Steem-Engine Tokens 5.: How To Be Rich, Quickly!

Summary

- Margins in the trading of Steem-Engine tokens are way too high

- This situation can be corrected by market making activity

- Market making can be a damn good business

“Deadly Margins In The Trading” – Originally, I wanted to give this headline to my last post about Steem-Engine Tokens market. Because they have 30 percent of average margin (spread) between buying and selling prices, and this, yes, is deadly, far too high. It reveals us a very illiquid market which causes a lot of suffering for small and large investors.

Now or never?

If you are not familiar with this: In this case, if you want to sell only tokens worth 50-100 STEEM, you can push the price 10-40 percent down on this market. If you want to buy a token with 50-100 STEEM, you will probably drive up the price by 10-40 percent, approximately.

Or, you can put an offer in the “book”, somewhere between the best selling and buying prices (bid and offer), and wait patiently. Maybe days, or weeks. Maybe the price shifts and moves away during this period, and your trade never realizes at that price.

Staking kills trading

I wrote last time that the broad margins are signs of the following three phenomenons:

- The product is very risky.

- The buyers and sellers are very scarce, volumes are very low.

- There is only one market-maker in some monopolistic position and this player wants to earn a lot.

But I forgot one: The tribes, the developers, many Steem enthusiasts, bloggers are encouraging people to “stake and hold” the Steem-Engine tokens. (“Power up” on Steemit.com.) This drastically reduces the number of sellers, and thereby also the buyers’ interest, the volume. Another reason can be the falling prices.

Profiting on the bid-ask spread

Don’t only criticize, also make good suggestions – I tell myself. I made one yesterday: We should make more market-making activity, put more offers in the “trading books”.

A market maker is a individual market participant or member firm of an exchange that also buys and sells securities for its own account, at prices it displays in its exchange’s trading system, with the primary goal of profiting on the bid-ask spread, which is the amount by which the ask price exceeds the bid price a market asset. (Investopedia.)

Some eloquent numbers

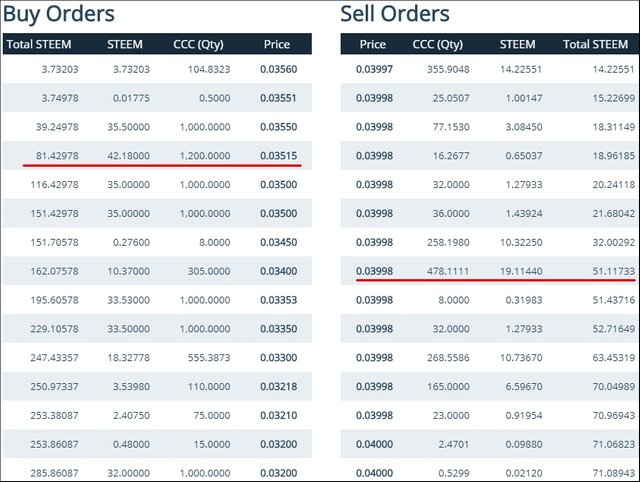

For example? CCC (CreativeCoin token) also has a wide spread, among others. If you want to sell CCC in value of 50 STEEM, you could only do it pushing the price to 0.03515. And if you want to buy 50 CCC, you would complete your order at 0.03998. (Marked with red on the picture.) The difference is 13.7 percent. If you want to buy CCC with 100 STEEM seemingly you couldn’t even do it – we see not enough offers in the “order book” at the moment.

Steem-Engine token market, CCC order book

Market making can be a damn good business. Some stock or bond or commodity exchanges are selling the rights for a lot of money to brokerage firms or individuals who want to be a market maker. Imagine it is an illiquid asset with a one percent margin. If the market maker can reach his goal and sell and buy only once a week, that is 1.01^52=1.6777, that means 67.77 percent annualized yield.

The same market maker can make 180 percent yield (almost triple his capital) in case of a two percent weekly margin. That is great for an investor. I’m also saying to myself, don’t only criticize, make something… Maybe I will try some market-making with some hundreds of STEEM myself.

Selling and buying IBM

Other “fiat” markets are working with totally different, much lower spreads (and lower risks). Read this about the liquid stock market:

If a market maker purchases your shares of IBM from you for $100 each (the ask price), it would offer to sell them to a buyer at, for example, $100.05 (the bid price). The difference between the ask and bid price is only 5 cents, but by trading millions of shares a day, the market maker pockets a significant chunk of change to offset risk.(The Balance)

Lucky of us, Steem-Engine seems to be a market-makers paradise. In other markets, market makers operate with far smaller margins – but mostly with much more frequency than a week. Maybe making trades every hour. Nowadays, most trades of this style are, of course, automatized, robotized.

Business and common good

I’m not a programmer so I can’t robotize this activity. Maybe Steem-Engine developers can offer someday some automated offer types, or somebody will find it rewarding to develop the program needed for it.

Without market makers, it would take considerably longer for buyers and sellers to be matched with one another, reducing liquidity and potentially increasing trading costs as entering or exiting positions would be more difficult. (The Balance)

Market making is good for all. Let’s do it.

Update, important tools:

The author, @cadawg announced new Steem-Engine tools here - related to this post and problems. See the Market Viewer and the Market Calculator on the page.

Series Steem-Engine tokens reports

4. A Costly Hobby For Rich People?

3. Which Was The Most Traded Coin?

2. Which Token Fell 80 Percent In A Single Day?

1. Do You Still Believe In Your Tokens?

(Photo: Pixabay.com, with an effect)

I like what you say here @deathcross

I also read your blog here with great interest

Hope many will read what you write here

Re-steemed

I remember @aggroed floating a suggestion around this a little while ago.

I went looking for the post. Found this post from @edicted instead.

Posted using Partiko Android

Thank you very much. The problem is I'm not a programmer and so don't understand it. Working on it.

Me neither, I'd love it if a ui could be built for this so some decentralized market making was possible.

Posted using Partiko Android

This infant market is a good thing one can earn more if the chart of the daily market activities is displayed and one know the history of the coin trading like of instant various tribes can use their earners from post to mark various market to create more liquidity! Iike our coin airhawk on steem-engine revenue from trading activities is used to buyback the tokens from the market and buyers and sellers earn airhawk when they trade on our instant messenger groups. Although trade is restricted to Nigerians only as it's a fiat otc exchange

Posted using Partiko Android

Perfect

You are right, those margins are too much of a spread. Smells like a stagnant market. Could it also be that Holders are just not willing to sell and are more interested in the long term returns?

Just curious.

I appreciate your post.

Could it be that some holders are holders because they just aren't able to sell? (at reasonable prices)

I don't agree, you can't get reach quickly, especially with Steem.

I meant: get rich with market making activities. In theory. In the practice, it may also be difficult.

Interesting take on the Steem Engine tokens. At some point we have to trade but if we stake we can earn more. I guess that’s how the market works...🤷♂️

!giphy stockmarket

Posted using Partiko iOS

Make yor own calculations but I think I have earned 5-15 percent in some weeks with three tokens and lost 30-40 percent on the price.

(PAL, LEO, CCC)

More price changes in one of the posts, see links.

It’s great how we have the potential to earn more from one post though isn’t it?

Posted using Partiko iOS

Yes, but also very complicated and time consuming. I suppose developers will solve this, and it will be better in the future.

This is not the same as a fake volume? Some will say 'fake volume to scam investors' (they will think that is a high traded token when in fact most of it came from a market maker. Sure, why not, shit tokens anyway.

No, definitely not. If somebody is trying to buy low and sell high, that is a serious trading. (And market maker is taking a lot of risks in the process.)

By fake trading no real trading happens and no real risk is involved. The traders are mostly making trades with themselves or friends, without taking risks.

I'm not sure if follow your logic. I'm not saying you are wrong but I disagree. To me, market making is just a euphemism to wash trading or fake volume. As you pointed:

(but hey that's the real market)

ahoa, now we create an entity to reduce the spread by making buy/sell orders (making the market or faking the market activity?) Eventually, most likely often, the 'market maker' will be trading with himself, as the real market is what you state above

(ofc it can, one who successfully manipulates the market wins big)

The fact that the 'market maker' is taking risks doesn't say much if he's faking volume or making real trades.

To me, 'market-making' as you said it's just a way to manipulate the market. And it's very different from an investor who just buys low and sells high...It's something usual to lure players and make them think there is more activity that really is. Every exchange does it. In fact, more than 80% of all crypto market is made of 'market makers'.

you can see the definition here:

https://en.wikipedia.org/wiki/Wash_trade

It's very different from someone who is buying low to sell high. That's what we are actually seeing on the Steem Engine tokens. The real demand/offer for the tokens...

You are saying: "let's create a market activity to attract more players" or you are saying: "Invest in SE tokens because they are a good investment to trade or hold" or "Don't stake too much, put some on trading to provide liquidity to the market"...see the difference?

Wash trade

A wash trade is a form of market manipulation in which an investor simultaneously sells and buys the same financial instruments to create misleading, artificial activity in the marketplace. First, an investor will place a sell order, then place a buy order to buy from himself, or vice versa. This may be done for a number of reasons:

To artificially increase trading volume, giving the impression that the instrument is more in demand than it actually is.

To generate commission fees to brokers in order to compensate them for something that cannot be openly paid for.

Without taking risks, there is no gain. Wash trading=artificial activity, artificial volume. Volume has nothing to do with gains, but yes, it can simulate liquidity, popularity.

I have no idea if "SE tokens are a good investment". (Although, I invested a lot of money in them.) I'm only saying that the illiquid market can be better with honest market making activity. The cure for poor liquidity is more buying, and not more staking.

Nobody buys your token, but the market maker does. Nobody sells you the token, but fortunately, market maker does. And this person is risking his money and making a profit. What is wrong about it?

Staking is good. But with a liquid market, means, better exit possibilities, there will be more people willing to stake. I hope.

Nobody wants to invest in products which can't be sold at a reasonable price.

I understand what mean, the thing is I don't really get what is in for this market maker if his intention is not to simulate liquidity, popularity and manipulate the market. He really got to believe in the token future, or be a member of the team with A LOT of tokens in the wallet (but then I think we fall into the artificial activity and inside information). It's all about the intention of the market maker and who he is, or for who he works. Hard to set a clear line.

Me too I've made trades with a few tokens, even staked a couple (gg and battle). But looking at the market I don't see much future for them. And, I agree with you, a market maker can help to solve the problem, I'm just not sure if to do that he will need to cross that line. If he doesn't cross, most likely he will take losses, IMO.

Maybe you should "duckduckgo" for more about market makers.

Thinking again, indeed, probably I'm missing some basic concepts on what a market maker is. I'm not an expert on the subject, I'm just expressing my thoughts on it...I'll do the search and learn more about it. Good chat. Thanks for helping clarify and for ur patience :)

I made trades with 5-6 tokens and there is some real demand. Not enugh.

I actually ended up making a tool based on this (didn't see your post first) which tells you how much it'd take to shift the market to a certain price: https://steem.tools/steemengine/market_calc.php?symbol=leo

Thank you very much. I made an update in my post (at the end). Tomorrow I will investigate further.

Thanks

Posted using Partiko Android

@organduo This may be of interest to you.

Posted using Partiko iOS

why?

I think because we are staking everything. Good to have another view point like yours.

Posted using Partiko iOS