Africa: Harnessing Cryptocurrency Opportunity

In the beginning of trade, Africans travelled across waters and lands to exchange commodities amongst themselves. Traders measured the value of their products and services, building consensus on the exchange – giving birth to batter trade. Thereafter, a new era of gold was ushered in, followed by other valuable resources as forms of trade. A few years later, promissory notes were converted based on the value of silver or gold an issue has in vault. These revolutionized into the so-called money, whose units can be derived from dollar through pound.

Africa faces numerous problems in cash flows and trade due to the boundaries enacted by the colonial masters. To date, these borders still guide the continent’s ability to trade or exchange money. Most of the trade policies or laws are outdated – dating back to between 60’s and 80’s. International banking institutions such as Afrexim bank suggest that for Africa to grow, people must trade consistently amongst themselves. According to Afrexim, traders must circumvent the problems inherent in money movement and bring underbanked and unbanked individuals into an accessible and easy ecosystem.

In addition, Africa faces the pitfalls of inflation. Many economies struggle with managing their inflation rates on their respective currencies. For instance, South Sudan suffers an inflation rate of over 280%. Further, people from developing regions have limited access to financial services. Financial institutions such as banks operate under strict guidelines while gathering information from clients.

Accordingly, many Africans do not meet the minimum onboarding requirements that banks have in place. The global financial systems are centralized, with bureaucrats dictating how transactions are processed – termed as Know Your Customer (KYC). KYC banking regulation allows banking institutions to collect customer identities including, but not limited to names, contact details, date of birth, etc. this form of financial surveillance robs customers of financial anonymity. Founded to bar criminals from laundering money to fund terrorists, the argument is that modern banking ecosystem is doing more harm than good – eliminating financial freedom initially enjoyed in cash-driven transactions.

Identity requirement in modern banking systems has given rise to financial biases since totalitarian financial surveillance defines who access the banking services. As a result, 2 billion people have been fenced off, as the World Bank Statistics reported since 2014. The very banks are laundering money for cartels and governments, further depicting the totalitarian effect inherent in modern financial systems.

Political turmoil can be cited as the reason why individuals have difficulty accessing their official documents. For instance, displacement resultant of political violence leads to loss of official identification, whose replacement is further challenged by instability of the victim governments. This is a challenge, as financial institutions require these documents to set up bank accounts.

The Internet plays a vital role in online transactions. Despite Africa’s goal to leapfrog the requirements for traditional telephony infrastructure to offer Internet services, the reality is a shortfall. In spite of high mobile phone penetration, mobile data are still expensive and prohibitive for most people, even in countries with relatively advanced broadband infrastructure.

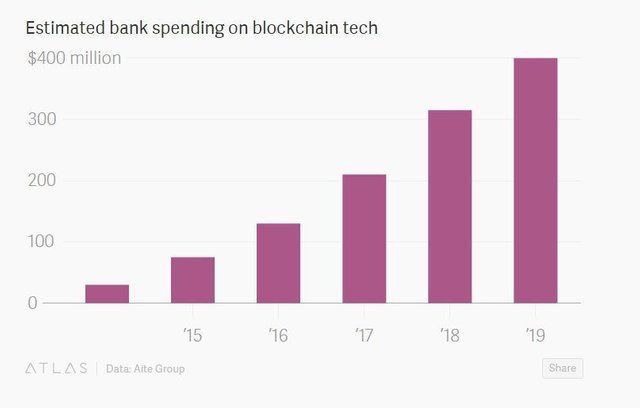

Global banking agencies are spending tones of funds on Blockchain technology (explained later in this article).

It is undoubted that Africa holds substantial potential for digital currency. The continent has over 30 million people working overseas, sending money home. This offers a massive opportunity to bypass the monopolistic money transfer agents and traditional banking system. Also, the continent holds a large population of underbanked and unbanked (without bank accounts) individuals – necessitating an alternative money transfer platform. Also motivating Africa are Ponzi schemes.

In an interview with BBC, the BitPesa’s founder Elizabeth Rossiello explained: “Credit cards are only available to less than 3% of the population in sub-Saharan Africa. PayPal is blocked in many countries or much more expensive in the few it is operating. Bank transfers and remittance corridors are two to three times the price as elsewhere. So in terms of a need for a cheap, fast, functioning alternative form of payment, yes – Bitcoin does have a greater opportunity in sub-Saharan Africa.”

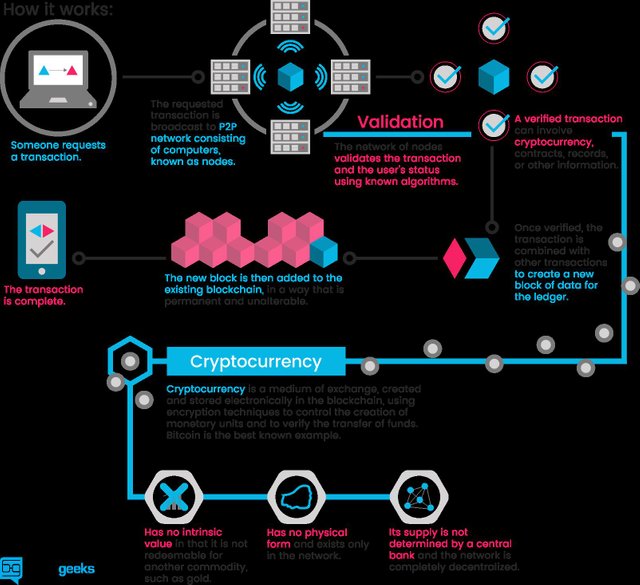

At the doorsteps of Africa has landed cryptocurrency. Cryptocurrency is a digital asset designed to act as a medium of exchange. This digital currency uses cryptography to secures transactions while controlling creation of extra currency units. Cryptocurrencies are a subset of digital currencies, alternative currencies and virtual currencies. Available in the global crypto space are various forms of cryptocurrencies – Bitcoin, RXP, Clubcoin, Litecoin, Iota, etc.

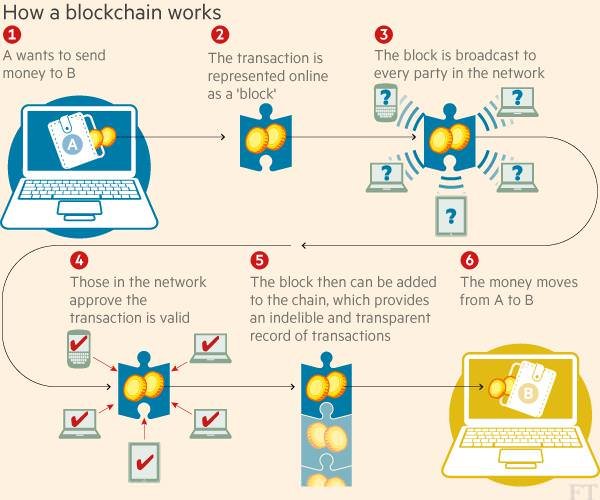

Cryptocurrency works hand in hand with Blockchain technology (see chart above). Blockchain is a continuously growing list of records (blocks) linked and secured using cryptography. By design, blockchains are resistant to data manipulation. Blockchain provides smart contracts, security data solution, cryptocurrency, etc.

The intangible nature of cryptocurrencies bars governments from physically removing wealth of a citizen. In a social contract, this paradigm provides an extra layer of security to people. However, lack of exchange liquidity to convert Bitcoin into local fiat currency, personal remittances using Bitcoin have proven to be more expensive than existing services like WorldRemit – making little sense to settle personal payments using Bitcoin.

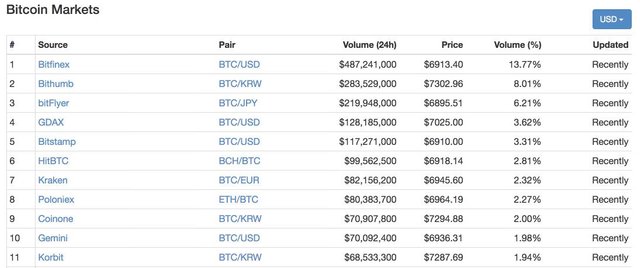

Since the beginning of 2018, global interest in digital currency, Bitcoin is steadily upward (see table below), providing private and institutional investors with the opportunity to harness high ROI. With a unique set of characteristics, Bitcoin is best suited to quench Africans of the barriers to global financial services. Since a number of African retailers now accept cryptocurrency, all that is needed is for people to buy Bitcoin through an exchange platform and gain access to the global market using their Bitcoin wallet.

Cryptocurrencies are the best alternative store of value in economies with restrictions taking cash overseas, large portion of population is underbanked or unbanked, or the local currency is struggling with high inflation rates – e.g. Zimbabwe’s liquidity crisis resultant of inflation spirals. Facing high levels of hyperinflation coupled with cash shortage, Zimbabweans are looking to acquire and use cryptocurrency. Several Africa’s leading Bitcoin startups provide low-cost remittances. They include BitPesa (Kenya), Sun Exchange and Custos Media Technologies (South Africa), NairaEx and ICE3X (Nigeria), Golix (Zimbabwe) and Bitland (Ghana).

Bitcoin regulations, which play a crucial role in its adoption and healthy economy, are divergent across the continent. Nigeria’s CBN banned local banks from conducting cryptocurrency transactions, later stating: “We don’t own it”. Algeria will ban Bitcoin in 2018. Egypt has no plan of legalizing bitcoins while Swaziland is researching cryptocurrencies while Segal plans to launch its own cryptocurrency. South African regulator’s paper outlined interest, later renouncing Bitcoin as “too risky”. Kenya’s CB warned against virtual currencies, though discussions are scheduled to reconsider this statement. Other regulations include Bank of Uganda, Bank of Namibia, There’s increasing Bitcoin trading volumes in Kenya, South Africa, and Nigeria – a positive indicator cryptocurrencies in Africa in resolving its current economic, political, and social problems. Whether we are ready or not, change still happens. Leaving cryptocurrency alone, the question is: What are Africans planning to do to harness the full potential of this opportunity?

Thank you for visiting my blog. Join me next time for more.

Well sure this is a real opportunity that people should embrace. However, the risk for it is too high. We would be better offer adopting technologies on blockchain than focussing all our efforts on bitcoin. For instance, steemit is a good place to start. They way I look at it, there is hope and blockchain is right at the top. Keep up, this is some good research.

Yes i agree, venturing into other platforms such as Steemit is another people can harness wealth, more content will be coming up, stay tuned.

I gain knowledge on crypto everyday when i read about it. I just wish we could adopt one already. They are all fighting for a market share and i think we still have a long way to go.

Thanks for your post

I think the best approach is to first focus on one, then work your way by diversifying to other cryptocurrencies, there is too much info on cryptos and can be overwhelming.

Wow this is such a well-done article. Thanks for all the deep insights. There is so much potential for Africa in terms of cryptocurrency & I am glad there are companies & opportunities cropping up.

Thanks, so much potential for Africa, keep it here for more crypto content.

I believe in cryptocurrency revolution

Interesting

I will follow you to see your future posts!

Congratulations @mboroto89! You received a personal award!

Click here to view your Board

Do not miss the last post from @steemitboard:

Congratulations @mboroto89! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!