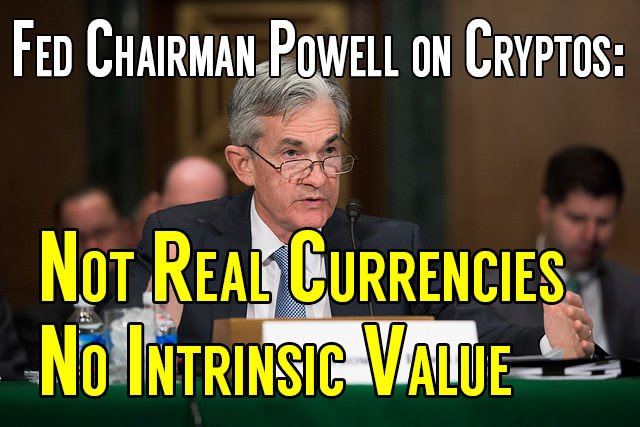

'Cryptos Are Not Real Currencies ', 'No Intrinsic Value', Says Fed Chairman Powell

Federal Reserve Chairman Jerome Powell has warned Congress about the "dangerous" Bitcoin and other cryptocurrencies. Why are they dangerous? Because "unsophisticated investors" can buy or invest in them thinking they are "real currencies", which he says they are not.

Source

The previous Federal Reserve chair Janey Yellen was also a crypto critic, which Powell replaced this past February. Powell see amateur "unsophisticated investors" trying to get into the crypto market after seeing the price climb and thinking they will get into it because it's climbing, yet there is no guarantee that the price will keep climbing for them profit from it:

"relatively unsophisticated investors see the asset go up in price, and they think: 'This is great; I'll buy this.' In fact, there is no promise of that."

Powell told CNBC that it's not only investors that should be wary, as there are "consumer protection issues as well". That's the reason they want to regular the whole damn crypto sphere so that they can "protect" people who don't know what the hell they are doing. That deter people from adopting bitcoin and other crypto, he added that cryptocurrencies shouldn't be considered real currencies as they hold no intrinsic value.

But these words seem empty in substance, as people can look around the world to see how crypto is moving and shaking the financial sector. BlackRock is the world's largest asset manage, and it has confirmed it's establishing a cryptocurrency working group. Not to mention big shots like Goldman Sachs have already gotten into the market with their Circle purchase of Poloniex. Grayscale Investments is investing about $10 million each week. Nasdaq has also been exploring ways to profit off the burgeoning crypto market.

How's that for a promotion of the cryptocurrencies rather than a warning to stay away, Mr. Powell?

Despite negative remarks about crypto, he seems to appraciate blockchain technology, saying blockchains "have significant applications in the wholesale payments part of the economy."

Powell isn't the only Federal Reserve stooge to be against crypto, as the president of the Federal Reserve Bank of Atlanta, Raphael Bostic, has warned people to not invest in bitcoin because it and crypto "are not currency". The head of the Minneapolis Fed also thinks crypto is a "farce" as he

compared them to the Beanie Babies phenomenon. hype and overvaluation. Some Beanie Babies are apparently worth up to $90,000.

Not all Fed branch executives are naysayers to the crypto boom. The St. Louis branch publichsed a report on BTC saying it has many similarities with cash, and "welcomes anonymous cryptocurrencies." It even added 4 crypto price trackers -- bitcoin (BTC), ethereum (ETH), bitcoin cash (BCH), and litecoin (LTC) -- to it's economic database.

As far as "no intrinsic value" the Federal Reserve Bank of San Francisco disagrees since it issued a report that theorized BTC has an intrinsic value of $1,800. This was calculated from the cost of mining a single coin. The current value of BTC Is higher than that, near $8,000. Does that mean BTC is overvalued, or simply that the intrinsic value doesn't determine the actual value in the market? I think it's the latter.

It seems not all the Federal Reserves are playing the same ball game. There is some dissension in the ranks. Crypto is here to stay, despite the remarks that it's a passing fad or farce akin to Beanie Babies. The top financial powers have no real interest in helping people become more wealthy, despite how some underlings appear to be in favor o want to help people get into crypto.

Though some are more honest about the opportunity than others, it doesn't mean they will openly welcome a decentralized asset class outside of their influence and control. But I don't think they will be able to stop the tide of crypto as it washes over the world and cleanses the dominating influence of the banksters and financial elite.

Thank you for your time and attention. Peace.

References:

- Bitcoin Not a Real Currency, Risky for ‘Unsophisticated Investors’: Fed Chair Powell

- Fed Chairman Powell says cryptocurrencies present big risks to investors

- Federal Reserve’s Kashkari Rips Cryptocurrency Market: ‘It Has Become a Farce’

- Federal Reserve Branch Adds Cryptocurrency Price Indexes [Yes, Really]

If you appreciate and value the content, please consider: Upvoting, Sharing or Reblogging below.

me for more content to come!

me for more content to come!

My goal is to share knowledge, truth and moral understanding in order to help change the world for the better. If you appreciate and value what I do, please consider supporting me as a Steem Witness by voting for me at the bottom of the Witness page.

All value is subjective! Nothing has intrinsic value.

What a condescending viewpoint, "some unsophisticated investors..." that's me, "look free money, gimme some!"

No, come on. People who invest in crypto do so because we think its revolutionary, and yes that likely means some expected gains in the future, but we dont just buy because we want gains. Because only those who 1st believe in crypto ever buy some crypto.

This aint no fad. Crypto really will change finance, data storage, data exchange, communication, online security and much more.

Yes, it looks like a fad to some, but it's much more ;)

Intrinsic would mean having a value in and of itself.

No currency has intrinsic value. Currencies are belief systems (as mentioned by @metalmag25 in these comments). You think gold or silver has intrinsic value? Maybe if you're spooling wire for electronics or manufacturing circuit boards.

Can you;

No you can not. You can exchange currencies for things of intrinsic value, but only if the other party agrees (believes) the currency holds some value for them in reference to the exchange.

Most of the fiat is digital as well... you'll find out how much intrinsic value any digital currency holds in a mass power outage or EMP situation. A big fat 0. As far as gold and silver goes, in a survival situation I'd be trading tomatoes for cucumbers, not silver rounds!

When, when the SHTF, it's all very low value and only serves as a medium of exchange if possible. Otherwise barters reigns again, but mediums of exchange are useful ;)

Beanie babies, baseball cards, action figures, comic books, crypto, all most definitely have an intrinsic value based on the fact that there’s is a supply and a demand. Behind every financial institution is supply and demand, it’s what drives economies. To deny crypto a place in verifiable economy is to deny that anything with demand has value. Superman #1 from 1938 isn’t worth the $3,207,852 USD it sold for in 2014 in my eyes. It wasn’t printed with gold on diamond encrusted paper, but that doesn’t mean it holds no value. Obviously it has a high demand and therefor holds a high price. It’s the law of economics. I don’t understand why anyone would believe crypto shouldn’t adhere to the same principles.

The proper thing to say is it scares most investors and financial institutions because of it volitility. Because it isn’t stable and swings both up and down completely unpredictably those who back fiat spread FUD.

Yeah, it's crazy what some things are valued at according to some people. But if ppl place value upon it, then it has value because someone is willing to exchange something for it.

As opposed to the "intrinsic value" of Federal Reserve Notes?

It's true that there is no guarantee that the value of Crypto will continue to rise. What is guaranteed, however, is that the value of Federal Reserve Notes will continue to fall, as they have since exiting the gold standard.

Yup, fiat always fails and goes lower and lower. Seems to reason crypto will rise at least relative to that :)

I think it's hysterical to have the Federal Reserve talking about currency having no intrinsic value given the US dollar is fiat currency. LOL!!!!!!!!!

Do they listen to themselves? Maybe they think we don't know that our money is no longer backed by gold and it's just pretty green paper we all agree is valuable. LOL!!!!!!! They are just upset that they can't control it and thereby control us.

I don't think they need to listen to themselves, they know they speak BS :P

When the elite pretends to care if people lose money it makes me chuckle to myself. They don't care about you. The reason they actually oppose crypto is obvious: control.

Once people realize that crypto is smart money and fiat is a desktop calculator the game will be over. Crypto wins.

You haven't checked the Coin Market Cap today. Bitcoin is up to $8200... with a dominance of 47% (boo!)

Yeah, it' snot about protecting ppl, it's about keeping ppl from going into another asset TPTB might not control, or maybe it's all a psy-op and they do :P

The only reason that any asset (gold - silver) has intrinsic value is because people agree that it does. If you were marooned on an island where one person had gold and one had food, which would have the intrinsic value?

Cryptos are dangerous to these morons (spelled crooks) but derivatives are fine right? If these paragons of virtue really want to "protect" us, why not get rid of the debt-based fiat system?

Yes, but debt system is gold for them, and sold as safety to the rest of us. Derivatives are great gambling "Assets" :P

Not to mention- where else but in a fiat system can debt be counted as an asset!

To me currency could be anything that people agree to have a value set by them, and can be traded for goods depending on its value.

For some Venezuelans, even food is used as currency.

I think that is the definition of currency that you described right there. If I am not mistaken.

Yup, anything can be a medium of exchange ;)

I wonder what his motivations truly are. I mean, of course he has a public job, but then I wonder if he has a secret personal life where he's actually a rebel-against-the-system and listens to rock music and invests big in his favorite altcoin.

LOL, yes they could all be investing while trying to keep the public out. Another way to dominate it.