POW Mining – Time to Get Out?

If there ever was an example of stupid money, the money that has moved into POW mining equipment this last year would be perhaps one of the best. On the other hand, if we ever wanted confirmation of the extremely unexpected price rise in Bitcoin and other POW Altcoins in 2017, that same equally unexpected rise in mining activity might just as well be one of the best of confirmations for that too.

Let’s look at the figures.

- Bitcoin’s price rose more than 10 fold, and its mining activity did the same.

- Litecoin was no exception with a 50x gain, and its hashrate did the same too.

- DASH’s price was more than 100 times higher by the end of the year, and its hashrate actually outperformed by ending the year almost 500 times higher!

- Groestlcoin was a 1,000x bagger, and even here, with a GPU minable coin, its hashrate multiplied by over 400!

And the list goes on and on.

People have thrown money at mining equipment with the same exuberance that they have thrown money at cryptocurrencies themselves!

Some might see this as confirmation of current prices. After all, if people are willing to pay the equivalent of 1 year’s mining proceeds (the average expected ROI time for most) in order to mine, then we certainly would have a very important demand source that corroborates price action, wouldn’t we?

Or would we?

Would it be the kind of quality confirmation we’d be looking for? Is it based on sound economics, or emotional irrationality? The P&L numbers suggest the latter, which, if the case, would actually confirm the opposite, which is to say, the worst of our fears that the POW sector of the crypto bull market is really based on lots of hopium.

Is mining POW crypto really a good business to get involved in?

Guess what?

On average, in 2017 you would have made more than 10 times as much money by directly investing than trying to mine.

That’s right, 10 times more!

Yes it would still have been a stellar mining year though. You not only got to ROI in just a couple of months thanks to the spectacular price rises, but you also made a nice chunk of money during the rest of the year – something never seen before, and likely never to be seen again.

BUT YOU WOULD HAVE MADE 10 TIMES AS MUCH BY SIMPLY BUYING AND DOING NOTHING ELSE!

Who in their right mind is going to invest in something that makes 90% less than what simply buying the raw material itself would make you?

Only stupid money would do that.

And I’m no exception. I bought state-of-the-art mining equipment in early January of 2017 thinking it would be a good long term investment.

I never dreamed that mining activity would rise just as fast and in equal proportion to prices.

Yes, I’m guilty of being stupid too.

Yes, I’m drawing from personal experience as well as from the widely available data whose numbers can be crunched by anyone willing to take the time.

At the beginning of 2017, I was fairly confident that crypto was a good long term investment, but I had no idea we were about to see one of the biggest bull markets in the history of mankind. No idea! I sold eventual big winners thinking I was making unbelievable profits only to shake my head in disbelief as I watched them climb even higher. I made lots of mistakes, but mega-bulls are thankfully very forgiving.

Everything was paying off big, but, as mining activity rose in direct relationship to price, I began to regret not having just bought outright instead of having dedicated an equal portion to mining.

Don’t get me wrong, I’m not complaining, even after having left huge sums on the table by taking profits too early or by buying miners that made only 1/10 of what my direct buys made me. Complaining about that would make me the biggest ingrate the world has ever seen. Nonetheless, I can and should learn from my mistakes, and just like I learned to HODL a little longer, I also learned that buying any more mining equipment was absolute insanity.

I don’t see the 2017 POW markets repeating, and, unless prices continue higher at similarly accelerated rates, there are going to be a lot of very disappointed miners in the future.

And God forbid that POW prices stagnate or fall.

Yet people continue to invest in mining equipment instead of simply buying direct, locking in a guaranteed 10 times better return on their money (regardless of how much things go up, it’s a fairly constant ratio).

I didn’t expect mining activity to increase at the same rate as prices. I was wrong. It has, and the lesson learned is that this will likely continue, leaving miners looking like idiots, at least until POW prices turn south, when they'll simply become losers hoping other losers will quit before they do.

And all this brings me to the even greater opportunity cost in the form of missing the boat with the likes of STEEM, BTS, EOS and ADA, all of which have nothing to do with POW and are the best examples we have today for the leaders of tomorrow.

Why mine a POW when buying it will outperform by a factor of 10?

Why, for that matter, even buy a POW when a STEEM, or a BTS, or an EOS, or an ADA will outperform POW by at least another factor of 10?

Imagine just how happy the smart money will be after having decided to reallocate all that money intended for POW mining into direct buys of crypto like STEEM, BTS, EOS and ADA with at least 100 times better returns. At very least!

And those poor schmucks who stick with POW mining?

Knowing what I know now, I would have to be stark raving mad to buy more mining equipment!

If it's not clear by now, I think the sustainability of POW crypto is in serious doubt. I wouldn’t even be directly buying POW crypto anymore, much less even thinking about purchasing mining equipment. It’s enough to try and eek out gains from current levels if your cost basis is simply the price of your favorite POW, but adding the extra costs of mining equipment and electricity would be just nuts in my opinion. Check out my previous post for more P&L analysis on that, and then, after reading that, and in combination with this, ask yourself if this might not be a good time to get out of mining while you can, and maybe even out of POW altogether.

And don't forget to let me know what your answer is!

Data Sources:

http://blockchain.info/

http://coinmarketcap.com/

http://chainz.cryptoid.info/

http://whattomine.com/

https://www.coinwarz.com/cryptocurrency

@cryptographic,

You are absolutely correct! I had a good example about POW and DPOS! I think I want to write it here to make a nice entry to the discussion!

5 Months back, one of my good friend asked my help to install a mining rig! He wanted to invest 3260.00 USD on it! I told him, better you invest that money on STEEM, so you get power of stake (POS) and the Delegate Power of Stake (DPOS) as well. The Price of STEEM was at 0.8-0.9 USD at that time

If he invested on STEEM, he gets 3000 STEEM Power and he had a chance to make more by using his SP! But that guy wanted to build the rig! I helped him and he is still made 1/3 of his investment! Paying for electricity bills and complexity of algorithm is not making a decent income to him. But STEEM price made an up trend and if he did his investment on STEEM now he almost earned his profit and making more money by holding SP!

If someone wish to invest on mining rig or any other mining equipment, you better invest that money on BTS or STEEM or EOS! I do believe this is the future.

The most important thing is, you are the person who helped me to see this path! Thank you very much friend! Actually this is pretty amazing! That's how I feel it!

Cheers~

Thanks for that first hand experience. Your story is typical and I'm glad you shared it - it might be just what someone else needs to hear in order to avoid making the same mistake.

@cryptographic,

Funniest thing is one more guy asked the same thing yesterday and he said the same thing as the previous one said :D

Cheers~

You are right... STEEM, BTS, EOS and ADA, all of which have nothing to do with POW will be the leaders for tommarow..I have very few knowledge about mining . Thanks for such an useful information when we make money just by investing and then why should we mine.

Upvoted & resteemed

Huh - I guess I shouldn't be surprised by this but wow. I still think a lot of this comes down to herd mentality. Folks see others having particularly incredible success and fail to take into account a significant first mover advantage that may have played a major role in the person.

That being said, in a perhaps too Machiavellian view, I think there's an investment opportunity in stocks of companies that touch upon crypto mining parts manufacturing. TSMC has started to add crypto miner revenue into its earning calls and Nvidia is facing a limitation in video cards. My bet would be that even if there was a dip in crypto valuations - mining demand would lag that deep as folks see an opportunity to gain "share" in the market. A potential hedge to cryptos...?

(Or if people could just be a bit more rational that'd solve a lot of this!)

I think you're right about the herd mentality aspect of things, and when you couple that with the romantic overtones that "mining" has - we all know about the gold rush and how the possibility of hitting the mother load was a magnet for gold miners in California in the 19th century - then I think we've got a double fun emotional attraction that is hard for many to turn down.

I did buy some contracts on hashflare and genesis and I feel it has been a bad investment. If I had put that money directly into buying cryptos would have made more.

No doubt about it, and it's all in the math.

Problem is that the people selling you the mining product don't want you to know that, and they do everything possible to make it look better than it really is.

Direct buying is the winning option, and better still if it's 3rd generation crypto that is as far away from POW as possible!

yes agree. The more they mine the more slower it becomes and in the end less ROI.

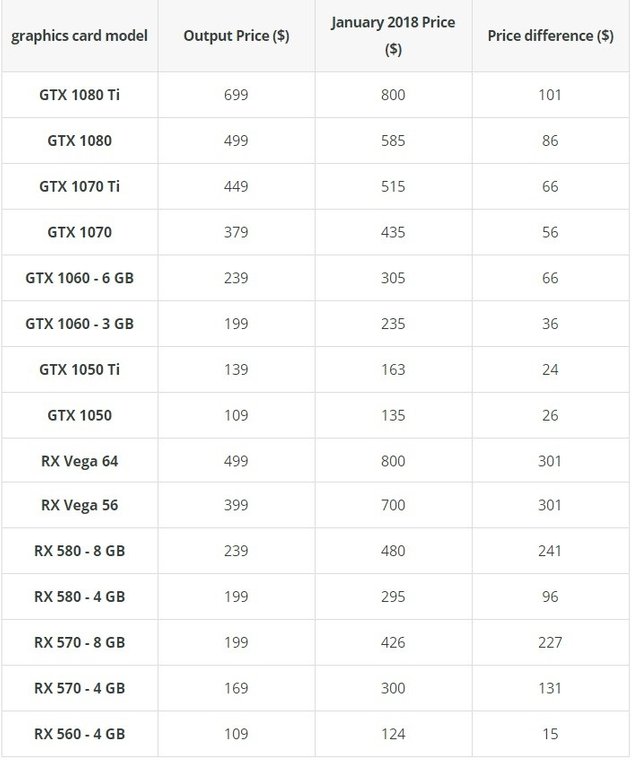

With the proliferation of mining, the prices of graphics card have increased too much. It's disturbing. When people demand, the companies wanted to take advantage of it. capitalism!

Man and how! Everything's up! My ASIC miners were up by 500% just 3 months after I bought them! I remember thinking back then that hell would have to freeze over before I'd buy more at that price. And that was the story just about across the board, and as prices went up, mining proceeds went down.

Prices will soon rise and the mining ratio will rise with it

This price difference is too much, don't you think? When mining became widespread, prices rose. Same goes for ASIC.

Great post @cryptographic. I never really looked at the mining prices in such a way but it makes total sense.

Why would you drop $40K on a bitcoin miner as opposed to putting $40K into STEEM or BTS? Like you said, are the odds great that the mining rates repeat in 2018? Not likely. Hell it isnt even likely that the biggest jumping coins in 2017 will sustain it in 2018. I doubt BTC will be another 10x + gainer this year.

It is time to move to other tokens that didnt run to the extreme in 2017. STEEM and BTS are mine hodlings for this year....been scaling out of the Big 3 and adding to them (mostly BTS).

Another insightful post. Thanks for sharing your experience with mining.

Ignorance?

And I don't mean that in a negative way. I just think that, simply put, that's got to be one of the best answers, and one of the main reasons why I wrote this post.

Remember, Enlightened Self-interest and Steemit: the more we help others, the more we help ourselves. 😉

Just drop it into STEEM or BTS!

I cant argue with that since I added a bit more BTS last night...I have some powder ready if it drops into the 20s, I will be adding more....might do it in the morning regardless of where the price is at.

I will see.

Looks like we barely dipped in. Not much time to catch it though. Was a good opportunity for the low 30s though. How did you do?

Very good post! Very interesting dynamic here related to Bitcoin... If miners are out of the market in the long-term, who will support the market? Do we rely on big company to continue dominating the mining space? What consequences could that have to adoption and the overall technological development? Thanks for the perspective!

You've hit on one of the key questions that has very negative consequences, especially with Bitcoin, where the difficulty retarget is 2 weeks. It could literally freeze up!

my knowledge about mining is very poor, but steem, bts, ada, eos has nothing to do with mining. i won't bother about mining equipments due to these genius projects. this is the future. hardware mining is the past & memories of crypto evolution. impressive article with lots of information why we focus on 3rd generation crypto currencies. @cryptographic

@resteemia

Miners snatching up all the video cards at retailers have forced companies like Nvidia to put buying limits on graphics cards. One of my buddies built a rig and bought as many extra graphic cards he could get his hands on, flipping them for profit. No desire to mine, HODLin strong! If we break down from this bull run, I will be prepared to pickup more of the said cryptos.

Just incredible how far a stream the effects have gone!

@cryptographic...yes bro what you said is really correct..i am also using a hash powers and also some mining sites i was invested and loose the money by cheated...some are good and most of them are bad ..actuallly they do a business by using our investments...if we invest money in the crypto directly we will get more profits compared to this...thank you for sharing with us....

Their sales pitch is that you can make easy money, but, as you say, the reality is that they are making the easy money off their customers. Thanks for sharing your experience. Hopefully it will help someone else!

yes bro...initially i lose lot of btc because of this fraud sites...within 2 days they used to give 5lakh santhoshi and 10 lak santhoshi ..after that they ask if you want to withdraw ammount..plz send maintanance charge of half of that amount..if we send afeter that no responce comes ..and if you login after some days it shows your account was suspended...this is the thing happend to me 3 times..beacuse of youtube promotions and fake withdrawal proofs i used that and got cheated..