and promise to pay it back later. That borrowing is done against a certain amount of collateral. That's debt. If the thing you're going to pay back later loses value in the interim, you buy the thing back off the market at the new lower price, and hand it over - at a profit! If the thing you're going to pay back later rises in value, at a certain point your liability will exceed the amount of collateral you have on hand, and you get automatically liquidated.

I won't pretend to understand any of that variable multiplier and collateral ratios and other such madness; I don't really know what it means. But I'm pretty sure about the first thing.

And, sure, on a long enough timescale, maybe Crypto beats fiat. I mean, hell, I'm here, right?! :)

But margin-trading isn't long-term. One tiny bump one way or another and you can get wiped out. Or make a mint. It's collateralized debt, no matter how you mark it.

On the stock side, the people who work in derivatives markets like that tend to be very short-term day-trader types. Or, they're people who have set up side-hedges to cover themselves if something goes very, very wrong.

(There's actually some really interesting stuff you can do, where you buy something you believe in, and hold it. And then you get some kind of derivative-style bet against it, and hold that too (up to a point). If your main bet pays off, you get margin called on your secondary bet, but if your main bet was good enough, you're still in profit. If your main bet tanks - horrifically - then you at least get a consolation prize on your secondary bet - and it's fine, you still hold your main bet (for now, unless you panic and sell it)).

So for you - and what I can figure that your positions are - I would dump a big chunk of money into good ole' BTC (or STEEM, or whatever currency floats your boat. Or a nice 'basket' of them). And then I would dump a smaller chunk of money - your hedge - into a short against it (SBD maybe? Or some other BitShares thing I don't know about yet?). You just have to work out a spreadsheet of your potential gains to potential losses, or whatever. And you'd have to remember; if your main 'position' goes well, you will lose your hedge. And that's fine, that means you've done well! I think the other thing to note is that you want those accounts to be separate; so that your main asset doesn't get lumped in with the collateral you have on your short. You want the short to liquidate itself (going to zero) when its collateral is spent, not have it keep going and run against your main bet!!!

DISCLAIMER - not financial advice. I don't know what I'm doing. I have never done the thing I just talked about.

I think I read something on Wikipedia once about 'bracketing options' - that might have more details if that's something you're worried about.

Yes, I'll concede it is indeed debt, but so are the pieces of paper with dead people on them in everyone's wallet. Fiat is a certificate of debt with no collateral other than taxes and economic productivity of a nation state (which, you know, I love to consider theft or, at the least, a version of extortion).

In this case, the collateral system really matters. Whereas derivatives traders are often trading with only a fraction of real value backing their positions, BitShares takes the opposite approach with over collateralization. It does so knowing that BitShares itself is a risky, volatile asset. The key being even if the margin is called, no one is hurt accept the person who took out the debt position. Everyone else gets exactly the value they are owed.

I like the idea of betting against yourself to some degree, but isn't that also just like doing the same thing at a smaller scale?

So if create 10k bitUSD out of nothing, buy BitShares with it and hope for the best, betting against myself would be to also buy up some bitUSD. How much? 2k? 5k? If I was to do that, I might as well just create 8k or 5k bitUSD to begin with. The key, I think, comes down to how much collateral you have and how much you are willing to lose.

But yes, selling the bitUSD for just BitShares may not be as good of a move as selling it for multiple cryptocurrencies (which I've also done in the past). With what we saw this past week or so, it wouldn't have mattered much though as everything went down.

I'm glad you're here, Brady. I hope you enjoy playing around with this economic sandbox which runs on smart contracts with no violence. :)

Wow, this is amazing advice and very motivational. I'm a huge Dave Ramsey fan (I disagree on minor details but overall he's awesome) and really agree with what you outline here. Thanks and I'll be following.

Thank you! I worked for Dave for almost 4 years. He helps a lot of people.

I like this. Exactly my thinking. I treat cryptos the same way I treat stocks. But to hold, so pick wisely.

Please visit @steemerite and give him a 100% upvote and a follow... For doing so, you can visit my postings and I'll give you my Theory on Pocket Change... Thanks...

"A little bit of perspective" posts are such a bearish signal. :-P

Hah! Yes, they are indeed. What's also a bearish symbol is the red candle bloodbaths we see all around us. Hahah.

I wonder if you will end up being right here...I think there's more downside to come yet.