Revisiting CanyaCoin

Disclaimer: I was not paid to write this. I do not own any CanYa.

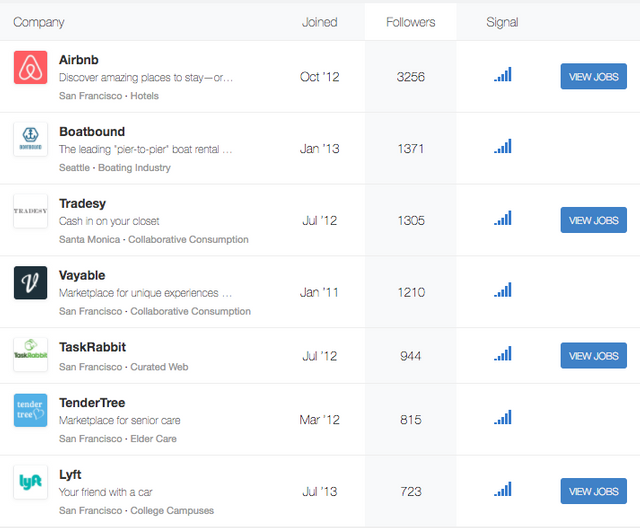

Peer to peer marketplaces started to become a trending topic in venture circles back in 2014. The hype has not died down. Just browing Angel.co's peer-to-peer tracker there are 1,185 companies with an average valuation of $3.6M. The granddaddy of them all is AirBnB. In this post I'll cover mostly USA based companies simply because I'm more familiar with them. CanYa is based out of Australia.

Source: Angel.co peer to peer tracker, sorted by followers in descending order

These marketplaces have enabled untapped economic resources. Every day chores were available for hire with Task Rabbit. Your home became a weekend stay for a traveler with AirBnB (I have been an AirBnB host for the past 4 years and I love it). Your parked car became a rental with Getaround and Turo. The peer-to-peer revolution is still growing and the torrent of this change has driven canyon like erosion into existing industries. Uber versus taxis. AirBnB versus hotels.

Each of these companies are tackling niches in peer-to-peer (which I will refer to as p2p for brevity going forward). These companies have grown tremendously in both revenue and headcount. All along the way, these companies charged a fee in exchange for provider a two way marketplace and a high level of convenience. As every business well knows, tradeoffs must be made.

Drivers expect Uber to match them to riders, optimize their route, and provide a reasonable fee. But one thing I always hear when I hop into a car is that "Uber takes too much of a cut". There's the rub. For the gig workers hoping to keep more of their pay, decentralized apps (Dapps) might be the solution they are looking for.

Enter CanYa

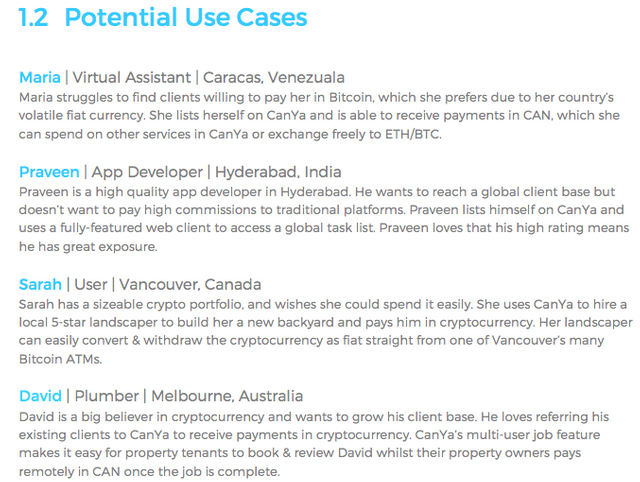

Nearly 5 months have passed since CanYa completed their ICO. I thought it would be worth reviewing where they are now for all of you CanYaCoin hodlers. But first let's review what is it that CanYa is trying to solve. From their whitepaper, CanYa is "[e]nabling peer-to-peer services through a variety of featuring a decentralized, trustless and hedged escrow service, a bridge between fiat and a variety of cryptocurrencies, a powerful rewards system to encourage network effects, and incentivized user-curation and user arbitration."

That's a lot to take in. So let's break it down in bullets:

- Peer-to-Peer services: providers can list their services and availability, and patrons/employers can search for providers

- Escrow service: a payment held in custody until all parties complete their side of an agreement completely

- Hedged escrow: we all know how volatile cryptocurrencies are so it's helpful to have a mechanism to stabilize the payment you pay/receive while the service is unfilfilled

- Fiat-to-cryptocurrency bridge: ability to exchange crypto to fiat through a trusted third party (i.e. licensed bank because crypto has yet to be mass adopted)

- Rewards systems: incentives drive human behaviors. High rankings for service providers rewards them for their good work. Think of going to a 5 star restaurant on Yelp versus a 1 star restaurant with similar prices - you'd choose the 5 star.

- User curation:

- User arbitration: if something goes wrong during a job, there's recourse

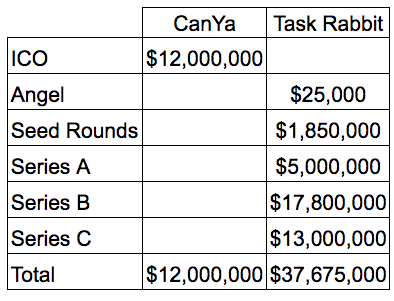

CanYa versus TaskRabbit Funding

CanYa raised ~$12M in its ICO. That's plenty of funding to plan for growth for the next couple of years. By comparison, TaskRabbit did not cross $10M in funding until it past two years in operation.Does this business need to be decentralized?

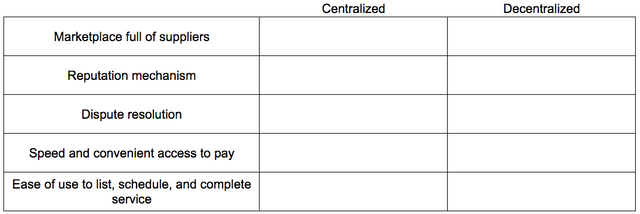

I can argue both yes and no. Let's think through why this may or may not make sense.

My first thought is to put on my service provider hat. What do I really care about? I care about:

- Marketplace full of suppliers

- Reputation mechanism

- Dispute resolution

- Speed and convenient access to pay

- Ease of use to list, schedule, and complete service

Like so.

Source: my own Google Doc (link)

Building a marketplace is hard to do

A good friend of mine manages the supply side initiatives over at Lyft. With real time demand, Lyft is constantly stressed to find drivers. Incentives such as bonuses for number of hours driven and flexed ride fees help to bolster demand, but these dynamics are massively stressed during high traffic events such as conferences or music festivals. On the other hand, small tasks like chores or large projects such as graphic design work do not require such flexing mechanics. In fact, the slower time frames of these jobs posting makes it easier for Task Rabbit, CanYa, or Gigster to provide both demand and supply. CanYa can do well if it targets these types of jobs.

Task Rabbit handles small home projects. Etsy handles arts and crafts. Gigster is for the technologist looking for a contract. Each of these marketplaces do one thing really really well. They focus. With CanYa I'm hopeful they tackle a niche and build an unassailable advantage. Once they've crossed one channel, they start tackling another market. An alternative strategy they can employ is to allow app developers to build on top of CanYa. The evergreen app partner strategy.

From their whitepaper:

Reputation Mechanism

Meritocratic based p2p systems always feature some sort of feedback mechanism. Yelp has a 5 star rating. Uber does too. AirBnB has a review section. I have not personally seen the CanYa platform but I assume they have one too.

I may be shortsighted on this topic but the one advantage I could see is the ability for a decentralized p2p network not caving into the whims of a more powerful counterparty. For example, when someone gives a negative review of a restaurant on Yelp in good faith the restaurant may have enough power to simply remove the comment or bury it. In this instance, Yelp has an incentive to keep the restaurant listed and happy with its service. So long as the restaurant is happy they are more likely to pay for sponsored content or listings. The power of incentives in centralized systems tends to shift in favor of the higher paying party.

I have yet to see how decentralization will fully solve power equilibriums but if you have seen examples of this play out I would love for you to send them to me ([email protected], twitter.com/CryptoQuantalys).

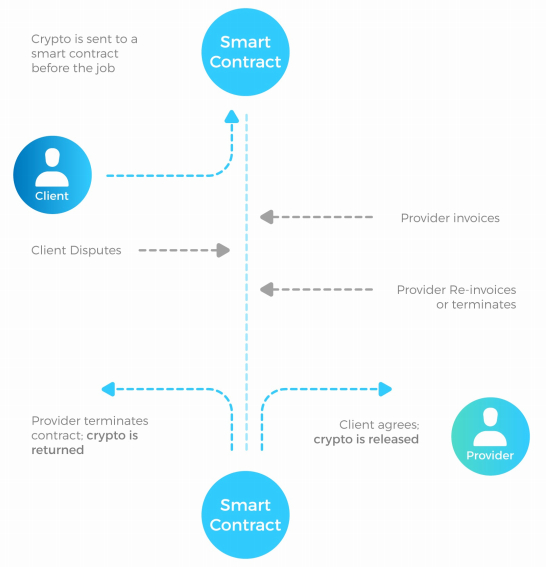

Dispute Resolution

All p2p networks require dispute resolution. When one party has a grievance, they need a mechanism of assurance their issues will be handled fairly. I use Venmo (owned by PayPal) a lot. If I send a payment to someone by accident on Venmo, I have to appeal to that person directly to send me the transaction back in good faith. If this doesn't work I have to escalate it to Venmo without assurance I will get my money back. That sucks. Uber and Lyft's dispute resolutions are automated - simply file a complaint and you're more than likely to receive a $5 credit.

So how is CanYa handling it? Through smart contracts! CanYa's provides a two step dispute process. First, handle it yourselves. Second, if that doesn't work, involve CanYa for a 5% fee. If 95% (I'm making this number up) or higher of disputes are handled automatically, it leaves CanYa with the option to handle disputes with a relatively lean team. I can hear the inner Chief Customer Relations Officer inside of me rejoice.

Speed and Convenience of Pay

Centralized parties pay in fiat. They can be slow.

Decentralized apps pay in cryptocurrency or fiat. Cryptocurrency payouts are immediate. Fiat gateways are slow. In this sense, Dapps are slow and fast.

The one argument I always come across when it comes to businesses accepting cryptocurrency is "how will businesses manage FX volatility"? Converting USD to EUR in practice isn't much difference than converting BTC to USD. There is a market spot rate for the exchange. The largest difference in crypto-to-fiat is the volatility.

Service providers (gig worker) accepting crypto should consider themselves small businesses. Normally these workers accept fiat currencies in the countries they work in. With crypto, you earn a currency that has to be converted to spend in every day life (until cryptocurrency overtakes fiat worldwide!). I'm curious to see how everyday individuals start to incorporate business like FX hedging strategies into their everyday lives.

Ease of Use

I'll reserve my comments here since I have not seen the CanYa platform myself.

Fees

A major advantage CanYa has is that their platform uses Smart Contracts. These contracts are basically programmatic agreements without needing to trust a third party. I like to think of them as "if this, then that" statements.

Escrow and Stable Coin

CanYa features an escrow system built on smart contracts. The escrow system attempts to address the volatility mentioned above in my points regarding payments. CanYa partnered with Digix to provide sufficient capital in the event of asset value volatility. Digix (DGX) is a token backed by gold. Basically, it's a stablecoin to provide liquidity in the event tokens depreciate massively in value. When prices go up in cryptocurrency, there isn't a problem. When prices go down (as they often do in cryptocurrency), we run into potential issues of posting sufficient collateral. Devalued crypto prices and collateral requirements are not a problem unique to CanYa but to the entire cryptocurrency industry.

CanYa aims to provide protection against downswings of up to 20% with further protection being covered on a pro rata basis to be determined.~CanYa whitepaper page 15

The quote above features a plan for downswings of greater than 20%. Basically they're working on an answer. While no answer is not good, I appreciate their overall honesty in they are working on it. Same with the rest of the industry - remember that everyone.

Staking to be on the network

Providers are charged either of two fees to list their services on the network. The first is a 1% list. The second is based on a freemium model. No free lunch as they say in economics. This fee is essentially a staking mechanism. Providers have to put skin in the game. It also solves for the famous Sybil attack where reputation systems (such as CanYa) are spammed by a malicious actor.Side note on Sybil attack: a malicious actor decides to create an obnoxious number of provider profiles, let's say 10,000 accounts. CanYa has 10,000 accounts in total before the attacker created his profile army. Fees were 0% to list. Now CanYa has 20,000 profiles and half of them are fake. Employers now trust the network less because the marketplace is flooded with fake profiles. Solution: charge a fee.

My one concern is using a flat 1% fee. I would prefer a sliding fee to deter Sybil attacks. Let's say for example that for furniture builder providers on CanYa that 1% is too easy a fee to post. Spammers from a competitive product see 1% as a reasonable expense to destroy CanYa's budding advantage in furniture building. Charging a variable fee is a reasonable defense versus Sybil. Just my opinion!

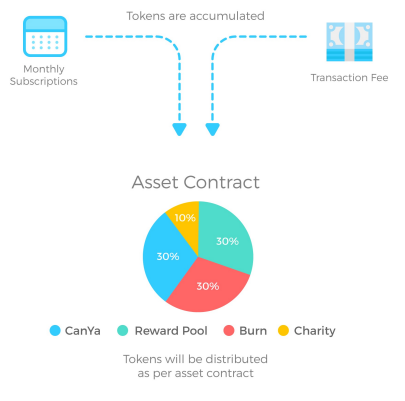

CanYa is charitable, kudos!

It's not all about profits. CanYa also created Giveth, a charity that receives CanYaCoin. Here's how all fees are redistributed. 10% goes to Giveth.Incentives

In the era of cryptocurrency projects, application incentives are wide in their variation. As someone who majored in economics at university, I certainly appreciate the ability for companies to play "god" in creating their own mini economies. Some models will show brilliance, some will lead to adverse outcomes that will doom their applications.I don't know how this will play out for CanYa just yet. CanYa's rewards come in four flavors:

- Friend referrals: $10 credit

- Welcome bonus: $10 credit

- Transaction rewards: 5% on each transaction. This is almost like a rebate. I am actually curious how future accounting standards will account for this.

- Commission payments: 2-4%. You refer someone and they transact, you get a commission.

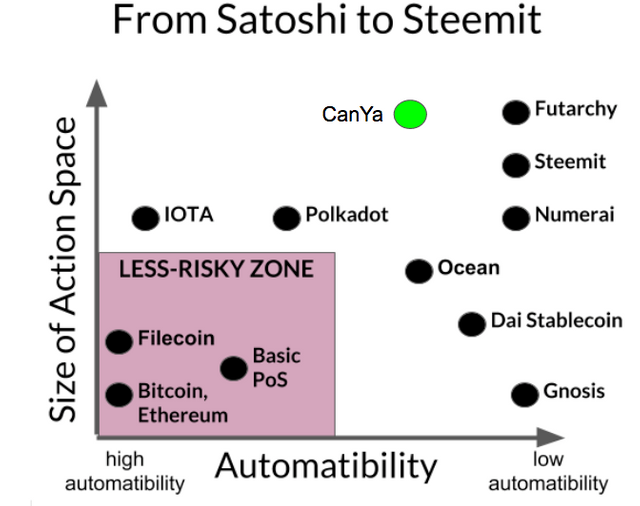

Qualitative Mapping of CanYa

The key to dapps is not necessarily the blockchain in my opinion. Personally, I believe the token economics and the incentives they drive is the secret sauce. Elad Verbin of Berlin Innovation Ventures created a qualitative X-Y axis to characterize blockchain projects in accordance to its incentive automation as well as latitude of potential actions. See Elad's original post. With CanYa, a user can refer others, post their services, hire others, etc. With so much latitude, I put CanYa right up there with Steemit. Basically, the top right corner of the chart below can be thought of projects that have a very hard incentive design ahead of them.My final thoughts

I personally do not own any CanYa. But after reading through their project I was impressed by how thorough it was. They featured a very well written legal disclaimer. They clearly laid out CanYaCoin as a utility token, not a financial instrument (much to the chagrin of the average crypto speculator). They even listed a 5 year expense breakdown (who does that in crypto!). They're tackling a problem that has a number of specialized behemoths (Uber, AirBnB). But I think there's plenty of room for CanYa. Different regions, different niches all have to be taken on. I do not see one player claiming this as a "winner take all". In fact, I'd prefer my investment to be "winner take (sm)all" - meaning, they are super dominant in the specific niche they are taking head on. I am personally most excited about the behavioral economic dynamics with CanYa. As mentioned above, they have a very difficult incentive roadmap to build.I wish them the best of luck.

If you like my content:

Other posts:

- Please consider donating. My blog's ethereum address: 0x1ea7ab9acd4294d32bb0c790dd08a66640342680

- Follow me on Twitter (@CryptoQuantalys)

- Blockchain: a game of tradeoffs: a framework for understanding blockchain

- Alchemint

- Loki Network

- Qtum

- Waves

- Banyan Network (BBN)

- Why we need regulation

- Token economics

- ICO paradox

Coins mentioned in post: