Gaining a Trading Edge by Thinking a Few Steps Ahead (Part 2)

Welcome to "Part 2" of this mini-series (click here if you missed "Part 1")! One little thing I hadn't mentioned in "Part 1" is that the title of this post was actually the same one I used on another post I wrote on my personal blog back in 2012. Yet, somehow, as is often the case in the markets, much of what I wrote then seems just as fitting today.

Here are some key points that I had outlined:

Traders and investors alike must always be open to taking every piece of relevant information into consideration, including our own preconceived notions and biases. As Ray Dalio of Bridgewater Associates once said “I constantly want to know what I don’t know. I want to know when I am wrong. And it helps when someone points it out.” While it certainly helps if someone else points it out, we can also objectively look at our own thought process, feelings, and emotions and consider how they too may be wrong or dangerously biased. This in itself becomes part of a valid trading edge. Everything counts, and we are often our own worst enemy in most endeavors we pursue. As in playing chess or poker, those players who patiently take a step back in order to “see the bigger picture” and contemplate the best moves will, in the long-run, always triumph over those less savvy players just itching to make a move.

We should always ask ourselves what do other traders think they know. What are they worried about or afraid of and to what extent? Am I starting to feel worried or nervous myself, and are these thoughts rational and based on sound reasoning? There was a great line in the movie "Margin Call" when CEO Tuld (played by Jeremy Irons) says “It’s not panicking if you’re the first one out the door.” Granted, no one (and no firm) should ever be leveraged to that extent in the first place, but from his “clear” perspective the mortgage game was up. And you certainly don’t want to be the one panicking out at the bottom of a move, with or without margin calls over your head.

Am I afraid that if don’t buy some stock tanking like a “falling knife” right now, I’ll miss the huge bounce coming right around the corner? Is it possible many other traders are thinking the same way? The reality is that it’s rarely “too late” to get a better price when buying into a crashing stock. When the price action settles down, stabilizes, and starts to rebound, the stock will probably still be priced below your initial entry. Sometimes our own feelings can give us strong clues as to what the “crowd” is thinking as well. There was no need to predict ahead of time that October 4th, 2011 would be the low of the last crisis and panic. However, through awareness of our own feelings, astute observation into the collective thoughts of others, and by watching the price action in relation to the current headlines, we are continually provided with clues as to what is more likely to happen next. For example, each time new headlines appeared about Greece and its debt problems, the chatter they generated seemed to lead to increasingly complacent market action and behavior. There would be short-lived dips that would quickly recover, as if no one really cared any more.

And in comparison to crypto, just think of all the times you've heard that China is banning something or other in crypto. At some point, you just become numb to a particular headline, and so do the markets. The widely publicized "talking point" has already been factored in and discounted. And while there may be a "short-lived dip", prices will most likely recover.

In reality, it is the unexpected shocks that lead to the most “real” fear. Especially where credit and leverage is concerned, it is these quick shocks that are most likely to catch firms (such as MF Global) unprepared and caught with their pants down. But the more time that goes by with an event in the forefront, the longer the world has to deal with it, adjust by preparing for the worst, and “get used to” the new norm.

Link: Gaining a Trading Edge by Thinking a Few Steps Ahead

(🤑 Bitconnect Annual Ceremony 2017 & Winners... Yippie, Lambos going all around! 🤑)

So... how's this really all relate to the crypto space?!

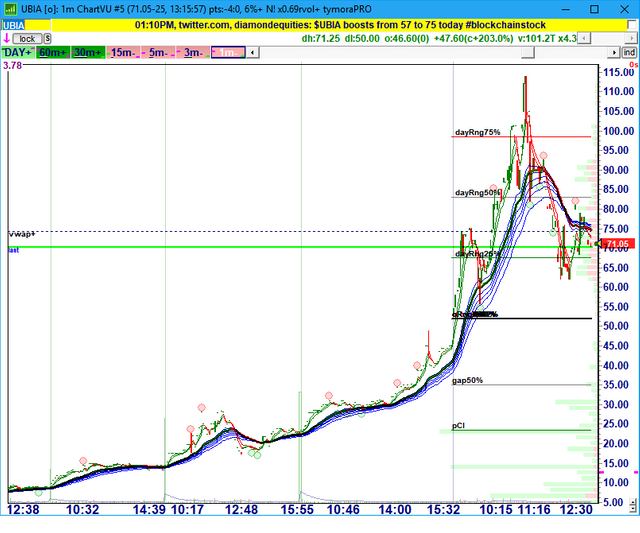

So, were there any "clues" out there that the crypto space had become ridiculously overheated and was well overdue for a sizable correction? Well, when prices quadruple or more in a matter of weeks or even days or hours, that's certainly one red flag! I'm sure some of you will also recall my recent post about all the crappy stocks running up 100%+ just by somehow associating themselves with "blockchain" or "crypto":

You know things have gotten really out of hand in a particular sector when one crappy public company after another is trying to pivot and "reinvent" themselves as "blockchain" and "crypto" companies! You may wonder how high can you stack a pile of shit...

Well, once Wall Street gets its greedy little paws all over it, pretty much the sky's the limit, until it isn't. Currently, this pivot to "blockchain" is the latest in a trend of companies rebranding, refocusing, or announcing new efforts related to blockchain and cryptocurrencies, sending their stocks soaring through the roof!

Link: How much would STEEMIT or BitShares be worth as SHARES on the New York Stock Exchange?!

Check in with the "mass media" too, cuz they're always on the right side of the current trend...! 🤣

Lots of Money Money Money did you say? Let's now be "BlockChain-Friendly" and maybe we too can grab us some of those crypto shitcoin advertising buckeroos!

And there are other "clues" as well. Everyone in the chatrooms parroting how they wish they owned a boatload of this or that coin... "if only"! Well, if they want 'em now... 50-75% off sale, yippie!!! 😀

And then, of course, you start seeing the fake news media that spent the last half-decade denouncing crypto, now fully embracing cryptocurrencies and all the money everyone's making... another big warning sign that a correction is in order! The following article appeared on the first page of the New York Times' "Style" section. If it had been front-page news, that probably would have been something to really worry about!

Regardless, once the lambos and ferraris are paraded around to grab your attention, well, needless to say... that's another huge red flag (ie. BitConnect)!

They talk about buying Lamborghinis, the single acceptable way to spend money in the Ethereum cryptocurrency community. The currency’s founder frequently appears in fan art as Jesus with a Lamborghini. Mr. Buttram says he’s renting an orange Lambo for the weekend. And he wears a solid gold Bitcoin “B” necklace encrusted with diamonds that he had made. Otherwise, HODL.

😂 Thank you New York Times for nailing another top on that one! 😂

Link: NYTimes (Jan 13th, 2018): Everyone Is Getting Hilariously Rich and You’re Not

Crypto "Experts" abound...

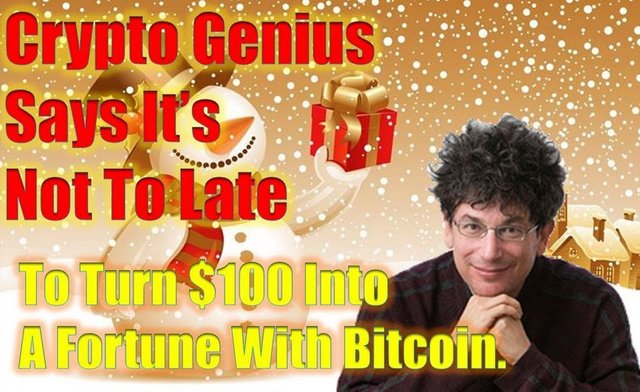

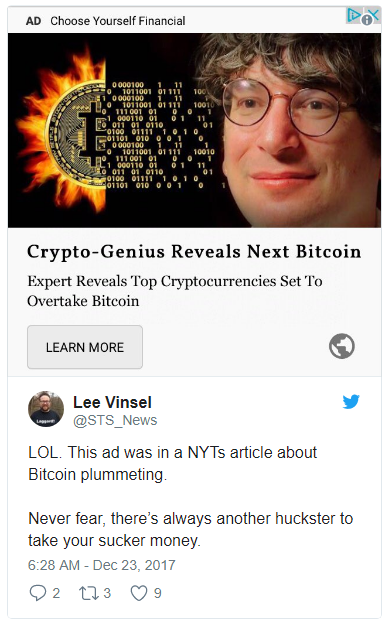

And then we have James Altucher, who has now pivoted to be a "Crypto and BitCoin Expert"...!

In 2013, James Altucher called bitcoin “a fad, or a scam, or a ponzi scheme, or worse.” [tweet has since been deleted]

Now, he’s become the face of the bitcoin bubble, appearing in ads across the internet touting the cryptocurrency — along with his paid newsletters with titles like, “Bitcoin Expert Reveals 3-Step Secret To Retire Rich.”

Link: This guy is the face of the bitcoin bubble

I actually used to enjoy reading Altucher's work. For example, this post is probably worth reading: "11 or 12 Things I Learned About Life While Daytrading Millions of Dollars". As an irrelevant side-note, we also both attended Carnegie Mellon around the same time, and I actually remember seeing him pacing and reflecting to himself around campus.

However, I suppose that form of "brutal honesty" just wasn't lucrative enough, and as of late, it seems he's edged towards the "darker side", and decided it may perhaps be more lucrative to take the Agora Financial approach of charging dumb-money "investors" small fortunes for pumping presenting "exciting new investment opportunities" once they've trickled down to him from his "little black book" of "high power" Venture Cap friends who are ready to start dumping their "secret" investments to you, cuz you know, they're just all about "sharing the wealth"! 😂

And if you're not already convinced, perhaps this image will help clarify things for you:

Yes, we need more regulation to legitimize the "crypto movement", which is in no way antithetical to the whole point of the "movement" in the first place! However, thinking about it, perhaps I could use some better regulation of my bowel movement, as I seem to be "shootin' out" a few too many PooCoins as of late! 🤣 💩 😂

Here's one more "doozy" I've come across:

Had a long talk w/friend who’s a smart realtor. She dropped $200k into BTC at highs and wanted to drop another $300k. She said she knows is a bubble but plan to sell BEFORE the bubble pops, maybe in a year. She says she’s not asking for much just to double her money.

She says her dumb friend put $30k and is up $100k. I asked did he sell? She says no. She agrees it’s all FOMO based why she wants in. Sees all these ppl making money. I said to her so it’s that easy eh. She says apparently so 🤷♂️ and can time it #gettingRichQuickIsEasy

Finally...

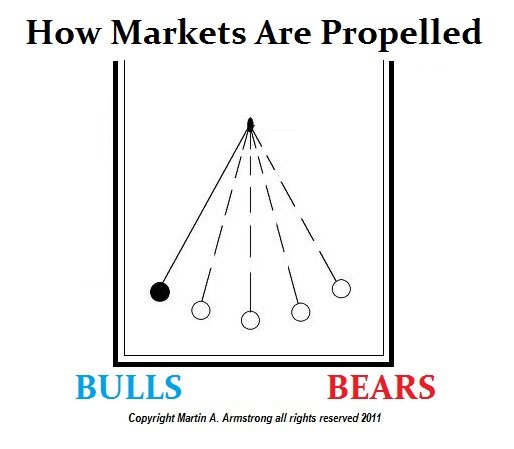

This post seems to have once again become a bit overwhelming! As such, I'll end for now by sharing one last concept... that of the "FALSE MOVE", which Martin Armstrong explains quite well:

The real energy within a market is always to trap the majority for then they lose money and it forces them to cover their position. If 90% of the people are long, then any news can set off the collapse. If you scare the majority, there will be no bid when you try to sell, which results in a flash crash.

Likewise, the lows are made by excessive short positions. Again, something takes place and then the news sparks a short-cover panic. Likewise, because the majority are actually short, they are forced to cover and reverse the position which creates an abrupt swing to the upside.

Therefore, markets always make the false move for that is the sling-shot that propels the market in the opposite direction. This is simply the REQUIRED movement of markets to further an important directional change.

Link: False Moves & the Force Behind Them

Also, seems like SBD is on a roll once again, trading back around the $7.50 level! How's that for earning a potential infinite ROI, especially if you're writing in your spare time anyway! As such...

This is a great post, people must realize that crypto is an investment, you can win or loose.. You just have to be very smart..

thank you for the kind words @mikel2la! It's not even so much about being smart.

In fact, people who think they're "very smart" (and perhaps they are, for certain things), believe it or not, often tend to do worse in the markets, because they often think they "know better" and can "outsmart her".

It's really more about being practical, gaining some "street smarts" and "common sense", and not sticking your head too far out, so that you miss the guillotine about to drop right over your head! 😱

Dude! Dynamite post and yes, getting ahead of the curve is key by simply heeding the warning signs.

For example, once bitconnect was launching a BitconnectX ICO that was the sign to get out of dodge. It scream "we need a capital raise"

thanks @scaredycatguide, and yeah, another great point. Doesn't even make sense they would have needed an ICO except to bring in one last influx of crypto cash to keep the party rolling and reboot the

musical chairs"magical algos". And hey, with plenty of dumb money suckers abound, why the hell not?!Of course, IPOs and ICOs also tend to be the "exit strategy" for most insiders locking in 1000%+ returns (and often multiples of that), while flipping to foolish public "investors" hoping to make another 1000% on top of that!

Yeah, I'm hoping to possible go against the grain on that. Have a fund me and a few guys have been doing generating good returns off margin lending. (Paltry compared to cryptos but sizable against real world) Maybe one day do an ICO as shares of investment once we have a long enough track record built up, who knows.

"...perhaps I could use some better regulation of my bowel movement, as I seem to be "shootin' out" a few too many PooCoins as of late!"

Comedy gold. Lot of wisdom in this post and I like to read the odd bit of Armstrong as well even though I am sceptical of his models. Keep up the good work.

glad I could make you laugh! :) and yeah, I'm not so sure about Armstrong's "models" either, but for his historical perspective and "big picture" worldview, I generally find his insights invaluable and often right on point.

Your lucidity and honesty is really appreciated by those of us who are novices to the crypto world. We should all take your advice and heed your warnings. Don't wade into the bittercoin swamp without watching for the quicksand hidden below.

thank you @domo for your kind words, and I'm glad you found value in my posts to help others hopefully avoid at least a few of those pitfalls! :)

How modest of her, you only should settle for 1000% gains. Everyone in crypto knows that! This is madness :)

yeah, and she was apparently one of the "smart realtors"! 😂

Your article is good, that’s the most I’ve heard of someone dropping 200k at once, smart move is to invest smaller amounts, I know scared money don’t make money , but a fool and their money are also soon parted.

It is a volatile market but I believe it’s still going to go higher and a lot of money can still be made.

Bitcoin will go back up, I remember back when it was only 40.00, I thought it was a waste of time and money to invest, wish I invested back then!

It’s not to late to get in, but don’t throw everything In at once and only what you can afford to lose, kind of like going to a bar, spend only what you can afford! But we get drunk and next thing you know your broke.

Love the article, thanks for sharing

thanks for the kind words, @buster544, and glad you enjoyed the article! :)

Amazing post as usual!

Thank you for sharing your insight on stuff like this, I've heard several terms like bull and bears but hadn't taken the time to research their meaning and importance of concept, and your posts always leave me with a litle more knowledge and understanding of the crypto and trading world so Thank you!! :)

You're so nice for commenting on this post. For that, I gave you a vote! I just ask for a Follow in return!

James Altucher removed a tweet dismissing bitcoin early on, doesn’t shock me at all, people just follow the money and I expect that from them

May be he's hiding in his own house, fearing that people will kick his ass off when they see him on the public... I pity those people who looks like him; may fortune be with 'em.

I think actually in his case, he's complete "owned" his look and used it to his advantage. More power to him on that point...

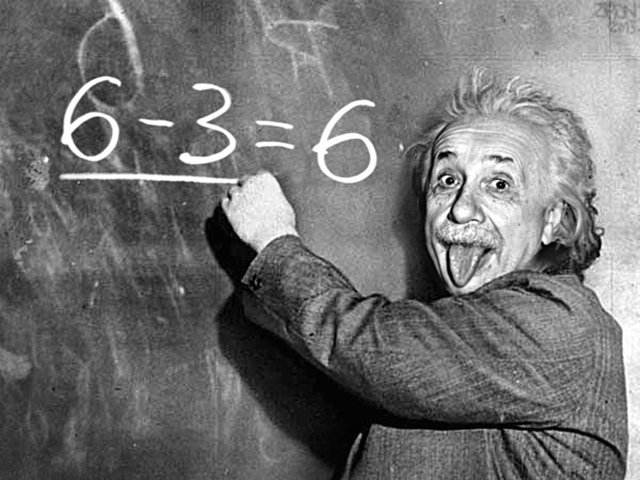

Probably makes people connect him with this other "character"! lol

Nice information here, upvoted :)

good read! Thanks for posting Alex :)