US SEC Ruling on the DAO May Have Chilling Effect on ICO Investment

Introduction - the SEC report

I came across an interesting story yesterday courtesy of Coindesk.

As many of you know I was originally a big proponent of the SlockIt DAO last year.

One of the main questions that kept coming up again and again in the discussions on DAOhub (the official discussion forum) was the legality of such an endeavour.

There was no obvious resolution to this at the time. For one thing, the DAO was an international endeavour and nothing quite like it had been done before.

Different countries have different laws and what is legal in one is not always legal in another.

However some of the larger and more powerful nations, like the US, have a large say in what happens overall. Smaller nations often follow their lead.

It was rumoured at the time that the US SEC (Securities and Exchange Commission) was looking into the matter.

They released their report yesterday which you can download here.

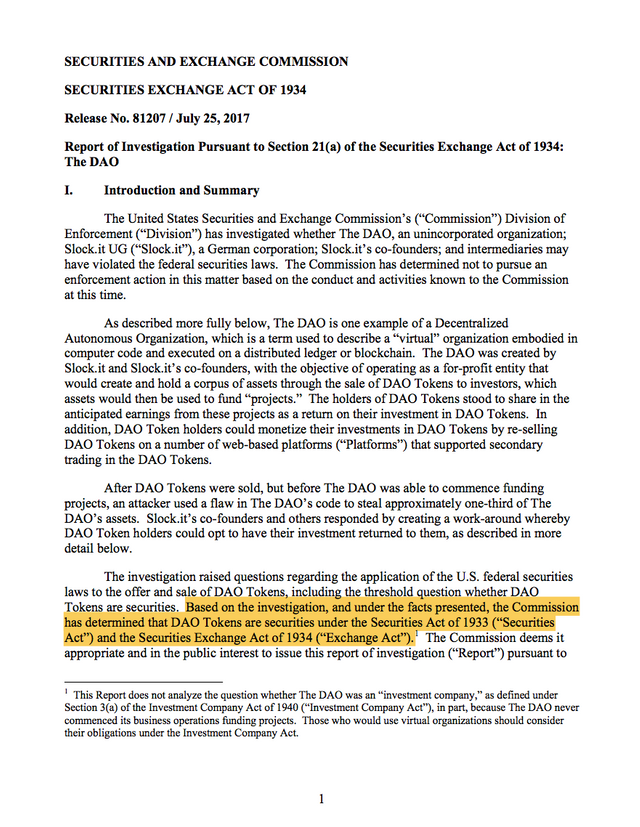

SEC Summary Excerpt

Here is an excerpt from the summary:

The investigation raised questions regarding the application of the U.S. federal securities laws to the offer and sale of DAO Tokens, including the threshold question whether DAO Tokens are securities.

Based on the investigation, and under the facts presented, the Commission has determined that DAO Tokens are securities under the Securities Act of 1933 (“Securities Act”) and the Securities Exchange Act of 1934 (“Exchange Act”).1

The Commission deems it appropriate and in the public interest to issue this report of investigation (“Report”) pursuant to Section 21(a) of the Exchange Act2 to advise those who would use a Decentralised Autonomous Organisation (“DAO Entity”), or other distributed ledger or blockchain-enabled means for capital raising, to take appropriate steps to ensure compliance with the U.S. federal securities laws.

All securities offered and sold in the United States must be registered with the Commission or must qualify for an exemption from the registration requirements.

In addition, any entity or person engaging in the activities of an exchange must register as a national securities exchange or operate pursuant to an exemption from such registration.

Although most of the discussion here is about the DAO the more important implications for this report (in my opinion) are in regards to ICOs:

My Thoughts On What They Are Saying

There is a huge amount I could write on this but I will keep it succinct. Basically from what I can ascertain:

Reducing administrative/regulatory burden is part of the attraction for ICOs.

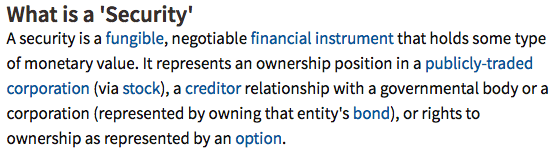

The SEC considers the DAO and ICOs in general to be securities and subject to securities law. There is a summary of the laws and requirements here.

This means that anyone issuing them in the US will need to be registered with the SEC.

It also means that exchanges trading them in the US will need to be registered.

If you examine the link I have provided in point 1 it goes through all the rules and regulations that must be followed and just a quick scan of it shows that it is actually quite onerous.

Part of the reason and rational for ICOs (and also DAOs) is to reduce the administrative burden created in large organisations.

Most of these ICO projects involve small teams for whom this kind of compliance could prove difficult, if not practically impossible.

What is a security? Source Investopedia.

Since the DAO has ceased to exist they no longer care about taking any action in relation to that - something which they make quite clear in the report.

It is also obvious that they will be expecting future ICOs to be compliant.

The question then becomes what, if any action, will be taken against existing ICOs?

Will US exchanges need to suspend trading of them until they become registered? Will the ICO issuers need to register with the SEC after the fact?

I would love the opinions of someone who has an understanding of the legal issues here.

A Chilling Effect on ICOs?

In my opinion there are a number of things that this ruling could cause to happen that could ultimately slow down growth in the ICO market:

Many ICOs may simply exclude US investors.

US exchanges may refuse to list new ICOs for trading.

Those ICOs that do want to register and trade in the US may take longer to come to market, be less efficient and find it harder to compete with competitors that don't.

There may be a general slowing of growth in the ICO market due to both uncertainty and a reduction in US investing as a result of the above.

Other nations may step in and take advantage of the gap left by the US.

Obviously the US is a huge market and one of the most important nations for tech innovation.

None of these outcomes are ideal and I think it hard to say for sure what will happen.

Ultimately it may mean that the US loses some of its prominence in the cryptocurrency sector and that other nations start taking more of a lead when it comes to ICOs and new business models.

What do you think? Please let me know your thoughts in the comments.

Thank you for reading

There are many ripple effects this can and/or will have. We have only seen on occasion ICOs not available to US investors.

This will just exacerbate that. Which leads to the possibility that you mentioned; other countries becoming more prominent in the crypto space. Given crypto is likely the future of transactions/currency then the US will be at risk of losing it's place as the world's superpower/reserve currency.

That's just one possibility. On the flip side, the registering of ICOs (and all coins possibly) will have the positive effect of weeding out alot of the potential garbage coins due to the resources it takes to register and launch.

That instance does have the inverse of us missing out on an innovative startup coin that will not come to be, a diamond in the rough if you will.

As I said, ripple effects in all sorts of directions. It should be interesting either way!

Excellent points. I think there could be some benefits in weeding out scams but as you say it might mean missing out on some great gems.

Centralized regulation never helps weed out corruption, it encourages it. Trust.

Agreed, garbage coins does not necessarily mean corruption. Higher the power higher the corruption usually.

yuup. this.

I think you wrote a super-informative piece here @thecryptofiend.

Here are a few of my thoughts:

FIRST THOUGHT ... and what if they don't? Say I start a ERC-20 token crowdsale right now from NJ, USA and list the event on a .onion site.

2ND THOUGHT

If the US Govt actually makes this a sticking point, they're going to cause the price of all digital assets to skyrocket because the cat will be out of the bag that they're afraid. This is undeniable, that they are afraid. When the people know the government takes crypto as a legitimate competitor to their legacy model, it will get mass-market adoption, but the big action will happen through private brokers and through decentralized exchanges such as https://openledger.io/

LAST THOUGHT (gotta have three, right?)

Let's all remember that decentralized systems like STEEM, BTC and others are not beholden to centralized, legacy, elite-funded-and-backed "governing entities" -- They're simply socially sanctioned monopolies of force.

Our system is going to make their system obsolete. I, for one, am dedicating the rest of my life to making this happen!

Awesome response. I think you make some great points. Ultimately they can't really stop things. What I think they can do is go after individuals that may be involved. For example they could target any people who are members of the team that reside in the US. They could also shut down any exchanges that are based in the US that don't comply.

That's the extent of their powers, it appears. I'm glad you agree they can't really totally stop ICOs if people are determined enough to skirt regulators -- somebody always is. If they come after ICOs, it could have a chilling effect. Then again, it could be the very impetus to free the cat from the bag, as it were.

Well they might just push things underground.

Actually I think this is a golden opportunity for developing and emerging markets. Crypto/Free-Market friendly legal frameworks and support can end up making the next wave of Singapores and Hong-Kongs. I hope the small developing nations wouldn't miss on this opportunity. There is always a bright side to things. USSA is trying to dig its own grave like the old British Empire.

Blockchain FTW!!!

Well said @vimukthi -- I'm following you in hope of more wise comments under my posts :)

I can't stop governments and its adherents doing what they will. I'm spreading real decentralization anyway :D

"are not beholden to centralized, legacy, PEASANT-funded-and-backed"governing entities". Fixed it for you. Please don't call these people elite. They are peasant of the lowest order.

True, it either trashes the word "elite" or it requires a re-naming of the shitlords on top of centralized, shitmountain. I see your point. Language matters.

Shit-peasants...all of them ;)

HAHAHA Yayyy! Doo-doo. Yep, shitpeasants on shittaxlord mountain :D

The problem I see is if you turn your crypto into something other than crypto. So long as you don't translate your holdings into fiat, there's really not a whole lot of anything they can practically do. However, if you're like me down here in the great state of Alabama, I can't buy a loaf of bread and school supplies for kiddo with BTC and Steem yet. At that point, there's a trail to follow and they could, if they so chose to, press the issue.

For one: You can. Have you looked into LocalBitcoins.com? If you didn't want to mess with that, I'll private broker for you. I'm sure plenty of people you ask here would be willing to private broker you fiat for crypto. I could get you cash in hand today, Moneygram for any crypto you wanted to sell. Nobody would need to know, especially governments.

I feel you on your concerns and you're right. It's going to get easier and the regulation they're proposing will only prove their fear.

Plus, before long, we won't need to leave crypto. You'll be able to scan a QR code at the local Walgreens and pay in crypto.

I am eagerly awaiting the day I can scan a QR code to buy groceries with Steem or some other currency XD I'll check out localbitcoins.com. Thank you so much for the suggestion!

Yessir!

Fiat currencies, especially those issued by the Federal Reserve, are in the most severe of SEC violations. If the Fed was an OTCBB stock, the SEC would have to regard it as stock printing press; having no intrinsic value. Turning any cryptocurrency into FRNs and having governmental hassles amounts to entrapment. FRNs have no value, except what people are willing to part with in order to receive them. The stock market is often called the greater fool market. The lack of value in fiat currency is reason why folks turn to gold, silver, cryptocurrencies, barter, etc.

I don't disagree at all. However, fiat is what most places currently operate on, so I don't have much of a choice at the moment. I'd love to develop my own merchant services to sell to merchants here locally, but I'm no engineer or developer, and I don't have the capital to pay others. I'll have to make due until then :D

@anarcho-andrei, have you looked at the Bitcoin site? They offer merchant accounts. Just add:

/merchant-solutions

to their home page. This could be one of the several temporary bridges for you.

BTW, seeing your alias, you might want to check out my profile and my introduce yourself post.

Upon a bit of thinking, you can contact Ned Scott (@certainassets, Steemit: @ned) our CEO and inquire if he and his team are or will consider offering merchant account services for Steem.

Upvoted and Resteemed by xx-votesplus, the dropAhead curation team! Want more earnings? Join @dropahead in Streemian https://streemian.com/profile/curationtrail/trailing/396, or delegate/donate some STEEM POWER to @dropahead!

Please upvote this comment! We will earn more STEEM POWER (SP) to give you more earnings!

Keep up the good work!

Most recent post: First 7 weeks of xx-votesplus: YOUR dropAhead Curation Team!

So instead of selling tokens...give them away..I mean people are just exchanging one virtual currency (US Federal Reserve Notes) for another..

If they gave them away, how would they raise funds?

Change your mindset. Currency is just an agreement between two parties. The Federal Reserve Note only has value because you believe to have value.

No change your mindset. That response makes no sense. You still need money to operate in the real world. If you do an ICO you need to raise money in some form. If you give tokens away it is not an ICO.

It makes perfect sense because my mindset has been changed. You believe Federal Reserve Notes to be money. I just see it as a symbol or an illusion.

No it doesn't unless you have completely lost touch with reality. Further you have no idea what I believe. No degree of changing mindset will allow people to raise funds by giving tokens away so stop evading the issue.

ICOs will be regulated.Not only in USA but in most part of the world. Its just a matter of time. When money(how ever you argue, coins are not given,its either fiat conversion or compensation) is collected from investor class defined as "public", then authorities have every right to regulate it.Even otherwise it is regulated but differently. I could bet on this!!!!!

I think you may be right.

I hope the SEC doesn't chill the cryptocurrency movement @thecryptofiend. I can see how they want to control it--because it allows them to collect more in taxes. I think many governments were a bit blindsided by the rapidity of the cryptocurrency growth.

I hope not but I think it will cause problems for US investors.

Seems like it.

Isn't that precisely what happened with EOS? Isn't this the reason that US investors were explicitly excluded from buying into the ICO?

That is probably why.

I think thats right, US will be excluded once again. When are people going to get tired of it, it's not good for business.

Exactly.

Not all ICO's are securities:

Source: Investor.gov bulletin

It depends on whether the SEC considers them securities or not though.

At least it will prevent fraudulent activities as well as scams but the bad thing is, this is just one step forwards towards the state trying to regulate and moderate cryptocurrency.

Sad thing is that it most definitely will decrease the number of ICOs reducing the plethora of different tokens on the market.

It seems like even though crypto was one a sign of freedom, showcasing how as the consumer want a decentralised world, without the ever pressuring presence of the state, might now be a thing of the past.

Let's hope crypto can stay decentralised and act as a platform where anyone can use it throughout the world with no precautions or anything prohibiting them accessing the cryptospace.

It all goes downhill when the state tries to get involved unfortunately.

I doubt it will prevent frauds and scams it will just increase the burden for genuine ICOs that operate in the US. Fraudsters will likely not care either way.

Last I checked most of these "scams" were done by the likes of the big banks. And very few did any jail time but they skimmed some of their profits for a trivial fine.

Yes they do it all the time. Occasionally a low level person will get into trouble but the people higher up rarely get in any trouble.

More regulations and rules only increase criminal activity.