Lessons From My First Day of Trading Cryptocurrency

After spending a couple of weeks watching technical analysis videos, and reading various articles on the subject, and on cryptocurrencies in general, I knew it was time to get started with some firsthand experience.

So far, I've spent two days watching and waiting, and a couple hours actively trading, and managed to lose six bucks in the process, including credit card fees for buying in. I couldn't be happier: If I'd won out in the trades I made, I wouldn't have learned anything. Worse still, I might have learned the wrong lessons.

I chose to trade Litecoin for the same reason I chose to trade cryptocurrency: I don't have a lot of money to start with. Volatility is the key here. I'm just not going to see any difference if $2,500 BTC moves by $5, but if $50 Litecoin moves that much, it's a 10% swing.

In my first day of trading I learned a lot of lessons that I had heard before, but that never stuck until if felt the sting in my pocketbook. First, I learned to pay attention to BTC (even though I'm not trading it). Second, I learned to set my stops significantly lower (I got picked off on little dips a couple of times in 2 hours). Finally, I learned to keep up my situational awareness, and to always know what's happening on the hourly and longer-term charts (I got lost watching five-minute sticks).

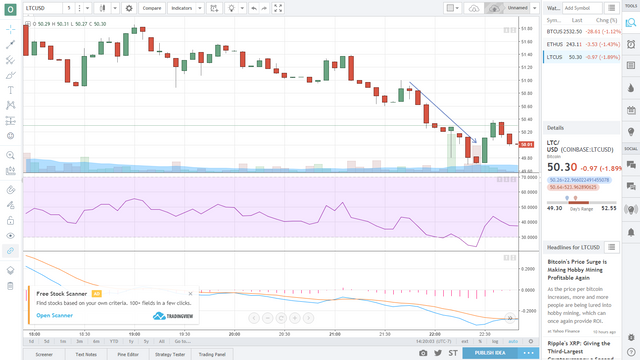

I spent hours watching the LTC chart, waiting. My first mistake was not to realize that I was watching a market that was acting like a derivative: the LTC chart was following the BTC chart.

Here's the LTC chart I was watching:

From this perspective, the bottom of the slide caught me off guard, and I didn't figure out to buy in until after the rebound.

Here's the BTC chart for the same time period:

If I'd seen this chart, with it's obvious slump, I might have acted differently. I'm not sure what my move would have been, but it would've been nice to have had the information.

Another of my teething pains was learning where to set my stops. When they say to set your stops below the line of support, they mean quite a bit below, not one cent below.

I spent some time chasing the bulls after I lost that stop (yet another lesson learned) and had yet another inappropriate stop picked off before finally selling a bit above my original purchase price--but not before losing more than I gained through poor stop choices.

Possibly my most painful error was getting lost in five-minute charts, and ignoring the longer term charts.

This chart looks like a relatively good buy opportunity at the bottom of a slide, where the RSI dips below 30 and the MACD lines cross:

But the same point, displayed on the hourly graph shows a completely different situation, with the RSI way up in the 50s and the MACD just beginning to cross downward.

Taken back even further, and looking at BTC instead of LTC, We can see even more clearly that this was not a good time to be looking for a buy opportunity.

Looking back at it, I really am glad I got in where I did, made the mistakes, and learned the lessons. Starting out here, with minimal funds is a perfect learning opportunity. Had I started out in April, when everything was daisies and chocolate, I would have been just as unprepared for this slump, and would have had a lot more money on the line. Not that I don't regret waiting. At all.

very informative post..wishing you all the best in cryptocurrency

Thanks!

Thanks for the post. Upvoted! Wishing you best of luck.

I am in the same place as you watching the same charts. FWIW, I was watching the LTC/BTC chart as well... also to decide if I exit to cash instead of bitcoin. My opinion based more on fundamentals than technical analysis (some on both) is that bitcoin will continue to trade sideways in a narrow range for the next few weeks until the BIP 148... so it might be convenient to keep some trading funds in Bitcoin.

Anyway, what trading platform did you decide on (and why if I might ask).

A last piece of advise for you on LTC is about the asian dominance of this. 2/3 or more of the market cap volume is in CNY and KRW... so you might want to watch the trading in these currencies and be aware of time zones wrt to LTC trading.

FYI a recent post of mine has some fundamentals "news" on LTC if you are interested:

https://steemit.com/cryptocurrency/@dylan.schickel/litecoin-in-a-major-pullback-thoughts-and-questions

FYI... as a example of the asian dominance of LTC... look at this: )![]

)![]

(

LTC broke out of the decending triangle pattern upward and was struggling to break the dual psychlogical resistance at 50 USD/350 CNY when the asian bear volume came in at 1830 (USA EDT) on the chart and down we go.

From my novice read, the next resistance is down around 44.50 USD... we shall see. Trade on...

Thanks for the info, and I'm glad you enjoyed the post! I did notice the timezone issue, but hadn't put it together with Asia. Very interesting. I'm currently trading on GDAX, just because of the ease of moving currency from coinbase. I'm not entirely attached to the platform, but I haven't seen anything to put me off it yet.

Thanks for your good posts, I followed you!

Congratulations @ohmslawn! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - Quarter Finals - Day 2

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes

Congratulations @ohmslawn! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!