What is The Trade.io Liquidity Pool?

In my previous two posts on Trade.io, here and here, I discussed in general terms the benefits and features of the Trade.io platform and the benefits and features of the platform as an ICO launch vehicle. I discussed the ICO features and benefits for both ICO issuers and investors. But the part that I like most about Trade.io, and which I think is its most valuable feature for investors, is the Liquidity Pool.

An Introduction to the Trade.io Liquidity Pool

Most cryptocurrency exchanges allow you to do nothing more than buy, sell, and trade the cryptocurrencies of your choice as long as they are listed on the exchange. Let's take #Coinbase as an example. Currently, you can buy or sell #Bitcoin (BTC), Bitcoin Cash (BCH), #Ethereum (ETH), and #Litecoin (LTC). But what if you could lend those assets to others through a pool where other investors can also place their crypto and earn daily interest on those assets? That's essentially what the Trade.io Liquidity Pool is--a lending pool.

But it's not quite as simple as lending out 10 Bitcoin and getting back 11 in return. In order to participate, you have to hold Trade.io's proprietary token (TIO) and drop 2500 TIOs into the pool.

How TIO Can Turn Ordinary Crypto Investors Into Lenders

Trade.io Token is currently listed on CoinMarketCap at $0.212601 per token. That means, to purchase 2500 tokens, you'll have to spend $531.51 in real fiat U.S. dollars as an ante in order to become a crypto lender on Trade.io. You'll essentially be a small part of a large bank putting your money into a lending pool. But you aren't just lending TIO. You can actually lend other currencies, including fiat money. The tokens are necessary to make the pool accessible to you.

After you pay your ante, Trade.io takes your 2500 TIO and converts it into U.S. dollars and holds it. All of the tokens placed into the pool by all investors will be backed up by $50 million USD from Trade.io's own assets. You have the option of lending Bitcoin, Ethereum, or various altcoins listed on the exchange if you own them, or you can lend USD or even TIO if you wish. Depending on the amount of digital assets you place into the pool relative to all other investors, you'll earn a portion of interest from the pool. That interest will be paid daily.

What you have to understand about the Liquidity Pool is, all of your interest will be paid in cryptocurrencies, but not in TIO. Even if you lend TIO or USD, you'll earn interest in the cryptocurrencies Trade.io "has generated." In other words, if the pool generates a lot of BTC today, you'll likely be paid in BTC, but tomorrow it could be ETH or some altcoin.

The potential interest you could earn from your contribution to the pool is dependent on three factors:

- How much you contribute to the pool

- How many other people are in the pool

- And your tier level

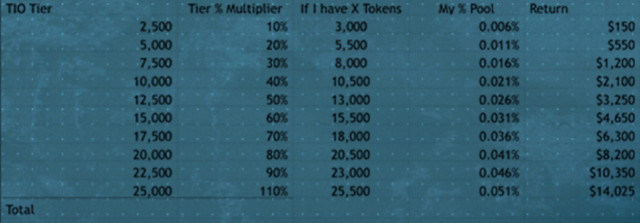

Your tier level is determined by how many TIOs you hold. The chart below shows you the various tier levels:

As you can see, the greater rewards will go to those who hold the most TIO. An upside to this could be the increase in value of TIO as more investors purchase tokens, so there's the possibility of seeing gains from both ends of the pool.

What Are The Risks?

It should go without saying that every investment comes with a risk. That's true whether we're talking about crypto investing or traditional investing. One of the things that I like about the Trade.io Liquidity Pool is the fact that investors can choose which digital assets they will lend. What I'm not quite sure about is what the assets in the pool will be used for. Are we lending those assets to borrowers, or will Trade.io use those assets for other purposes--such as investing in risky ventures? Their literature doesn't say.

Beyond that, there are the typical risks associated with lending. For instance, for the time period that your TIO and other assets are in the pool, you do not have access to them. You will be allowed the exit the pool on a daily basis, however, at designated times.

Trade.io assures investors that in the event there is a loss, investors will not have assets removed from their wallets. That does lower the risk threshold. After all, there is that $50 million backing the pool, but what if the total investment in the pool exceeds $50 million from all investors joining it? That scenario is not discussed in company literature, but I don't see that as likely happening right out of the gate. It could happen if Trade.io becomes popular. By then, they could increase their backing.

Another thing I like about the Liquidity Pool is that Trade.io promises to drop 50% of revenues generated from all of their channels into the pool, which should also reduce the risk for all investors.

While Trade.io has a "high-water mark" and promises no distributions will be made until that mark is reached, if the company becomes insolvent for any reason, investors will likely lose all of their holdings. That's a big risk, and considering how new crypto lending and crypto investing are, not to mention how competitive it is, that's a real possible scenario. Half of small business startups don't make it past five years.

Conclusion

There is much to like about the Trade.io Liquidity Pool opportunity. I think it's a unique offering and one that has a lot of potential for crypto investors to take their current asset holdings and turn them into a passive income stream. However, it is a huge risk. If investors keep a cool head, perform proper due diligence, and keep their crypto assets diversified, Trade.io could prove to be another great resource, but I would not rely on it solely just as I would not rely on any one source of crypto trading no matter how proven that source is.

Trade.io says Liquidity Pool is scheduled to go live about one month after the launch of the Trade.io platform. They also provide a calculator so investors can calculate potential returns.

To learn more, visit the following links:

- Company Website

- Telegram Channel

- YouTube Channel

- On Medium

Disclaimer: I am not a financial advisor. Nothing in this post should be construed as financial advice. Be sure to perform your own due diligence and consult with a financial advisor before making any financial decision with your physical or digital assets.

Update:

I've had a chance to look into liquidity pools a little more. It seems they're fairly common in traditional trading. The idea is to loan your assets back to the exchange in order to maintain stability and "liquidity" in the market. Small traders can get by on stop-loss orders, but large investors and institutional investors can move a market with huge trading volumes. A liquidity pool is designed to prevent that from happening by keeping traded assets in the pool so that they don't affect the market too heavily in a short time frame. The trading will actually take place in the pool. Trade.io's intent is to reward those who loan to the pool with interest payments in cryptocurrencies generated from the pool's use each day. The following video shows a little more about the liquidity pool.

Looking for an outstanding content writer?

I write authority content for hire.

Review Me, Please

While you're here, check out the backside 5 (my five latest posts):

- Why Are Steemit Users Powering Down and Leaving?

- Trade.io Review: Do We Really Need Another ICO Platform?

- Two Poems: Battlefield Confession & Life

- Farmpunk: Racioppa's Revenge

- Trade.io: Review of a New Crypto Exchange

Join us @steemitbloggers

Animation By @zord189

created and used by veterans

with permission from @guiltyparties

Note: All images in this post were provided by Trade.io.

Thank you very much for sharing this with us on steemit.

You're welcome.

Hi @blockurator!

Your post was upvoted by utopian.io in cooperation with oracle-d - supporting knowledge, innovation and technological advancement on the Steem Blockchain.

Contribute to Open Source with utopian.io

Learn how to contribute on our website and join the new open source economy.

Want to chat? Join the Utopian Community on Discord https://discord.gg/h52nFrV

This is an awesome post, as usual! I love the implied versatility of this platform but the lending pool makes me a little nervous because not a lot of information has been released on it yet. I'm looking forward to hearing more from this company as their launch draws closer.

Ivy

Thanks. Look for an update on this post. I've had a chance to research liquidity pools. It's actually a thing.

Very interesting concept. Indeed lending is not that heard of that much when it comes to crypto platforms. Would also be interested to know what they use the pool for, as you said that they are not clear on that in their literature. I think it would also give an idea of what you can potentially earn from it.

I'll post an update later. It turns out that liquidity pools are fairly common in traditional trading.

This is interesting. I will look into them but one thing I am not sure I follow. Say I give them 1BTC today after getting my tokens. Not that I have a BTC Now but for this example. They would turn it into 6500 USD. Now lets says BTC moons to 10,000 and I say I want my money back. Do they only pay me back 6500 worth of any asset they want? That is what it looked like to me. If so not sure that would be something I would be okay with.

That's a good question. Your money stay in the pool until you take it out, but you earn interest daily. Your interest will be in the currency that they generate the most of for that day, or it could be that it will be distributed proportionately among all the members of the pool. So, for instance, if 10 people are in the pool and the interest earned today is 90% BTC and 10% ETH, then everyone's interest is divided proportionally so that each pool contributor receives BTC and ETH according to how much they contributed to the pool. That's my understanding.

The situation you bring up is a good one, though. When you decided to pull your money out, will it be in the currency you put in? I don't think I read anything that said. I'll see if I can find out, though.

Ya cause if it is isn't I wouldn't put in any BTC. But you could still do well just putting in a lot of their tokens. I would think that their value will rise if this exchange is popular. The one think i don't really understand is how the pool makes them money. I do see how the exchange would make money but what are they doing with the pool cash.

From what I can understand, the pool is there to help investors who want a little more privacy in their investing and who don't want to move the markets by dropping huge sums of cash in at once. The pool, being liquid, won't move the market as much with a huge investment. So the cash in the pool helps the exchange facilitate big trades. So if investor A exchanges BTC for Dash and Dash goes up, the exchange wins. They'll pay pool contributors interest in Dash. That's how I understand it.