RE: POSSIBLE SLINGSHOT BITCOIN CRASH AHEAD

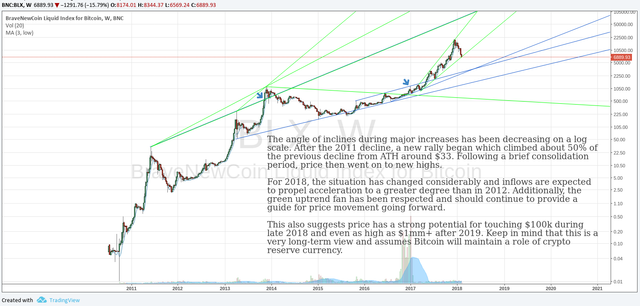

Since my prior comments, we had fallen back into the ascending wedge, so I widened my perspective back to log chart I had posted in other comments which I had linked from the blog. I’m waiting my trader friend to send me an update of the following chart (will update this comment when/if he does), but I return back to my thought that the steepness of this correction and the length thus far matches exactly the 2011 scenario (and the update should show the same green deadcat bounce that occurred mid-way down the crash in 2011):

click to zoom

Although the slope of the rise is less steep, this is expected because there’s more adoption by now and smaller things grow faster. But the crashes can be as steep because the adoption is still highly speculative and this remains a risk-on dependent asset.

So the point is with a wider perspective, I’m still thinking we’re going to crash to $3505. I was wondering why my perspective became misaligned with Armstrong’s GMW warnings of a potential crash ahead. I think perhaps this is because my TA was too short-term focused and not factoring in all the historical patterns.

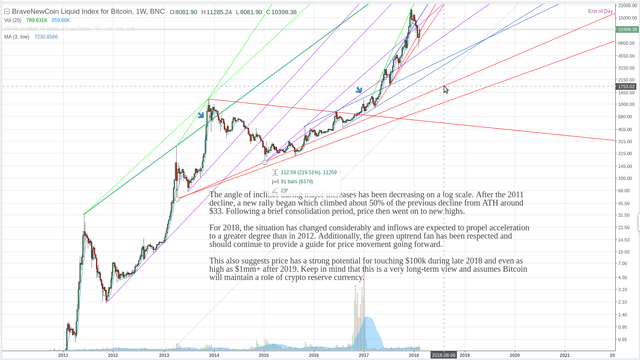

EDIT: okay here is the updated chart:

click to zoom

So with mouse pointer is on the projection to a low if pattern matched to the 2011 crash, which would take us below $2000 by July/August. But that would mean that new ATHs would be delayed by nearly 2 years. That doesn’t seem to fit the SLINGSHOT scenario nor the current reality of the crypto market.

However, the March 2013 crash also matches the current one. So this projects down to the purple line which means back down to $5900 one more time in March/April. That seems to match Armstrong’s possible scenario. Hmm.

The April 2013 pattern match scenario takes us back down to $5900 one more time next month, then it projects to a blow-off peak just below $100,000 in December. Wow.

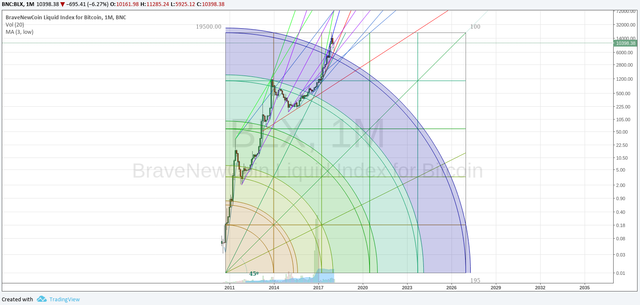

Edit#2: here is another monthly chart that confirms the prior thoughts. We’ve had a very steep bounce as evident by how thin the candlestick is for this month. We likely need to come back down to the red or purple line to confirm the bottom and thicken the volume down below $7000 and $8000 to establish a firm bottom. If we come back into the purple band as Spring 2013 did into the green band, then $3505 or $5900 are possibilities. Below $3505 is not feasible. And price may not even get down to $5900, perhaps just to the red line in the $7000 – $8500 region.

click to zoom

Originally I stated I thought we’d bounce to $11k, and we have. I had also stated earlier that if we bounced too quickly to $15k, I would surely sell some.

EDIT next day:

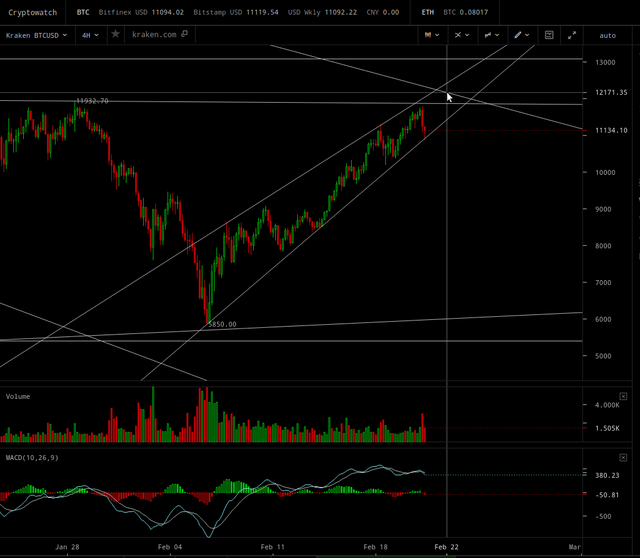

click to zoom

click to zoom

As indicated by the update to my prior post, I expected it to fall down out of the ascending wedge, and I was correct to expect a renewed risk-off due to release of FED minutes. We sold above $11k and looking for a significant decline into next month, perhaps as low as $5500. I had actually drawn that horizontal line on my chart well before the peak was reached at $11,7xx, and that turned out to be exact resistance line. I reiterate that Armstrong has explained numerous times that rising interest rates can correspond with a rising stock market, and he reiterated today that the real risk is the coming sovereign debt contagion due to rising cost of servicing debt with the end of ZIRP/NIRP and the contagion of bank failures expected.

https://www.armstrongeconomics.com/market-talk/market-talk-february-21-2018/

EDIT next day: chart updates:

click to zoom

click to zoom

EDIT day after prior chart: when I posted those charts last night (night for me in Asia), it looked to me like a bounce was forming, and I thought maybe we should repurchase our 5 BTC (would have yielded > 5.5 BTC), but decided to sleep on it. Then I saw the DJIA closed Friday above 25300 which is bullish for next week. So we purchased 5.25 BTC at $10,300 to lock in our gains. Looks like we are headed back up to a double-top below $12k and then we’ll re-evaluate from there.

EDIT 2 days later:

I am not ruling out that it won’t make another crash in mid-March from higher prices than currently, but what I see it appears to be curling up in a cup formation.

EDIT after sleeping: Okay so I’m expecting $11.5k by Wednesday. Then we have the new FED chairman giving testimony at Congress. So that will be too fast of a rise, and thus that might be the start of the next downwave. I have a resistance line there (as well as one right here at $10.4k which it is currently trying to hurdle). It’s also possible we hurdle through $11.5k then onwards to $13k. Mid-march is another turning point though on Armstrong’s model. So caution at $11.5k and again at $13k.

To zoom the two charts in the prior post, please click here instead. I was informed about a problem with

imgur.com.Here’s an updated chart showing that I had more or less predicted each top of the deadcat bounces in ascending bearish wedges. And showing where the price might end up ~$6400 in the week of March 12 if the combination of FED chair testimony and the Italian election spooks the markets into risk off:

click to zoom

That is not a prediction; just the range of possibilities I see as not very improbable. The very improbable is $3500 and shouldn’t go below that in any case.

EDIT: on further study with a wider perspective, there’s an inverted H&S pattern on the above chart, which is targeting $13+k, with a possible spike up to $15.7k. This may occur before any renewed decline. $15k was my first quip as to the price I would like to sell, when the price had first declined below my $7000 – $8500 target for a potential bottom.

To zoom the four charts in the prior post, please click here, here, here, and here in respective order instead. I was informed about a problem with

imgur.com.But don’t click here, lol.