Case Study 76: Hobby vs Business Classification - Reduced Expenses

Index - https://steemit.com/tax/@alhofmeister/47caku-tax-blog-index

Introduction

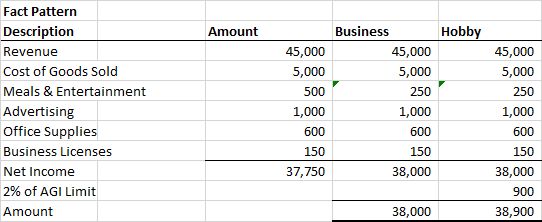

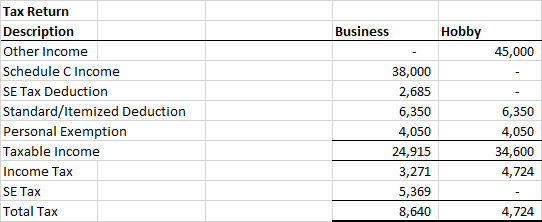

The purpose of this posting is to further demonstrate the difference between hobby and business classifications. The following example assumes that the taxpayer structured their activities as a sole proprietorship.

Solution

As demonstrated above, the self-employment taxes associated with the business classification cause the business classification to be less favorable than the hobby classification. This favorability, however, is largely dependent upon the facts and circumstances surrounding the taxpayer's activities as will be demonstrated in future examples.

References

https://steemit.com/tax/@alhofmeister/hobby-vs-business-classification

Disclaimer

Any accounting, business or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.

@contentvoter

Nice vey nkce

Thanks!

@OriginalWorks

As requested I have voted for you! 🎁 To call me just write @contentvoter in a comment.

Thanks!

Very good. money hobby business post I share and we vote and comments made

Thanks!

Waw .. amazing post.

Thanks!