Finally, the Big Cut appeared.

There's a only one way for the interest rate to go. The direction is already decided. The 🇺🇸 CPI(Consumer Price Index) is around 2%. But, the U.S. labor market is getting worse. The goal of the Fed is to stabilize both the consumer price index and the labor market.

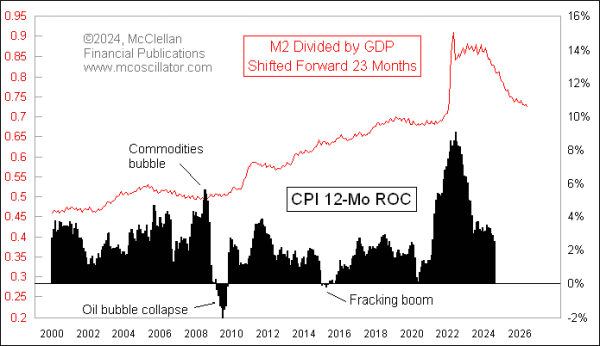

As I prviously explained it, the M2 divided by GDP is a leading indicator of the CPI by 23 months. So, I think investors need to more focus on the labor market change.

Definitely, a new generational wealth is coming. If the U.S. succeeds the softlanding and enter the Goldilocks, long-term investors will made great profits in the future.

Upvoted! Thank you for supporting witness @jswit.

The problem with inflation figures is how they are derived. Depending on what you use as a basket, your figures will vary. Using low inflationary products, utilities & services hides the true & extensive inflation rate.

不错

Hello

Nice note please visit the website https://valuefocussed.com/