Building and Interpreting Footprint Charts

Hello everyone, How are you doing, I welcome you again to my blog in the Steem Alliance community.

Today, we will discuss an interesting topic on the platform which will be Building and Interpreting Footprint Charts

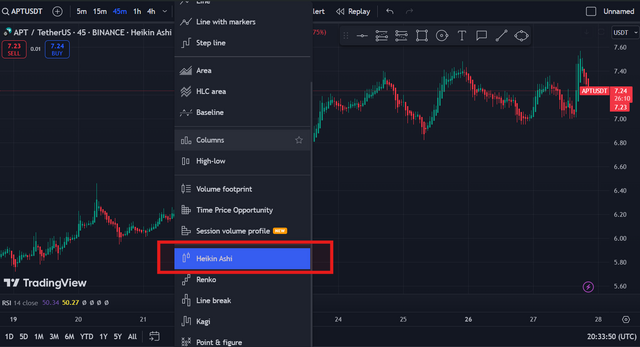

TradingView

Interpreting Footprint Charts

Understanding the different features of footprint charts and what they tell about market activity is important for understanding footprint charts, these are the main points to take now of:

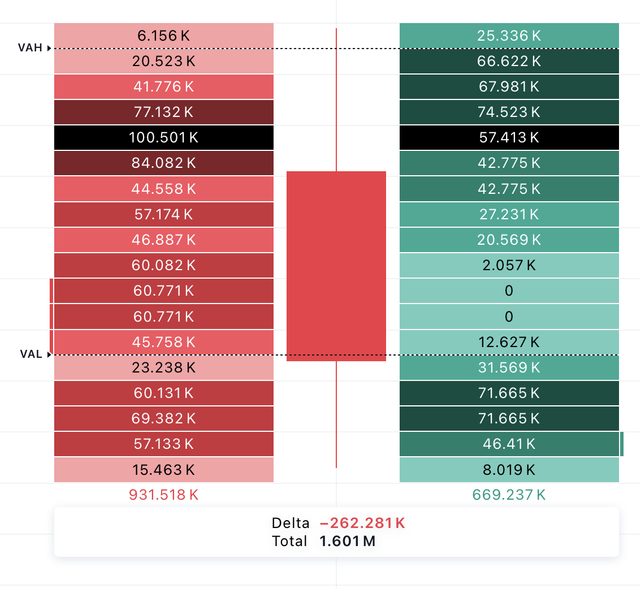

Volume Profile: Within a bar or candlestick, the volume profile shows the distribution of trade volume at different price levels, the high volume areas are usually used as support or resistance levels and it shows considerable interest from both buyers and sellers.

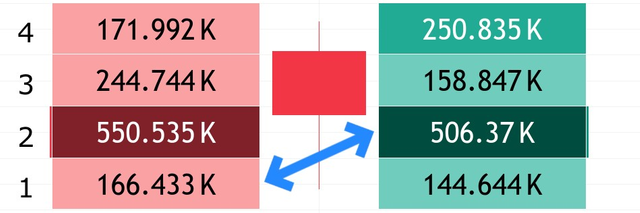

Delta: The Delta gauges the buying or selling pressure at every price level. At that level, a positive delta implies more buy orders were executed, whereas a negative delta implies that more sell orders were executed as well, the delta can also indicate possible reversals or support trends.

Analyzing Footprint Patterns In A Chart

1 . Absorption:

We can notice an absorption pattern on the market chart when we notice that there is a large order at a particular price level without particularly moving the price, this is usually an indication of a trend reversal or continuation.

2 . Exhaustion:

This occurs when we notice that there is a sharp decline in trading volume after a substantial price movement, and they mostly indicate that the trend may be losing strength or a reversal is coming.

TradingView

3 . Initiative Buying/Selling:

When you witness that there is a significant delta in one direction, it indicates that buyers or sellers are acting aggressively at that position, and this may indicate the beginning of a fresh trend or the continuation of an existing one.

Trading Strategy Using Footprint Chart

1. Trading Resistance and Support

Footprint charts can help based on important levels of support and resistance where substantial volume was traded, these price levels usually serve as a key-zone where the market may turn around or stabilize.

Trading Strategy: You need to Locate high-volume regions on the footprint chart that correlate with support or resistance level, you can make use of these levels as your possible trading entry or exit points.

For Example: A particular price level may serve as support if you notice that there is a high amount of buy orders there, and near this level, you might put in a buy order with a stop-loss placed just below the key zone.

2. Breakout Trading

Footprint charts can help to detect the areas of low volume and strong directional delta, which can help traders spot possible breakouts in a market.

Strategy: You need to look for places on the footprint chart where there has been low volume and price consolidation, followed by a strong spike in volume, this implies that a breakout is probably coming, giving us an early trading opportunity.

For Example: When a price consolidates in a narrow range with little trading activity, and then a sudden increase in buy volume and you also witness a positive delta, this could be a sign of an uptrend breakout, you should put a stop loss below the consolidation range, then make a long position.

3. Order Flow Analysis

Understanding the goals of major market players, such as institutions, the whales, and trading alongside them can be understood by traders through the analysis of order flow.

TradingView

Strategy: - Keep an eye out for big buy or sell orders on the footprint chart and track the movement of these orders, this may indicate the existence of institution traders in the market and there might be possible changes in market price.

For Example: When we see that a significant market move is building up, implying that there is more upward price movement, so therefore if you consistently keep track of these massive buy orders at the price point, then you need to put your long position with the order flow.

Conclusion

Footprint charts give us some market insights that are not visible on the usual price charts, and this provides a unique and thorough understanding of market activities.

Traders can use this tool to detect possible breakouts or reversals, also identify important support and resistance levels, and have a greater understanding of market dynamics.

Regardless of whether you are a longer-term trader or scalper, you can incorporate a footprint chart in your trading strategy and this will help you increase your trading performance and make better trading decisions.

NB: This tool is only available on the TradingView Premium plan, so this article was meant for educational purposes only.

https://x.com/_bhardmorse/status/1829142186241470943

Upvoted! Thank you for supporting witness @jswit.

Note:- ✅

Regards,

@theentertainer

Thanks you ser