Steemit Crypto Academy | Course By @stream4u - All About Price Forecasting | @nachomolina2

This is my entry in the contest sponsored by @steemitblog: Steemit Crypto Academy Weekly Update #10 [ April 19th, 2021 ]. Homework Post for @stream4u: Steemit Crypto Academy | Course By @stream4u - All About Price Forecasting. I invite all Steemit.com users to join. @juanmolina @betzaelcorvo @corinadiaz

What is price forecasting?

In the crypto area, price forecasting is the application of statistical techniques or processes that allow predicting the bullish or bearish behavior that a cryptocurrency will have in the future.

The processes are based on the behavior of the market governed by the buying and selling of assets, therefore, it is taken into account that we are working with a human quality of impulsive behavior on the part of the negotiators.

The purpose of price forecasting is to establish a buy or sell point close enough to reality to obtain solid gains in a given time interval.

Image created by the author, Steemit logo

Discuss why price forecasting is necessary.

When trading cryptocurrency we must be clear that we are working with tokens with an associated value.

Due to the effect of fluctuation, that value can change abruptly without warning.

Crypto investing is a win-win process, it would make no sense to imply any margin of loss in our trading. Hence arises the need to diagnose the trading behavior of virtual assets in order to have an accurate investment guide.

For example, if we enter the market and buy a token at random without any prior study, we would be putting our capital at stake as we have no notion of the upward or downward trend that may exist at that moment; however, if we initially analyze the candlestick diagrams through technical study or make a fundamental analysis in advance, then our investment would be safer and would enjoy commercial logic.

When we enter the market, we must determine the entry price and the exit price that will lead us to obtain a certain profit.

Charts describe patterns of behavior that are usually repeated throughout the history of a currency; price prediction is vital to know when to enter and exit the trade or when we can make multiple transactions without being greatly affected by volatility.

What methods are best for price prediction / forecasting?

Technical analysis:

According to my criteria, the most recommended method for price prediction is technical analysis. Given its visual characteristic based on the interpretation of real-time charts that illustrate market behavior.

Additionally, bullish and bearish candlestick charts have several tools that allow traders to broaden their criteria and adapt to their needs.

For example, the command serves to choose the time interval is useful according to the type of trading being carried out. For a short-term trader can set ranges from one day to a week, likewise, the long-term trader sets larger intervals ranging from a month to a year or more, according to their purposes; for its part the Scalping sets spaces of a few minutes to operate, in most cases of 5-10 for quick negotiations.

Similarly, it is through technical analysis that patterns of stock market behavior can be established which leads to the establishment of support and resistance lines so strictly necessary to predict the beginning and end of bullish and bearish trends which is essential to support a good prediction and know the right time when to buy or sell a cryptocurrency.

Fundamental analysis:

I was practicing the fundamental analysis method for some time and according to my opinion, it makes it possible to choose a certain crypto taking into account the company's reputation, track record and management performance.

Information related to coin capitalization, market volume, percentage of increase, financial liquidity; make it possible to choose a solid crypto project to invest in.

However, other data such as those offered by technical analysis (which I mentioned in the previous segment) are not taken into account.

The capitalization of a coin in the market speaks of the number of people who decided to buy the crypto at the current price, this factor generates confidence as it gives an idea of the amount of money that has been put at stake and therefore the solidity and security of the investment. A large-cap coin is able to withstand volatility and retain value in the face of market downturns. In contrast, small-cap coins can generate significant investment losses due to their low denomination, however, it is worth noting that to the same extent small-cap cryptocurrencies can generate large gains in a short time if on the other hand it were an uptrend.

According to my own criteria, fundamental analysis is ideal for choosing a solid project in which to invest from a qualitative and quantitative point of view, but for price prediction purposes supported with real time data I would recommend technical analysis for its versatility, visualization, diagramming and multiple support tools.

source

DOGE Coin price prediction.

(Technical analysis)

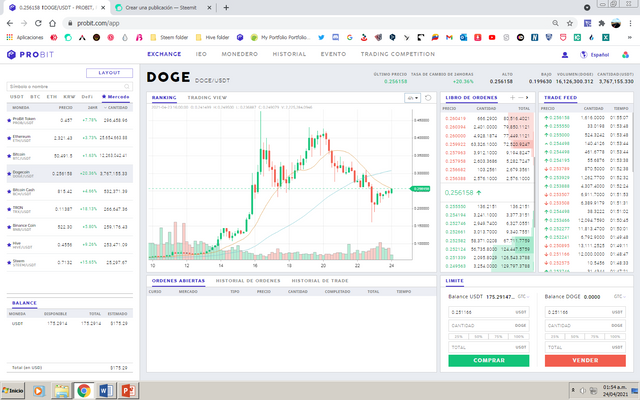

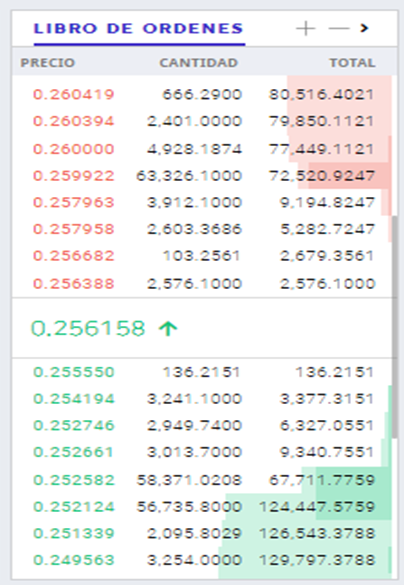

For this occasion I have selected the DOGE coin, since like many, I could notice on the exchanges the uptrend that kept this crypto leaving potential profit margins in just a few days.

Based on my own personal experience trading with DOGE Coin.

I decided to wait for a remarkable support point, which occurred on 04/17/2021.

I then proceeded to buy; as we can notice the rise in value is quite atypical for this crypto and being a small cap crypto then I had to remain alert to any sudden changes.

Use Case

The escalation of up and down in value in just a few hours I believe allowed multiple trades to be made especially for Scalping traders based on volatility, however, I held on as long as I could to wait for it to reach its support value.

I entered with the price at 0.25 USD and when it reached 0.40 USD I watched for a short time until I was convinced that it was resistance.

I proceeded to sell and with my initial investment being 0.25 USD, in just three days it was multiplied by a factor of 0.15.

Since 0.15 was my first profit, I should try to maintain this margin as long as I persisted in my investment. Then, when the chart later returned to coincide with my initial support line, I began to observe the market behavior given the volatility of the DOGE, which in its history had never had a similar behavior, this made me pay special attention to the possibility that it was a bubble.

To my credit, the downtrend continued past my support line and when I decided to buy back the crypto had fallen to $0.21 USD, thus making some additional profit as expected ($0.04 USD).

Now having my new support point I continued in the trading activity with the full assurance that any value above my new purchase would represent a double profit.

It has been four days since I made my investment and the market has become really volatile after the BTC drop to 48M, however as of today a new recovery has started which directly impacts almost all coins in the market. From this, taking into account that the fall in value usually occurs in a shorter interval than the rise, then I make the subjective prediction that according to the previous behavior of DOGE on the timeline, I could expect it to reach for the next three days an average value of 0.40 USD or higher as I must take into account that the historical maximum reached on the 17th day when I took my resistance point was 0.47 approximately.

In that case my investment could make another 0.07 cents more profit which when multiplied by my actual investment amount would represent an unbeatable profit in just one week.

Image created by the author, Steemit logo

Cc: -

@steemitblog

@steemcurator01

@steemcurator02

Original content

2021

It's nice to meet you, here is my new presentation on Steemit.com: IntroduceYourself

Hi @nachomolina2

Thank you for joining The Steemit Crypto Academy Courses and participated in the Week 10 Homework Task.

Your Week 10 Homework Task verification has been done by @Stream4u, hope you have enjoyed and learned something new.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

Thanks for evaluating, I will take your suggestion into account @Stream4u

Twitter:

https://twitter.com/addverso/status/1386092832260247552?s=20