RE: Most Important Bitcoin Chart Ever

This post is a continuation of the prior post which this post replies to.

Selected commentary from the Internet

@keystroke wrote:

I'm surprised no one around here is talking about PlanB's Medium article -- “Modeling Bitcoin's Value with Scarcity” -- on modeling Bitcoin's price based on “Stock-to-flow” ratio. I believe he's found a solid fundamental price driver.

Recent stock-to-flow ratio posts impressed me as the most interesting new price model to come out in years. But this thread is really for following

masterlucIMO, although he no longer posts here of course. Maybe we should make a new thread about bitcoin stock-to-flow.

@Wanga wrote:

I looked at the weekly and daily closed candles .... Not a hint of a weak trend. Bitcoin said "WTF is Wanga" and defiantly went to draw a bubble from 3000 to 10000 in one wave, breaking 6 thousand like butter. All the same, we will test $6000, but on top). Hmm. What does this tell us?

Bitcoin has demonstrated that it is heavily oversold. (hmm, still, sitting almost astride a weekly ma200 ....). If you extrapolate what is happening now for the future, it is not difficult to imagine that now it is only the first unit of the first wave, and then there will be triples ... And fives ... Well, that is, this jump is just a pimple on the ass of the future elephant.

And also Bitcoin said who will be his short, will be without panties.

Generally. My new opinion is $ 10k, then $ 6k. But it is not exactly! ))

@Naida_BR wrote:

In my opinion, this sudden and rough decrease is going to happen if bitcoin price is going to rise instantly.

If the upward trend is abrupt then the downward trend is going to follow the same direction.

@MasterLuc wrote on Jul 3, 2017:

What made MasterLuc famous was his 2016 prediction of Bitcoin price all-time high at $20k, which was done at a time when no one could even imagine such figures.

MasterLuc shared with us his vision of the future of the crypto market, he explains why Bitcoin is strongly undervalued, and why most altcoins are going to die.

Right now, we see a profound correction of the Bitcoin price.

From a technical point, everything is alright up until the

$2,990 mark[he presciently predicted BTC’s $3122 bottom] […]

I expect a new strong bullish trend in Bitcoin not earlier than 2019.

But you won’t find Bitcoin [in the cemetery of dead altcoins]. Instead, there are hundreds of alts, and they will all eventually get there. Partly because no one yet has brought a revolutionary technology that resembles the scale of Bitcoin to the table. If we were to compare Bitcoin to the invention of the internal combustion engine […]

In theory, Litecoin would have died just as the others had. But what makes it special? People are actively testing new features on it and then merging them into Bitcoin. The most significant achievement for Litecoin was its implementation of SegWit. Yes, this was a huge benefit, but again for Bitcoin.

(Note he’s mistaken. SegWit is enabled on the altcoin “Core Bitcoin”, which isn’t the immutable Real Bitcoin. I’ve explained that extensively in my archives.)

The founder of Ether did something unacceptable—he has censored the network. He also does not hide his central role in the project, calling himself the “kind dictator.”

Understand that the revolution of Bitcoin consists of Blockchain technology, which helped eliminate the need for an intermediary institution, such as a bank […] to exclude a central “dictator” who maintains the exclusive right to [control] coins […]

The founder of Ether became that central entity. Ethereum is centralized, and it has one point of failure—the founder, who forks its chain left and right. Why? He just does what he wants, let’s not even discuss the motives of this nonsense. I don’t know why he uses Blockchain technology in this case since the technology was created to counter entities like himself.

Blockchain is essential in places where no center or regulation is needed [nor wanted!]. If there is a center of any kind- like some office, leader, or something else that you can just close or fire- then there is no need for Blockchain.

You also don’t take ICO seriously, could you explain why?

Oh, this is just a dot-com. This is how Wall Street entertained themselves in 1999. They would create imitations of online stores, issue shares of stock, sell out for millions, then repeat the cycle. Only a few companies survived during the dot-com hysteria, and they have since become the current giants such as Google, eBay, Amazon, etc. The remaining 95 percent of projects were washed away by the wave following the collapse of this pyramid. History is repeating itself with ICO.

Finally, I would like to discuss your critique of PoS […]

[PoW] was invented for the fight against spam. When sending a message, the sender would have to include his hash in the header. In no way did this complicate the lives of regular users because they needed to calculate only one hash. It did, however, seriously complicate the lives of spammers […]

In other words, this technology, which opposes the centralization and virtualization of resources, opposes one person doing the work that should be performed by many people under normal circumstances. For example, sending messages, or verifying transactions and so on.

Now about PoS […] To understand the absurdity of this idea, imagine an analogous situation where a PoW-miner has extra video cards and ASICs materialize on their own out of thin air while working on a network. They configure themselves on the fly, connect to the server, and begin working. That is precisely what happens to those with quite a wealthy wallet under the PoS framework.

Besides that, I believe PoS is wild centralization and deflation in one bottle. If the concentration of a fixed amount of money generates new money on its own […] with PoS you can unleash an entire zoo of different PoS-systems, making a profit from all of them immediately and simultaneously. Drawing a parallel, you can participate in 10 or 100 networks at the same time. Now return to the initial example about spam and the story of why PoW came to be for Bitcoin to understand why the situation of PoS is absurd.

@PlanB wrote:

"What do antiques, time, and gold have in common? They are costly, due either to their original cost or the improbability of their history, and it is difficult to spoof this costliness. [..] There are some problems involved with implementing unforgeable costliness on a computer. If such problems can be overcome, we can achieve bit gold." — Szabo

Bitcoin has unforgeable costliness, because it costs a lot of electricity to produce new bitcoins. Producing bitcoins cannot be easily faked. Note that this is different for fiat money and also for altcoins that have no supply cap, have no proof-of-work (PoW), have low hashrate, or have a small group of people or companies that can easily influence supply etc.

Saifedean Ammous talks about scarcity in terms of stock-to-flow (SF) ratio. He explains why gold and bitcoin are different from consumable commodities like copper, zinc, nickel, brass, because they have high SF.

Armstrong’s Facepalm Bitcoin Denial

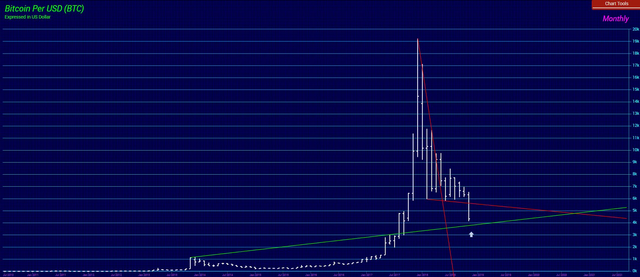

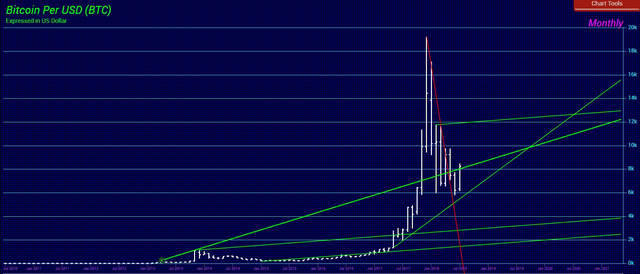

Armstrong will never see these Topological Data Analysis patterns if he continues to use the non-logarithmic chart below:

Instead he will instead view the current rise to $8k as just a dead cat bounce on the way to his I-am-going-to-eat-my-foot-foolish The End of Cryptocurrencies?.

And then after the moonshot rise to $1 million in 2020 or 2021, Armstrong will likely claim Bitcoin is a Tulip Mania. Lol. If he would simply read the stock-to-flows ratio blog we cited in the prior posts, maybe he would realize his myopic mistake.

Armstrong wrote in Bitcoin To Be or Not to Be?:

QUESTION: Hi Martin,

Despite the Bitcoin fanboys arguing that Bitcoin is untouchable by governments, would you agree that once governments, in particular, the Chinese government, make it unlawful to own Bitcoins, the additional introduction of proceeds-of-crime legislation would make it extremely difficult, if not impossible, to use Bitcoins to acquire assets, and dealing a permanent blow to Bitcoins’ value? At some point, Bitcoin owners need to be able to interface with the real market to buy assets, and that’s where the government can catch them and ask them to prove how an asset was acquired.

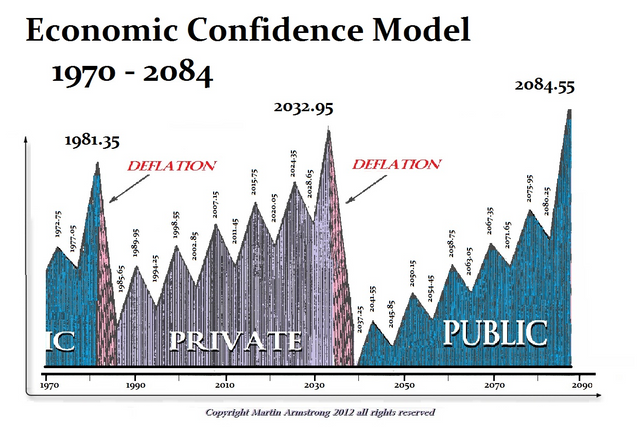

Armstrong’s answer was a category error, non-sequitur because he presumes that Bitcoin will be a currency for the masses. No! The transaction fees will rise so high (as measured in fiat, e.g. $50,000 per transaction) that only very few people (the wealthy) will be able to transact on-chain with BTC. Any countries that attempt to mess with the wealthy, will just induce those wealthy to leave and take the wealth to other friendlier countries. In this coming massive period of deflation (as seen on his chart above after 2032), nation-states are going to be begging (competing against each other) for the wealthy to stay, invest, and pay (reasonable) taxes. The thriving nation-states (i.e. Asia) will be those which do not abuse the wealthy.

Bitcoin is truly untouchable by the governments, because the wealthy can arbitrage the nation-states against each other! Bitcoin will enslave the governments and enforce a discipline on them by being John Nash’s IDEAL MONEY.

Armstrong wrote on March 13, 2019 (right before the massive rise in the price!) in Bitcoin v Gold:

QUESTION: Do you think that Bitcoin will replace gold as some people claim it is some new reserve asset?

Thank you for being the voice of reason in the middle of all these people preaching their own position.

ANSWER: That is really a bizarre question. I do not see how that is possible. As far as it becoming a reserve asset that surpasses everything else, I would have to say that is not plausible. These are proposals propagated clearly by retail people involved in the conspiracy world. Even if we look at the German hyperinflation, the PRIMARY assets to survive was real estate. That became the backing of the replacement currency.

Real-estate is becoming relatively worthless.

WTF can anyone do with land to generate profit in the knowledge, Internet age? Bankrupt governments such as Argentina make land worthless for agriculture. Land is now a liability, not an asset! Nobody is going to accept a land-backed monetary restoration.

Those who don’t sell real-estate now and buy BTC will become impoverished.

Money itself is NEVER a store of wealth. It rises and falls against tangible assets.

These elder Boomers such as Armstrong and some gold-bugs I know (I was born 1965 on the cusp between Boomers and X-gen) can’t seem to wrap their minds around the concept that tangible assets have become liabilities and are no longer assets.

Armstrong sort of halfway understands this when he says he can’t hop on a boat or train with gold anymore and that real-estate can be taxed by bankrupt governments. But he doesn’t seem to connect the dots all the way to the massive transition our economy is undergoing with technological shift which also requires a monetary shift.

It does not matter what you are talking about. ABSOLUTELY NO instrument will ever be the main “reserve asset” for people will always disagree. There will be people who cling to gold, others to stocks or real estate, and then we have the sublime fools who will hold government debt. You will never convince everyone to create a single reserve asset.

Most people are not going to agree. They won’t even have any Bitcoin! But the wealthy who will discipline the profligate nation-states will be holding their wealth in the Bitcoin. John Nash’s IDEAL MONEY manifesto stated that all the other assets essentially float against the IDEAL MONEY whether they agree or not (sort of like the power of the U.S. dollar now but more absolute because IDEAL MONEY can’t be disrupted any manipulators).

These are usually the rantings of people unfamiliar with how the world economy really functions.

No Martin. You’re the clueless one here in this debate. And yes, I know your blogs were a response to the emails I sent you.

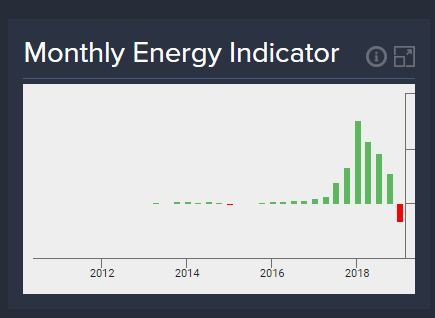

Our Energy Models have turned negative so it has squeezed out most of the excess which would allow it to make a rally […]

I warned you many times via email. When are you going to wake up? When it is too late for your elder readers?

Bitcoin is likely to also wreck Armstrong and his Socrates models, because they’re incapable of recognizing the Bitcoin phenomenon. Thus impoverishing all those who believe in Armstrong. Bitcoin is a wrecking ball destroying all the status-quo, sweeping it aside as refuse of the creative destruction necessary to usher in the new world.

Look at Argentina as a poster-boy of perpetual enslavement in sovereign debt defaults that will be happening to every nation on Earth over the next decades (the massive deflation seen on Armstrong’s chart) as the Bitcoin deflationary wrecking ball destroys the global financial system:

https://www.marketplace.org/2014/07/29/world/what-happens-if-argentina-defaults/

The Western democracies and the stability they entailed were built on the debt model to keep everyone placated. That is all coming unraveled now:

https://www.armstrongeconomics.com/world-news/central-banks/qe-its-failure/

https://www.armstrongeconomics.com/market-talk/market-talk-may-13-2019/

Argentina is an example of what comes next for those Western nations as they slip back to banana republics with massive unemployment, populism politics, etc..

Glad to see that you are back. I read all your threads about Nash playing a central part in the development of bitcoin. Now some recent court documents from craig have leaked the name Paul Calder Le Roux. Would you mind giving an opinion on your view about this?

Link for context:

http://boards.4channel.org/biz/thread/13616424/paul-solotshi-calder-le-roux-the-real-satoshi