South Africa's Looming Digital Retail Revolution

Advances in Technology have fundamentally changed the way we interact and experience the world and will continue to do so for the foreseeable future. Nowhere is this more evident than in the American retail sector where a once small online book retailer founded in 1994 has in just over two decades transformed itself into one of the most valuable retailers in the world and overtaken the retail behemoth Walmart in the process. The retailer in question is none other than Amazon.

Amazon is a case study on how businesses that embrace technology win and win big they have. Amazon has continued to gain market share while many of its rivals are shutting their doors in an increasingly difficult trading environment globally.

To its credit Walmart has responded to this new threat by strengthening its online presence and offer through a host of business acquisitions which include the purchase of online retailers Jetmart.com ,Shoebuy, Moosejaw Mountaineering, Backountry travel and Madcloth to name a few. The question will be asked however, is Walmart actually innovating or just throwing money at the problem in the hope that it will catch up to its rival. Whatever the answer, its first quarter results seem to suggest that its plan is working.

Investment in ecommerce, and by in large innovation, is no longer a luxury for businesses it is now a necessity for survival. The question therefore has to be asked, can retailers in South Africa learn a thing or two from the digital retail revolution currently going on in the United States?

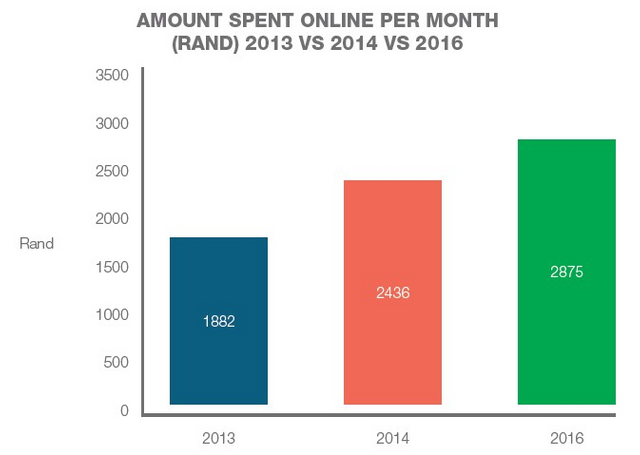

According to a September 2016 research report conducted by the market research group Urban Studies it was found that Americans and Britons do 13.9% and 16.8% of their total retail spending online respectively. In comparison South Africans only spend 1.2% of their total retail spend, which is estimated to be worth R900 billion, online. This number when looked at in isolation is not compelling but when coupled with the fact, according to this same report, that online shopping has increased in both volume and value when comparing online shopping levels from 2014 which were sitting at 39% at an average spend of R1875 to those in 2016 sitting at 43% at an average spend of R2875, it is clear that online shopping use and value is on an upward trajectory.

(Picture courtesy of Urban Studies)

The study also found that the main benefits that its respondents tied with online shopping included: Convenience; Variety of Choices; Price/Product Comparisons/Cheaper Price; The ability to shop after hours; Faster & Free Delivery and not having to deal with out of stocks

While SA online shopping may not be at the lofty heights of more developed countries it is growing, albeit very slowly. There are a number of reasons why the growth of online has not been adopted at the same rate of our international retail counterparts. Some of these include:

· Low internet connectivity levels amongst low to middle income families due to high data costs

· Safety concerns when shopping online(Credit Card/Security Risks)

· Not being able to interact with the product

· Uncertainty around quality/size of the product

· The Fear of having the wrong product size delivered

· Problems exchanging goods

· Long/Delayed/Inaccurate delivery lead times

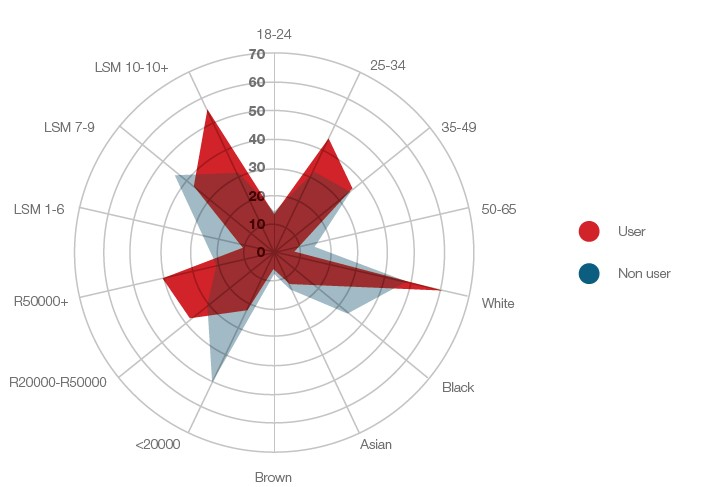

All these factors have led to a homogenization of the shopping profile of the average South African online consumer,as seen below:

(Picture courtesy of Urban Studies)

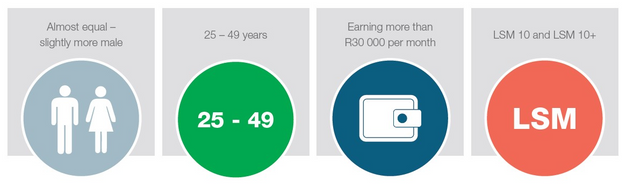

In summary the average online shopper in South Africa will more often than not be a white South African citizen who earns more than R30 000 per month classified in the LSM 10-10+ range.

(Picture courtesy of Urban Studies)

According to the national census of 2011 South Africas white populace makes up only 8.89% of the South African population.Taking this into consideration it is no wonder that SA’s number of online shoppers is low as the majority of its populace which are black citizens (79.2%) do not use this retail channel due to a mixture of external factors, buying culture and general skepticism around online shopping.

Despite this experts in the online retail space, such as Efi Dahan, General Manager of PayPal in Israel and Africa, forsee a rise in the online spending patterns of South Africans. Many factors have been cited for this optimism, but the main factors that will drive this growth are a predicted change in both the demographic and the adoption rate of the average SA online consumer in the future owing to the following conditions being present:

· Data prices in South Africa continuing to fall

· Greater rates of smart phone penetration in the SA market

· The number and spending power of SA black middle class continuing to rise and

· Greater numbers of tech Savvy millennials entering the SA work force

While this is good news, SA retailers cannot afford to sit back and wait for conditions to improve or, worse yet, have an African version of Amazon spring up and shock them into action. Although online sales make up a small percentage of sales in SA, SA retailers can start to leverage SA’s strong culture of in-store shopping and obsession with malls and integrate this with an online experience in an effort to start to build a trust relationship with their customers that makes it easier for their customers to start making use of their respective online retail channels.

A practical and personal example of this would be the fact that on a recent shopping trip to Mr Price I was pleasantly surprised by a small till point change it had introduced. The store in question had taken the hassle and stress out of a shopping pet peeve of mine which is having to keep a physical slip in order to return/replace an item should it be faulty/unsuitable. To my glee it replaced this archaic system with an updated system whereby a digital slip of my purchases is now emailed to me directly. Although this may be considered a small and insignificant change in the midst of all the innovation currently going on in the retail space. This simple change has undoubtedly taken the stress out of an all too familiar shopping problem experienced by many a shopper and has no doubt bought goodwill with a few of its customers.

In South Africa’s ever increasingly competitive, low growth and low margin retail environment at no time has it been more important to innovate and improve the customers shopping experience in a direct and meaningful way. The online retail channel provides a clear and tangible way to do this and should not be neglected.

So the question remains, can retailers in South Africa learn a thing or two from the digital retail revolution currently going on in the United States? It turns out a helluva lot.

The views and opinions expressed in this article are solely my own and do not express the views or opinions of my employer

Hi. I am @greetbot - a bot that uses AI to look for newbies who write good content.

I found your post and decided to help you get noticed.

I will pay a resteeming service to resteem your post,

and I'll give you my stamp of automatic approval!

Resteemed by @resteembot! Good Luck!

The resteem was payed by @greetbot

Curious?

The @resteembot's introduction post

Get more from @resteembot with the #resteembotsentme initiative

Check out the great posts I already resteemed.