Bitshares Focus Post | Investment Language 101 Series: TERM OF THE DAY: -- What Is: ' Return On Investment - ROI ' | E.102 | Trading Candle Cheat Sheet Incl. Each Episode.

A series designed to help all the new people flooding into & entering Crypto/Investments daily who get thrown into the rabbit hole so to speak and everything is new to them.

Bitshares 101 Focus/Resources Section for New Crypto Folks now included near the end of each post - starting just prior to Christmas 2017. BTS is a Decentralized Exchange and much more. Very undervalued!

It is a TLDR / Short Form Series, covering ONLY one thing each episode in blue collar, easy to understand language to give a SHORT OVERVIEW of the term or lesson of the day.

It is specifically designed this way to keep it short and simple.

People can then search out extra info if they wish.

I've never seen a regular series or resource running on Steemit to continually address this basic need so I decided to do it.

TERM OF THE DAY:

What is....

' Return On Investment ' ?

--

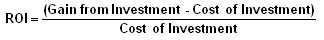

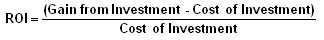

A performance measure used to evaluate the efficiency of an investment or to compare the efficiency of a number of different investments. ROI measures the amount of return on an investment relative to the investment’s cost. To calculate ROI, the benefit (or return) of an investment is divided by the cost of the investment, and the result is expressed as a percentage or a ratio.

The return on investment formula:

Return On Investment (ROI)

In the above formula, "Gain from Investment” refers to the proceeds obtained from the sale of the investment of interest. Because ROI is measured as a percentage, it can be easily compared with returns from other investments, allowing one to measure a variety of types of investments against one another.

--

Breaking Down...

' Return On Investment ' :

--

Return on investment is a very popular metric because of its versatility and simplicity.

Essentially, return on investment can be used as a rudimentary gauge of an investment’s profitability. ROI can be very easy to calculate and to interpret and can apply to a wide variety of kinds of investments. That is, if an investment does not have a positive ROI, or if an investor has other opportunities available with a higher ROI, then these ROI values can instruct him or her as to which investments are preferable to others.

For example, suppose Joe invested $1,000 in Slice Pizza Corp. in 2010 and sold his shares for a total of $1,200 a year later. To calculate the return on his investment, he would divide his profits ($1,200 - $1,000 = $200) by the investment cost ($1,000), for a ROI of $200/$1,000, or 20%.

With this information, he could compare the profitability of his investment in Slice Pizza with that of other investments. Suppose Joe also invested $2,000 in Big-Sale Stores Inc. in 2011 and sold his shares for a total of $2,800 in 2014. The ROI on Joe’s holdings in Big-Sale would be $800/$2,000, or 40%. Using ROI, Joe can easily compare the profitability of these two investments. Joe’s 40% ROI from his Big-Sale holdings is twice as large as his 20% ROI from his Slice holdings, so it would appear that his investment in Big-Sale was the wiser move.

Limitations of ROI

Yet, examples like Joe's reveal one of several limitations of using ROI, particularly when comparing investments. While the ROI of Joe’s second investment was twice that of his first investment, the time between Joe’s purchase and sale was one year for his first investment and three years for his second. Joe’s ROI for his first investment was 20% in one year and his ROI for his second investment was 40% over three. If one considers that the duration of Joe’s second investment was three times as long as that of his first, it becomes apparent that Joe should have questioned his conclusion that his second investment was the more profitable one. When comparing these two investments on an annual basis,

Joe needed to adjust the ROI of his multi-year investment accordingly. Since his total ROI was 40%, to obtain his average annual ROI he would need to divide his ROI by the duration of his investment. Since 40% divided by 3 is 13.33%, it appears that his previous conclusion was incorrect. While Joe’s second investment earned him more profit than did the first, his first investment was actually the more profitable choice since its annual ROI was higher.

Examples like Joe’s indicate how a cursory comparison of investments using ROI can lead one to make incorrect conclusions about their profitability. Given that ROI does not inherently account for the amount of time during which the investment in question is taking place, this metric can often be used in conjunction with Rate of Return, which necessarily pertains to a specified period of time, unlike ROI. One may also incorporate Net Present Value (NPV), which accounts for differences in the value of money over time due to inflation, for even more precise ROI calculations. The application of NPV when calculating rate of return is often called the Real Rate of Return.

Keep in mind that the means of calculating a return on investment and, therefore, its definition as well, can be modified to suit the situation. it all depends on what one includes as returns and costs. The definition of the term in the broadest sense simply attempts to measure the profitability of an investment and, as such, there is no one "right" calculation.

For example, a marketer may compare two different products by dividing the gross profit that each product has generated by its associated marketing expenses. A financial analyst, however, may compare the same two products using an entirely different ROI calculation, perhaps by dividing the net income of an investment by the total value of all resources that have been employed to make and sell the product. When using ROI to assess real estate investments, one might use the initial purchase price of a property as the “Cost of Investment” and the ultimate sale price as the “Gain from Investment,” though this fails to account for all of the intermediary costs, like renovations, property taxes and real estate agent fees.

This flexibility, then, reveals another limitation of using ROI, as ROI calculations can be easily manipulated to suit the user's purposes, and the results can be expressed in many different ways. As such, when using this metric, the savvy investor would do well to make sure he or she understands which inputs are being used. A return on investment ratio alone can paint a picture that looks quite different from what one might call an “accurate” ROI calculation—one incorporating every relevant expense that has gone into the maintenance and development of an investment over the period of time in question—and investors should always be sure to consider the bigger picture.

Developments in ROI

Recently, certain investors and businesses have taken an interest in the development of a new form of the ROI metric, called "Social Return on Investment," or SROI. SROI was initially developed in the early 00's and takes into account social impacts of projects and strives to include those affected by these decisions in the planning of allocation of capital and other resources.

Resharing this one..... This is a KEY everyday thing to understand in the crypto space / markets. So many new people coming daily and posts often also miss people in other timezones..... 2 things I try and remember, to help people and be aware of, thanks.

Your Friend in Liberty, Barry.

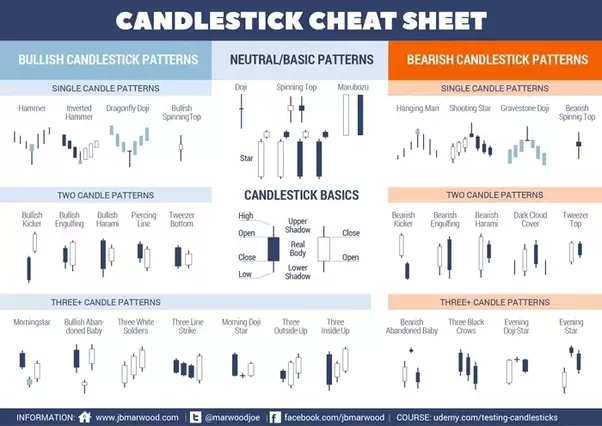

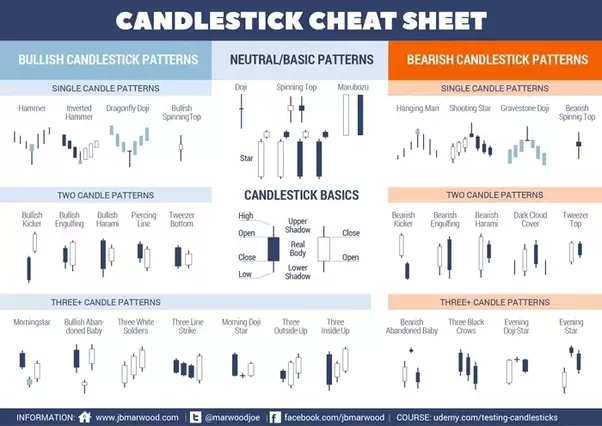

Trading Candle Cheat Sheet:

--

Further Reading/Source/Resources

Friend of the People -- Enemy of the State.

--

Bitshares 101 Focus/Resources Section:

for New Crypto Folks.

https://bitshares.org/

--

-- Bitshares is a Trading platform, and a LOT more.... designed by blockchain wizard here Dan Larimer - @dan / @dantheman.

I've blogged on him, and BTS many many times.

It's a place you can use that is decentralized, with an active community, to use trading lessons like this, that we are learning together.

Just a few of my past $BTS blogs....

to help you apply lessons today!

--

Thanks for reading, have a nice day.

PixaBay has tons of free pictures for us all to use!!!

Super Easy/Fast Picture Edits / Resizing at: http://www.picresize.com/ and also https://www298.lunapic.com/editor/

If you liked this blog post - please Resteem it and share good content with others!

--

Some of my recent blogs:

--

--

Most Images: Gif's - via Giphy.com , Funny or Die.com / Pixabay. Today:

If you feel my posts are undervalued or you want to donate to tip me - I would appreciate it very much.

--

EOS (EOS) - 0xD37bEFf5bf07E3aa432de00cE0AaA8df603A4fB0

LiteCoin (LTC) - LKdsnvSXk9JW99EiNicFMGKc1FXiBo9tUE

Ethereum (ETH) - 0x3Ad69Ff057C9533ca667B2d7E3E557F5eeFd4477

Ethereum Classic (ETC) - 0x5ab2b08d4ce8d454eb9d1ecc65c6d8b0c5f9784c

Bitcoin (BTC) - 18J6RRuzX4V7b2CDbx7tWZYNBLkkGWsvWX

DASH - XgZvsvSZgPkNbmGbRhc3S1Pt2JAc7QHwiS

PIVX - DA3azxQqJiX9t7EviuacpamfNhMi2zGAUh

Stratis (STRAT) - SNsJp6v1jXvKWy4XcXSXfNQ9zhSJJppJgv

ZCash (ZEC) - t1aCPEYELkGaf3GtgGTiCEDo7XfPm4QEwmL

Please note -- I will have limited internet access for awhile -- so PLEASE do not be upset that I cannot reply right away, or to everyone. I am dealing with some changes, and will have limited time online and will be happy if I get a few blog posts up a week.

This has really upset some people but I do not force my opinions on others, or need to communicate every detail of my life or issues, most people do not care anyways. I invested around 10 hours or more a day on Steemit most of my first 13 mths here, trying to build community, put out content and engage people, help and donate to people, and I just do not have that time in my life right now, and that includes for replies and voting/curation.

I have done my best, sorry if you do not understand like some are clearly having a problem with. It's a blogging platform, and I will do my best at everything, and to keep blogging.

Carry On.

A series designed to help all the new people flooding into & entering Crypto/Investments daily who get thrown into the rabbit hole so to speak and everything is new to them.

Bitshares 101 Focus/Resources Section for New Crypto Folks now included near the end of each post - starting just prior to Christmas 2017. BTS is a Decentralized Exchange and much more. Very undervalued!

It is a TLDR / Short Form Series, covering ONLY one thing each episode in blue collar, easy to understand language to give a SHORT OVERVIEW of the term or lesson of the day.

It is specifically designed this way to keep it short and simple.

People can then search out extra info if they wish.

I've never seen a regular series or resource running on Steemit to continually address this basic need so I decided to do it.

TERM OF THE DAY:

What is....

' Return On Investment ' ?

--

A performance measure used to evaluate the efficiency of an investment or to compare the efficiency of a number of different investments. ROI measures the amount of return on an investment relative to the investment’s cost. To calculate ROI, the benefit (or return) of an investment is divided by the cost of the investment, and the result is expressed as a percentage or a ratio.

The return on investment formula:

Return On Investment (ROI)

In the above formula, "Gain from Investment” refers to the proceeds obtained from the sale of the investment of interest. Because ROI is measured as a percentage, it can be easily compared with returns from other investments, allowing one to measure a variety of types of investments against one another.

--

Breaking Down...

' Return On Investment ' :

--

Return on investment is a very popular metric because of its versatility and simplicity.

Essentially, return on investment can be used as a rudimentary gauge of an investment’s profitability. ROI can be very easy to calculate and to interpret and can apply to a wide variety of kinds of investments. That is, if an investment does not have a positive ROI, or if an investor has other opportunities available with a higher ROI, then these ROI values can instruct him or her as to which investments are preferable to others.

For example, suppose Joe invested $1,000 in Slice Pizza Corp. in 2010 and sold his shares for a total of $1,200 a year later. To calculate the return on his investment, he would divide his profits ($1,200 - $1,000 = $200) by the investment cost ($1,000), for a ROI of $200/$1,000, or 20%.

With this information, he could compare the profitability of his investment in Slice Pizza with that of other investments. Suppose Joe also invested $2,000 in Big-Sale Stores Inc. in 2011 and sold his shares for a total of $2,800 in 2014. The ROI on Joe’s holdings in Big-Sale would be $800/$2,000, or 40%. Using ROI, Joe can easily compare the profitability of these two investments. Joe’s 40% ROI from his Big-Sale holdings is twice as large as his 20% ROI from his Slice holdings, so it would appear that his investment in Big-Sale was the wiser move.

Limitations of ROI

Yet, examples like Joe's reveal one of several limitations of using ROI, particularly when comparing investments. While the ROI of Joe’s second investment was twice that of his first investment, the time between Joe’s purchase and sale was one year for his first investment and three years for his second. Joe’s ROI for his first investment was 20% in one year and his ROI for his second investment was 40% over three. If one considers that the duration of Joe’s second investment was three times as long as that of his first, it becomes apparent that Joe should have questioned his conclusion that his second investment was the more profitable one. When comparing these two investments on an annual basis,

Joe needed to adjust the ROI of his multi-year investment accordingly. Since his total ROI was 40%, to obtain his average annual ROI he would need to divide his ROI by the duration of his investment. Since 40% divided by 3 is 13.33%, it appears that his previous conclusion was incorrect. While Joe’s second investment earned him more profit than did the first, his first investment was actually the more profitable choice since its annual ROI was higher.

Examples like Joe’s indicate how a cursory comparison of investments using ROI can lead one to make incorrect conclusions about their profitability. Given that ROI does not inherently account for the amount of time during which the investment in question is taking place, this metric can often be used in conjunction with Rate of Return, which necessarily pertains to a specified period of time, unlike ROI. One may also incorporate Net Present Value (NPV), which accounts for differences in the value of money over time due to inflation, for even more precise ROI calculations. The application of NPV when calculating rate of return is often called the Real Rate of Return.

Keep in mind that the means of calculating a return on investment and, therefore, its definition as well, can be modified to suit the situation. it all depends on what one includes as returns and costs. The definition of the term in the broadest sense simply attempts to measure the profitability of an investment and, as such, there is no one "right" calculation.

For example, a marketer may compare two different products by dividing the gross profit that each product has generated by its associated marketing expenses. A financial analyst, however, may compare the same two products using an entirely different ROI calculation, perhaps by dividing the net income of an investment by the total value of all resources that have been employed to make and sell the product. When using ROI to assess real estate investments, one might use the initial purchase price of a property as the “Cost of Investment” and the ultimate sale price as the “Gain from Investment,” though this fails to account for all of the intermediary costs, like renovations, property taxes and real estate agent fees.

This flexibility, then, reveals another limitation of using ROI, as ROI calculations can be easily manipulated to suit the user's purposes, and the results can be expressed in many different ways. As such, when using this metric, the savvy investor would do well to make sure he or she understands which inputs are being used. A return on investment ratio alone can paint a picture that looks quite different from what one might call an “accurate” ROI calculation—one incorporating every relevant expense that has gone into the maintenance and development of an investment over the period of time in question—and investors should always be sure to consider the bigger picture.

Developments in ROI

Recently, certain investors and businesses have taken an interest in the development of a new form of the ROI metric, called "Social Return on Investment," or SROI. SROI was initially developed in the early 00's and takes into account social impacts of projects and strives to include those affected by these decisions in the planning of allocation of capital and other resources.

Resharing this one..... This is a KEY everyday thing to understand in the crypto space / markets. So many new people coming daily and posts often also miss people in other timezones..... 2 things I try and remember, to help people and be aware of, thanks.

Your Friend in Liberty, Barry.

Trading Candle Cheat Sheet:

--

Further Reading/Source/Resources

Friend of the People -- Enemy of the State.

--

Bitshares 101 Focus/Resources Section:

for New Crypto Folks.

https://bitshares.org/

--

-- Bitshares is a Trading platform, and a LOT more.... designed by blockchain wizard here Dan Larimer - @dan / @dantheman.

I've blogged on him, and BTS many many times.

It's a place you can use that is decentralized, with an active community, to use trading lessons like this, that we are learning together.

Just a few of my past $BTS blogs....

to help you apply lessons today!

--

Thanks for reading, have a nice day.

PixaBay has tons of free pictures for us all to use!!!

Super Easy/Fast Picture Edits / Resizing at: http://www.picresize.com/ and also https://www298.lunapic.com/editor/

If you liked this blog post - please Resteem it and share good content with others!

--

Some of my recent blogs:

--

--

Most Images: Gif's - via Giphy.com , Funny or Die.com / Pixabay. Today:

If you feel my posts are undervalued or you want to donate to tip me - I would appreciate it very much.

--

EOS (EOS) - 0xD37bEFf5bf07E3aa432de00cE0AaA8df603A4fB0

LiteCoin (LTC) - LKdsnvSXk9JW99EiNicFMGKc1FXiBo9tUE

Ethereum (ETH) - 0x3Ad69Ff057C9533ca667B2d7E3E557F5eeFd4477

Ethereum Classic (ETC) - 0x5ab2b08d4ce8d454eb9d1ecc65c6d8b0c5f9784c

Bitcoin (BTC) - 18J6RRuzX4V7b2CDbx7tWZYNBLkkGWsvWX

DASH - XgZvsvSZgPkNbmGbRhc3S1Pt2JAc7QHwiS

PIVX - DA3azxQqJiX9t7EviuacpamfNhMi2zGAUh

Stratis (STRAT) - SNsJp6v1jXvKWy4XcXSXfNQ9zhSJJppJgv

ZCash (ZEC) - t1aCPEYELkGaf3GtgGTiCEDo7XfPm4QEwmL

Please note -- I will have limited internet access for awhile -- so PLEASE do not be upset that I cannot reply right away, or to everyone. I am dealing with some changes, and will have limited time online and will be happy if I get a few blog posts up a week.

This has really upset some people but I do not force my opinions on others, or need to communicate every detail of my life or issues, most people do not care anyways. I invested around 10 hours or more a day on Steemit most of my first 13 mths here, trying to build community, put out content and engage people, help and donate to people, and I just do not have that time in my life right now, and that includes for replies and voting/curation.

I have done my best, sorry if you do not understand like some are clearly having a problem with. It's a blogging platform, and I will do my best at everything, and to keep blogging.

Carry On.

--

EOS (EOS) - 0xD37bEFf5bf07E3aa432de00cE0AaA8df603A4fB0

LiteCoin (LTC) - LKdsnvSXk9JW99EiNicFMGKc1FXiBo9tUE

Ethereum (ETH) - 0x3Ad69Ff057C9533ca667B2d7E3E557F5eeFd4477

Ethereum Classic (ETC) - 0x5ab2b08d4ce8d454eb9d1ecc65c6d8b0c5f9784c

Bitcoin (BTC) - 18J6RRuzX4V7b2CDbx7tWZYNBLkkGWsvWX

DASH - XgZvsvSZgPkNbmGbRhc3S1Pt2JAc7QHwiS

PIVX - DA3azxQqJiX9t7EviuacpamfNhMi2zGAUh

Stratis (STRAT) - SNsJp6v1jXvKWy4XcXSXfNQ9zhSJJppJgv

ZCash (ZEC) - t1aCPEYELkGaf3GtgGTiCEDo7XfPm4QEwmL

Please note -- I will have limited internet access for awhile -- so PLEASE do not be upset that I cannot reply right away, or to everyone. I am dealing with some changes, and will have limited time online and will be happy if I get a few blog posts up a week.

This has really upset some people but I do not force my opinions on others, or need to communicate every detail of my life or issues, most people do not care anyways. I invested around 10 hours or more a day on Steemit most of my first 13 mths here, trying to build community, put out content and engage people, help and donate to people, and I just do not have that time in my life right now, and that includes for replies and voting/curation.

I have done my best, sorry if you do not understand like some are clearly having a problem with. It's a blogging platform, and I will do my best at everything, and to keep blogging.

Carry On.

You're doing the best you can.

"Don't live to inpress people"

Your blog is more valuable & informative.We can take out a lot of information about crypto,bitcoin & so on from your post that's why we can increase our steemit skill .I always visit your site & wait for your upcoming post.

Thanks @barrydutton.

@Resteen & follow has done.

Isn't everything in life an ROI challenge (trading, relationships, learning, a job, a hobby)

.jpg)

You might be right on that.

Just want to say that center-aligned text looks good to quote something and one liners but not so much with paragraphs. Great post regardless!

hey so nice I really like your post! Lets make steemit together to a better place with our content! I would like to read a bit more about you? Look my Introduceyourself like I do it. I went to jail because of cryptos : https://steemit.com/bitcoin/@mykarma/3-jail-review-from-colombia-to-madrid-and-then-straight-to-jailng-time

I have asked you several times now, quit spamming my page, and everyone else's, I have checked your comments tab many times, you never reply to my comments!!!!! I tried to warn you and be nice!!!

Stop this! Your acct will be flagged and damaged, why do you never bother to reply to me and keep spamming the same replies and links every day ???

How are you still at 43 rep. score doing this every day

@spaminator

@patrice

@steemcleaners

Help!

LOL