[Financial Freedom] Do you have any capital?

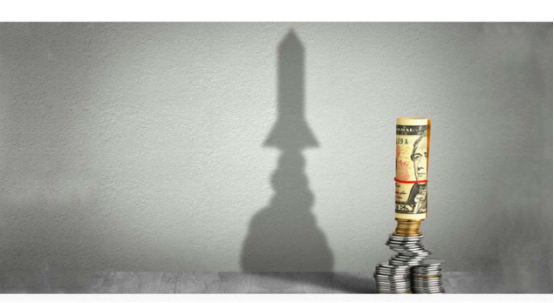

This week, we will update a concept that is really important for those who walk on the road to financial freedom: capital.

I especially love to use an analogy, and used it repeatedly on various occasions, with many creative ideas (like tricky):

House was built mainly by bricks, but just a pile of bricks is definitely not a house...

The same reasoning:

Capital is really composed of money, but it is certainly not capital when where only a pile of money is put.

Money and capital are actually very different things, just like a pile of bricks and a house are certainly not the same thing. So, money and capital, in fact, are totally two different things.

So, where exactly is the difference between money and capital, what elements of “funds” are worthy of being called “capital”?

Money itself can be counted as funds at most, and it wants to be an effective capital, there are at least three other elements that need to be:

- The amount of funds

- Time limit for the use of funds

- The wisdom behind the funds

In today’s world, one hundred dollars cannot be treated as “capital”: Only because the amount is too small. One million may be capital, maybe not: It depends on which area is used for investment, right? Billion? The amount of one billion is certainly far beyond the scope of “enough”, but even so, only one billion itself is still hard to calculate directly as capital.

Because the second element of capital is more important: See the time you can use a large enough amount of money. You can only use the words of the day, not to mention the investment, even find a place to gamble (because you have to find a match, have one billion dollars gamblers is not very easy to find in a secure manner)... The amount of funds that can be used for a large enough amount of money can be used for one day, one month, one year, two years, ten years, or even forever: All different, and difference between the powers is very different.

Vanke has a legendary shareholder, Mr. Liu Yuansheng (刘元生). In 1988, Mr. Liu took down 3.6 million shares of Vanke shares for 3.6 million dollars, and has not moved so far... With a market value of 269.7 billion dollars on June 27, 2016, Liu Yuansheng’s asset wealth was approximately 2.7 billion dollars: Equivalent to 28 years, 750 times! (Actually, this is not yet another fact: In 2016, Vanke’s market value has shrunk a lot...)

But don’t envy about it, this is the capital the most people can’t have. The 3.6 million dollars in the late 80s is large enough; but what is more critical is that for Mr. Liu Yuansheng it is money that need not be appropriated to death, so that’s capital! People with such capital say it is one hundred thousand miles to pick both too much?

In fact, the most important is the third element: the wisdom behind funding. The same money, in the hands of different people, will play a different power. If you really have a space-time shuttle, take you, me(Li Xiaolai), Lei Jun, Wang Gang, Xu Xiaoping, back to some point in the past and give them a million dollars each. Do “first angel investment”, do not guess, the highest yield is certainly not you and me, right? Didi Taxi’s angel investment just 1 million dollars, and the already listed jumei.com’s angel invested only 100 thousand dollars.

Still the same wording - this is a cruel fact:

Most people do not deserve to stand after capital.

I’m very clear about this fact and how cruel this fact is:

In 2008, even if I had 1 million idle money, I didn’t even know whom to investment for... By 2013 I think I knew it, and the result was a lot of wrong people and projects...

Yes, it took me a long time and spent a lot of energy before I basically felt that I could stand behind the capital, but I also knew that it was only pass.

The good news is that, although it is not easy, the strength behind the capital can indeed be learned. The method of acquisition is to gradually break through the various dimensions (amount, time, and wisdom).

The first thing to break is not the amount of money - this is the fundamental trap for the vast majority of people to stop.

Many people mistakenly think that they “don’t have much money anyway”, so it doesn’t matter to yourself. Instead of comforting themselves, they said, “it’s silly to watch those people calculate their money all day...” This is a common psychological means of self-protection, it is as if during the school period, those who did not study well just looked down on those who studied well. And the boys are disgusted with the little girls to cover up another emotion and even start to hate being attracted to girls, exactly the same, there is absolutely no difference.

In fact, the focus of investment is not the size of the absolute value of profit and loss, but the size of the profit and loss ratio. This is particularly important. Look at the relative value, not the absolute value. In the same investment environment, a profit of ten thousand dollars is 50% and a profit of the hundred thousand dollars is 15%. the former is better than the latter, or a little more professional is that the former is more efficient than the latter.

Focus on the profit and loss ratio (relative value), not the size of the principal - the profit and loss amount (absolute value). Is more than 90% investors did not learn thing for life. This is essentially the failure to apply primary knowledge of mathematics to its use. 90%! You may not believe it, you may think: “There is so much exaggeration!” - You see how many people in the stock market like to buy junk stocks then know that the fundamental reason they buy junk stocks is “that stuff is cheap.” They value the absolute value, so even if the stock with high profit potential, they just look at the price and “feel too expensive” and turn away.

Many people didn’t really think seriously, today’s stock market, in fact, thousands of dollars that can start the investment, is the vast majority of people have, but they don’t know, didn’t expect: the principal in relative size is not important, important is the proportion of profits and losses....

(About the bizarre of the domestic stock market (China), not to discuss here, not to argue this topic is too heavy, too distorted... Also note: the purpose of this article is not to encourage everyone to buy stocks now or immediately, but to use the current situation of stock market as an example to prove that many people’s basic view of capital is superficial....)

The second breakthrough is the most important: Can you give your investment money a “sentence of life imprisonment”....

Psychologists have come to this conclusion through a lot of research:

If more than 2/3 of people lose 10% of their annual income....

If more than 1/2 of people lose 20% of their annual income....

- In fact, it will not affect the quality of their own lives... but most people aren’t soberly aware of this fact.

In other words, those who earn 60 thousand dollars a year will take 5 thousand dollars as an investment and give the investment a life sentence. In fact, it will not affect their quality of life in a large probability.

This most important breakthrough is easy to say and difficult to do. It also is only a matter of concept - conceptual transformation, the so-called “breakthrough” is naturally well down, even don’t decision that cannot be made; if the concept is not changed, it is at most “perseverance” for a while, and it will naturally give up.

This is the most important concept and the most important iron law:

If you can’t calmly be sentenced to life-long imprisonment for capital, then don’t pretend to occupy the capital of world....

The second breakthroughs are most important because the third breakthroughs need are concurrently combined with the second breakthroughs:

Investing knowledge, experience, and wisdom can only be obtained from actual combat - the books written and Boles are all not related to you, because only those things that take root in your bones sprout and don’t die and wait for a long time. Will be strong and even lush....

Must believe that this long process is indispensable, it is not what smart can do. It is like having children, ten months must be ten months, and more than a month less a month are very dangerous, and in any case not possible with IQ is not closed for four or five months in advance. Nothing can help you to cross that experience. (You think about it, this principle and the above-mentioned “The vast majority of people are not able to apply primary school mathematics knowledge to their own lives in life” is exactly the same reason....)

The stock market is the largest investment market, 80% of investors lose money - if refined to sum up, the most fundamental reason, in fact, there’s really only one: they don’t deserve to be called investors, they used the “investment” is not capital, just “damn money”. The key is not that the amount is not large enough. The key is that the time limit is too arbitrary. Therefore, when the most basic conditions aren’t satisfied, even if there is a short brilliant, it will eventually be a mirage.

Eventually you’ll find that for its own funds “sentenced to life imprisonment,” actually have enough wisdom, so that they are eligible to stand in the capital behind-and they can eventually become an outstanding investor. It’s just a matter of time sooner or later, first because they has already started; and is equivalent to the already “win at the starting point,” because the first that “put their money on a sentence of life imprisonment” behavior has been for them after “can develop long-term in-depth thinking of the future” the ability to lay the foundation. With this foundation, many of the skills simply don’t need to be used , and many of the traps disappear automatically, and many of the entanglement moments vanish....

I know that you may now feel that life imprisonment is cruel and unnecessary, but that’s the wisdom you need to learn: Struggle to learn clearly the great difference between “very want but no ability” and “can but not necessarily”. it’s like a person had already a university acceptance letter but chose not to go. And someone actually did not get an admission notice but claimed that “I didn’t want to go at all.” This is totally different matter. You can give your money a life imprisonment but end its “sentence” in two years later, and actually you can’t give your money a life sentence but eventually end it in two years later. Even the same ending, which is also a huge difference the big difference to it even affect your brain work, not just thinking quality is so simple....

In a word, you should now understand why “borrowing money to investment” is in less cases the odds?

1. The amount is not even too small, but it is simply a negative number;

2. The time limit is always not long enough, but it can’t be sentenced to life imprisonment;

3. If even the above two problems can not be thought of, that brain really do not deserve to stand after the capital....

But there are really many people in the world who are obsessed with doing more dangerous things: borrow money to gamble. Big world!

At the end of last year (2015), I said this on Twitter:

I actually found a shortcut, but unfortunately already beginning the way long time...

Walking along the way, the more you go, the farther you go, the more you sigh. The simple things, such important things, no one haven’t been explained to me all the time, and how can I be able to read books to “ingeniously” escaped it at the same time?

(Of course I can’t be foolish enough to believe that “the three elements of capital” are my personal “first-to-first-discovered truths” - surely some people had understand them, and surely people have already written in a book I haven’t read before. Oh, life! After a long time, I’d like to understand another thing, I won’t list it right now, I’ll explain it in detail in a later article.)

From this point of view, for the vast majority of people, the breakthrough of these key points has suddenly become a threshold-less activity after the escalation of the concept. For those who still lag behind that it was a chasm, no, it was a chasm of chasm, one could not pass.

Ok, now start thinking.

- If 5000 dollars can begin formal investment activities (Temporarily not matter what kind of investment activity), what time may your earliest start? How long has it been so far? How long have you missed it? (that’s part of your limited life!)

- If 5000 dollars can begin formal investment activities, what percentage of the people around you can actually engage in investment activities, but in fact they never realize that they can? Guess how long they will miss?

- The 5000 dollars is just a number. The important thing is to ask yourself seriously: how much money can I really have to “sentence it to life imprisonment?” If you don’t feel enough, then what’s the number in your heart? How long will it take you to do it?

- If you have already started investment activities, do you use the “money” to be called “capital”? Have you ever thought about the “sentence of life imprisonment” for your money? If you did not do it later, why? If you do, do you think those who can’t do it are really ridiculous?

- Just know that it’s useless, do it. You have just upgraded a very important idea, then, what can’t be done? What must be done? Pull a list. You may be scared, because you have no long existed before. In the future you may be scared again because you can forget about this serious list.

In the ensuing weeks, we will still return to concepts that seem to be irrelevant to “wealth”, “capital”, and “make money”. However, thinking about capital should not stop once it begins.

【The previous chapter】

Meet talent scout’s scientific method

“Live in the present” vs “Live in the future”

What is the most heavy shackle of your life?

PAY IS GET MORE

What is the most valuable asset you have?

Every reading is once study. I have read more than once in this article. I have learned a lot and I hope to enjoy it for everyone~