HIPERQUANT

WHAT IS HiperQuant?

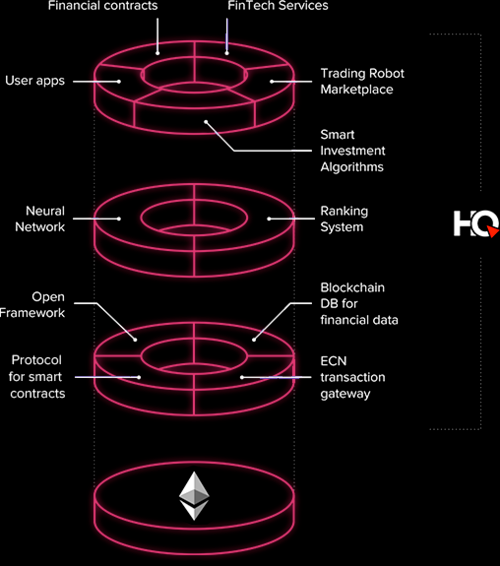

HyperQuant Blockchain is a platform for automated investment. With HyperQuant, the investment process becomes simpler and transparent for all market participants ranging from small investors, big investors, to professional capital managers. HyperQuant is a platform dedicated to the creation of highly effective decentralized financial services. This platform provides new opportunities for software developers and algorithmic trading by providing a quantitative framework reinforced by advanced risk management and AI blockchain technology that ensures system stability and reliability. HyperQuant implements a smart contract realization mechanism. The HyperQuant system provides utilities for the creation and development of algorithmic trading solutions. AI regulates ranking and artificial intelligence systems that make it possible to manage various platform elements. The HyperQuant application contains services and solutions for retail and corporate system users.

The HyperQuant Ecosystem is not only a much-needed financial tool today, but also a new place devoted to global distribution. AI-based advanced technology is rapidly developing and developing lately.

HyperQuant's unique feature is the interaction between AI, blockchain technology, and users. This gives users the opportunity to create new products and entities for the platform, such as configuring Megabot, the automated trading system portfolio. The user creates his portfolio containing configuration parameters, identification number bots, and other system data required that add up to the value of the new entity itself into a balanced solution.

What issues are omitted by HyperQuant?

The infrastructure created by the HyperQuant project developer will not be so valuable if it does not allow the solving of a very important and complex problem.

And there are such problems, and there are many. There are at least some of them:

- lack of transparancy of the crypto market - not all users are convinced that a trading token is safe and open;

- lack of control in funds transfer to management - today the funds that manage cryptocurrency investments, do not guarantee that the money will reach them;

- dependence on investment Funds - owners of capital, who transfer money to management, can not influence manager's decisions;

- a small number of profitable strategies - actions that produce results, have long been known, and revolutionary things do not appear in the marketplace.

HyperQuant solves all these problems. This platform allows you to trade through the mobile app and do it safely and transparently. The money invested in HyperQuant remains under the user's control - it can withdraw it at any time. Well, the fact that fund management is done by computers, not people, leads to various asset management, which ordinary people often can not oppose anything.

Benefits of HyperQuant

The main advantage of HyperQuant, due to which the developer plans to win the competition - fully automated investment. This is a very important advantage: it provides an opportunity to invest in tokens and generate even people who do not understand anything in the investment. This is enough to manage how much you need and what risks are acceptable, and the platform will do it all on its own.

It is also important that HyperQuant allows participants to develop bot trading "for themselves". Sites where you can do a little, and HyperQuant is one of them.

Thus, HyperQuant attracts not only those who want to completely outsource the acquisition process. The platform also appeals to investors who are fluent in the crypto currency range, but want to automate the process of generating revenue.

How Do HyperQuant Work?

HyperQuant's business model is based on an innovative approach that determines what's important and necessary for users. The concept of this business model relies on identifying high profit zones, determining methods for gaining market share and ensuring its protection from competitors. HyperQuant ecosystem creates an architecture that allows to turn pioneering technology into actual economic value. Services created in the HyperQuant ecosystem have great potential for growth.

HyperQuant uses trading robots to complete trading operations on financial markets with a set of algorithms. Trading with the help of an algorithmic system has several advantages: to make decisions at maximum speed and complete trading tasks at speeds that are not available to humans, automatically processing market data and generating trade signals, and trading signal processing accuracy allows to prevent errors by market demand settings .

Trading robots work strictly in accordance with established algorithms and complete trading operations without emotion and can manage several thousand securities simultaneously. Cryptocurrency traders and token holders are vulnerable to emotions that lead to irrational decisions. Trade strategies apply in any market, with any assets and at any time. Algorithms are typed carefully and do not risk making wrong decisions due to uncertainty, anger, fear, and dissatisfaction. The basis of this algorithm is in the division of strategy class.

Trading strategies and models have several classifications:

- Following the Strategy Trend:

The main purpose of this strategy is to find favorable levels for completing trading operations with the aim of maintaining a favorable position in the longest period of time. The trend-following strategy tries to capture the huge fluctuations of financial instruments. A trend-based strategy based on technical indicators is the most popular strategy. Technical indicators are functions based on the values of indicators of statistical exchange, for example, prices of traded instruments. The rules of opening and closing positions in this strategy are shaped by the derivation of indicators and comparative values calculated between themselves and market value. - Counter-Trending Strategy:

is a strategy based on expectations of significant price movements and consequent positions opening up in the opposite direction. The assumption is that the price will return to its average value. The counter-trend strategy is often attractive for trading because the goal is to buy at the lowest price and sell at the highest price. - Pattern Recognition Strategy:

The purpose of this strategy is to classify objects in different categories. Image recognition tasks in distributing new, recognizable objects to specific classes. The strategy uses neural networks as the basis for education and is widely used for the recognition of candlestick patterns. The candlestick pattern is a certain combination of candlesticks. There are many candlestick models and assumptions about continuous or reverse price movements that occur based on the appearance of the candlestick model. These assumptions are a strategy based on the introduction of technical analysis. - Arbitration Strategy:

There are different types of Arbitrage strategies: Cross-Market Arbitration and Arbitrage Statistics. - Strategy based on machine learning:

The basis of machine learning is the modeling of historical data and the use of models to estimate future prices. One type of machine learning is classification.

Based on these strategies, HyperQuant created a strategy with Si Technologies Algorithm. The Si Technologies Strategy HyperQuant algorithm is:

- Smart order execution strategy

This strategy class is based on work with orderbook. The HyperQuant software makes it possible to dynamically cite strategies depending on specific tasks.

It is impossible to execute orders with the same price first, all trades will be at the desired price, but gradually the price will become less profitable. To reduce costs, institutional clients need to use the Smart Order execution strategy. Execution of large market orders can be divided into several steps and involves a combination of strategies. HyperQuant platform users will be able to configure certain fields of citation strategies such as Instruments, Volume, Minimum Volume, Maximum Volume, Maximum BBO Distance, Internal quotes, Internal quotes, Hedging, Hedging type and Hedging settings. - Market Creation Algorithm

The execution of market-making algorithms leads to an increase in liquidity in trading instruments. This also results in lower volatility of trading instruments. Providing liquidity is essential for the development of the trading industry. The mechanism of liquidity provision is widespread in the largest stock markets such as NYSE, NASDAQ, and CME. Market makers should support bidirectional quotes in orderbook and adhere to some requirements. The minimum quotation period and the volume of all orders are purchased and sold according to market maker data. - Risk Management Management

risk is the process of adopting and fulfilling complex actions aimed at reducing the possibility of unfavorable outcomes and minimizing the possibility of loss. Every trading and investment activity poses certain risks. The risk in this case is the possibility of unexpected financial losses in an uncertain environment. Every trader faces market risk ie the possibility of changes in asset prices due to market exchange rate fluctuations. There are other risks that are rarely known to operational, functional, selective, and liquidity risks. - Hedging

Hedging can be divided into Selling Hedge and Buying Hedge. Buying Hedge is used when traders plan to buy assets in the future and try to reduce the risks associated with price increases. Hedge Selling is used in the case of a sale in the commodity market to protect the risk of future price declines, and implies that the seller fixes the fixed price for himself. - AI-based Financial Advisor

The majority of investments fail because of incorrect risk management and inadequate control by users. To solve this problem, HyperQuant uses artificial intelligence based on data collected from HyperQuant platform users. - Blockchain under the Smart Contract Protocol

The HyperQuant team developed an integrated protocol with standard settings for the algorithmic strategy portfolio, which is implemented as a smart contract.

ICO INFORMATION AND TEAM

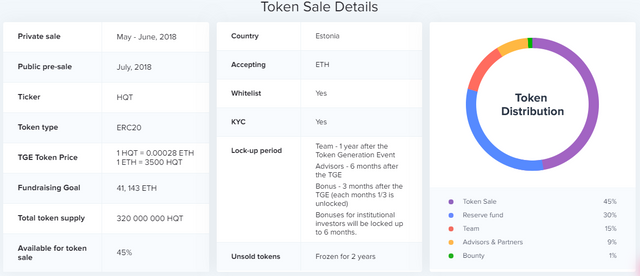

- Price PREICO 1 HQT = 0,00028 ETH

- Price 1 HQT = 0,000285 ETH

- Bonus Available

- Bounty Available

- MVP / Prototype Available

- Platform ether

- Accept ETH

- Minimum Investment 0.5 ETH

- Soft cap 5,000 ETH

- Hard cap 41 143 ETH

- Country Estonia

- White List / KYC KYC & Whitelist

- Restricted areas USA

320,000,000 HQT tokens will be made for the project, with 45% reserved for ICO. The token sale will take place in July 2018. The exact date is still pending. The funds will be used to develop and market the platform. The team working on the platform is experienced and committed.

conclusion

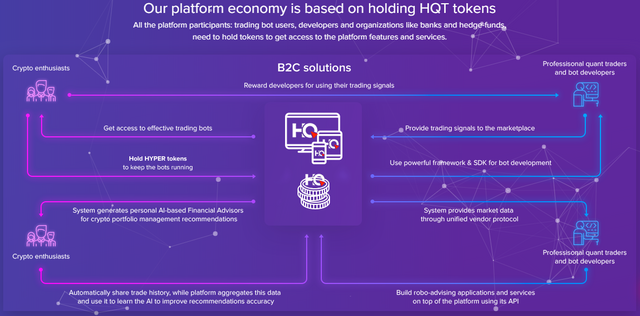

They introduce themselves as B2B and B2C and present themselves as a provider of new and reliable cryptocurrency investment solutions. Their cutting-edge solutions, such as KI, give them a unique advantage over their traditional competitors and companies, who still use ancient technology. The amount of data collected from the market will be classified and processed to be briefly provided to investors on platform cryptocurrency.

Decentralization of cryptocurrency investments and trading markets is the ultimate goal of the platform Today, there is a need for large-scale integration in many businesses to improve efficiency and usability. The latest innovative solutions presented by crypto currency trading and investment teams will have long-term effects on mass adoption of cryptocurrency. What do you think of the services offered by the platform to investors? Are we ready to invest?

TEAM

The HyperQuant team consists of 11 team members and 4 advisors. The founding team consists of quant traders, IT professionals, and market analysts. According to CEO and co-founder Pavel Pavchenko, creating a HyperQuant platform is a direct result of the combined experience team. Pavchenko himself has more than 14 years experience as a successful trader. He has worked in investment companies as an independent quantitative trader, managing large hedge funds and even taking part in the creation of Russia's second largest stock exchange.

FOR MORE INFORMATION

WEBSITE: https://goo.gl/4Jc6yc

TELEGRAM: https://t.me/hyperquant

WHITEPAPER: https://hyperquant.net/en/wp/

ANN THREAD: https://bitcointalk.org/index.php?topic=2104362.0

FACEBOOK: https://www.facebook.com/hyperquant.net/

TWITTER: https://twitter.com/HyperQuant_net

MEDIUM: https://medium.com/hyperquant

YOUTUBE: https://www.youtube.com/channel/UCOgRfmQR-GKJlbnF1tRQPgw

author: muhammadsosa

profil link: https://bitcointalk.org/index.php?action=profile;u=1914532

eth: 0x8056b4866D50eBCE01D33EDc967D38a6Bf724420

Follow me than I will follow back

Good post

Congratulations @muhammadsosa! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard!

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes