The Multi-Protocol World

...in the first few years of the blockchain industry one may be forgiven for thinking that there would be only "one blockchain to rule them all", in recent times such a possibility has been receding further and further from reality.~Vitalik Buterin

One chain to rule them all? Unlikely. One blockchain is not going to follow the path of TCP/IP and eventually defeat its foes. A world with a divine blockchain does not make sense to me for a variety of reasons in which I argue my points down below.

Today's blockchain protocol will capture value unlike TCP/IP

On the other hand, open source and decentralized projects that power the internet like TCP/IP, Wikipedia or Unix have generated huge amounts of value but historically struggle to capture most of it. Success in open source is measured by user adoption, not by revenue.~Ramon Recuero, Y Combinator

The history of TCP/IP does not neatly apply. TCP/IP generated value in which today's internet applications then built successful multibillion revenue companies. TCP/IP is an open source project that vanquished its competition in OSI during the internet protocol battle in decades past. Blockchain protocols today such as Ethereum, Neo, and Qtum are open source. One of the main differences today is that these blockchains are able to draw in funding via their token vehicles. TCP/IP grew up in an era void of tokens. The incentives and value these new blockchain protocols provide make for a new chapter in protocol wars. The battle will be measured by these project's ability to draw in applications, much like TCP/IP has the likes of FANG(Facebook, Amazon, Netflix, Google) as its application offerings.

Everyone knows FANG. These companies have enormous market caps. In fact, you can buy shares in these companies but you cannot invest in the underlying protocols such as TCP/IP. But with the blockchain ecosystem, you can participate financially in both. You can own build an application on a Loom Network (LOOM) sidechain and secure the application through its underlying security provider, the Ethereum (ETH) blockchain. You can also own both the Ethereum and Loom tokens.

Where TCP/IP protocol failed to capture financial value, the current blockchain investment theses floating about actually focus on investing in blockchain protocols. Popular YouTube influencers such as Ian Balina categorize ICO investments into one of two camps: infrastructure and Dapps (decentralized applications). His largest investments and successes to date have been in the infrastructure camp.

This line of thinking has been refined and articulated within the venture capital and crypto funding communities as well. Several hypotheses have emerged. Joel Monegro (Union Square Ventures) outlined his Fat Protocols thesis where he describes the base blockchain protocol layer (i.e. Ethereum) as the major capturer of value, unlike TCP/IP. A slight modification of the Fat Protocol thesis is the Thin Protocol thesis postulated by Teemu Paivinen. In Thin Protocols, forking is explored further as a results of incentives and the cause of value capture thinning out across the newly forked protocols.

...while these protocols in aggregate will continue to capture most of the value, individual protocols will in fact be quite thin and tend towards capturing minimal value, due to the combined effects of forking and competitive market forces.~Teemu Paivinen

Thin protocols to fragmented protocols

Teemu called for thin protocols. I agree with this assessment but I would use the term fragmented protocols as it seems to describe more accurately what is happening to the blockchain space today. Aside from just financial incentives, there are a variety of reasons why developers would break away from the main chain. A few reasons include:

| Rationale for fork | Description | Potential solution |

|---|---|---|

| Financial incentives | Late developers have little incentive to upgrade the main chain and have more to gain by creating their own forked version | Realign financial incentives for later developers to upgrade the network: bounties, large percentage of inflationary tokens, split mining fees |

| Governance incentives | Similar to a boardroom takeover, a developer may wish to have more control | Governance is ultimately offchain and a human issue. Good governance should allow for dissent and commitment |

| Difference in vision | Vitalik Buterin left Colored Coins to develop Ethereum due to frustration in project direction | Similar to governance, this is ultimately a human issue. This is commonplace in companies as employees leave for greener pastures. |

| Serve a vertical industry | Blockchain specifically for an industry. The blockchain conforms with current industry and compliance standards. | Less of an issue but more of an application strategy (i.e. Achain/ACT deliberately forks to serve specific use cases) |

As the number of protocols fragment they begin to compete for the attention of dApps. Over time they start to reach feature parity along several fronts: throughput speed/transactions per second (TPS), smart contract functionality, interoperability (atomic swaps, notary, hashlocking). Given enough time, applications looking to develop atop a blockchain protocol will have a large number of options to choose from. In this vein we see a repeatable pattern of applications capturing value. This time hopefully it will be different as network users will share in the spoils.

Applications will take the higher ground, capturing more value

In Thin Protocols, the technology stack is even further broken down. You could describe a base layer as the underlying protocol to an application. Think of companies running smart contracts on Ethereum. Loom Network for example would be the application providing scale/speed and Ethereum as the underlying base protocol providing security and processing capabilities. At the application layer lies a token economy. This is far more powerful to the end user than the baseline layer.

Let's say there's a social network built on top of Ethereum with an application called FaceCoin. The end user goes about their day to day empowered to contribute to the FaceCoin community. He/she shares photos, text updates, and creates events every day on FaceCoin. The user accrues FaceCoins based on other users liking and sharing that content. In fact, this application is the very first app the user opens up on their mobile phone every day to interact with friends and family. When the developers of FaceCoin define their ongoing roadmap they publish their approaches on the network and users spend their FaceCoin in a vote to decide which direction to take. Nowhere along the way did the FaceCoin user wonder if Ethereum is running their favorite app. In fact, if the fees to use Ethereum become expensive, the application developers can simply fork Ethereum to suit their needs or simply switch to a friendlier baseline protocol.

Applications in the long term will prove the fat protocol investment thesis inferior

So what does this mean for cryptocurrency investors? Today the prevailing retail investment advice is to chase after infrastructure (Balina) and base layer (Monegro) protocols. Previous history, albeit a short few years, base layer protocols will likely realize the large percentage of gains in the cryptocurrency markets. These gains reinforce the opinions proselytized today. Whether you believe cryptocurrency valuations are right sized or oversized, much of the gains to centralized apps are also due to the fact that there is an absence of killer apps. Protocols such as Neo, Ethereum, Qtum are still under development. Next generation protocols such as EOS and Cardano have yet to even launch. Until the underlying infrastructure hardens, application entrepreneurs can start to wonder:

-

Will I see all-in-one protocols (general purpose) or am I better off looking for protocols competing for my specific niche (“blockchain-as-a-service”)

Will base layer protocols compete for faster, cheaper transactions thus leading to the commoditization of their services. As an application I will search for alternatives with low switching costs to maintain flexibility. At the time of this writing, dapps on the Neo blockchain require 500 GAS (worth roughly $25 USD) to launch their app. Compare that to simply turning on a AWS instance.

I’m wading into the prediction marketplace now. Rather than fully writing out my thoughts I opted for bullets.

- Near term:

- Best archetype projects (ignore specific names, just used as examples):infrastructure (base layer): Ethereum, Neo, Qtum, Icon, Zilliqa, EOS, Achain

- Hardening of protocols

- <Nascent application protocols emerging

- One of the FANG members announces a blockchain project

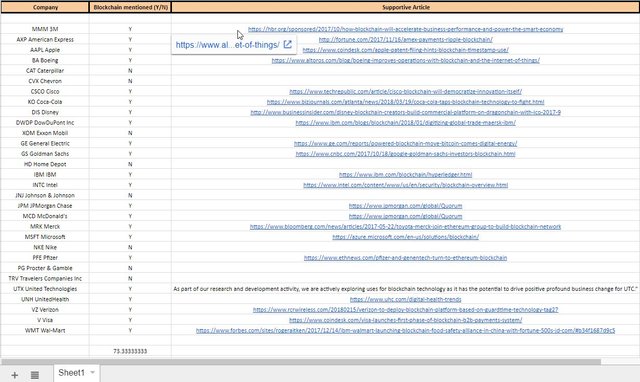

I did some quick analysis: 73% of the Dow 30 companies mention and/or are currently building blockchain solutions...right now. Spreadsheet attached in pic

— David Nage (@DavidJN79) March 19, 2018

- Intermediate:

- Best archetype projects (ignore specific names, just used as examples): ManufacturingCoin(s), HealthcareCoin(s), LogisticCoin(s), FinanceCoins(s)

- First-in-line crypto friendly governments put legislation on paper

- Winning dApps start to emerge in several, but not all, verticals:

- Consumer apps:

- Why?

- Privacy and permission based - consumers take back their data

- Share in the spoils

- Companies find increased value and throughput in increased targeting

- Verticals

- Social media

- Consumer data sharing

- Why?

- Enterprise

- Manufacturing

- Robotics, tooling

- Healthcare

- Sensors, diagnostics

- Electronic medical records

- Medical directives

- Logistics and supply chain

- Inventory management

- Transportation and distribution

- Financial sector

- Alternate Trading System

- Digitization of financial instruments

- Personal finance and retail banking

- Manufacturing

- Consumer apps:

- Long term:

- Everything is on a blockchain. Even the air we breathe (all jokes aside).

I always urge my readers to think for themselves. To develop their own theories. Periodically check in with how the market is playing out to validate whether your theories are correct. Participate in crypto by investing in yourself. Join the conversation with me. Follow me on Twitter if you enjoyed this article.

Other posts:

- Alchemint: a NEO stablecoin

- Loki Network: Monero with smart contracts

- Qtum: The NEO alternative and frankenstein blockchain

- Waves: a powerful DEX and ICO generator

- Banyan Network (BBN)

- Why we need regulation

- Token economics

- ICO paradox

- OSI: The Internet That Wasn’t

- Interoperable chains (Multicoin Capital)

- Chain Interoperability (Vitalik Buterin)

- The Token Effect (Y Combinator)

- Thin Protocols (Teemu Paivinen)

Disclaimer: I am just a bot trying to be helpful.