Steemit Crypto Academy Contest / S1W4 – Reviewing the Instability of the Crypto Market by @phlexygee

Made with LogoMaker

Made with LogoMaker

Most of the cryptocurrency market is currently experiencing a sharp decline, especially in recent days. What do you think of this drop? State its causes and how long do you think it will continue in this downtrend?

As most of us know, the crypto market doesn't move in a straight line, there are regular ups and downs of prices due to the volatile nature of cryptocurrencies. It's been a while since the crypto arena has experience such drastic bearish trend like what we are witnessing now. There are certain factors which have contributed to this recent negative development in crypto, of which I will ponder on some of them in the following subsection of this article, but personally I think this drastic drop of prices is normal, and it is an opportunity for buyers to utilize and buy more reliable tokens in order to make future profit, as long as prices usually bounce back stronger, regardless.

I also think this drop serves as a confirmation to the fact that crypto is profitable, but highly risky, therefore crypto enthusiasts should always invest what they are willing to lose, and we should apply proper risk management as well as good entry and exit positions.

State its causes and how long do you think it will continue in this downtrend?

Various factors contributed to the current drastic decline in prices, and below are some identified ones.

Elon Musk's unacceptance of Bitcoin as payment; yes, Elon Musk's reversal of accepting crypto (Bitcoin) as a mode of payment for purchasing his cars or products has had an impact in drop of prices, since the usage of crypto has been narrowed. The use cases of any crypto asset contributes to the price movements of such asset, conversely, limited use cases causes a bearish trend due to massive selling of holdings, since the services of the underlying asset would not be needed that much. Bitcoin is the father of all cryptocurrencies, and therefore all other tokens follow suits as it falls and rise.

The current Ban of crypto by some states; the government of many countries such as China have worked towards the banning of cryptocurrencies, whiles they are planning of introducing their own system of cryptocurrencies. China has ban crypto, therefore banks and other financial services of china have stopped accepting crypto for transactions, and we are aware of the population of China.

No one wants to be caught by the system, so China's crypto holders are initiating more selling orders.

Higher supply leads to low prices, and that is what is going on for now.

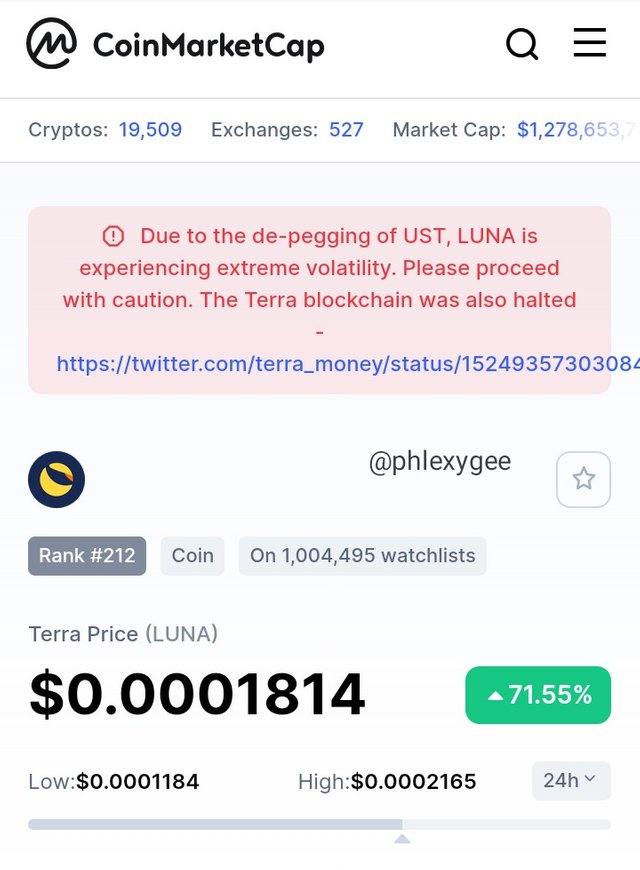

Terra USD and Luna effect; UST is a stable coin of the Terra ecosystem pegged with $1 which is used to back Luna. In normal circumstances, Terra USD is equivalent to $1 which can be swapped for $1 worth of Luna, but unfortunately the value of Terra USD which is supposed to be $1 devalued to $0.80, therefore many holders exchanged their Terra USD for $1 worth of Luna which in turn mounted pressure on the mechanism for the stable coin leading to its malfunctioning.

Besides, there existed an Anchor Protocol where UST holders who about 75% of the total holders of UST staked their UST for an interest of 20%, but unfortunately the Anchor Protocol announced a possible change of the interest rate which was expected to be below the initial rate, and the holders of UST panicked and started dumping their available UST for alternative stable coins, Luna and other tokens, this made the complex mechanism to ensure the stable rates stopped operating.

The development resulted in a massive supply of Luna which in turn led to the crashing of both UST and Luna. As said earlier, the higher the supply, the lower the price.

The Luna Foundation Guard (LFG), which is a foundation of the Terra blockchain developers bought and reserved about $3.5 billion worth of BTC, to be used to buy Terra in order to maintain the pegging of UST with the dollar to help the value bounce back, but the reserve rather got emptied without any positive development on UST and Luna's value.

UST which is supposed to be a stable coin pegged with the US Dollar dropped drastically to $0.14, whiles Luna which is known as one of the reliable and renowned token also decreased from $140 to $0.02 within 24h period.

The crash of UST and Luna created a lot of pressure and fear on the part of many holders and traders, whereby they started selling huge amounts of tokens and that resulted in a very pathetic bearish trend.

In the last seven days Bitcoin has been moving $31,000 whiles Ethereum trades below $2,100 indicating the negative emotions of traders and holders towards crypto market within this short period. The last time of closing under this prices was in July 2021.

Despite the aforementioned factors, I think the bearish trend would not last for long, because as prices drop buyers become in charge of the market, as buyers or investors buy at low prices and sell when prices are high. The rushing to purchase at low prices results in higher prices as only buyers control bullish trends.

I believe within a month period from now, the market will fully recover, since Bitcoin is experiencing a bullish reversal.

Why doesn't this drop in the price of a few coins decrease their trading volume (eg: Bitcoin)? How will they deal with this market instability?

Probably, the drop in the price of some coins has not tampered with their trading volume for example Bitcoin currently has a 24h trading volume of $19,246,876,404, and this is because whiles some are loosing by selling at unfavorable prices, others are capitalizing on the opportunity to buy more for future profits.

Coins such as Bitcoin and Ethereum are more reliable and have many use cases, therefore regardless of the drop in price people will always go for them, therefore resulting in a balance trading volume.

How will they deal with this market instability?

To me, I think dealing with this instability of the market isn't something complicated, because these few coins have competent and reliable teams as well as projects backing them up, so it will be very rare to see such coins jeopardize as a result of some manageable factors.

The developers or owners of such coins are financially endowed, and therefore will do everything possible to ensure the survival of the coins within this trying times.

Also, the rush for traders and investors to purchase these coins will help them to recover their value in no time.

What is the relationship between the current instability and the downfall of the Terra ecosystem and its Luna currency? Do you think its price will bounce back? If so, tell us how and when?

I have already pondered on this issue in the initial section of this article, therefore I will just summarize it.

The instability and downfall of the Terra ecosystem is as a result of the unpegged of UST with the USD. The UST which is supposed to be equivalent to $1 has lost its stabilizing mechanism, therefore leading to a drastic drop of value. A decrease in the value of UST made about 75% of its holders to exchange them for Luna, which resulted in high supply of the Luna tokens, and therefore making the price of Luna together with the value of UST to fall drastically beyond expectations.

The value of an ecosystem moves hand in hand with its native tokens, so if the value of the tokens become worthless, so as the ecosystem does, and that is happening to the Terra ecosystem.

Do you think its price will bounce back? If so, tell us how and when?

Although, so far as crypto is concerned, anything can happen, but personally I think there is a very tiny probability that the price of Luna will bounce back after this historical drastic 24h bearish trend, besides no solid attempts have been put in place by the developers to ensure its bounce back.

Luna crashed 99% severally within a short period, the first, from $120 to $.0.02 on May 11th to 12th following other drastic falls which made Binance to delist and re-list it.

source The current status of an asset which used to worth more than $100, very pathetic

source The current status of an asset which used to worth more than $100, very pathetic

To me, I think the price will not bounce back, because it unlikely for an asset to bounce back after going through 80% to 99% price fall.

Our Steem ecosystem, like most currencies, has been affected by this market downturn, has this caused you as a user some stress? Or are you still confident in this project? Give your opinion, specifying the arguments that support your review

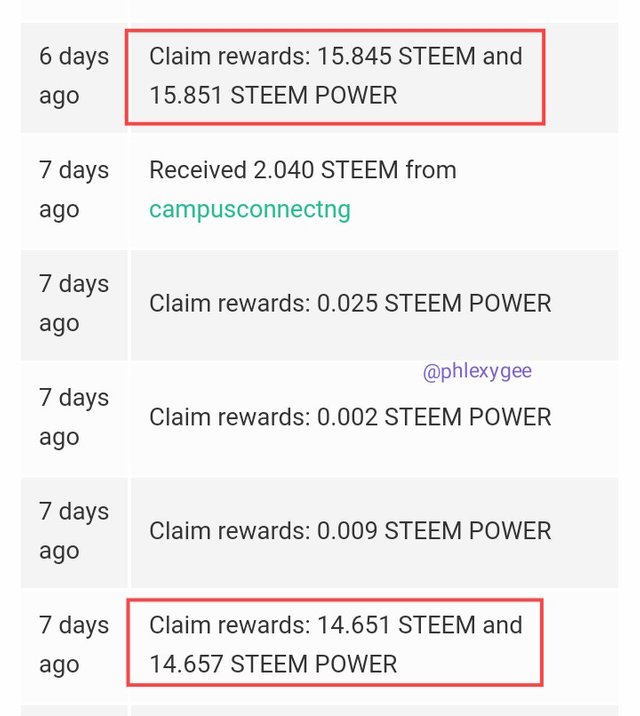

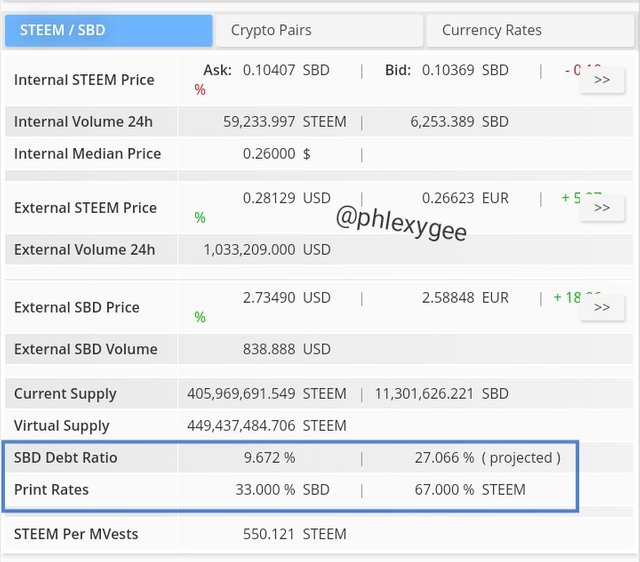

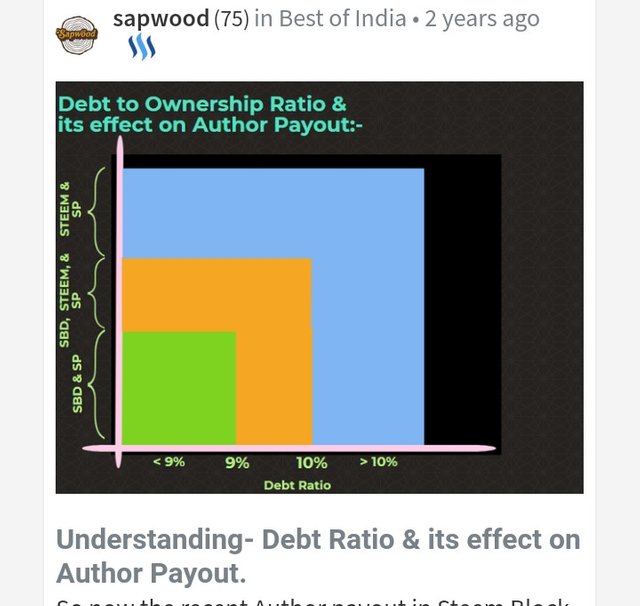

Yes, the effects of the market downtrend on the Steem ecosystem has had a negative impact on me as a user. The drastic downtrend, affected my author payouts. My maximum curation rewards within the period $22 and $18 later turned $14 and $15, following the emergence of the SDB dept ratio. Instead of receiving the normal SBD, SP and TRX, SBD was replaced with Steem after the dept ratio moved greater than 10%.

As a result of the depth ratio caused by the market downtrend, I received a total of 29 steem on the two posts instead of 9.5 SBD which worth more than the steem I received.

So, I will say the massive downtrend has somehow caused a stress and frustration on me.

screenshot from my steemit wallet

screenshot from my steemit wallet

source The SBD dept ratio, and Steem/SBD print rate at the time of writing this article

source The SBD dept ratio, and Steem/SBD print rate at the time of writing this article

But, regardless of the current happenings in the Steem ecosystem, I still have some level of confidence in the project, because this is not the first time such thing is occurring as it happened in two years ago which was address by professor sapwood and the project bounced back hard afterwards untill recently.

The backing of steemit to the steem token makes it reliable and trustworthy, as the platform lives forever and attracts investors who will buy more steem, therefore increasing the price of steem.

Conclusion

The current happenings in the crypto arena are unhealthy, but also an opportunity to buy more reliable coins and make future profits.

Aside the crash of UST and Luna, this isn't the first time the crypto market has gone through such tough times, but it recovers and bounces back harder, and the steem ecosystem is of no exception.

I will take this opportunity to send my condolences to those who made massive loss with regard to holding and trading UST and Luna.

There involves risk in everything, but moderate risk taking should be the hallmark of every investor.

Thank you for glancing through my article.

The instability in the market is an unfortunate situation but it's also an opportunity. That's nice to know

Yes, thank you for passing by, bro.

Thank you for publishing an article in the Crypto Academy community today. We have accessed your article and we present the result of the assessment below

Comments/Recommendation

Thank you for participating in this contest.

Total|8/10

Thank you very much prof, I appreciate.

It's been awhile though.

You have done a good research before carrying out your work! I like how you detailed the problem with the terra blockchain breakdown.

I have really learnt alot from your article. Keep posting quality contents on this reputable community and I will keep learning from your work. Thanks for sharing with us!

I am excited that you have gain some level of knowledge in my publication. We always learn from each other, so far as steemit is concerned.

Thank you bro.