NEWPORT LEGACY ZURICH SWITZERLAND – $11TRN EMERGING-MARKET LURE THAT HERALDS 2019 REVIVAL

Newport Legacy wealth management Zurich Switzerland thanks the writer for reproducing this article.

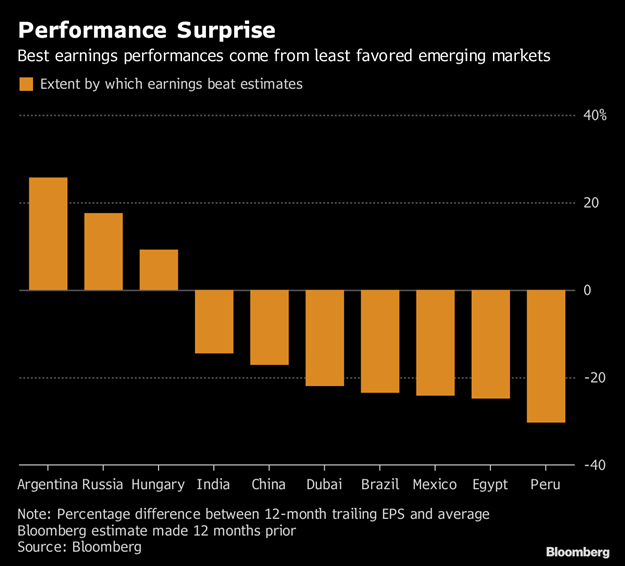

First, the bad news: corporate earnings across emerging markets aren’t as good as analysts hoped.

In four out of every five emerging economies, company finances have fallen short of estimates that were made 12 months ago, according to a study of 25 benchmarks. That’s even after analysts cut their forecasts by 6% since a peak in April.

Now the good news. Stocks across developing nations aren’t as risky as their US counterparts, and they’re good value for money. And thanks to a sell-off this year, $11trn of equities are about the cheapest since the financial crisis.

It may be hard to convince investors to return to emerging markets based on earnings alone, but the combination of low valuations and reduced volatility could make the asset class too good to pass up in 2019.

Growth is broken

performance

Profit expectations are unraveling. India, perhaps the biggest emerging-market favourite of global money managers, is missing earnings projections by almost 15%. China, the world’s second-biggest economy, is trailing by 17%. Six other markets including South Korea and Mexico are falling short by more than 20%.

There are handful of outperformers, but they’re countries where analysts typically give cautious projections, such as Russia and Argentina, because a seemingly endless stream of trouble makes predicting earnings difficult.

How Bloomberg got the data: The ranking is based on the percentage difference between trailing 12-month earnings per share and Bloomberg estimates made 12 months prior.

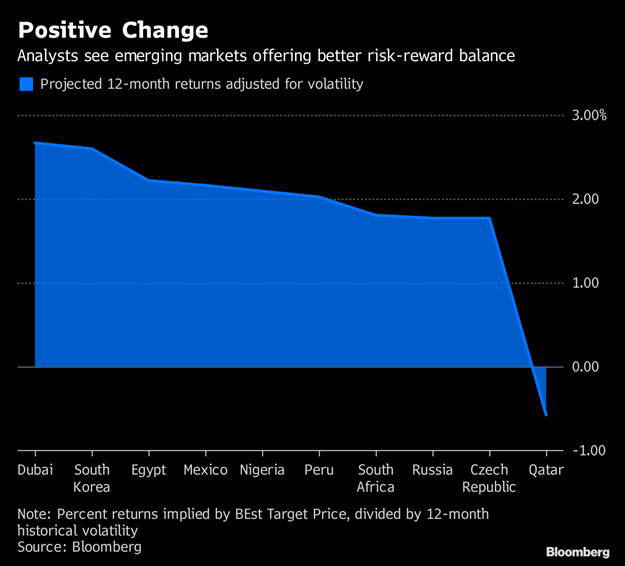

Not as risky

positive change

A measure of risk-adjusted return that strips out historical volatility from analysts’ target price shows 12 emerging markets are projected to yield returns superior to the US in the next 12 months.

Dubai emerges as the least risky stock market for the next 12 months. Among the other gauges enjoying the greatest bullishness are Mexico and Nigeria. All the three markets are among the worst performers this year

While emerging-market stock volatility has risen this year, it remains a third of what it was at the end of the financial crisis a decade ago. So any gains next year will come at a lower risk, bolstering the argument of some money managers that emerging markets are maturing.

How Bloomberg got the data: Bloomberg calculated the difference between analysts’ average 12-month target price and the gauge’s last price, divided by the index’s 260-day historical volatility.

How cheap is cheap?

bargain

Among 30 emerging markets, 16 trade at a standard deviation above the 10-year mean. In other words, companies are earning more profit for each dollar of their share price. Returns from Argentina are almost three standard deviations above normal, the best value-for-money across the emerging world.

The best picks for value traders are in Latin America, eastern Europe and China’s neighborhood. Other Asian and Middle Eastern markets trade close to their historical returns and are considered expensive.

How Bloomberg got the data: This is the calculation: 100(BEst EPS)/ Last Price. Instead of using absolute figures, Bloomberg News used standard deviations.

The MSCI Emerging Markets Index capped the best November since 2009 and rose for a second day Tuesday.

Congratulations @weverton! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!