Steemit Corner #5 : Understanding Debt-Ownership Ratio

Background :

The debt-ownership ratio calculation model helps the company to know the amount of debt and ownership used to finance its assets, in order to determine whether the financing of the company's assets tends to be debt or ownership. The debt-to-ownership ratio also reflects the shareholders' ability to cover all outstanding debts in the event of any decline in the company's commercial activity.

And this is the case for our Steemit ecosystem which always tries to reduce this Debt-Ownership ratio from becoming too high, by minimizing the amount of STEEM allocated via SBD conversions if the level of debt were to exceed 10%.

According to the payment rules of the Steemit blockchain and if the user chooses the parameter "50% SBD / 50% SP", the payment will be made in SDB and SP by default but this will only be applicable when the debt ratio- ownership will be less than 9%.

What is Debt-Ownership Ratio ?

Blockchain Steemit designed the SBD token as a factor or means to reward content creators, giving it the STEEM equivalence based on the market price.

With the exception of authors and Steem DAO (another group aiming to fund proposals) who are rewarded in SBD, other representatives like (curators, SP holders and witnesses) are rewarded in SP.

Debt ownership ratio varies with market condition, i.e. if the market is bullish, it is usually low since the value of STEEM is usually high, so the STEEM/SBD ratio is also high , which means less STEEM tokens are needed to support 1 SBD.

Conversely, if the market is bearish, the price of STEEM is also falling and the STEEM/SBD ratio decreases, which means more STEEM tokens are needed to support 1 SBD.

The Steemit blockchain system constantly prints SBDs to reward content authors. However, it has been programmed to stop printing new SBD tokens if the debt holding percentage exceeds 10% (the cap), in which case the payout is in STEEM.

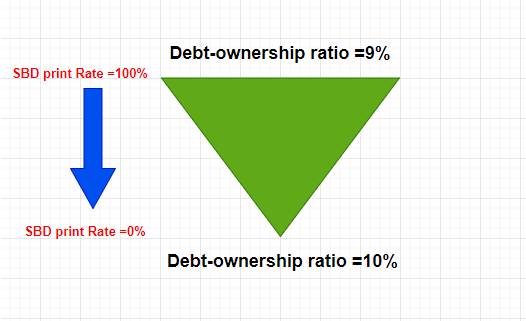

Blockchain prints 100% SBD for debt ownership ratio up to 9%, from 9% to 10% the print rate starts decreasing linearly and stops completely at 10%.

The SBD print rate, in this case, would correspond to this formula: SBD print rate = 100% * (10 -debt ratio).

To better understand the above chart, we will take the example where the debt ratio is 9.5%, then SBD print rate = 100% * (10-9.5) = 50%

That is, 50% of the cash reward will be paid in SBD, the remaining 50% of the cash reward will be paid in STEEM, and the fortified reward will be in SP as usual.

Suppose debt ratio is 9.7%, then SBD impression ratio = 100% * (10-9.7) = 70%

So 30% of the cash reward will be paid in SBD, the remaining 70% of the cash reward will be paid in STEEM, and the fortified reward will be in SP as usual.

Once the debt ratio reaches 10%, there will be no SBD bonus.

The debt-to-ownership ratio is defined as the ratio of SBD market capitalization to STEEM market capitalization.

Debt-to-ownership ratio = SBD market capitalization/STEEM market capitalization.

The STEEM market capitalization takes into account the entire virtual supply, including those necessary to support SBD.

STEEM Market cap= Virtual STEEM supply * STEEM current value

Also, SBD market capitalization takes into account the total supply of SBD as well.

SBD Market cap= Total SBD supply * SBD price

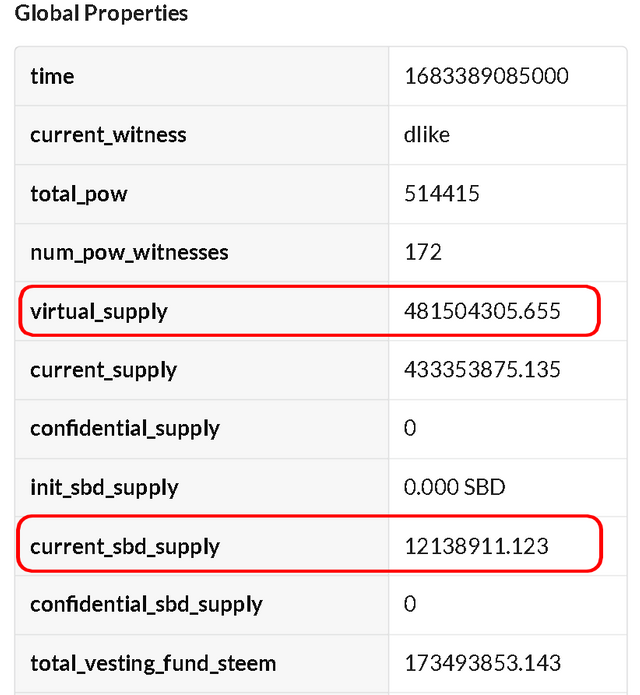

Total SBD supply and Virtual STEEM supply can be obtained from Steemdb.io.

STEEM Market cap= 481504305.655 * 0.2094 $ = 100827001.60

SBD Market cap= 12138911.123 * 2.54 $ = 30832834.25

Current Debt-to-ownership ratio = 30832834.25 / 100827001.60 =0.30

According to this calculation, the debt-to-equity ratio is now 30%, which means that the printing rate for SBD is 0%.

Thus, now 0% of the cash reward is paid in SBD and 100% is paid in STEEM. That's why you can now see author payments in a combination of STEEM + SP.

Notes :

It is seen that the debt-to-equity ratio decreases if the market cap of STEEM increases, and if it reaches the 9% threshold, Blockchain Steemit will start printing 100% SBD and the author will be paid in SBD + SP.

If the authors of the Steem Blockchain set the yield to “Power Up 100%”, it will also help to some extent, as the daily money supply will remain under control, which will affect the supply/demand ratio in favor of STEEM and STEEM. Better performance in the market. If the price of STEEM goes up, the market value will also increase and the debt ratio will go down.

Conclusion :

Since the debt ratio is over 10%, "Power Up 100%" should be encouraged even more in PoB, at least until we have a debt ratio in the comfortable zone (preferably below 9%).

I wish that this fifth post in this series helped many users to understand about debt-ownership ratio in steem blockchain in the hope that the series will continue in a future episodes.

Best Regards,

@kouba01

Cc- @steemcurator01

What you calculate here is the external market cap, based on market prices. However, for blockchain purposes, I believe that this:

Should generally be this:

Because the blockchain debt is based on the internal conversion rate, and the blockchain never values SBDs above $1, regardless of what the external markets say. This would put the current debt ratio around 12%.

But, it gets more complicated because - when the debt ratio hits 10% (as covered in post & comments here), the conversion rate actually dips below $1, so that the debt ratio technically never increases above 10%.

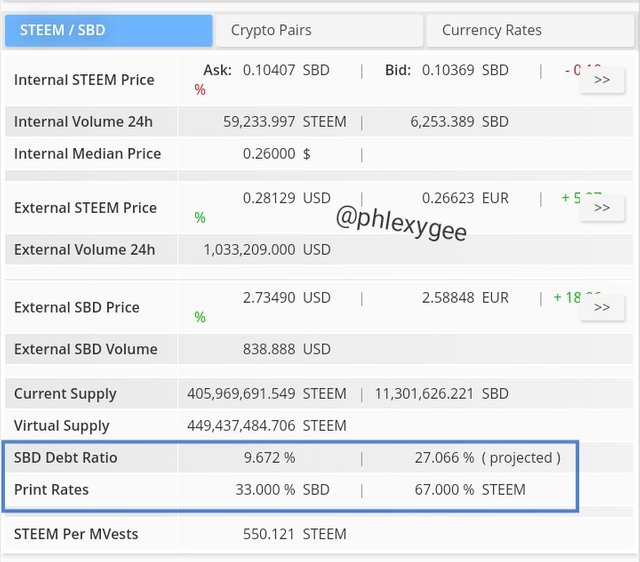

This can be observed on SteemWorld:

I think that if the value of debt ratio exceeds 10% it will automatically be displayed 10%, maybe the exact figure of this ratio 35%.

It is right, that steemchiller calculates the projected ratio as you described. But as @remlaps noted, this has no significance for the SBD print rate.

An example from the time when SBD were printed (May 2022) illustrates this:

Source

Although the projected ratio is 27%, SBD were printed, which should not be the case according to your statement above.

I played around for a few minutes earlier, and couldn't exactly reproduce that projected number, so I'm not sure what that represents.

I am pretty sure that the actual debt ratio from the blockchain perspective never goes above 10%, though. When it hits 10%, the median price is locked in a way that reduces the SBD price for internal conversions in order to prevent the debt from spiraling out of control.

The external market price doesn’t matter, because that's not the price that the blockchain uses when converting from SBD to STEEM (i.e. retiring the debt). The details are in the conversation with @moecki in the comments of the link that I pasted above. (I am on my cell phone right now, so can't chase them down again atm.)

Yes, I read the conversation with moecki, thanks for the valuable information, and I will correct my calculations as soon as possible explaining the reasons.

Thanks for the clarification

Hello dear big brother @kouba01. You have beautifully explained the Debt-Ownership ratio. Thank you so much for clearing so much doubts about this concept.

We can hope that the value of Steem should improve to lower the debt ratio and hence we will be able to get the rewards in SBD as well.

There are some typo errors, I hope you will fix them.

In the brackets, I think you want to write '10 - debt ratio '. And,

I think there is a mistake in calculations, the result should be 30%. Please check it out again.

Although, I have understood these points but this could be confusing for others.

Again big thanks for the great lecture, my great professor.

That s True my friend, i fixed the mistake, and thank you for your good reading.

I am happy that the information was well received and I hope it will help you to understand our Steemit blockchain how it works in all its mechanisms. I invite you to read the other episodes.

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Thank you very much sir for this very informative post. After reading this post I felt now I'm able to take part in week 4. And now you can visit my post. I did my best and provide appropriate formulation. Thank you for this post.

Greetings sir, your post is really helpful and informative, i take guidelines frim it to complete my task in engagement challenge.