Costs to launch an ICO

Thank you for coming to the site. Quantalysus publishes blockchain research and analysis for the crypto community. Please follow on Twitter, Steem (please follow and upvote if you can - thanks!), and Medium to stay up to date.

Launching an ICO costs money. I layout an in depth look as to how much it actually costs to launch an ICO. I've attended several blockchain conferences and the first thing that stands out is the number of service firms that directly serve the ICO industry. Yes, doing an ICO is an entire industry unto itself. Now if you're interested in bootstrapping an ICO use the numbers below as a rough guide. You may very well find providers who will charge less. You will also pick and choose from the smorgasbord of services they provide because you can simply do much of it yourself.

Pre-ICO costs can run as low as $80,000+ for basic services (assume 8 week ad campaign) to $500,000 for an 8 week long ICO. There are also post-ICO costs geared towards "getting the word out" such as a media push through podcasts and YouTube, bounty program management, and community building in different languages. All in, you can see pre-exchange listing cost run up to $1M. My estimates below are based on a few conversations I have had with consulting firms, media outlets, and ICO providers.

I'm reminded of the Gold Rush when I think of this entire industry. Between the 49ers and the shovel sellers, who did better on average? In fact, Levi's, the jeans maker, rose to prominence by selling their wares to the 49ers.

Lastly, there's the fee to get on an exchange. Let's just say you need briefcases worth of funds.

Pre-ICO costs

Legal support: $20K - $100K

- Legal consultation

- Entity setup

- Agreements development

- White paper and lending page legal review

- Ongoing legal counsel hits the high end of estimate

- Fundraising software, zero percent set up fee, 1% success fee (provider will need a broker license in order to charge a success fee)

- KYC/AML services

- ICO landing page

- Smart contract development (contracts on Ethereum and Qtum are written in Solidity, Neo NEP5 smart contracts written in several languages, etc.)

- White paper consulting and co-development

- Token design

- Token economy model

- Translation is not included.

- ICO landing page design

- Timeline and milestones

- Cryptonews Websites

- Media outlets

- Press release distributed to over 100,000 journalists and 5,000 media outlets

Getting the word out

Influencer mentions and exposé services: $5K - $20K depending on breadth and depth of coverage- Not all influencers take fees, remember there are many who strive for journalistic standards. Some take fees over the table and mark their content as sponsored. Some don't - and that's troubling in jurisdictions with stringent securities laws.

- For the influencers who do charge:

- Name drops - little to no effort, low fee

- Review/interview - unscripted for the most part, typically charges less

- Skype interview

- In-depth review

- Listing on +30 top listing websites

- 2 reviews

- featured status

- Monthly banner advertisement on 6 cryptocurrency websites

- Websites reach over +500,000 monthly traffic

- Project advertisement on 3 +10,000 Telegram channels

- bounty creation, determination of what bounty programs your project needs

- designing and creation the whole program

- signature codes designing for Bitcointalk bounty program

- snowball effect with low criterias

- getting as many participants as possible

- community management through Telegram with 4 representers;

- English and Russian languages are included, Korean, Japanese and Chinese languages can be added with extra fee.

Getting listed on exchanges

The process of getting a token listed on an exchange is not very well defined. Exchanges are where the liquidity is for digital assets, so naturally they become a market player who can command impressive fees. Like influencers, not all exchanges take fees to list. Coins can and do get listed because the exchange believes in the project's success. But for exchanges that do take fees let's say they are arbitrarily broken down into tiers. Let's call these tiers: Tier 1, Tier 2, Tier 3, and Tier 4. Tier 1 exchanges commend the highest liquity. Getting listed there gives a token the highest chance for active price action. Prices to get on exchanges are not published anywhere so naturally it leaves outsiders in the dark. A few articles circulating around the web have ranges of $50K to $1M for a listing. Off the cuff, I've heard of fees closer to $2M - $4M for Tier 2 exchanges. And you wonder why some ICO hard caps are raising well over $20M. Just add up the fees and you can see why.

If you ran an ICO I'd love to talk to you about refining the estimates here. The more evidence I have the better I can spread the word to other entrepreneurs and projects. Personally, I don't think many of these fees should be as high as they are. There are many advisors who are willing to support your project with more compelling economic structures that are less cash upfront and tied to bonuses based on the project's success.

If you like my content:

- Please consider donating. My blog’s ethereum address: 0x1ea7ab9acd4294d32bb0c790dd08a66640342680

- Earn Aelf tokens by following them on Twitter (my referral link)

- Follow me on Steem (@quantalysus). I appreciate upvotes!

- Follow me on Twitter (@CryptoQuantalys)

-

- ICO Review: Quarkchain

- ICO Review: DAOStack

- ICO Review: Alchemint

- ICO Review: Loki Network

- Coin Review: Ontology

- Coin Review: CanYa Coin

- Coin Review: Aelf

- Coin Review: Mithril: a social network app on the blockchain

- Coin Review: Qtum

- Coin Review: Waves

- Coin Review: Banyan Network (BBN)

- Opinion: The multi-protocol world

- Opinion: Blockchains and the Game of Tradeoffs

- Opinion: Why we need regulation

- Opinion: Token economics

- Opinion: ICO paradox

This explains why most ICOs are destined to fail from an investor perspective. Most have no clear way to return funds/ value to investors and are just a way for a company to generate capital with no legal requirement to pay it back or to do anything at all really. Investment relies heavily on the greater fool theory and apart from several well run projects, investors will lose serious amounts of money.

@grizgal Many investors have already lost much. I wrote another post detailing a range of as high as 80% of ICOs from 2017 have failed. I struggle with the narrative that it's different from traditional VC investing. Normally, retail investors do not invest in risky asset classes such as startups. The appetite for the risk reward simply hasn't existed for the common investor. That's changing now though with the advent of ICOs. I'm in favor of raising costs to create a higher level of quality, similar to how blockchains charge fees per transaction to mitigate network spam.

I’m all in favour of opening up the asset class to retail investors if they accept the risk, but Most ICOs are not investments. An investment implies you give a company money with an expectation of a return and most ICOs don’t even talk about a mechanism for this. Traditional VC investors own large parts of the company they invest in. If they fail they lose the lot but if they succeed they make s killing. Most ICOs issue worthless tokens which entitle you to nothing. That is my issue. Some are better than others agreed but the vast majority could turn into multi billion dollar companies and return nothing to ICO token holders.

Fair points all around @grizgal. My post (https://steemit.com/ico/@quantalysus/crypto-files-the-ico-paradox) dives into topic to some degree. Ultimately what is the business model after raising funds from an ICO. Presumably, it's to build a product or network that returns value to said community. Businesses have long measured value in the form of a financial return. Crypto assets should have a very similar expectation of return. Sia Coin actually has a dual token structure. One is a utility token that is meant to have an attractive price to compete with it's centralized competitors and another that entitles one to financial gains (fiat and crypto transaction fees alike). I think the dual token structure makes more sense than a utility token that also has an expectation of financial returns. The two traits are incompatible in my view.

Here some ICO coin make me confuse to hold on long

Well the advertising costs can be way lower. TenX for example claimed that they didn t spend a single Dollar on Marketing . It always depends on how many Followers the Team already has on Social Media. Or if they are already known at the Crypto Community.

True @elbiasto. But it can equally go much higher. My friends who run ICO advisory firms and a few crypto funds have confirmed these costs can get out of control quickly.

This post has received a 21.39 % upvote from @boomerang.

You got a 1.46% upvote from @postpromoter courtesy of @quantalysus!

Want to promote your posts too? Check out the Steem Bot Tracker website for more info. If you would like to support the development of @postpromoter and the bot tracker please vote for @yabapmatt for witness!

Thanks for this post, good content appreciated. If you could take a look at our content, it would be great, TY :)

Just followed you in return.

Excellent content and so needed in this space! Thank you!

I am a blockchain consultant and advocate as well as a writer, editor photographer, artist.

Darcy K. Butcher, @fieldsofgold

Thanks @fieldsofgold. I'll follow you in return. What do you specifically consult on?

@originalworks

@quantalysus Thanks for doing thorough research as I was curious about the cost of an ICO! I would assume advertising cost could even range in the six-figure expense as there is extreme competition for space on popular web pages. I'm sure hedge funds that are behind certain ICOs are willing to pay sky high to fund the advertising as well. Would love to hear your thoughts!

@researchgeek. The costs can be much higher for marketing. I had to choose a reasonable range for my article based on the conversations I've had with projects. The real runaway costs are with marketing and exchange listings if you ask me. Also, I didn't mention advisors but they also take a huge cut.

ahh, gotchya. And yes I would agree with that thought....Marketing and exchange listings are insurmountable expenses I would assume as well. Great article bud!

Thank you for giving me what is the first look I have seen at an estimate of how much it actually costs to launch an Initial Coin Offering or ICO using blockchains outside of Steem because this makes an amazing case for planning to launch with a Smart Media Token or SMT on Steem as seen at https://smt.steem.io/ and promoting within Steem given the costs would be a fraction of using another option, require almost no technology development, and offer instant access to every user on Steem for any applications and reporting of a user base all while not needing to be listed on any exchange!

Funny you mention SMTs @jerrybanfield I'm posting an article on the subject tomorrow. A friend of mine shot over a beta of his app and I've been using it to filter out my @steemit feed more easily.

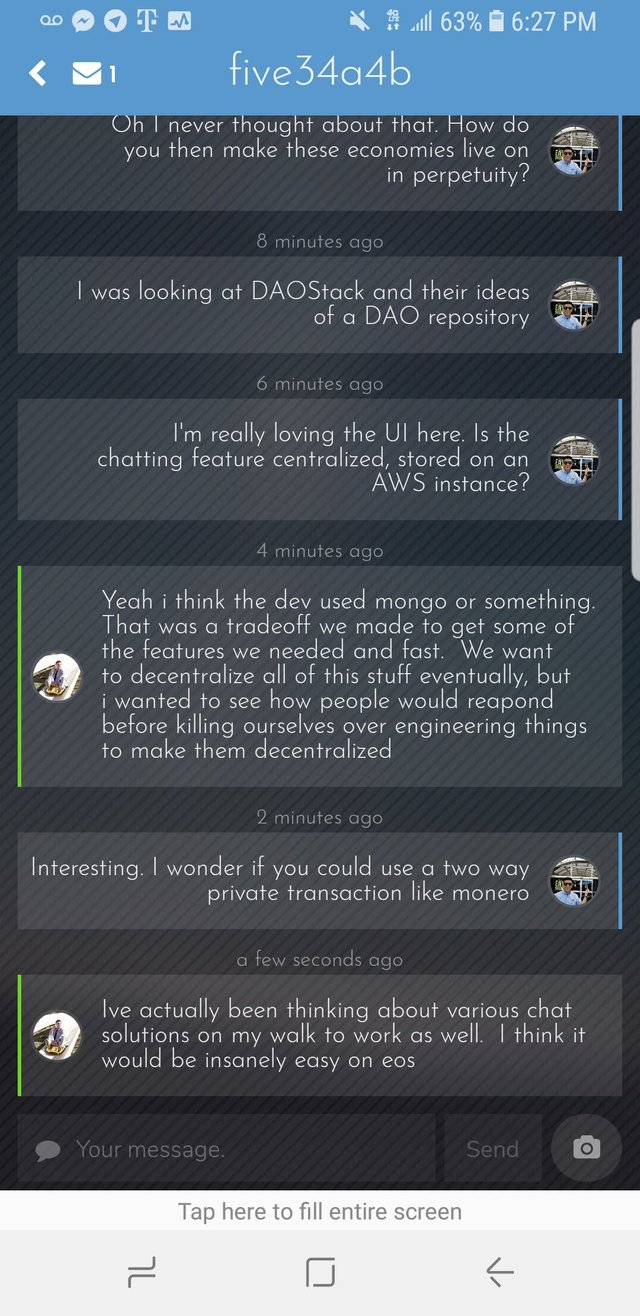

This is the chat feature of the app.