CryptoTrading for Beginners Part 7: Portfolio Rebalancing

Welcome to Part 7 of a series of articles about CryptoTrading for Beginners.

For an overview of previous parts, scroll to the bottom of this article.

Today I will talk about portfolio rebalancing. I will show you how you can increase your profits by taking advantage of fluctuations.

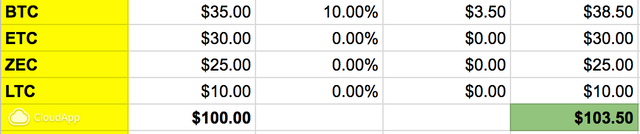

Remember our portfolio that we created in Part 1:

- BTC 35%

- ETH 30%

- ZEC 25%

- LTC 10%

Rebalancing your portfolio

Let's assume a scenario where we invested $100. Now, BTC is going well and goes up 10% while the other coins stay the same. This is what you can see in the image below.

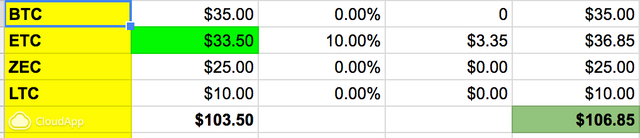

Now let's assume we take our gains on BTC and invest it in buying ETH. In other words, we would sell $3.5 worth of BTC, bringing our total back to $35 and we buy more ETH, bringing our ETH value to $33.5.

Now let's assume that in week 2, BTC stays the same and ETH goes up with 10%.

As shown in the image, my total value of ETH now becomes $36.85 and my total portfolio value $106.85.

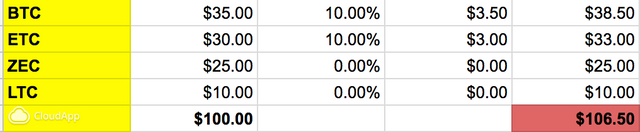

What if we didn't rebalance?

Now, you can think, if both coins went up 10%, I would have made a profit anyway, so what is the point of all this?

Let's just have a look at what would be the result without rebalancing.

If we did nothing, our total value would have been $106.50 instead of $106.85.

This may seem like a minor difference, but imagine the compounding effect if you keep doing this!

Be careful of hidden costs.

One thing to be aware of is transaction costs. Make sure your costs don't outway your profits. In this example, the numbers are kept small for the sake of argument, but your costs might be higher. But if you are dealing with bigger numbers, typically the costs have less impact on your gains.

When to do it.

Personally, I wouldn't be doing this every day because the markets are too unpredictable for this. Instead, look for trends over a longer period of time, f.i. 30 days.

This is the 30 day trend for our portfolio (at the moment of writing):

- BTC +49.69%

- ETH +26.68%

- ZEC +42.7%

- LTC +28.53%

These are pretty good numbers already. But as you can see, BTC and ZEC have been performing much better than ETH and LTC.

You have to ask yourself, can these coins keep having these gains? Probably not.

As you can see from the chart below, BTC had a big dip around November 12.

.png)

These are times that you look for rebalancing opportunities. Look which coins are doing relatively better and exchange to the lower priced coin. This is taking advantage of opportunities on the market.

But if you look at the macro, you notice BTC and ZEC gained more than ETH and LTC, so there is an opportunity to rebalance your portfolio in favor of the cheaper coins. I would suggest rebalancing back to our original ratio of 35/30/25/10.

Be aware that I'm just a guy on the Internet writing about stuff that nobody really knows what is really going to happen. Do your own analysis and take responsibility of your own decisions. I'm just sharing my thoughts and might be completely wrong about this.

Previous Parts in this Series

In Part 1 I talked about choosing your portfolio. We did everything on paper before actually buying any coin.

https://steemit.com/cryptocurrency/@gorik/cryptotrading-for-beginners-part-1-choosing-your-portfolio

In Part 2 I explained how to buy your first coins using Coinbase.

https://steemit.com/cryptocurrency/@gorik/cryptotrading-for-beginners-part-2-where-to-buy

In Part 3 I discussed how to use Exchanges.

https://steemit.com/cryptocurrency/@gorik/cryptotrading-for-beginners-part-3-using-exchanges

In Part 4 I showed how to transfer Bitcoin from Coinbase to your Bittrex wallet

https://steemit.com/cryptocurrency/@gorik/cryptotrading-for-beginners-part-4-transferring-coins-to-wallets

In Part 5 I wrote about what to look for when choosing a CryptoCoin to invest in

https://steemit.com/cryptocurrency/@gorik/cryptotrading-for-beginners-part-5-what-to-look-for-when-choosing-a-cryptocoin-to-invest-in

In Part 6 I discussed how to focus on the macro instead of the micro

https://steemit.com/cryptocurrency/@gorik/cryptotrading-for-beginners-part-6-focus-on-the-macro-instead-of-the-micro

Anything else you want me to cover? Let me know in the comments or join my free group on Facebook

Stay tuned for Part 8 of this series! And don't forget to upvote my post on SteemIt :)

Sound advise again! Do you have a template for how you log and keep track of your investments?

I was using Google Spreadsheets at first but then added some online tools, such as https://cointracking.info/ and https://www.cryptocompare.com/

this is just what I needed! now time to go read parts 1-6...

img credz: pixabay.com

Nice, you got a 53.0% @lays upgoat, thanks to @gorik

It consists of $3.83 vote and $0.2 curation

Want a boost? Minnowbooster's got your back!

The @OriginalWorks bot has determined this post by @gorik to be original material and upvoted(1.5%) it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!