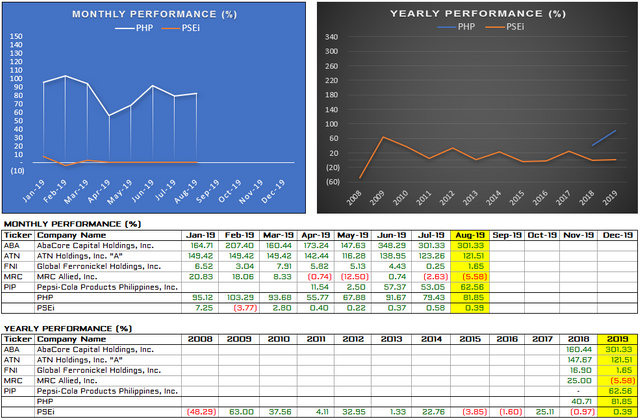

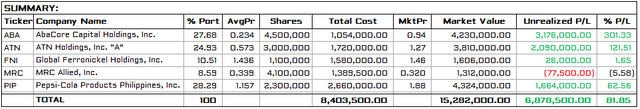

[19H1] PHP Portfolio Update

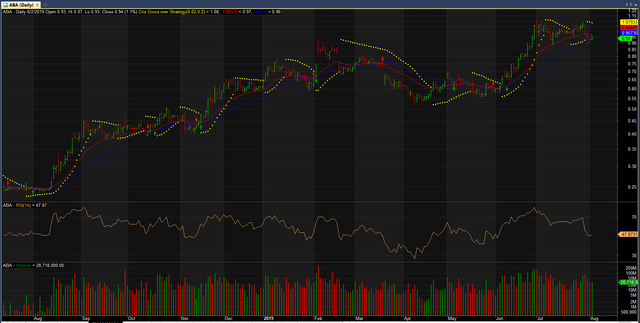

AbaCore Capital Holdings, Inc. (ABA)

It’s an uptrend since my buy signal on 01-Aug-2018. According to the PSE disclosure, ABA ordered to pay a fine of 1 million pesos for the material deficiencies and misstatements in its 2008-2009 financial statements. If this penalization prospers, in my opinion, this has only a petty impact of ABA’s fundamentals and I’m expected ABA in a sideways position in the near-term.

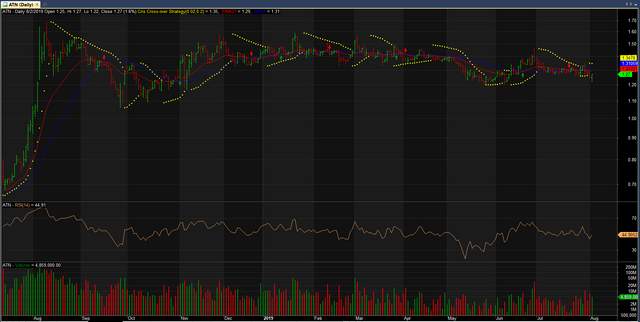

ATN Holdings, Inc. "A" (ATN)

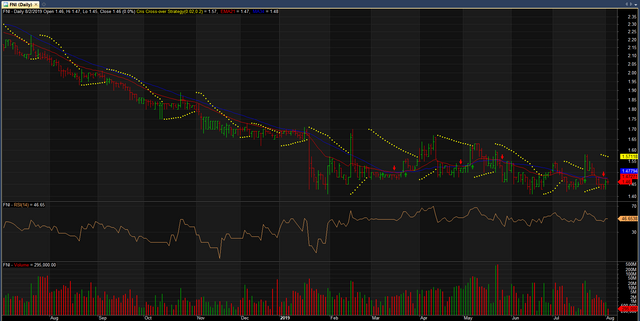

Global Ferronickel Holdings, Inc. (FNI)

This ticker is in continuum bearish trend. If the company’s plan to put up a $20-million steel plant in Luzon alongside partner, Hong Kong-based Huarong Asia Limited, which jump-start operations by 2021 will push through, then it’s a significant value-added to company’s fundamentals in the long-term as well as to investor. It’s only high speculation at this stage.

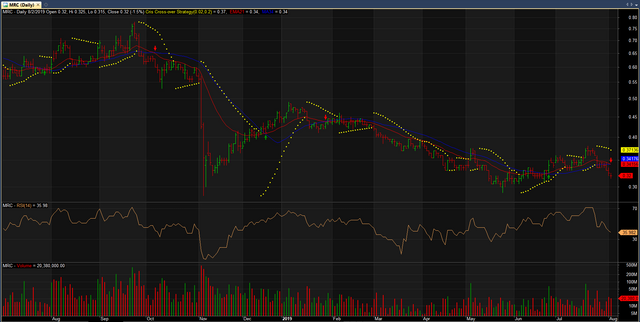

MRC Allied, Inc. (MRC)

Since the parabolic reversal on 07-Nov-2018, it is in a sideways trend but overall in downtrend territory. Due to the lack of catalyst that continuous drag the price down. The second-quarter report still laggard though a bit improved from a year ago. I’m not expected MRC to wipeout deficit in the mid-term although I’m bullish on their renewable energy portfolio that gives investor intrinsic value in the long run.

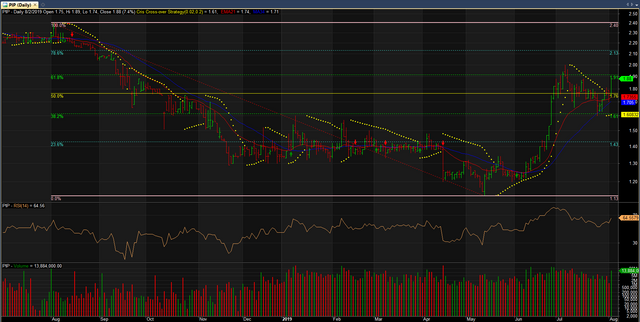

Pepsi-Cola Products Philippines, Inc. (PIP)

If this failed to revisit my 2nd resistance at 2.40, this may continue in a sideline trend. It seems that yesterday’s price tried to climb in my 1st resistance level at 2.00. If the price will breakout at this level, then a sideways trend range at 2.00 to 2.40 is expected in the coming months.

DISCLAIMER: I'm not a Certified Financial Planner. Published herein is my personal opinion and should not be construed as a recommendation, an offer, or solicitation for the subscription, purchase or sale of these securities.

Hello php-ph!

Congratulations! This post has been randomly Resteemed! For a chance to get more of your content resteemed join the Steem Engine Team

Hello, how often do you rebalance your port? For example, last week and this week have been quite red for many stocks. Have you rebalanced since then? Or are you in cash?

My portfolio allocation: 30% Real Estate (landholdings), 20% Stocks, 15% ETF's, 10% Mutual Funds , 10% Bonds, 5% Money Market Instruments , 5% Gold Bullion (physical) and 5% Cryptocurrency. I never rebalance my real estate and gold bullion. My Stocks will only be rebalanced when it falls outside my risk tolerance threshold. ETF's, Mutual Funds, Money Market Instruments and Bonds in the annual interval. Cryptocurrency as deem necessary as it is a very volatile asset class (unregulated).

Hello, nice strategy...