Why You Should Not Trade on Exchanges - Buy/Sell Tips by Charlie Shrem

Thank you @Gandalf for suggesting I write this

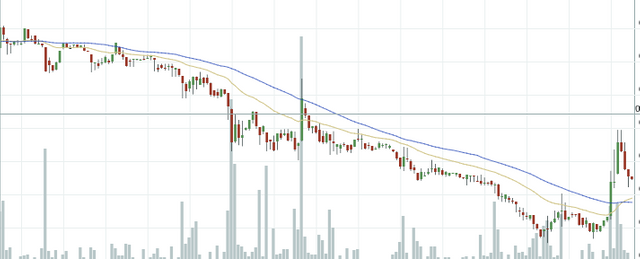

Lately with the falling price I've seen calls for "Stop powering down" and "Whales are dumping their steem". We need to stop this.

When you see the price falling, rising or doing anything crazy, keep this in the back of your head "Markets are Efficient". Free markets always win. It's why we always end up in the global financial meltdowns every year like Venezuela and Argentina. Governments step in and try to control the markets, capital controls and the like.

When we tell people what they can and cannot do with their own money, markets fail.

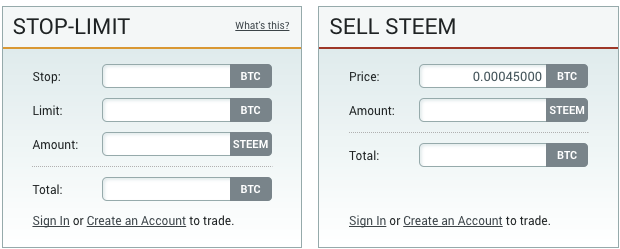

So how can you sell Steem without hurting the price? Please stop using exchanges!

Traders and speculators are on exchanges, they are ammeter and professional traders that buy and sell assets for the purpose of making a profit. They make money when the price is going up and they make money when the price is going down.

When you or I go onto an exchange to sell some Steem, we are trading against them. We could be hurting the price by adding unwarranted selling pressure, even when you have a trading bot that has orders higher than the current price. These add walls.

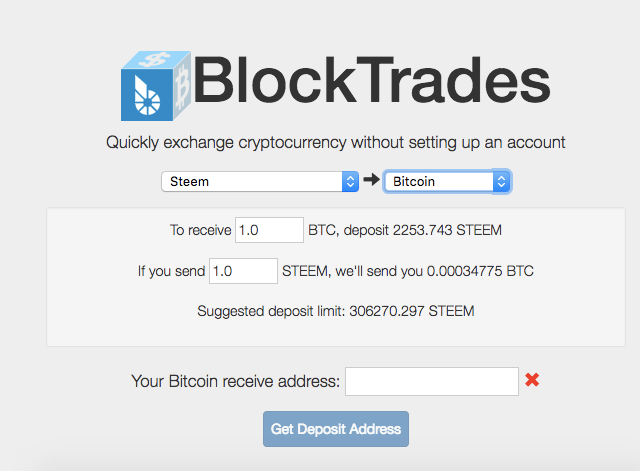

I started using Blocktrades.us recently to sell my Steem and SBD. Blocktrades has a trading desk and has a financial incentive for Steem to succeed. The difference is he does not sell into the market and hit SELL 10,000 STEEM which most of us do.

The biggest threat to steem's price is when a whale dumps into the market or places large orders that scare the market. Most of our whales are experienced enough to realize this. But it's really hard to do this well without using a bot.

Large buys and sells of Steem should be done OTC (Over the Counter)

In regards to Steem, I consider OTC all retail companies like Blocktrades, Shapeshift and Changelly. They have professional trading desks and know how to buy and sell without causing day to day volatility.

The benefits to buying and selling OTC are great. You get a good rate without slippage, you don't have to wait the few days and are not suppressing the market.

Your funds get delivered instantly!

By not keeping your funds on an exchange you can also save from those occasional losses on a hacked exchange, something generally ignored when people do their pricing analysis.

In the long term this is important.

We will hit a point where either 2 things happen:

1 - People stop selling because the price is too low and they are willing to hold and invest in the future of the platform.

2- Everyone panic sells and we die.

I think #1 is happening. Volume has been going down as we go lower.

If you sell retail, it won't effect the price as much! Please sell retail!

What are your thoughts?

-Charlie

SteemPower Witness Vote

Help keep SteemPower running! Voting for us as witness pays for the development of apps and tools for Steem.

- Vote for us as a witness the following way:

https://steemit.com/~witnesses click the arrow next to "charlieshrem"

Mr. @charlieshrem. Your gift for explaining dynamics of Steemit in an easy to understand form is what make you so valuable to the platform. Thanks. BTW...I just received my Steemit Wirex card you recommended in an earlier post.

YES! Nice!

just here to screw with 66 comments and upvote of 666 ... ;)

Voted lol

If everyone is trading OTC and not on exchanges, where do we go for price discovery? Markets are only efficient when provided with enough data. An example is how the mobile phone has greatly improved market efficiency in Africa in recent years, without price info you can't make good price judgments.

There are good reasons why large buyers should go OTC, but the masses of smaller buyers are much better off using exchanges benefiting from better prices and more price data.

Great question and I'm happy you brought this up! Where we get price discovery is a question we still struggle with in Bitcoin as well. I personally use index's that incorporate OTC rates like LocalBitcoins and Gemini.

Since Blocktrades, Shapeshift and Changelly trade on the exchanges and source their assets other ways, they set their rates. Their rates need to be good and competitive or else we will go elsewhere, like back to the exchanges.

At the end of the day, value is "What someone is willing to pay for it".

I would make the case that OTC rates are a truer indicator of price discovery than exchanges

the point is, you don't avoid the exchange market by using shapreshift but you do pay an extra fee of ca. 10%. These things make sense for small purchases and convenience. But you should always use exchanges when buying larger amounts.

Dear @charliesherm, we have a good article about trading process on simple instant exchanges, you are welcome to have a look: https://steemit.com/money/@changelly/network-fees-and-suggested-minimal-amounts

My thoughts are people should buy/ sell at a price they are comfortable with on a platform they trust.

If the choice is between two platforms, I'd advise going with the one that would give the better return. The fact is, no-one knows what the person on the other side of the trades intention is, so their is no point second guessing.

Blocktrades or whoever you buy or sell to OTC may opt to pump or dump on the market (for whatever reason) and they are entitled to. It's their money afterall.

My job is to know what my strategy is and execute it. Simple.

As you state, the "free market" will ultimately decide regardless. The free market includes those that are day trading, swing trading and attempting to manipulate the market. Let the buyers (and sellers) beware!

so now I can look forward to a new stats report of who is selling on exchanges and who are not :)

from SD to visa debit using blocktrades

Yup, I just ordered one but the Visa Shift Card not Bitpay (no reason, that's the one I saw first and it's connected to Coinbase from the start, which I already had). Same $10 sign up and no fees (YET! The TOS says reserve the right in the future).

Thanks for the tutorial tho on making Steem work with it too, but I'm only buying Steem and powering up right now, trying not to spend it.

Very nice how-to Craig, think that is very helpfull for a lot of Steemers!

I'm gonna get myself a shift card as soon as I can. Wirex is good but they really don't have the service standard that would make me happy. Shapeshift has been less than stellar too, though they are pretty good.

That's pretty good buddy. Nice video.

it's easy enough to do by scraping the blockchain for shapeshiftio or blocktrades vs poloniex or bittrex. I'd quite like to see those statistics, actually.

Are these numbers not already being published? It wouldn't be hard for me to modify one of my existing scripts to get this information. Maybe it's not being published already to avoid witch hunts?

Do you have any specifics on how you would like the data laid out? I think it would be a bit of disservice to not show both the incoming and outgoing. Perhaps a table with 3 columns for each exchange in, out & net +/-.

just search for the usernames of the exchanges and otc changers like blocktrades and shapeshift, in the memos of users.

Yeah I know how to get the data. I'm just pondering how to output it and do people justice. Like if I just published money going out to poloniex and others but didn't show you the money coming back, it could make an active trader appear to be selling a lot without ever showing buys. If I just show the net amount it could miss big traders that with zero sums.

What will add some complexity is the exchange to exchange transfers which I will have to figure out the identity of the trader through use of the memo key. I've noticed some traders transfer directly from their Poloniex account to their Bittrex and vice versa so I'll have to map users to memo keys.

well, if it's necessary to identify the flows sources and destinations to that detail... but simply identifying the amounts that flow in and out, that still would be useful information.

Hmm this article goes counter to what I thought I knew. Maybe someone can help me out with a few questions I have.

Doesn't shapeshift and the likes dump it on the market automatically too?

If not, why are these trading desks assuming the extra risk on behalf of steem? Doesn't seem like something a good trader would do. If they aren't converting your steem to btc, usd or some other reserve currency right away then they are speculating on steem and so far that speculation isn't doing so well. Is it just that their "dumping" on the market is done with bots that chop the orders up and make it more palatable to market?

I don't think this advice is good for the small dolphin or minnow cashing out a few hundred SBD they made with some stellar posts. They aren't going to be pushing any market scaring volume and will get a much better price on poloniex or bittrex than shapeshift will net them after the massive fees (10% now?) are applied.

I think this advice is more for the elite few at the top.

Hey!

When you say "dump", no they don't have an open sell order that just dumps it all. Most of these companies go in both directions, so they likely hold and hedge in a bull market, they also sell back to customers who want to buy. Every day or week, they probably settle on an exchange or sell large blocks to other companies.

Also, they buy/sell dozens of pairs of even more immature currencies than Steem.

For a small seller/buyer it does not make a difference, however I never recommend keeping money at an exchange.

"however I never recommend keeping money at an exchange."

Agreed, they are just a stepping to stone to my cold storage.

Thanks for the info.

in my dealings with shapeshift, i can confirm that they do not make their settlements unless they have to. shapeshift has often not been able to buy as much steem as I want to sell to them, and these are generally small amounts.

I don't think it is as profitable, at least not yet, to run these multi-crypto OTC dealer businesses, but I think they probably are doing ok. They basically act as buffers between the in-and-out of the various cryptos out there. I hope more of them spring up, because I hate dealing with exchanges.

I think shapeshift and blocktrades accumulate capital and only go on the exchanges when the balance gets out of kilter. So they are not taking risks, they just are more liquid.

How is accumulating a highly volatile and incredibly immature currency in constant decline not taking on more risk? What kind of timeframes are we talking here for accumulation? I'm having a real mental block getting over that hurdle.

I must be missing something.

they accumulate lots of these from many different cryptos. it balances out, i'm pretty sure. they probably have to trade things in and out as they move against each other but because they hold a big bag of everything, they are not influencing the exchanges as much.

I would love to see the algorithms monitoring that and what happens when there is major market move that skews their books. I'm picturing one of those red siren lights going off in an office. Maybe it's as mundane as some trader uttering, meh, and then presses a button though.

yeah, from what i've seen with shapeshift, the red light sounds like about how they operate. 'balance approching zero, warning, warning!'. about 1/4 of the time i go to do an exchange through them, they say they can't accept even my small trades. and nobody works night shift there.

Let me explain. All the simple instant exchanges mostly provide operations via Poloniex or Bittrex. Our service http://Changelly.com also do the same. We have deposits on exchanges and on our proxy wallets to make exchanges fast for users. For each exchange operation we make the hedge deal on Poloniex and take a small fee for this. You can have a look, how it works, and how do we calculate rates here:

https://steemit.com/money/@changelly/how-changelly-suggests-the-best-exchange-rates

OTC dealers don't have to make orders as often or as big, because they hedge.

Actually, that makes me think of something... so, when is the crypto-hedge-fund going to be a thing? They would be very helpful partners for the OTC dealers.

Alt coins crypto market is very volatile. In this case to prevent risks dealers must have hight commissions and rates should be differ up to a few percents from Poloniex exchange provider. I can't say for all the OTC dealers, but on http://Changelly.com we have only 0.5% fee. That's why almost all the deals are hedging, especially for high amounts to exchange.

One thing that the Steemit community has going for it is that there's not much focus on price. Check out R/bitcoin from a few years ago and every day the price moves by 5%+, the whole front page is posts about price. It's rare that posts on price make the front page on Steemit, and I hope it stays that way.

I couldn't agree more!

They are giving for 1 SBD 0.00133594BTC... in Bittrex u can get 0.00147000 BTC... I understand ur point but it is a bit below the market. Not a good incentiv to use it. Anyway u got my up-vote, did not knew about Blocktrade

Mostly all the instant exchanges provide operations via Poloniex or Bittrex. And take a reasonable fee for this. But it seems that blocktrades have their own order book and matching. Their trading bot holds a big spread, that's why they have such prices. But they are build in steemit and many users use them as default option to buy steem/sbd.

Don't forget slippage...

That's only really an issue for big buyers/sellers. In general smaller traders will get better prices on the exchange than OTC.

Yes, this article was written towards larger orders, usually on greater than $1,000 buys or sells.

Ok, but then you should make it clear in ur post because ur followers, Im pretty sure, are mostly small fishes ;)

But even slippage can be mitigated by layering in sell orders. Of course, even a limit order is going to avoid slippage. It's just going to put a lock on the price until it gets filled.

I get the concern, but it doesn't seem wise to pay for the premium service even if you're dumping large quantities, unless you just don't care about paying the convenience fee. IMO, it's steep enough to make selling in layers or small tranches on an exchange the wiser course.

OTOH, even if you face a little slippage on an exchange, is it enough to make up for the Blocktrade fees?

I guess the question is, "How much am I willing to give up to try to help protect the price of Steem?"

"How much am I willing to give up to try to help protect the price of Steem?" is a good question :)

... but this is more at the end a post for whales ;) ...I do not think fishes and dolphins have enough power to put in danger the price and for sure many need the extra bit-cents that you loose exchanging your SBD in Blocktrade right now.

Of course. I was offering the comments as I would see it through a whale's eyes. IMO, it's simply unwise to set aside potential gains. There is a point where it may be wise though, depending on how much they're dumping and what the market is doing at the moment. If I were a whale, I'd have to ask myself that question every time I sold. And I'd be very reluctant to sell through a service that was tapping me for more than 1%.

hmmmm... could be, but not when u look the market, in Bittrex for example and there are selling walls of 638.13105397 SBD at 0.00147000 BTC, then 992.94004987 SBD at 0.00146000 BTC and also 1000.00000000 SBD at 0.00145001 BTC. That is what I means for a bit under the value of the market ;)

It is really naive to think that OTC market is something different than exchange. It is exactly same thing. Only one different is that you do not see participants.

I will tell you one ugly truth. There are not traders on the steem market. No speculators. All people who trade steem are pure amateurs. Why? because every single professional trader already know that steem valuation is unrealistic. There is no way how to make money on the falling market when you have nothing to sell.

Do you really think that traders will invest their time to trade small and corrupted market like steem. Not at all. Traders are not the problem because they are not even involved. Only problem is that people want to cash out. You guys killing your market by your own. You can try to convince people to not sell for a while but not forever. Steemit has no value.

Do you want proof of this hypothesis ? Look at your post. Do you think that you are right on this about OTC. The fact is that you are not. Look at your reward for this post. Almost 800$. Do you think that your post is 800$ worth.

I can show you another example. Look at the guy who made almost 60k $ by posting nonsense "steem trading" spam. He produce same type of spam every day. Where is the authority to stop this guy? Nowhere.

How do I know that guy is spammer. I know because trading is my day job for more than 8 years, and his posts are about "trading" :) :) :) . Almost every single steemian knows that guy is a spammer. People are re-steeming and up-voting his posts every day. Even whales are involved :). Very nice example that steemit has no chance.

Simple question at the and. Are you willing to pay real money for same content as you see on the steemit every day?

If No , then steemit has real problem. It is better to power down or force people to think about their behavior. Not forcing them to use different cash out method. This doesn't make any sense.

This is great Charlie! I have not sold any Steem but I did not know about the Bitshares option. Thank you for the education!