What if the bitcoin bubble bursts?

Is the latest frenzy like tulipmania, a gold rush or the dotcom boom?

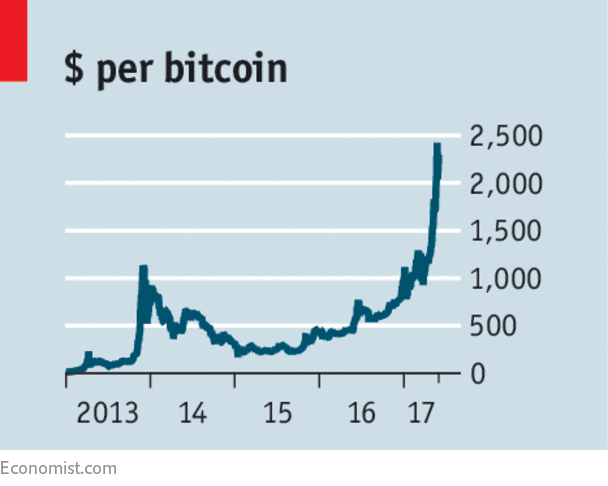

MARKETS frequently froth and bubble, but the boom in bitcoin, a digital currency, is extraordinary. Although its price is down from an all-time high of $2,420 on May 24th, it has more than doubled in just two months. Anyone clever or lucky enough to have bought $1,000 of bitcoins in July 2010, when the price stood at $0.05, would now have a stash worth $46m. Other cryptocurrencies have soared, too, giving them a collective market value of about $80bn.

Ascents this steep are rarely sustainable. More often than not, the word “bitcoin” now comes attached to the word “bubble”. But the question of what has driven up the price is important. Is this just a speculative mania, or is it evidence that bitcoin is taking on a more substantial role as a medium of exchange or a store of value? Put another way, is bitcoin like a tulip, gold or the dollar—or is it something else entirely?

Start with the case that this is nothing more than a virtual tulipmania, a speculative hysteria in which a rising price encourages ever more buyers, no matter what the asset is. Bitcoin’s recent trajectory certainly seems manic. Retail investors have piled in. Many already familiar with bitcoin investing have moved on to bet on alternatives, such as Ethereum, and “initial coin offerings” (ICOs), in which firms issue digital tokens of their own.

It looks like a scammers’ paradise, yet unlike tulips, bitcoins have real uses. They now buy everything from pizzas to computers. So if a tulip isn’t the right analogue, how about gold? Bitcoins certainly seem to bear more than a passing resemblance. Goldbugs mistrust governments and their money-printing tendencies; so too do bitcoinesseurs: no central bank is in charge of bitcoin. But a store of value should not bounce around as much as this one does: bitcoin swung from more than $1,100 in late 2013 to less than $200 a year later, before climbing, in fits and starts, to its current dizzying heights.

Rather than being just a form of digital gold, bitcoin aspires to loftier goals: to be a means of exchange like the euro, yen or the dollar. Regulators are starting to take bitcoin seriously. Some of the price surge can be explained by Japan’s decision to treat bitcoin more like any other currency. Yet the bitcoin system is operating at its limits and its developers cannot agree on how to increase the number of exchanges the system is able to handle. As a result, a transaction now costs nearly $4 in fees on average and takes many tedious hours to confirm. For convenience, a dollar bill beats it hands down.

Not so dotty

If bitcoin and the other cryptocurrencies are unlike anything else, what are they? The best comparison may be with the internet and the dotcom boom it created in the late 1990s. Like the internet, cryptocurrencies both embody innovation and give rise to more of it. They are experiments in themselves of how to maintain a public database (the “blockchain”) without anybody in particular, a bank, say, being in charge. Georgia, for instance, is using the technology to secure government records . And blockchains are platforms for further experiments. Take Ethereum, for example. It allows all kinds of projects, from video games to online markets, to raise funds by issuing tokens—essentially private money that can be traded and used within these projects. Although such ICOs need to be handled with care, they could also generate intriguing inventions. Fans hope that they will give rise to decentralised upstarts taking aim at today’s oligopolistic technology giants, such as Amazon and Facebook.

This may seem like a dangerous way to generate innovation. Investors could lose their shirts; a crash in one asset class could spread to others, creating wobbles in the financial system. But in the case of cryptocurrencies such risks seem limited. It is hard to argue that those buying cryptocurrencies are unaware of the risks. And since they are still a fairly self-contained system, contagion is unlikely.

If there is such a thing as a healthy bubble, this is it. To be sure, regulators should watch out that cryptocurrencies do not become even more of a conduit for criminal activity, such as drug dealing. But they should think twice before coming down hard, particularly on ICOs. Being too spiky would not just prick a bubble, but also prevent a lot of the useful innovation that is likely to come about at the same time.

Hi !

This is an automatic message.

According to SteemData, you have now used #introduceyourself 33 times.

You might not be aware of this, but #introduceyourself is mainly used by new accounts, to introduce themselves once. Please consider other, appropriate tags.

Hello, thank you for taking the time to create this post. It appears to be in the wrong category. You have tagged this post into one of the introduction categories, but it does not appear to be an introduction. For any error in this assessment I apologize, you have not been flagged.

If you need help finding new tags, please review the sortable list at https://steemit.com/tags , there you will find many options that are very active with their own community. If you would like to post into introduction tags, feel free to do so on the premise of telling everyone more about yourself, even a whale can tell us more.

Thank you for reading this message. STEEM ON!

This is really informative, I'm questioning if this bubble will ever burst but I don't see it slowing down at all!

Have you looked into the other currencies besides Bitcoin for now? And what are your thoughts?

Ltc is good but i guess bitcoin is the best as it is more vast then ltc

Welcome to Steemit @rubal :)

Make sure to participate in this weeks giveaway to get known in the community!

Here are some helpful tips to get you started:

@reggaemuffin, the creator of this bot is a witness. See what a witness is and consider voting for the ones you feel are good for steem.

It's not going to

https://steemit.com/bitcoin/@yoda1917/what-the-f-ck-is-happening-to-cryptocurrency-valuations

It will really... And i dont support ur many points and future will be good judge so wait and watch...

It's too tiny to burst man in the total finds.

But then, what do you think will happen if it does burst bro

Welcome to the community. your introduction was very nice. Followed. Follow me back 😘

Welcome to the community. your introduction was very nice. Followed. Follow me back 😘