The Most Important Information in Modern History That Mainstream Media Chooses to Ignore or Are the Financial Reporters Really That Ignorant?

My last article on Steemit was picked up by an alternative news website called The Last American Vagabond and talked about sweeping things under the table and I believe the smartest financial reporters have tried to report on this but have been told 'let it go'. It is way over the heads of the rest of the reporters. Yes, this is about money so lets follow the money and discuss why it is the most important thing we can manage in order to pull people out of poverty globally.

Firstly, I will show you where the money is and who controls it. Then I will discuss why it is so important and how we can change things to get the maximum bang for our bucks using techniques that promote transparency and community such as the new blockchain technology. That is correct processing power is going to bring a revolution with computational trust.

A little about me first, I am not too sure why I am championing, 'the revealing of these facts' as if, maybe the emperor has no clothes. My career started as a pizza delivery driver.

I stuck that out until I owned the company which included doing my own bookkeeping. I went on to owning many other small companies and continued to do my own bookkeeping. My last 10 year gig as I mentioned in my introduction on Steemit.com was in the Finance & IT department of the worlds biggest company. Why I mention this is because as I was learning bookkeeping and taking bookkeeping courses I got a real good understanding of generally accepted accounting principles. In my 35 years of accounting only a few times did I almost fall out of my chair when I heard of these new rules: Short Selling; Mark to Market Accounting and HFT high frequency trading.

The following information is based on an extremely in-depth study done by 3 PhD's; Dr. Stefania Vitali, Dr. James B. Glattfelder, and Dr. Stefano Battiston all from the Swiss Federal Institute of Technology in Zurich.

I noticed that this study was barely reported on by mainstream media and has had no follow up studies. As proof, this is probably the first time you have read about it. Yet, in my opinion, is the most important thing on the planet for bringing people out of poverty – it is money! Lets follow the money and pin point fraud and waste so we can reallocate that huge resource. My guess is there is 5-15% of global Gross Domestic Product (GDP) that is wasted on the wealthy and finance processes.

Mainstream media, rating and regulatory agencies and accounting auditing firms have not dwelled on this because their agencies and shareholders are part of those that benefit. Luckily, thanks to the internet and new ways of sharing information, this have been discovered. Example, Greg Hunter (USA Watchdog), an independent reporter formally from CNN and ABC has moved to a platform on YouTube and now has more views than most CNN anchors. All this while he does no get paid by shareholders but by reader donations and YouTube advertising streams. We will come back to why this is important, but we will drill down on the study for now:

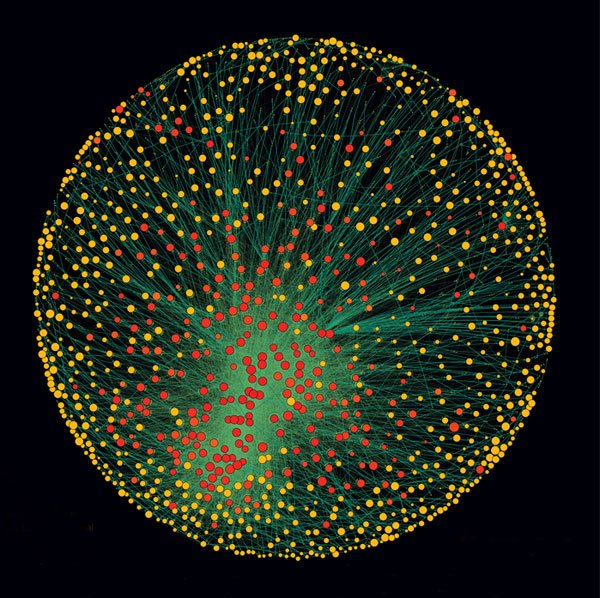

This 36 page intensely detailed study of the data set shows 147 companies own 40% of the shares of 43,060 transnational companies.

Now why is it so profoundly important that the media or any industry is not owned or controlled by a few? Pretty obvious; they may have a conflict of interest. Don't get me wrong, we have excellent reporting in the world, the best money can buy; on emergencies, entertainment, weather etc., but just not on this most important item. We have lots of great things going on in this supposed free market. We just need to take the fraud and waste out and that fraud and waste resides at the very top of the corporations control! I know it gets complicated but please stay with me even if the rabbit hole goes real deep.

Let's start with the one mainstream media article I found on this revelation, from New Scientist. Just look at how they named the study; “The Capitalist Network That Runs The World”. Sounds pretty gentle, just how the world should be, capitalism runs the world. Nothing negative is mentioned about the few that really make the decisions especially via proxies, in the title. Remember 62 people hold more wealth than the bottom 50% of the world. I boil it down to under 100 people making all important big money decisions for the globe.

The image above has real connections of ownership and this study should be done annually and forced by the public to move in the trend of fairer equity distribution. From the study, I quote;

“relationships between 43,000 transnational corporations has identified a relatively small group of companies, mainly banks, with disproportionate power over the global economy”

Make sure to read that twice! This in my opinion is profoundly important to know if we are going to be able to change things. It is to follow the money. Going deeper in this type of analysis would help form better decisions and rules in making global economics more stable and therefore less likely to cause volatile swings. This definitely would go a long way to prevent the connected few front running you in wealth transfer through their investment companies.

This is not to be taken lightly, the 36 page study is the largest most comprehensive study of its kind in history. And it has mostly been ignored by mainstream media!

The results starts from a list of the worlds largest companies from a sample of 30 million. Yes huge, 30,000,000 in a data set called Orbis 2007. They zeroed in on a smaller subset group of connectivity as it represented 94.2% of the total Transnational Corporations operating revenue. Make sure that sinks in 94%! To get to the bottom line the concentration of control their study pointed to the top 80% of total control. That means 737 companies or holding companies accumulate that 80%.

This part is crazy: That network of control also shows it is more unequally distributed than wealth. Top ranked companies hold 10 times more control than expected based on wealth. In other words, despite its small size the core holds a large fraction of the total control.

This needs to change! Download a copy of the full study here before the link is taken down should you want to report deeper on it.

I call on the entities like the Brookings Institute, Mises Institute, Fraser Institute, Rand Corporation, antitrust agencies and the Federal Deposit Insurance Corporation (FDIC) to get their head out of the sand. To start building back their credibility and annually fund these studies. Spread the information, demand a direction change for a more decentralized corporate world! With recent record mergers and acquisitions because of near zero interest rates, the control has become more condensed. The public needs to demand change. The FDIC says one of their core missions is “Expanding Economic Inclusion For The Under Served”. The best, quickest and easiest way to do all that is to increase competition and decentralize global corporate control – period.

One radical and sweeping simple change would be to change the 'corporation act'. An easy change requiring all publicly traded companies to have a percent of voting shares held by employees and the communities they operate in. This would force the board of directors to listen to what the employees and community are saying very seriously while sharing the profits at large.

The above study concluded that a group of 147 companies has almost full control over itself and they refer to it as an “economic super-entity”. The study also makes note that 75% are financial enterprises.

This has made the world entrenched with too big to fail actors therefore reducing global economic stability. In other words, they are very densely connected and prone to systemic risk! I suggest your money is at risk right now and you should move your investments or pensions to the least risky assets. Please note I am not a financial advisor and suggest you seek one for all your needs but in my opinion they are paid for by corporations and live off your fees, and so totally present a conflict of interest. There is power in the individual and the first thing you could do is shop local and or avoid all national companies. Next, you could take your money out of the bank and put it in a lock box or buy physical silver. The banks are stealing your money with fees, inflation and fraud. Banks are allowed to leverage your money and put everyone at systemic risk by at least 10x so for every $1,000 dollars you take out you hit that bank by $10,000! Hit em hard folks and take these felons down.

Where it really breaks down is mainstream media does not report nearly enough on bank fraud, military spending and the fact that only a few in the extremely powerful super-entity controls the money. The super-entity owns the media. Remember the world is a pretty good place and the system has taken hundreds of millions out of poverty, brought about productivity gains and technology that has been incredible but over time greed has crept in deep and eroded the already shaky rigged system to its core.

I just think it is time to take the conflict of interest away by making things more transparent and exposing the fraud like the war on drugs for what they are, a means of controlling the money, people and corporations. As David Stockman former director of the Office of Management and Budget under President Reagan, says in his new 2016 book called Trumped; "there is a $45 trillion dollar bubble".

The existence of an economic super-entity as the study authors call it has never been documented before. I suspect that control is less now than a hundred years ago but I don't know that. The fact that these large data sets have only recently become available has restricted antitrust institution actions and pretty much went unnoticed. I suggest it is time these organizations are forced to act on this information. It has been proven small cross-shareholding companies can effect market competition. It seems to me to be common sense as we just look around. We don't see too many price wars at our local gas stations, utilities, banks, etc. Is it because they have the same shareholders and are either conspiring or simply a wink and nod, or is it the smart way to make more money? Back to following the money and it all makes sense.

The worlds largest 49 holding companies are financial companies and their few leaders control markets. So you may see different logos such like Shell, Esso, BP or Coke verses Pepsi but really these leaders set the companies tone and direction. To me this is a near monopoly with different logos floating around.

To quote from another study done by Oxfam February 2016:

“CORPORATE DOMINATION

A lack of competition presents opportunities for companies to set prices that enable them to extract returns over and above real value and productivity. Examples include household names such as Google, which has 69 percent of the global Internet search engine market and in 2014 reported profits of $4bn. Google not only defines how the Internet is used but also has a major influence on data protection laws around the world. Other monopoly companies are less in the public eye but nevertheless have a significant impact on people’s lives. Some 80 percent of the corn harvested in the US is genetically engineered by Monsanto, a company that also dominates the global research agenda for genetically modified (GM) crops and their safety standards. These corporate behemoths not only have the power to set prices to maximize their profits, with little threat of competition, but they also influence the politics of these markets, which has a much further- reaching impact on societies. Small retailers also pay a price for corporate dominance. In the US, the Justice Department is currently probing allegations that AB InBev is curbing competition by buying up distributors, making it harder for micro-breweries to get their products on to store shelves.”

Wonder why the Oxfam study did not mention banks (finance) or petroleum companies or the few who really control the big decisions. These 49 chairman of the boards for the largest holding companies set the tone and direction for all the largest institutions on the planet! This is extremely hazardous and they have placed themselves too big to fail systemically to protect their wealth.

This knowledge should make you sick to the stomach and furious with outrage.

Awareness is our first defence as you are also a “Powerful Individual”, the same rule-of-law for rich and poor is our second defence. Insisting on the equality gap trending in the right direction is paramount. Solutions are easy but seems complicated but not when you follow the money - just a few simple changes and a much more stable economy would develop.

I believe the next crash is soon but always could be delayed by extending what I call fraudulent zero or implementing negative interest rate policy or even money printing. This crash will hurt so much, I expect a 40-70% lost in value on riskier parts of pension holdings. People will finally scream for transparency. Accounting firms, rating agencies, clearing houses and government will be forced by a vacuum into computational trust. All other trust will be subject to suspicion. What is computational trust? My next article will go into a more detailed deeper dive down into computational trust, transparency, audit trails and technology security.

Should we allow a few to hoard the wealth in castles so big you won't believe, see images below. I wonder how much money they have tied up in paintings worth hundreds of millions or a store of gold in case the markets or a hostile government decides to seize their business holdings. This just screams for a consumption tax, estate tax and or luxury tax.

Here is a further comprehensive read on topic for those interested unfortunately it is in German. Michael Maier: Die Plünderung der Welt ISBN 978-3-89879-853-2.

Two Rothschild properties above

If I have helped you understand or you learned something please follow me and you can read my introduction here, my other posts or my favorite on trust.

I am using Steemit as it is user friendly for this type of information sharing.

Hey man , my altcoins going up like crazy. Do you think there will be big dip before august 8??

Nope.

@greenman AMAZIN pic!!!!!!!!

I love those pictures ... Awesome

that post really help me. Thanks For Share @greenman

that post really help me.... I'll look forward to your future posts...

Thanks for writing, Paul. Upvoted. But you should have mentioned that the Swiss "Glattfelder"-Report was already published in 2013. There is a book written in Geman which treats all this stuff comprehensively:

Michael Maier: Die Plünderung der Welt ISBN 978-3-89879-853-2

Further, what are the implications for each of us?

That's a topic I reflect on since many years. Surely worth to publish a post here in the next weeks.

Greetings Christian @freiheit50

Thanks, that is exactly the type of feedback I am seeking!

I added mention of the German book to post.

Great post. What are your thoughts on the Pareto principle and do you think it applies here and to "human nature" in general (whatever that is)?

I'm not convinced economic inequality is automatically bad (and I don't think you're saying that either). I think the impact on human well being and morality/ethics is how we determine if something is "bad" or "good." There are certainly risks to consider as well. One thing I like to remind myself of is how "Corporations" are government created entities. Governments create non-natural monopolies via their monopoly on the "legitimate" use of force. In my view, many things corporations do (via government support) would not be allowed on a free, transparent market with accurate price discovery. I'm even okay with natural monopolies because it means resources can be better used elsewhere to create new opportunities. If customers are happy with the service and the price, other market actors won't jump in unless there's profit to be made.

Many see government as a benevolent actor with a moral mission to protect and nurture good actors in society. I'm not there yet, but I'm reading books I disagree with to better understand the other side. I'll look forward to your future posts and will resteem this for more visibility.

I really believe in the Pareto principle and used it when I was in business so now we have to move business shareholder control towards 80:20 and not 99:1.

I agree with you on monopolies not all being bad hence some nationalized utilities etc. have done good. I will review the Pareto principle. Thanks for you good comments. My main thing is getting awareness that this is how it is. Then each can make up their mind who and what to support. I don't like the deceptions.

Brilliant! Not only did you point out the problem in a clear detailed way, you gave a feasible solution that would do exactly what you say it would as far as I can see. following you.

Another great piece of advice!

and Balanced! I look at it exactly the same way. I am about to read some more of your posts. I won't leave any more crazy long comments like this. I just had to say more than "great post!"

Thank you - your great comments hit me emotionally!

Upvoted you :)

wow