How My Most Painful Investing Mistake Could Make You A Steemillionaire

Since joining the Steemit community only days ago, and ponying up some cash to “power up,” I’ve been thinking a bit about the dumbest thing I ever did with money. It was a very painful lesson, but it made me wiser and taught me to make better decisions. Hopefully, this story can help you too.

I’ve shared this online before, both in this mini eBook and in this article, and probably a few other times on PropertyInvesting.com.

But here’s the full version for you, my Steemion friends, with some special application to what we’re all doing here.

“I’m ‘bout to get rich!”

I had just graduated from college with a degree in finance and was working as an intern for a stockbroker at Merril Lynch. The DotCom Bubble of 1999 had just burst, and considering myself to be a sophisticated stock market professional, I saw an opportunity to “get rich.”

I did the only rational thing that any poverty-stricken recent college graduate could do. I emptied my savings account and borrowed $6,000 cash off my credit card to deposit it all into a newly opened brokerage account.

After all, I had a degree in finance and an internship with a major investment bank. What could go wrong?

I had my eye on a tech start-up incubator company called CMGI. The stock price was rolling for months between $100 and $120 per share. Investors were buying at $100, selling at $120, then buying again at $100, and selling again at $120, over and over again.

After the NASDAQ bubble burst, CMGI fell to $55 per share. What a bargain!

I went all in, buying 200 shares, using about half my own cash and half what I had borrowed off my credit card.

After reading an analyst’s prediction that CMGI would eventually be worth $550 per share, my emotions lit up. I would lay in bed at night and dream about what my winnings would bring me: a new car, a trip around the world, the respect and envy of my friends.

Almost a month later, my broker called and said, “Jason, CMGI is now valued at $75 per share. I think it’s time to sell.”

I thought to myself, “What kind of weak, short-sighted, pansy-ass stock broker am I working with? Doesn't he know these shares are headed for $550?”

So I simply replied, “No way, we’re gonna let this one ride.”

“Oh, %$&!, what have I done?”

A few weeks later, CMGI fell and was trading again at $55 per share. I thought, “Maybe I should have sold at $75. Oh well, this is temporary. I’ve learned my lesson. I won’t be so greedy. I’ll just double my money, then get out.”

Another week passed, and now my shares were trading at $45. I still remember the sick feeling in my stomach as I anguished over what to do. Do I cut my losses and sell now or hold out? Fear gripped me.

My new plan: “If they go back up to $55, I’ll sell and break even.” I started bargaining with God. “If you get me out of this, I will never…”

Before long, CMGI hit $35 per share, and then $25. I was already all in, and had completely lost faith in the future value of this stock.

So again, I did what any rational-thinking investor gambler would do. I maxed out my credit card, and bought another few hundred shares of the exact same stock.

Now, if it would only go up to $33, I could sell it all, break even, and walk away with a lesson learned.

CMGI kept falling to $15, then $5, then $2 per share where it stayed for years. I finally sold at $2.16.

I told you it was a painful story. But thankfully it taught me something.

1. Only speculate with what you can afford to lose.

The most obvious mistake I made was borrowing money to buy an asset that was highly volatile and which I knew very little about. I had a university degree and an internship – just enough knowledge and arrogance to get me into trouble.

There will be many new people attracted to Steem in the near future. Most of them will be like me, having never owned a cybercurrency before.

This is a beautiful thing, because we Steemians are awaking the world to the value of the blockchain. But it could also potentially present great risk to people.

Warren Buffett once said, “Risk comes from not knowing what you are doing.”

Some people will look at Bitcoin’s growth and assume that Steem’s growth will be exactly the same. Some may even be as dumb as I was 17 years ago, and borrow big to speculate on Steem’s future value.

Steem could be huge, or as any venture in its infancy, it could all fall apart. We’re all here because we expect the best, but we need to be aware of the consequences of being wrong.

For now, because I know very little, I’ve only invested what I can afford to lose. Perhaps in the future, as my understanding increases, it will be wise to buy more Steem.

In the meantime, what I can do is leverage off my skill and knowledge in other areas, create content, and hope that by adding value to the Steemit community, I can grow my Steem holdings gradually over time.

Which brings me to my second revelation…

2. Think long term and do your part to add value.

I’m reminded of an ancient Hebrew Proverb, “Wealth from get-rich-quick schemes quickly disappears; wealth from hard work grows over time.”

I made the CMGI mistake because I was greedy and wanted to go from pauper to mogul overnight. Even worse, I failed to appreciate the reality that wealth follows those who consistently add value, little by little.

That’s one of the beauties of Steem. You receive an instant reward based on the degree of value you offer to the community.

Not every post will be a grand slam, but through consistent effort, you can grow an asset base of Steem Dollars and Steem Power by sharing your creativity, talents and knowledge with the world. How amazing is that!?

3. Check your motives for why you’re here.

As you can imagine, after the loss that I experienced, I did a lot of soul searching. How could I have been so dumb? What was I really chasing?

King Solomon of Israel, one of the richest men to have ever lived, once wrote, “Those who love money will never have enough. How meaningless to think that wealth brings true happiness!"

One of the things I realised was that what I was really after were feelings of validation and significance from other people. I wanted to be respected. My deepest problem was I was insecure and thought that by making a lot of money I would feel more important.

The starting point of true happiness is a contentment with and gratitude for the more important things that one already has – family, friendships, health, meaningful work, and life’s basic necessities.

If you want to check your motivation for why you’re here, read what my friend @lukestokes wrote here about how the real currency of Steem is relationship. It challenged me.

Do you have any additional wisdom to offer? Have you ever done anything dumb with money? If so, I’d love to hear about it.

There are two ways to see steem. One is from the cryptocurrency perspective and one is from the user-angle of a social platform.

The first one is concerned about entry and exit points, when to buy/sell, good trades, charts, etc. The second starts with zero investment and just starts to write and make money... so there are two worlds here, in parallel, that don't really overlap.

Imagine you came here today, not as an investor but as an author, made this 1.6k USD article (as of the time of my comment), and thus were +1600 USD from when you joined. In that case, the tips relevant to becoming a millionaire would be how to produce content that gets a good share of the content-reward pie. See how subjective the experience is?

As for your personal experience in investment, I think everyone will at some time or another have a bad investment experience, no matter how knowledgeable they think they are. I had some stocks back in '99, they crashed bad and lost tons... lol... multiple lessons learned.

That said, I am a long term buyer and holder of SP.

Nice... In terms of a mixed investment/author strategy, you can maximize your SP by being a good curator/voter. I see a lot of people who don't use their voting power, yet the voting power, used correctly, can increase SP and SD.

Can you tell me how to check how much voting power i have at any given time. I hear it flictuates and you can use up. Then it regenerates. How do i track it and how do you check others' if you see them not using it? Thanks in advance

https://steemd.com/@mguy808

You'll see it on the left column. You'll see it rises when you don't do anything and falls when you vote.

Thanks @alexgr. I have been doing some curating, hanging around the new feed at the 20-30 minute mark. But I need to have another good read of the white paper to better understand how to maximise voting power. Any insights you could offer would be appreciated.

I don't know if the white paper covers changes in the code that were done a few weeks ago to prevent automatic bot upvoting. I think right now, it's something like proper curation rewards are given between 15 and 30 mins - and supposing more votes come afterwards.

The recipe of success is to vote before others do, but not too early (most or all of the curation reward goes to the author) or too late (most or all of the curation reward goes to the author). And the time to do so is, from what I remember after the last changes, after the 15m mark and prior to the 30m mark. And of course the good payout is contingent on big rewards accumulating after your upvote. If say you spotted an article and you were the fifth vote at 15 minutes and then came another 300 votes and 20k USD, then you get a good slice (I don't know the precise algorithm). If you were the tenth vote at 18 minutes you'd get far less, etc, etc.

Super-helpful @alexgr. Thanks!

@alexgr, thanks for highlighting that. What's great is you can be both investor and author at the same time!

Yeah I may have overstated the "do not overlap" aspect, because for some of us it does. And the ratio of these two groups right now are relatively close. However as the number of people coming in from outside the cryptosphere increase, we'll be like specs in the sand compared to the "masses".

Oh the memories. I also worked in finance around '99/2000 and had much the same experiences. Some stocks I sat on tanked and others, slated by all the brokers, I happily traded in and out of over and over. Def multiple lessons learnt :)

Funny that after getting a degree in finance and that internship I still had no clue how to manage my own personal finances. Education is near useless for most people when it comes to basic life skills. And few of us had parents that taught us well.

I was lucky then because I'm very efficient with personal finance. Maybe all the years of backpacking taught me that as no money meant no travel :)

Great Post. I'm not trying to date myself but I was at Merrill in 2000 in the same exact position of your post. My friend worked as a prop trader and referred to CMGI as a 'pile of poo'. While he was trading it every day both long and short, I decided to hunt for the stock that would make me a millionaire. So since he said it was total junk I decided to make my own 'amazing' investment decision. BOSTON MARKET: Geez the chicken was great.

Well needless to say I had the same exact experience as you. Watching it melt down to 0 while I sat and dreamed of it going to the moon. I took every penny I owned to make that trade, and to be honest it was probably a cheap lesson that I learned about investing early on. It was that pain that made me learn, but it was a hard lesson.

Diversification and risk management is key. It's all about proportions. Had you taken your 6k investment in CMGI and put in only in $180 dollars or 3% or so of your portfolio you wouldn't have been crying. The same $180 dollars invested in apple when it was trading at $4 dollars could have turned into 30k.

Risk management is so crucial. Buy Steemit, but only with a proper risk management strategy that is proportionally related to your total net worth.

"Risk management is so crucial. Buy Steemit, but only with a proper risk management strategy that is proportionally related to your total net worth." Very wise words. Thank you for pulling that out. And crazy! You were in the same role! We should grab a coffee sometime :-)

Thanks Jason for seeing value in my post. I really appreciate that and have added you to my 'followers' list. I live in Princeton NJ and will turn 40 this August. I cannot wait for Steemit to add their chat feature so that private dialogue may take place so I can connect with quality posters like yourself.

I think I can add much value to your original contribution in sharing all of the dumb money moves I have done over the years. I also think we would get along quite well since you are quoting King Solomon and old Hebrew Proverbs. It seems we share the same core values as humans and perhaps the same spiritual base.

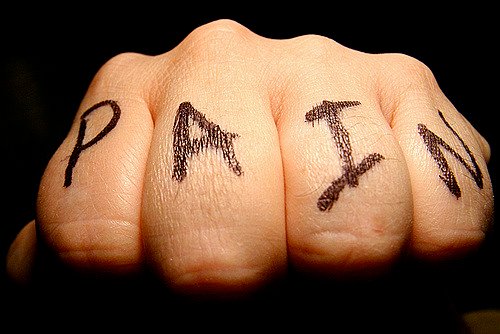

At first I thought your post was fear mongering simply by the initial photo, but as I read along I realized what value you offered to the readers here. Your advice also was prudent and wise. I think that encouraging others to share wisdom is a great way for this community to grow. This is why I have created a 'Question & Answer' type of blog here. I think that a Question format offers people the most opportunity to offer up wisdom if they are willing to contribute.

You ended encouraging others to contribute their 'wisdom' and already I was like: YEAH...ANOTHER OLDER PERSON ON STEEMIT.....because I'm starting to believe that people 40+ are like senior citizens.

I think that offering younger people sage advice is a great way to contribute to them, and to teach them what we learned the hard way. When you were trading CGMI stocks were trading in fractions still 1/16, 1/8, 1/2 etc, and market makers and specialists that were not digital were still important. You probably even looking in the newspaper to check your quotes on the weekend. I totally get it.

I'm happy for the great success of your article here. I'm glad that the younger folks here are seeing the value of your experience and are soaking it all up. Mostly the part about family, friendships, health, meaningful work, and life’s basic necessities.

In that quote from your writing the 'meaningful work' really hit home. While I was at Merrill there was one guy who really hit it rich. He retired early on at age 45 with about 5 million in net worth which was quite a bit at the time, at least enough to make 200k a year sitting around. He did just that and got super bored and felt he had no purpose. He even felt all of the work he did at Merrill really had no purpose. The fact that he felt he no longer had meaningful work took a massive toll on his health and well being. He died of a heart attack 2 years after he left Merrill.

My father worked at a famous private mental health center here in Princeton as acting medical director. It is a well known fact that for men the number 1 factor for mental health is having purpose and meaningful work. Your wisdom identified it in your writing and I'm here to confirm what you have written as sage and wise advise.

Have great purpose, have meaningful work, have friends, and your health is your greatest wealth. #VIVASTEEM.

Thanks Jason for such an excellent post and I will go through my dumb money archives and come back with a few nuggets for your thread.

Cheers.

TJ

TJ, amazing truths there. I've heard the average male retiree dies within 4 years of quitting work. I look forward to hearing more from you in the future. Thanks for following me.

That's crazy Mr Question-Answers that you had the same experience as Jason! Cool comment.

The fact that you can identify me as a Mr. I find amusing. Thanks @elka for your comment. Small world I suppose.

Must be a female intuition :-)

Super-cool!

i wish i was able to awnser questions like you and post on boards like you do your actually really talented to be able to do something like this o.o

My advice would be to not invest too much money but "work" for it on steemit. The only thing you invest is time, you can use time others spend on TV ;)

Just for a while would be sufficient, using it like facebook or twitter. When it pays off, continue, if not, just leave it for a while.

This is still early steemit, maybe in some months / years the work from now will be worth much more.

Good advice. Thanks

I made a similar mistake when investing in the altcoin 'Mooncoin'. For weeks I had been trading it against bitcoin and had been on occasion placing a trade and waking up another £250 richer... then one week I was away on a training course for my work and didn't have regular internet access. I had around £3000 in Mooncoin at the start of the week, one morning it dropped around £200, I didn't mind as experience had shown that it would rebound - that's how I had been making such huge gains so no big deal... it went up a little as the week progressed... then down a little... and then a little more... and then...

By the time I got home from my training course my £3000 holdings had become £75 :(

Mooncoin never significantly recovered.

I stayed well away from cryptocurrency for several months after.

Ouch! Great story. Glad to hear you recovered from that one.

Thanks! I definitely learnt a lesson with that one. I've still made a few silly calls since (cough cough... The DAO) but try to keep a much more long-term perspective with investments now and question what value they could have in several months to several years time based upon the actual fundamentals.

Yeah, the wounds from my later options trading losses are still a little too painful to write about :-). The lesson there has been it's much better to be a seller of options than a buyer!

Three words: diversify diversify diversify. Did I mention you should diversify?

You would have thought they'd cover that in the Finance degree!

So it's like that then?

Great post!

That about sums it up :-)

I love this article! I love how you've given experiences from your real life! I can't fully relate because I haven't done that type of investing before, I also don't have a degree in finance. But I"ve always been interested in the subject! I've done some stock investing and I had a similar situation you did, I lost money in the end because I waited too long! But I've found Peer to peer lending a lot of fun!! I think you just have to learn more about what you are doing before you do it, IN order to reduce risk as much as possible.

Thanks @kaylinart! It was definitely a hard lesson but one I was thankful to learn earlier in my life.

Hahah! Wow, this is awesome, Jason. I was reading through this great post, telling @corinnestokes about it as I went, and then I saw the end where I got a shout out and was like, "Wait a minute... OMG! This is Jason's article!"

Hahaha... to funny. You're killed it with this! Such an amazing life lesson and you tell it so well. Thank you for sharing it all with us.

Ha! That's awesome. I was wondering when you were going to comment. I'm really glad you shared this steemit thing on facebook ;-)

Once friend list notifications get built in, it'll be a lot easier to keep track of what's going on. Right now it's like, "Whoa, how did I miss that?!?" all the time.

Looking forward to that.

Hey, can you pay it forward and add a post entry to the #bitcoinpizza challenge? I'd love to hear your thoughts on this from someone who got such a large payout and the conversations you started having with your friends and family about it.

This is one of the most amazing article i have ever read. And honestly am at this point in my life. My own story though i did not learn from it easily as you did. Maybe because i was a little bit dump at that time. During high school i used to go the library, infact we were forced to go to the library which i deeply hated. Most times, we use that opportunity to steer at your female crush or silently gossip with friends. After a while i decided to take my studies seriously in order to pass my matric exam. As time goes by i cultivate an habit of reading the news papers, before doing any serious reading for the day. The most interesting part of the newspaper for me was the stock and shares prices. Naive as i was, i would use a blue pen to journal the price of the shares that is doing well, and use a red pen to indicate that which is not doing well. The following day, i would compare the previous shares price, and therefore make an hypothesis of what each share price might be in the future. As time goes by, i began to enjoy this little habit of mine. My favourite part was searching for old news paper some dated five years back, and would compare the current price with the previous price. Then after matric, i was employed at a local hospital as a clerk. Luckily, my school was close to where i work, so during break i would go back to the library and indulge in my old habit of comparing and analyzing the prices of shares. And by the way, in those days we hardly have access to the internet. I could still remember the feeling of receiving my first salary which was $70. It was a feeling i could still remember till this day. Then i say to myself, i would save 50% of my salary to invest in shares, 30% for my monthly expenses and the remaining 20% will be given to my parents to support them in house responsibilities. After 8 months of savings, i thought to my self, yes i need a broker to buy my shares. Through the assistance of a friend of mine i was connected with a broker and this was the most difficult and interesting conversation we had. Me "Please i would like you to buy an EcoBank Shares for me" Him "But why would you chose to buy EcoBank, you should buy Oceanic Bank" Me "But why?" Him "Because Oceanic Bank shares is appreciating in value, and such trend would continue" There was i thinking to myself, should i go with my instinct and trust in research i have done for years having seen the gradual and consistent growth of EcoBank, or should i go with my broker advise on Oceanic Bank. I was aware that Oceanic Bank as a new generational bank shares price was growing tremendously, however it does not have the proven historical consistency in which EcoBank has maintained. Then a second thought came to me, do you know better than a broker? Don't you know this is their job!!! not you a common hospital clerk. Then, i left my instinct, also doubted even my little knowledge and took my entire savings to invest in Oceanic Bank momentum shares hype. And the rest was a sad story. Few months later, the CEO of Oceanic Bank was arrested and prosecuted for shares manipulation and other charges. And within, a day the price of the share went from up the loof to almost nothing. And there was i, struggling to hold back my tears. This was the money i intend furthering myself to the University. That day, was a bitter day for me. To make the matter worst, within few weeks, EcoBank through its new partnership Eco Transitional Incorp executed a massive objective to establish more branches across Africa. Within few days the value of EcoBank skyrocketed, appreciating in more than 2x it's previous price. And there was i looking at myself in what an idiot i was to ignore my instinct, believe in myself and also believe in my own knowledge. That was the most difficult investment lesson for me. So how do we apply it to steemit. I would seriously agree with @jasonstaggers that there is no guarantee in any investment. Only invest that which you can afford to lose. Do your research deligently, and believe in yourself. like Wallen Buffect would say, do not taste same river with both feet, hence diversify your portfoloi. And if it is too good to be true, it just might be. Finanlly, i think the best investment is in your self. While money is certainly a great thing, but if you do not invest in the know how of money management, it may just fly through the window. I thought i could share this personal experience with steemit, and hope it may be of value to someone out there. Peace.

Thanks for sharing your story. I made the same mistake, blindly trusting the analyst recommendation, failing to understand how he was incentivised to hype the stock. We live and learn. All the best.

Arbitrage and Market Making profits are short-term. So that Hebrew proverb is a bit generalist. Nice message anyways.

hmmm. You give me thoughts to ponder.