What Will 2018 Hold for Rising GPU Prices?

TL;DR: The rise of cryptocurrencies has brought with it a significant demand for bulk graphic processing units (GPUs). Manufacturers of these units, which have proven to be very useful for mining cryptocurrencies, are desperately fighting to keep up with recent demand. The issue has polarized communities and raises questions about whether or not cryptocurrencies will provide long-term demand for manufacturers. This article hopes to dive into some possible answers and breaks down different perspectives on the issue.

Outline

Introduction

Ethereum’s GPU Boom

Push-back from GPU manufacturers

Meeting market demand in 2018

The Proof of Stake Issue

Introduction

Last year, in what some enthusiasts might call the first successful moon landing since December 11th, 1972, cryptocurrencies celebrated stellar growth rates. Ethereum, Bitcoin, Litecoin, Ripple, and other such cryptocurrencies went from underground hobbies to heavily-backed and well recognizable stars. This shift, primarily due to an explosion of interest from a range of investors, miners, and tech startup companies brought with it several new challenges for hardware manufacturers.

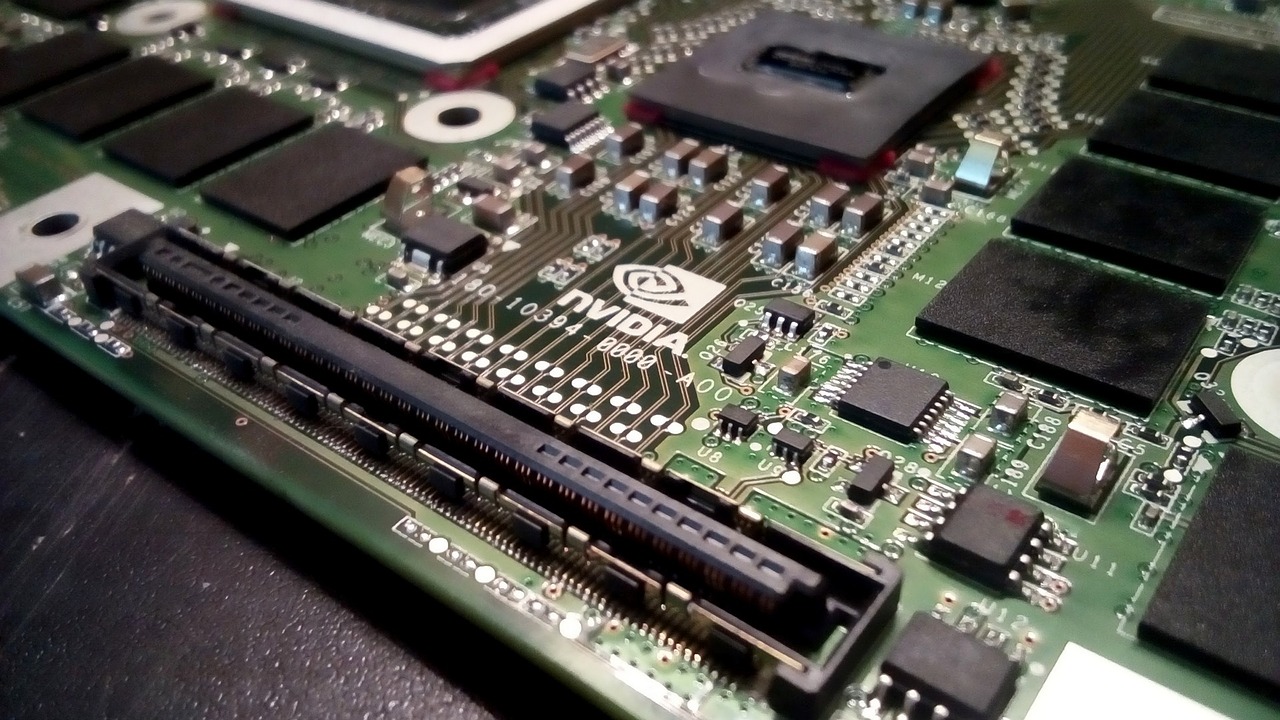

As the price of these emerging cryptocurrencies has erupted, so has the demand for high-end graphics cards. What is a GPU and how does it perform calculations differently from another processor? GPUs (Graphics Processing Units) are computational units designed for completing simple yet massive calculations in a brief timeframe. A common example of this would be outputting high definition video to a monitor/television, rendering changes to a video game, or simulating physics engines for scientific experiments. As it turns out, these types of processors are also great for making the calculations needed to mine cryptocurrencies.

High-end GPUs have seen unprecedented price hikes and massive supply shortages from online and retail businesses because of this gold rush in cryptocurrency mining. Sales of high-quality graphics cards, traditionally used for gaming, have been reported to have spiked as much as 88% from last December. Those hit hardest by the cryptocurrency gold rush include mid to high-end products from AMD and Nvidia. The price of some mid-range and high-end GPUs doubled over this time, and often it was nearly impossible to find a retailer selling Nvidia GeForce GTX 1070s or an AMD Radeon RX 580s. These graphics cards are in such short supply as a result of new cryptocurrency demand, but why is this truly the case, and why are GPUs uniquely struggling to keep up?

Ethereum’s GPU Boom

Ethereum is a blockchain-based platform which enables developers to build and deploy decentralized applications on top of a growing network. The advantage of Ethereum over something like Bitcoin is that it can support many different types of decentralized applications and general purpose contracts. Applications are not just limited to basic financial transactions but become applicable to any particular industry.

Ethereum also has the second largest market cap after Bitcoin and has gained massive growth in the last year. The market cap for Ethereum (Eth) has reached over $100 billion and has a circulating supply 82.7% greater than Bitcoin.

This recent demand for Ethereum applications has also brought significant demand for Ethereum miners. Ethereum mining is similar to Bitcoin mining, in that miners will also have to solve complex cryptographic puzzles to receive their reward. Except, Ethereum’s Proof of Work algorithm requires not just computational power, but memory allocation as well. This reduces the competitive advantage of ASIC mining rigs (specialized hardware made for one type of calculation, IE: mining) over common GPU rigs. The result is a mining ecosystem which is resistant to the emergence of specialized hardware that favors bigger miners and larger investments.

Ironically though, it would seem that this distinction in Ethereum has only strengthened the divide it set out to repair. The point of using GPUs over a specialized ASIC device was to maximize the opportunity for independent miners to participate in the system. Seeing as how graphics card manufacturers can’t keep up with the community’s demand though, it has created a buyer’s market where bulk purchases from wealthy investors prevail over small orders from independent enthusiasts.

Push-back from GPU manufacturers

Ethereum provides a highly valued service for decentralized application developers, as well as emerging financial institutions. Despite all of this new found demand from within the blockchain and mining community, manufacturers seem vocal about staying loyal to their original market.

Nvidia has encouraged its retail partners to prioritize gamers over cryptocurrency miners, but this suggestion often falls on deaf ears. Retailers can generate much larger margins by selling directly to miners, and it seems unlikely that retailers would act outside of their own financial interests to follow the will of Nvidia. While individual retailers are limiting bulk purchases so that miners can’t hoard stacks of graphics cards and alienate their other customers, most retailers are simply embracing the new demand. Other companies like Micro Center are specifically offering discounts to PC gamers who buy graphics cards alongside additional components, which helps gamers who are just getting started with their builds but seemingly alienates everyone else. Micro Center blames the high demand from miners on constrained shipments from vendors, which vendors blame on industry-wide shortages due to contract limitations.

As you might imagine, video game makers are also weighing in on this controversy. For miners, price increases simply represent changes to potential returns on investments. For members of the gaming community though, and businesses that revolve around the health of this community, price increases often mean users migrating away from the PC industry. Price increases are driving troves of PC gamers towards consoles from Microsoft and Sony. Several huge players in the gaming industry are either rooting for, or against, these changes in demand based upon their interests.

Meeting market demand in 2018

This is a shortage that’s affecting pricing worldwide, not just in the US. It seems unlikely to end unless graphics card vendors can flood the market to keep up with interest, or cryptocurrency demand drastically dwindles.

Nvidia and AMD both share a similar business model of licensing their unit designs to manufacturers. The two companies focus on the design process of generating graphics cards and return a profit from these competitive licenses they provide to actual manufacturers. The result is a very politicized environment, where companies fight for the right to manufacture graphics cards at all. For Nvidia and AMD, this new demand simply means streamlining their workforce and sticking to their expertise. Rather, the crisis of GPU production falls on the shoulders of their first party vendors and chip manufacturers. A few of these manufacturers include Foxconn, TSMC, Samsung, Asus, Gigabyte, and EVGA. All of which have very specific contracts that outline their terms and prevent each other, as well as new manufacturers, from producing more units currently.

This business model produces a lot of unnecessary overhead and is a significant portion of the larger problem at hand. One thing is for certain though, which is that demand is not dwindling from either community. Nvidia and AMD must acknowledge these changes and act accordingly, or they’ll forefit a thriving market to lesser-known competitors.

The Proof of Stake Issue

Many vocal members of the mining community, as well as the GPU industry, argue that Proof of Stake (A proposed alternative to mining) will diminish demand among miners and return the community to a happy medium. The technology is hailed as a doomsday for miners, and a large win for gamers. However, Proof of Stake’s adoption timeline remains uncertain.

On December 31st, 2017 the Ethereum core development team released their first alpha test-net including Casper (A Proof of Stake implementation) to the public. While a huge achievement worth celebrating, it is important to note what the alpha network truly achieves for Ethereum. “Alpha” is not used lightly in this instance, and the core development team will evidently be the first to disclose the massive amount of work and research still needed for Proof of Stake. It’s unclear when we’ll see Casper implemented on the main Ethereum network, and what changes will need to be made first. In addition to this uncertain timeline, Casper simply does not bring about the end of Proof of Work altogether. Rather, Casper is a proposed coexistence of the two consensus mechanisms. Ethereum hopes to utilize both protocols and intends for Casper to further improve Ethereum’s core security as well as public trust. While there’s no official timeline for Casper’s roll-out, it’s safe to say that there will be plenty of room for Proof of Work in 2018 and beyond.

This raises a critical question for both Nvidia and AMD:

If demand for both industries is not met, will the PC gaming industry survive?

As long as miners are able to take greater risks, and spend more on equipment, gamers will continue to receive subpar treatment over the next few years. It’s not unlikely that this could drive consumers and developers away from PC gaming, and substantially alter the industry. It’s conceivable that by ignoring miners to appeal to gamers, Nvidia and AMD are only hurting their long-term community. Perhaps the best solution is to give the market what it wants and to issue more contracts to manufacturers.

For PC gamers, this all represents a potential worst-case scenario, but whose fault is it really? With no immediate solution being proposed by the industry, some comfort can be taken in the fact that all parties will always want to generate larger profits. Selling more cards to as many people as possible is the clear economic answer to this crisis. However, the problem is that it’s unclear if Nvidia and AMD understand just how significantly their market has changed. To institute necessary change, both gamers and miners must collectively demand that the industry recognizes everyone and adapts. Conceivably, a unified effort should push companies to increase the total potential orders they can handle instead of ignoring new demand. Only through such alignment can both markets truly see a better landscape for everyone.

Congratulations @connorgutman! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @connorgutman! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!