Candle School, part 3

In this post I'll try to explain some of the problems with relying on absolute candles and closes, relative to time periods.

I'll explain a real situation, but it's exaggerated for demonstration purposes only :-)

You've been watching a stock for a while on the hourly chart. It's been bouncing off resistance the last couple of days but in an ascending triangle. So you decide if it breaks resistance and closes above the line then you'll go long.

Unknown to you though, on the other side of the world there's a bank clerk sitting with an order on his desk to sell a million shares in that stock. It's a big enough order to spook the market and make the price drop 20 pips in a couple of seconds.

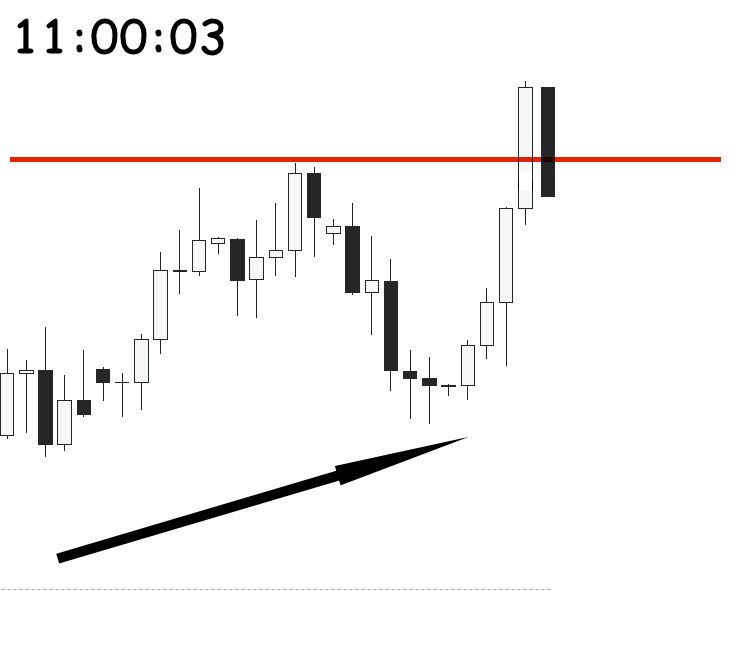

The time is coming up to 11.00 and you're waiting for the 10.00 candle to close, so you can make your decision to go long.

At the same time, the clerk is thinking to himself, "will I put this order on now or go for a quick pee first ?". He opts to go for a quick pee and holds the order for a minute.

So the candle closes at 10:59:59 and you go long.

Just then, the clerks order hits the book and the price drops 20 pips in a couple of seconds.

No problem though, maybe it was just a bad trade and you'll get stopped out. Maybe it will bounce and go back up, doesn't really matter, just normal business. In this case, it was a bad trade and you get stopped out as the price falls away over the next few hours.

But what would have happened if the clerk had put his order on just before going for a pee instead of after ? In that case the candle would have finished like this, a very bearish pinbar.

Would you be long in the market on that signal ? Hell no ! All the bears are probably waiting for "pinbar at resistance" signals to go short, so the price is going to drop.

Hopefully you can see why the close of a candle at a specific point in time can be absolutely meaningless. It can go from a strong buy to a strong sell in a matter of seconds. In my example, a couple of seconds either side of the hour could make a big difference. The end of the 'hour' is completely arbitrary.

But people absolutely insist on a 'complete' candle to make decisions. Some will or won't take a trade purely based on where a candle closes in that one tiny second of an hour long period.

Retail traders need to start thinking a bit more flexibly about what they're looking at. I don't necessarily think it's a good way to trade, but the motto is 'always wait for confirmation' and let the price tell you what's really happening.

If you rely on the shape of complete candles then very often they're going to be wrong and you're going to enter a bad trade.

Even if they are correct, you've already missed your chance and you're entering the trade too late (I'll discuss this a lot more in a future post as it really separates the people that make money trading from those that don't).

In parting though, there's one caveat to relying 100% on candles. If you're trading a 100% mechanical system, then you need to define a single point in time that says 'buy', 'sell' or 'stay out'. But that's on a non-discretionary system that you've backtested to hell and know the statistics of. The candle close time is just the 'yes/no' decision point, only because you need a single point somewhere.

But instead of exactly the end of each hour, you could make the decision point every 37 minutes and 42 seconds after the hour. There's just no reason at all why it needs to be exactly on 00:00 every hour.

In the next post I'll explain about blending candles and why all candle patterns are the same pattern on different time periods.

Header image credit : independent.co.uk

Images found via Google image search, no affiliation

About me -

I'm a full time financial trader, mostly in Forex and Commodities. I write for fun and try to help beginner traders get started, avoiding all the mistakes that I made. I'm always happy to chat or discuss ideas so please just give me a shout in the comments !

I'm currently trying to build up SP but everything I earn from Steemit is donated to a Steemit charity or worthy user.

Congratulations @tradergurl! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @tradergurl! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @tradergurl! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPThe first test of that resistance is more what I would've liked to have seen personally. Slow build up and a load of bearish and indecisive candles.

I fall guilty of what your overall post is saying sometimes. I've learned though - if it gets to your level, and you've no reason to doubt your level, take the trade. Candles end up skewing the picture

I've got a simple motto with candle patterns, and I mean the more complicated one that are 2 bars or 3 or 4 bars, by the time you see the pattern, you've already missed the trade. That's why retail trades fail... between that and using lagging indicator systems...

actually that's a really good way of putting what I was trying to say, but I said it badly.

the price is the price, you take it at the price you've decided on, not wait around for arbitrary patterns to form. Good call ! lol

What about just using shorter time period candles to assist with such decisions?

sure, that's one way. I'm writing a post soon about trading shorter timescales using longer scale candles which covers some of that

Great. Looking forward to it.

Even if they are correct, you've already missed your chance and you're entering the trade too late fast a full time financial trader