Steemit Crypto Academy Contest / S16W5: Navigating the STEEM Token

I sincerely hope that everyone enjoys the educational themes of the Steemit Engagement Challenge S16-W5 . subsequently, the competitors' epic entries under the designated subject. I was eager to learn more about this new topic, so I did some research and shared my own opinions with you all. I hope that my contribution will also be valuable.

Sentiment analysis of STEEM coin on social media can impact price fluctuations by revealing the overall mood and sentiment of the community towards the cryptocurrency. Positive sentiment often correlates with increased buying activity, leading to potential price rises, while negative sentiment can trigger selling pressure and price declines.

Traders and investors can make better judgments by using sentiment analysis to gain insights into investor sentiment, market trends, and possible adjustments in sentiment. Furthermore, sentiment analysis can provide valuable insights into the community's overall viewpoint on STEEM, including opinions about its technology, usefulness, development status, and general community involvement. These insights can have an impact on the cryptocurrency's long-term dynamics and investor confidence.

There are rational ways to go about making predictions about the future of the STEM market based on trends found on social media platforms like Reddit and Twitter are going to share with you to justifying the required question.

- Sentiment Analysis:

Keeping an eye on how STEM-related conversations are being received on social media might reveal information about the general attitude of enthusiasts and investors. While negative sentiment could signify fears or skepticism, which could result in lower investment and market downturns, positive sentiment could indicate growing interest or optimism, potentially leading to more investment and market growth.

By locating popular STEM-related subjects, hashtags, or phrases on social media, one might predict new trends or market niches. Monitoring the enduring appeal of these patterns can reveal information about prospective advancements, breakthroughs, or funding prospects in the STEM fields in the future.

- Event Analysis:

Yes, It is possible to predict market reactions and attitude shifts by monitoring mentions of forthcoming conferences, events, product launches, or legislative developments pertaining to STEM on social media. Events that have a big impact on the market and investment behavior include big product launches, regulatory changes, and breakthrough discoveries.

- Community Engagement:

One way to measure interest and involvement in the community is to look at metrics like likes, shares, and comments on postings about STEM subjects. Elevated degrees of involvement could suggest robust community backing and enthusiasm for particular projects, innovations, or campaigns, which could significantly impact market dynamics and investor attitude.

Well, we can observed that based on information obtained from social media data, stakeholders can make more informed decisions regarding future ramifications for the STEM market by methodically studying these trends and combining them into prediction models.

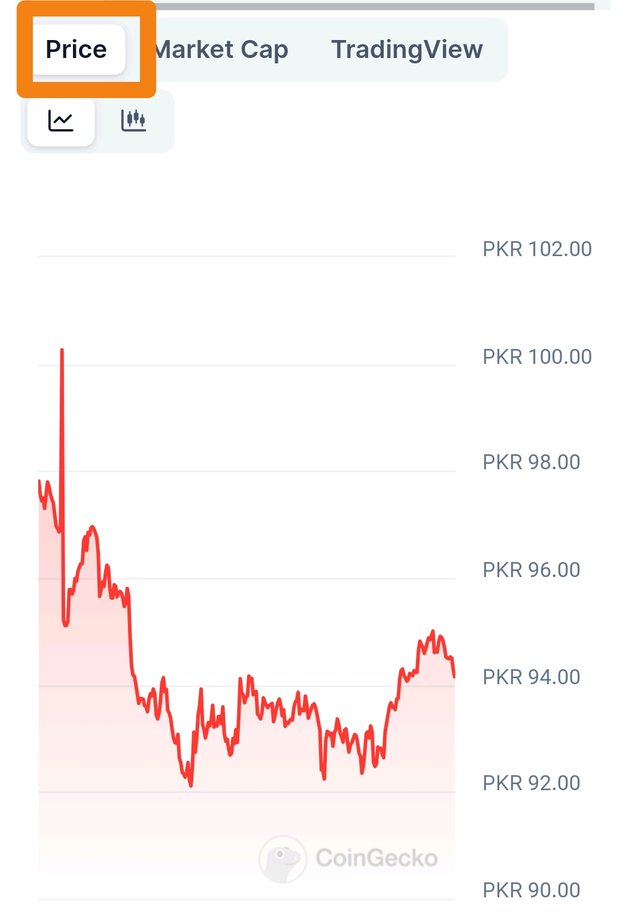

Well , The significance of STEEM-related trading signals can be increased by combining sentiment research with other technical indicators because doing so offers a more thorough understanding of market dynamics and sentiment-driven price fluctuations. Using a hypothetical scenario as the basis for a graphical analysis is one useful source to demonstrate this.

By analysis this above showing lining graphic analysis shows that shown as a line that the sentiment scores obtained from STEEM-growing price fluctuation and the clear trading review for the trader's trading. The variables above the baseline indicate positive emotion, whereas numbers below the baseline indicate negative sentiment.

A positive sentiment analysis surge (above baseline) that corresponds with the short-term moving average crossing above the long-term moving average is indicative of a bullish indication. Growing price of Steem that also become the reason to grow investor optimism is indicated by this alignment, which could spur higher price momentum and beneficial for trading as well accordingly to the recent fluctuation of Steem Price.

Best Indicators for Crypto Trading: Day and Swing Trading Indicators Guide

During the research, I have seen very meaningful article closely linked to the given theme of engagement challenge and which is also relatively justifying the answer of above mentioned question. You can access by clicking that link and came to acknowledge in detail review of trading indicators and it's price analysis.

Sentiment analysis in the context of STEEM can assist investors in making better choices by offering perceptions on how the community views the cryptocurrency.

Positive sentiment could be an indication of rising investor confidence in STEEM's technology or development prospects, while negative sentiment could draw attention to doubts or worries and advise investors to proceed with caution.When applying sentiment research in a turbulent market, it's important to keep the following things in mind:

- Real-time Updates:

In order to capture the quickly shifting market attitudes during volatility, sentiment research needs to offer real-time updates.

- Understanding Context:

It's critical to comprehend the context of sentiment fluctuations in order to prevent misinterpreting abrupt increases or decreases in sentiment during volatile times.

- In conjunction with additional indicators:

Reducing false signals and offering a more thorough understanding of market dynamics are two benefits of combining sentiment analysis with other technical indicators.

Well , Investors can more effectively traverse the volatile market conditions of STEEM and take advantage of new trends or movements in mood by implementing sentiment analysis into their decision-making process.

In the fast-paced STEEM market environment, traders can get a tactical edge by consistently tracking trends and conducting sentiment analysis on social media for a number of reasons. Some of them are going to share with you here.

- Early Market Trend Identification:

Through constant social media platform monitoring, traders are able to swiftly spot new STEEM-related discussions, trends, and developments. When these patterns are identified early on, traders can take advantage of the opportunity to position themselves ahead of the market and profit from them before they are widely acknowledged.

- Quick Reaction to Sentiment Shifts:

Real-time sentiment analysis on social media gives traders an idea of how people are feeling about STEEM. Traders can modify their trading tactics, such as modifying holdings, placing stop-loss orders, or seizing short-term trading opportunities, by recognizing changes in sentiment.

- Adaptability to Market Dynamics:

Constant social media monitoring gives traders the adaptability to adjust to changing market conditions in the fast-paced STEEM market environment, where trends and attitudes can shift quickly. Traders can remain agile and responsive to market dynamics by promptly modifying their strategy in light of the most recent data and sentiment analysis.

Well, All analysis considered, consistent trend and sentiment research monitoring on social media provides traders with timely information, insightful analysis, and a tactical edge in successfully navigating the volatile STEEM market environment.

| Kind Regards 💐 @uzma4882 |

|---|

Greetings friend,

When we look at what people are saying about STEEM on social media, it can give us an idea of how they feel about it. If the overall mood and sentiment are positive, it often means more people are interested in buying STEEM, which can lead to the price going up. On the other hand, if the sentiment is negative, it can cause people to sell their STEEM, which can bring the price down.

By using sentiment analysis, traders and investors can make better decisions by understanding how people feel about STEEM, spotting market trends, and adjusting their strategies accordingly. It can also give insights into the community's opinions about STEEM's technology, usefulness, development status, and overall involvement. These insights can have a long-term impact on the cryptocurrency and investor confidence. Good luck in the contest my friend.

Congratulations, your comment has been successfully curated by @𝐢𝐫𝐚𝐰𝐚𝐧𝐝𝐞𝐝𝐲 at 5%

Thanks sir @𝐢𝐫𝐚𝐰𝐚𝐧𝐝𝐞𝐝𝐲 for your valuable support. It's appreciated..

@uzma4882 Your comprehensive analysis of sentiment analysis and its implications for the STEEM market is truly enlightening. Your breakdown of how social media trends can influence investor sentiment and subsequent price movements demonstrates a deep understanding of market dynamics. Best of luck

Felicitaciones por tu post he aprendido más sobre este tema.

Me pareció interesante lo que mencionas sobre los hashtags o frases populares relacionados con el STEEM en las redes sociales.

Ahora entiendo mejor la importancia de compartir nuestras publicaciones a través de los íconos de redes, al final de nuestros post.

Éxitos

The power of social media is a huge force. Because it is easy to promote anything through social media. Besides, anything is more likely to be good in a short period of time. If that thing is right then it will discuss the positive aspects of people. Similarly, the more positive discussions about Steem, the higher its price trend and the more popular it will become. And if people point out its negative aspects, eventually the price trend will decrease and its popularity will decrease. A dark view of people towards Esteem will be detected. However, some currencies may fluctuate in price trending up or down. I think the trend of social media information will double the popularity of the topic and everything. Best wishes for you.

Regards @shohel44

Hello friend greetings to you, hope you are doing well and good there.

It is true that we can't ignore the importance of social media in crypto market. It creates the sentiments of people through various trends. analyzing sentiment on social media can help traders anticipate potential shifts in the market. A positive trend about any crypto project make it to the moon and same a negative news make it dump.

You said that The significance of STEEM-related trading signals can be increased by combining sentiment research with other technical indicators. Yes this is very much true. Looking for fundamentals along with TA of crypto asses is the best trading it's dynamics and sentiment drive price fluctuations. You have beautifully explained the topic very well. It seems you have good command of the topic.

I wish you very best of luck in this contest.

Upvoted! Thank you for supporting witness @jswit.

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

https://x.com/UShaharyaar?s=09

Your post has been successfully curated by @𝐢𝐫𝐚𝐰𝐚𝐧𝐝𝐞𝐝𝐲 at 40%.

Thanks for setting your post to 25% for @null.

We invite you to continue publishing quality content. In this way, you could have the option of being selected in the weekly Top of our curation team.