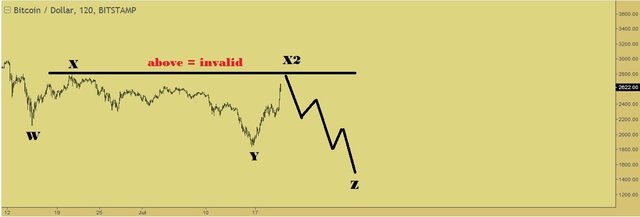

BTC in a stable upmove - Above 2800 the bulltrap has been invalidated!

As I already wrote in my last Post - the 2800 level was the crucial mark for a possible bulltrap. And now it has been breached, which means that according to Elliott wave theory such a bulltrap is not possible anymore.

So we are now looking at a stable upmove, which will continue to new all time highs.

As a Trader I will now start to buy into every corrective wave i see... As an investor I will hold on to what I have (not looking to sell soon).

.png)

For those of you who don't know yet:

Elliott wave theory is a very complicated form of technical analysis. It looks at recurring market patterns and predicts possible next moves by likelyhood. I have been trading using Elliott Wave Principle for 5 years now.

If you think this to be useful information:

.png)

DISCLAIMER: I provide trading ideas using EW and Pattern analysis. The material in this post does not constitute any trading advice whatsoever. This is just the way i see the charts and what my trading ideas are. The author of this post is holding positions in this market at the time of this post.

If you make any trades after reading this post it is completely in your responsibility. I am not responsible for any of your losses. By reading this post you acknowledge and accept that.

Tell me what you think...

Have a nice day :-)

Thanks for the update. Think December 2017 we could be looking at $6000.

I don't know about the timing but if this is a wave 1, the upcoming wave 3 will be huge and could reach 5700

You Received an UpVote from @worldclassplayer. To Learn More, See DetailsHere

Interestingly enough there have been several people here who have posted reference that Robert Prechter (father of Elliott wave theory) is now calling bitcoin teh biggest bubble since the tulip mania. :-) I agree with him. I am tracking bitcoin via the U.S. exchange traded bitcoin tracker GBTC and blog about it. I currently have a full short position in GBTC (paper trade only as GBTC is not actually shortable) and if it crosses the $420 price barrier I believe there will be a major selloff that will cut the price in half very quickly. "Actual" bitcoin will follow. This rally in bitcoin the past 2 days is being sold on massive volume btw. So to me it appears that those manipulating price used the "preferrable" news of the segwit over the hardfork as a catalyst to sell to the less expereinced traders. You can "clearly" see the high selling volume on teh 3 day live bitcoin ticker.

http://bitcointicker.co

High volume selling and BTC still up with no sign of weakness. That to me is as bullish as it gets. People who bought low wanted to make a quick profit, and people who bought high were very eager to sell with a small profit as they feared the market collapse. This explains the high volume... The market should be settled now

With the VIX volatility index making a new multi-year low at the close on Fri and at least 2 of the major stock market indicies already showing as long term confirmed tops, I believe we will know for sure as early as this coming week. In disclosure, I am already short teh SPY, and Russel 2000 via IWM. Looking to go long the dollar, VIX, and short QQQ this coming week. The initial move down should be one we will all remember imo. My "theory" is that when the stock market bubble (this one centered in Silly Con Valley, Cali) collapses...so will the entire crypto sector.

I get that, but my theory is the opposite. When the stock market crashes, or as I would say "it starts a healthy correction", people will turn to gold, silver and crypto. Because if it crashes this will not be a few days but months. So in this period there is not much to win in the stock market and the risk is high. This sector rotation has been seen often in the past. But it would be the first for the crypto market I think.

What are your arguments for the crypto market crashing with the stock market?

I think the cryptos are being driven by Wall St money. And when the stock market begins to crash the big players will run to the "safe havens" like they did in 2008. Gold crashed into the 4th quarter of 2008 if you recall. And the ONLY reason it began to rally before the general market did was because it "correctly" predicted the inflationary aspects of the free money policies of the Fed and Treasury Dept. This time I believe it will be different because the ave guy on the street now knows that bailing out the banks provides no benefit to them. Any Congressman who even thinks about voting to bail out the banking sector like they did in 2008 will have to hire 24 hour armed guards just to go out in public as America will revolt if they try to bail out the banks again. The windup is that this time the "real" market will be allowed to price everything to "fair" value. Imo this ponzi scheme actually started back in teh 1980's during the Reagan presidency. So I wouldn't be surprised to see home prices, gas prices, oil prices, labor prices, everything go back to there. The two safe havens will be U.S. govmint debt, just as it was in 2008 as for a short time the very shortest maturities paid a negative rate of return. Increased demand for govmint debt has already begun imo.

http://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=&symb=tlt&x=61&y=9&time=18&startdate=1%2F4%2F1999&enddate=2%2F18%2F2017&freq=7&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=0&maval=9&uf=0&lf=1024&lf2=2&lf3=8&type=2&style=320&size=4&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=11

Next will be the dollar. Look for my buy call on teh dollar at my blog titled >>> "What goes down MUST go UUP!" I think the dollar turns higher this week as the markets top out, and the sexy VIXens begin to rocket skyward.

http://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=&symb=uup&x=58&y=23&time=18&startdate=1%2F4%2F1999&enddate=2%2F18%2F2017&freq=7&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=0&maval=9&uf=0&lf=1024&lf2=2&lf3=8&type=2&style=320&size=4&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=11

Also, something else for you to consider. Even though Bitcoin is attacking the multi-year high most of the other "established" crytos are nowhere near previous highs. The only ones generating massive gains are the most speculative ICO's like Veritaseum for one. A stock trader would note that as an obvious "divergence."

That is true. An obvious divergence. But I think this is because people are not buying the BTC rally yet. Not everyone is as convinced as I am that it will go up, or has the elliott wave knowledge to see the chart indicating that it will.

I see that bitcoin pulled back from the $2850+ area it was at this morning and dropped $100+ on those volume sell spikes I outlined. Now back up above $2800. I think it will bounce up and down like this (wit a slightly upward bias) until around midweek. I don't expect any major selling until late in the week.