SBD Supply Revisited

In case anyone was curious about the recent conversion affects on supply, I've been periodically recording the data continuously about twice a day and dumping them into a spreadsheet.

I first posted about it here, and from the looks of it, nobody informed me whether someone else was recording this data or not, so for now I'm still in the dark there. But someone had mentioned wanting to see this information, so I updated the public spreadsheet and made a chart.

The public spreadsheet is viewable here and the third tab contains a chart with the current filter I happen to have set up. Feel free to copy and make your own.

Initially the table was populated from coinmarketcap data, but then I fillled in with my own data.

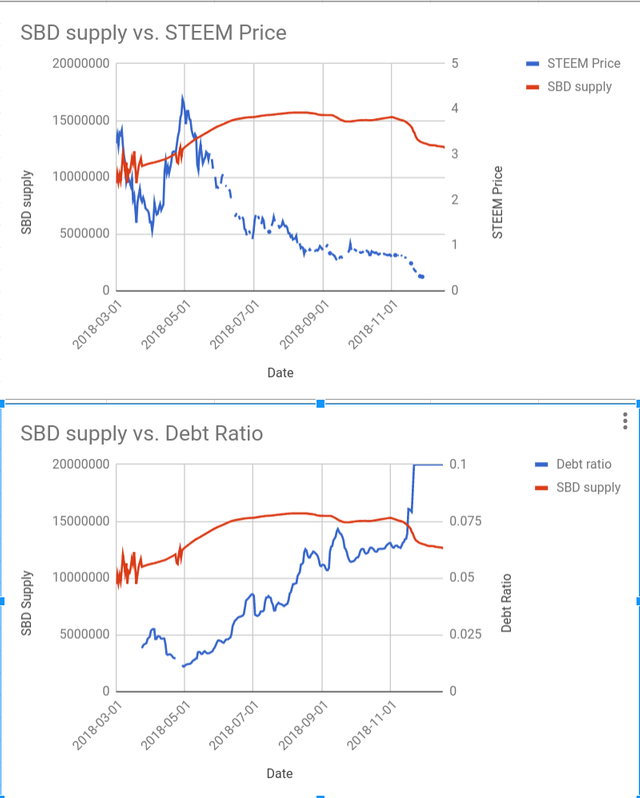

Here's a screenshot of the chart:

The end lists a supply of 12.5M and a peak of 15.3M for SBD supply. Price data isn't super accurate, the cryptofinance add-on for google sheets seems to be flaky as of late.

Also, you'll see two humps. The first decrease is likely when the SBD peg fell off and conversions started happening, and the increase is attributed to HF20 when we bumped the ratios for the start/stop printing rates to occur in the 9-10% range. As you can see from this graph, anyone who says that this 9-10% bump did anything at all does not know what they are talking about. The supply never reached the same height, and in fact, the supply went down as more conversions happened. Which means that the debt ratio hitting 10% is attributed to solely the STEEM price.

But you'll see that the debt ratio has hit the 10%, and I remember vaguely whisking past posts worried about STEEM flooding. Rest assured-- the protection is in place that STEEM supply cannot be overwhelmed by conversions (just imagine if we were still respecting 1$ worth of STEEM on payout... the amount of STEEM would be unbounded....). Yes, STEEM supply is still affected by conversions, and may give downwards STEEM price pressure, but the extent at which it will affect the overall STEEM marketcap is limited.

Hmm.. when I get around to it I suppose other data of use is the SBD price and current effective peg price. But anyway, that effective peg price simply rises and falls at same % as STEEM price in the current state of affairs, so it's not super interesting, and it's not really worth playing around with arbitrage with respect to market rate vs peg rate because of the 3.5 day median and the low SBD liquidity. I could get into this more but I feel like what's the point. If you're long on STEEM though, suffice it to say that SBD will return to 1$ (and possibly more...) when things recover.

Makes me wonder why I don't just snap up some SBD and park it... though my goal is to get more STEEM, not get a 2x return on USD (and yet it is still a risky maneuver, in the event that long positions don't work out).

Addendum, code block:

const fs = require('fs');

const steem = require('steem');

const rpc_node = 'https://api.steemit.com';

steem.api.setOptions({ transport: 'http', uri: rpc_node, url: rpc_node });

setInterval(() => {

steem.api.getDynamicGlobalProperties(function(err, result) {

const row = result.head_block_number + ',' + result.time + ',' + parseFloat(result.current_sbd_supply) + ',' + parseFloat(result.current_supply) + ',' + parseFloat(result.virtual_supply);

console.log(row);

try {

fs.appendFileSync('sbd_supply.csv', row + '\n');

} catch (err) {

// nothing

}

});

}, 1000 * 60 * 60 * 12);

running continuously with pm2 on my puny remote server somewhere out there...

I keep a close eye on the SBD supply even though, like you, I'm more interested in holding vested STEEM. The SBD peg is a valuable gauge of market health. It should come back well before STEEM returns to its previous highs. In fact, the peg was broken when the market was hitting its high mark, too. That was actually more distressing because it didn't make any sense. When people were buying $8 SBD they clearly had no expectation of getting $8 worth of returns.

The current prices seem rational given the risk and the haircut on conversion. I would like to support the SBD market by buying and holding, but I am afraid when the peg starts working again the STEEM price will be well over 2X what it is now. I can almost guarantee it.

Posted using Partiko Android

I have similar thoughts here. I remember jokingly thinking to myself that the value of SBD is a sanity check on the market. If it's well over 1$, it's just crazy. Now it's well below 1$ and is a troubling signal. Let's recover to a more normal state soon!

Thanks for putting this together visually! I was an example of someone who was buying SBD to immediately convert given the arbitrage opportunity. While I used it to power up it could be games for profits but as you say the haircut is doing its jobs on not allowing it to be worth it at a certain threshold. In fact, given the 3.5 day period needed it is a risky proposition which could lead to losses which is probably why conversions had stopped and SBD price is now more correlated to STEEM price.

Posted using Partiko iOS

Yeah, the amount of steem you get is going to be roughly the same per SBD (depending on supply fluctuations), so it makes sense even from that. So I'd rather buy the steem directly. If the market price of SBD was wildly off the haircut price though, I may revisit. But even so that 3.5 day period is killer.

I also converted when we weren't in haircut range. Much easier to reason about.

Would be cool to also see Steem supply graph here

I worked on plotting it, but it isn't so interesting. It's in the linked public spreadsheet if you want to hover over the chart to see the values themselves.

Yeah, that doesn't really work. Hard to see any differences or if there's any relation at all. Sadly I'm not a graph guy myself at all so can't say how this could be made to work.

@paulag ?

I’ve a degree in economics and I still can’t get my head around all of the above . Il have to read this a couple of times to get it in my brain. Really interesting though. Not enough people write about this stuff . @eonwarped you are a crypto companies wet dream. Coding and business acumen.

Hi @eonwarped!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 4.807 which ranks you at #1349 across all Steem accounts.

Your rank has dropped 1 places in the last three days (old rank 1348).

In our last Algorithmic Curation Round, consisting of 391 contributions, your post is ranked at #43.

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

Thank you so much for participating the Partiko Delegation Plan Round 1! We really appreciate your support! As part of the delegation benefits, we just gave you a 3.00% upvote! Together, let’s change the world!

Where do I see what the debt ratio percentage is? Do you know what the ratio is right now?