The US Dollar vs. the World Economy - Battle Royale

Many people watching the US economy feared the worst for a Trump presidency. As Trump made comments in the news and in debates, the media told us it was bad, and the US economy took little hits. If it seemed like Trump was getting ahead, the US dollar would dip as a sign of fear that he would win.

Alas, the reverse emerged, as the markets boomed with the news of Trump winning the election.

What is going on? At first, Trump winning is bad, as it made the US dollar go down at signs of his increase in electoral choice among the populace. Then, when he wins, the reverse happens.

One thing this can indicate, is of media and market manipulations of some kind. If Trump was actually bad for the US dollar as was indicated when his popularity rose, then winning would have been the reality instead of mere popularity rising. The other thing this points to, is how the value of a currency is largely based in belief, with it being sustained, and not collapsing, based on the trust, loyalty and faith derived from the belief in value.

I have talked about this aspect of all currencies before. The value of currencies might not actually reflect real world existing assets that give it value in the first place. The value might be in some part based on illusions of smoke and mirrors...

The Federal Reserve will likely raise interest rates later in December, given the strengthening dollar. Now the US economy can handle it. This will make the dollar even stronger.

As the US dollar goes, it might be good at first, but there are other factors to consider, like other currencies and economies in the world.

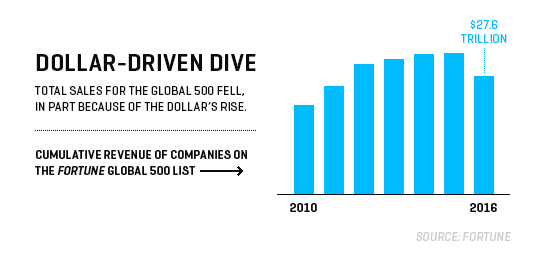

Overall, companies in the world don't do so great when the US does dollar does great. Borrowing to boom your business, is not as much of a breeze.

Those who hold debt, will be in trouble, like Brazil, Chile and Turkey who have been hit with the rising dollar. They might not be able to pay the interest rate, default on their debt, and further impact their economies. What happened in Greece can happen elsewhere. With enough pressure, bubbles pop.

When people or countries borrowed on cheaper US dollars, with low interest rates, there was an inflow of capital to push local assets up, which encouraged local borrowing. However now, the reverse is happening. With a rising dollar, debt cost rises, interest on existing ones rise, and the inflow shrinks and asset price values fall.

Trump wanting to impose more restrictions on trade with China and Mexico, have some people worried about the future of the US dollar, and the world economies impact from the effect of the US dollar.

As it is, the muscled up US dollar will continue to have a short term gain, with a likely long term elastic rebound effect when the rest of the world economy can't keep up to to trade with the US. Unless the US becomes an island of self-sufficiency unto itself, which might be what Trump wants, then the US won't be able to survive a booming dollar when the other countries can't afford to trade with it. This will send the dollar in a reverse direction since it won't be used in the world economy as much.

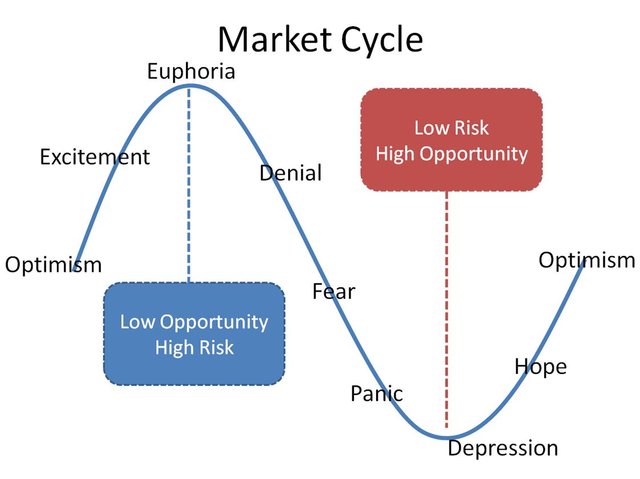

Cycles

Up and down we go with the market cycles, or at least it seems. That may be a primary factor int he psychological determination of how people create market situations. But perhaps it's not so linear and sideways either...

What is more likely though, is that these cycles are more of a vortex spiral helix, an oscillating frequency in time that goes forward but loops back and spirals in on itself as it goes downward further and further.

It's not just a circle where we end up back where we were. That would be neutral in the end.

What we may be doing, is spiraling downwards while it appears that economic cycles.

Currency Value

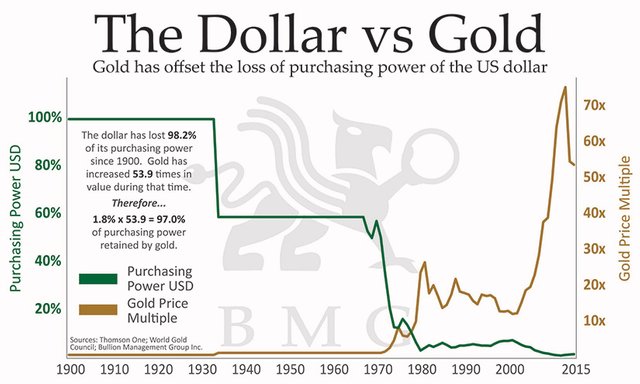

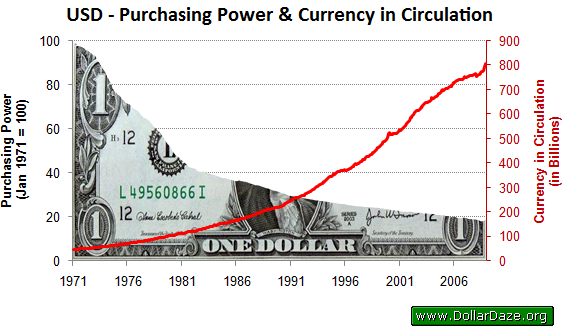

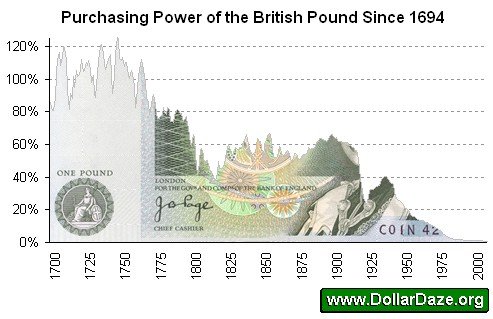

To understand what I mean, take a look at these charts.

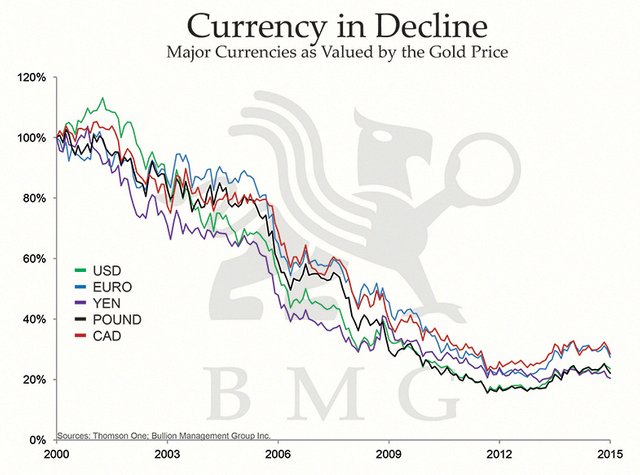

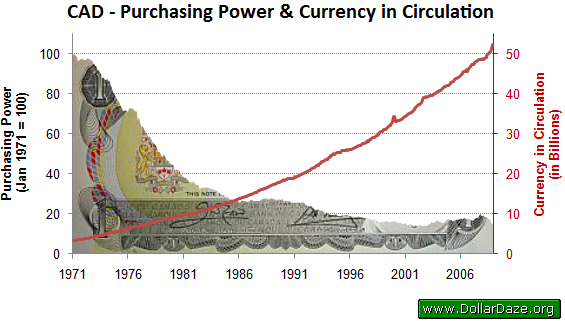

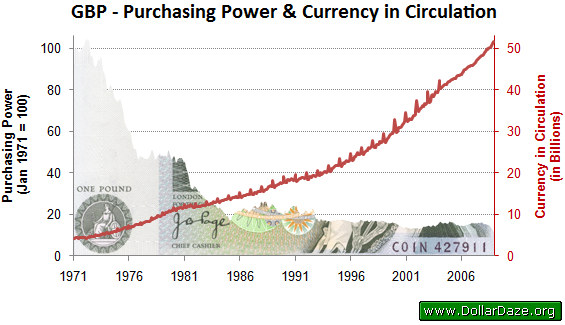

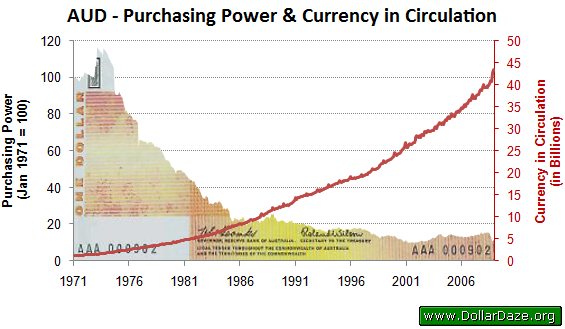

That's only the US, here's some more currencies:

Still not convinced right? Just the past 15 years... and only against gold, right? Like, who cares about gold?

Ok, I feel ya... here we go!

These show the value of major currencies over a longer period of time, and not dependent on gold.

Did you notice something?

Did you notice how the value keeps dropping or levels off, and yet more and more of the currency is created. More of it gets created, and it becomes worth less. Now, if things worked properly, the amount created wold be balanced by actual value in the real world, a 1:1 representation with reality, meaning the value and purchasing power would not go down or fluctate by much when the currency would need to slow down or catch up to the real world value. But like I said, things aren't based in reality for the economy we have, it's largely based in belief and faith.

To further emphasize my point about it not being simple linear cycles going up and down. Let's look even further back in time and see how the cycles don't just move up and down within the same constant range, simply moving left to right. They also go downward into a negative progression to where we are now...

Nope, we are going up and down, but at a downward angle. Rather than actually pop our bubble of unreal economics we have been living in for decades and longer, we choose to keep rebuilding our deluded house of cards and keep putting off the eventual correction that is required to properly value what exists in reality. The fantasy fiat currencies are in for a shocker. All fiat currencies in history have ended in self-destruction.

It's a bubble, inflated by our hopes and faith in a dream of easy money. People have been warning of this for decades. Sound economics has gone out the window for a while, and it seems to just get more ridiculous. The bubble from the 80's was propped back up to 2000 and popped. In 2000 the bubble was reinflated, then popped in 2008.

And now it's being expanded more, while each time in previously partially popped, it never popped all the way, we never hit rock bottom to correct things properly. When we do finally choose to heal, we are going to have to fall very low to a bottom we haven't felt in over a century, or more.

The sugar coating though... is that these bubbles and the faith and belief we have to simply prop our failed economic back up again, can be repeated over and over until we destroy ourselves. If we keep doing the same things, making the same mistakes, things will keep repeating, these cycles will keep going, and we will keep falling lower over time. The higher we climb, the further we have to fall.

None are so blind as those who fail to see.

It's time for us to open our eyes, to realize the real lies with real eyes.

Thank you for your time and attention! I appreciate the knowledge reaching more people. Take care. Peace.

Payout Selected

Payout SelectedIf you appreciate and value the content, please consider:

Upvoting  , Sharing

, Sharing  and Reblogging

and Reblogging  below.

below.

@krnel

2016-12-04, 4:46pm

I disagree with this statement: "we are going to have to fall very low to a bottom we haven't felt in over a century."

I would amend it to say that we are going to have to fall very low to a bottom we haven't felt since the fall of the Roman Empire when the cities had to empty out into the countryside because the supply chains broke down.

Totally agree. I made an correction that originally in the editor, and then posted a different article instead over it, and the one I had saved on my computer didn't have that addition of ", or more." Thank you for the feedback.

"The Federal Reserve will likely raise interest rates later in December, given the strengthening dollar. Now the US economy can handle it. This will make the dollar even stronger."

Hmmm, well that is interesting. To early for QE4? One could say that because of a strong dollar an extra stimulus package could not hurt the US economy. Or perhaps fight deflation due to the strengthening of the dollar.

We'll just have to wait and see.

Good work @krnel

Yup, anything is in the air, but there are high expectations given they didn't the last times this year. Thanks for the feedback.

Quite an insightful post, those graphs are real eye openers. It seems the nations of the world are all in a headlong race to the bottom. This reminds me of a comic I read once regarding the stock market. I can't remember the exact source, but it had a tag line that went something like "the extent of our profits is determined by the strength of our delusions". The only reason currencies work is because people believe that they will. When people stop having faith in their national currency, then that's the beginning of the end.

Yup, a house of cards propped up by faith.

So the actual purchasing power of the dollar is about 1.8 cents...I wasn't far off I had it figured just over 2.

Hehe, yeah depending on where you look in history, it's quite a drop anyways though.

I kinda did the math in my head based on the dollar being worth 1/35th oz of gold compared to what gold is worth now...it comes out to around 2 cents roughly!

No one predicted what was going to happen.

Now that it's happened

People continue to make predictions...

I agree @everittdmickey. There is no single cause of market movements like election day, other than the combined behaviour of everyone participating in the market.

You weren't able to see what was coming? Does that mean that you are totally unprepared?

that's not what I said.

for those of you not already reading Martin Armstrong's blog, I highly recommend it...

https://www.armstrongeconomics.com/markets-by-sector/precious-metals/gold/stock-market-crash-gold-rally/

Very good analysis :-)

I've been investing in low value currency to make a healthy profit once they turn around, mainly the WW2 era German mark

Nice Post!

Great info.