How Long Until the Inevitable? – Australian Property Market Update - Week Ending 18 June 2017

I write a weekly property market update for PropertyInvesting.com, so I’m thinking about adapting some of the same content to post as a weekly update here on Steemit. If you think it’s valuable information and belongs here on Steemit, let me know and I’ll keep them coming.

If you’re not familiar with the Australian Property Market, you may want to read this post to understand the basics before preceding: “5 Facts About the Australian Property Market That Will Make You Shudder”. In case you’re not bothered about reading the full article, here are the highlights:

1. Home prices in Sydney have risen over 70% in the last five years.

That’s a lot in a short time; obviously unsustainable.

2. Australian household debt is nearly double disposable incomes.

That’s also a lot; also unsustainable.

3. Every single Aussie mortgage loan has a built-in variable rate.

Americans really shudder at this as the norm for them is a 30 year fixed rate. Aussies carry a lot of interest rate risk. When interest rates rise, households feel it immediately.

4. About 40% of Australian mortgage loans are interest-only.

They are not paying down any principle whatsoever.

5. Two out of three Australian property investors record an annual cash flow loss.

Their rental properties actually lose money. The only way they can win is if property prices continue rising. Aussies are the ultimate property speculators.

As you can probably tell, Australians love their property. Real estate investment is an obsession here. It’s a rite of passage into adulthood. If a young person can’t afford to buy where they want to live, they will rent where they want to live and invest where they can afford. To not own real estate is un-Australian.

The Latest Preliminary Auction Activity

One odd thing about the Australian property market is that houses are often auctioned off like cattle. This is especially true in Sydney and Melbourne where auctions are most popular.

The agent and seller schedule an auction on a particular day, and after about four weeks of advertising and marketing, people show up and yell out their bid. Whoever bids the highest gets the property. The aim, of course, is to get some competition between buyers. In the hot property markets of Sydney and Melbourne, it’s not uncommon for a home to be bid up hundreds of thousands or even a million or more over the seller’s reserve price.

Each week, a reporting firm called CoreLogic posts the latest auction results as reported by agents. Most auctions are scheduled on Saturday, or sometimes on Sunday. There’s a preliminary count of successful auctions that gets posted on Monday morning each week. Then on Thursday, CoreLogic posts the final tally.

The key figure is called the auction clearance rate. This is the percentage of all auctions in the city that have cleared or found a winning bidder. The auction stats are a useful measure of both supply and demand in the housing market and give a weekly snapshot of how the market is performing.

An auction clearance rate in the 70s or 80s is considered very high and tends to be associated with rising house prices. A result in the 50s or 60s is moderate and tends to point to stable or flat home price growth. Results below 50 percent are considered low and may indicate that demand is weak and prices are falling.

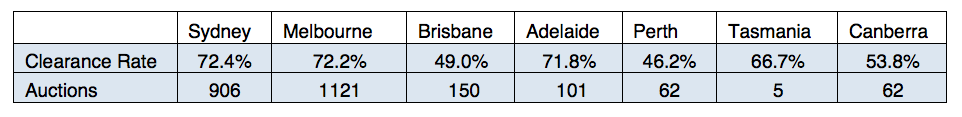

Here are the latest preliminary results for the Australian capital cities:

source

You can see from the latest preliminary results above that the Melbourne market was the busiest with 1,121 auctions held. Both Melbourne and Sydney had a similar clearance rate, although as the final numbers come in, that could change.

It’s not uncommon for the final results to be a few percentage points lower, especially in Sydney, as the agents tend to inflate the stats to build hype in the Monday morning headlines. Then when the true numbers are posted on Thursday, no one is really paying attention, so everyone believes all is still well, even clearance rates are starting to trend down.

Last Week’s Final Auction Results

In most of Australia last weekend, we were celebrating the Queen’s Birthday. Monday was a public holiday, so since a lot of people get away for a long weekend, there were very few auctions scheduled, relative to other weeks.

Here are the final results from last weekend’s auctions:

source

With supply down significantly in Melbourne, it meant that buyers were competing for a fewer number of properties, so the clearance rate rose from the previous week. In Sydney, sellers were less hesitant to auction their properties over the long weekend, so supply didn’t fall as far as in Melbourne. With buyers in Sydney having more options, the clearance rate was lower than the previous week.

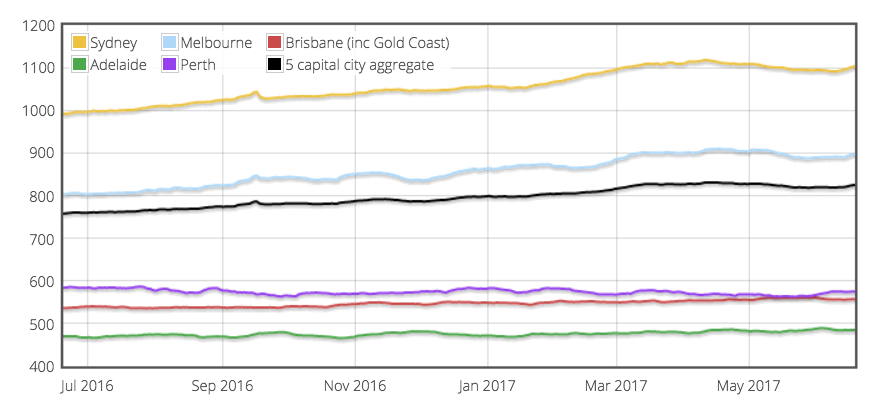

Recent Changes in House Prices

For the last few years, home prices in Sydney and Melbourne have been steadily rising. Then in April, they peaked, and started to fall slightly. Now it seems that prices are rising again in Australia’s two largest capital cities.

In Brisbane and Adelaide, home price growth is relatively flat. In Perth, prices have been falling.

The following graph shows the median house price growth in our five largest cities over the past year:

source

Here you can see the quarter-on-quarter and year-on-year price changes for the capital cities:

source

Due to a slight correction, property prices in Sydney and Melbourne are now sitting about the same place they were three months ago, although still up about 12 percent on the year.

Perth is the only city down for both the quarter and the year. The Western Australia economy has been hit hard by the mining boom, although prices are still higher there than they were in 2012 when the most recent Australia-wide property boom began.

Market Summary

source

An interesting trend has developed over the past three weeks that indicates demand for housing could be softening. The nationwide auction clearance rate has not broken above 70 percent for the last three weeks, although Melbourne and Sydney are posting results a little higher.

APRA, which is the nation’s regulatory agency keeping the banks in check, has been forcing banks to tighten up on lending to investors. Many of the investors I’m personally working with are having a harder time getting loans, and I’ve found the same to be true for myself. Having six kids does not work in your favour when you want to borrow to invest in real estate.

It’s too early to tell what will happen with home prices. It’s hard to see prices rising much higher due to the extent to which households are already swamped with mortgage debt. But with the RBA still able to lower its cash rate further, anything is possible. Plus, the typical investor’s psychology is still very much optimistic. Until the fear level rises, people who can buy will keep buying.

Thanks to Janet Yellen and Company hiking rates in the USA, the RBA has a little breathing room and can delay another rate cut until perhaps later in the year. Another thing that would have brought a spring into Philip Lowe’s step (he’s the reserve bank governor) is the Australia’s latest jobs report. It appeared stronger than expected on the surface, which breathed some new life into the Aussie Dollar. If our Dollar climbs higher though, expect a more dovish tone from the RBA moving forward.

So, where are home prices headed from here? Longer-term, it’s hard to imagine anything other than a crippling crash that will devastate debt-ridden, cash-strapped families. The timing of that, however, remains a crystal ball gazing act. At the end of the day, unless (until) something crazy happens overseas (likely in the bond market) the future of Aussie home prices is in the hands of our regulators – the RBA, APRA, and the Federal Government.

How long do you think it will be until we see a correction in Aussie home prices, and how far will prices fall?

Jason Staggers

Wow great post jasonstaggers. I just read bloomberg yestersay and i saw the credit agency has downgraded australia soverign rating because of the housing concern, but australia housing bubble has been lasting so long that it may not seen that expensive comparing to what is happening to other emerging market.

Thanks! Yes that was Moody's. S&P also downgraded some banks a few weeks ago. It will raise their wholesale funding rates and end up raising rates for borrowers, maybe 10 or 20 basis points. If that trend continues, it won't bode well for home prices.

Hey @wilkinshui how do you have the same 8 users upvote your post, the very second you post a comment, reply, ect? Thats a really stong fan base you got there ;)

That's the power of a curation trail :)

Wow that's really dumb now that voting power doesnt drop down to zero, how can we get rid of this?

Why would you want to get rid of it? It's just someone who wants to automatically upvote all of someone's posts and comments.

Well because he using a bot and having his posts jump ahead on the trending page when no one's actually reading them, thanks for letting me know about curation trails though I was pretty confused about them until now!

Australia’s property prices are on fire, Most of that growth comes from Melbourne and Sydney, which gained over 15% each

And it's been a slower year compared to 2014, 2015, 2016

I believe we will not see too much correction to the downside. Property prices also reflect the general purchasing price of the AUD which will only continue to be inflationary.

That's a great point. Thanks for bringing that up. Another possible scenario is the correction in unrealised investor and home-owner gains through a loss in buying power. Ultimately, I think that's what our regulators want to happen.

Whether through deflation of house prices or inflation in wages, the disparity between incomes and house prices will have to correct.

"Another possible scenario is the correction in unrealised investor and home-owner gains through a loss in buying power.": Please elaborate, I am having a difficulty in understanding.

Yes, where ever we read nowdays, the government is trying to press employees to force their employers for higher wages and salaries. This is total nonsense, I have been an employer for 20 years and the problem is that industry is on the limit, it's very difficult to generate good new profitable revenue, customers expect lower prices or they don't order the infrastructure investments.

If Australia does not focus on refining, vertical integration, manufacturing penetration, inhouse production depth, then it will soon be doomed to far lower revenue.

If the scenario you described plays out - let's say 3% annual growth for ten years while property prices remain flat - then all investor gains since 2012 in Sydney will be fully eroded. Property will need to keep rising at the same rate as inflation, otherwise investors will have been better off to sell now and realise their gains.

But as you mention, I think rising wages will be a very tough thing for the RBA to make happen. They can lower the cash rate but APRA would need to increase capital controls on banks to keep property from rising further. And the RBA gets a diminishing return every time they lower rates because the debt burden gets bigger.

Interesting times.

Agreed. Are you waiting for a chance to buy in cheaper if we get a few 10% cracks? I am on the look out. But jittery.

I think yields would still be too low with a 10% pull back. It all depends on interest rates really. It would take a lot more than that for me to buy for capital growth. It could mean there are more subdivision deals that stack up though.

Thanks for the info @jasonstaggers. Your time to reply is highly appreciated.

This is great to know, thank you it was most interesting as my sister has moved down under!

Thanks Gina

Great post! It is interesting to learn how different the housing market is in Australia compared to the US, from the auctioning to the financing. I can't imagine getting into an Adjustable Rate Mortgage now, or having an interest only loan!

It is crazy how different the Aussie mindset toward real estate is. We never had our 2008. It's been 26 years with no recession in Australia.

Unfortunately, I believe you might be headed towards yours. In the US, most people have completely forgotten about 2008. We are in an even bigger bubble now than we were then, but no one seems to notice or care.

Westpac is lowering interest rates for principal and interest loans. Hopefully other banks would follow to encourage owner occupiers.

http://www.news.com.au/finance/business/banking/westpac-drops-rates-for-owneroccupiers-paying-off-principal-and-interest-on-their-home-loans/news-story/eb8922158183281507cced892036f68a

Thanks for the link. I expect all the banks to move that direction. It's really APRA who is putting the pressure on them to shift their balance sheet more toward the owner occupier market.

Great post Jason - I started preparing for a property market and stock market (especially US led) crash basically in January - believe we are at the beginning of it now. Your post does more to confirm that. Thank you. SK. (Resteemed)

Thanks sirknight. You're a smart man. Appreciate all of your support.

@jasonstaggers great post mate keep on posting great content

Thanks :)

hopefully prices fall on the property market while Steem rises, will finally be able to afford something more than a rental

You're not alone. A lot of people in the same situation as you.

I recently moved to Sydney (coming from Europe) and I did get a massive surprise when I noticed the cost of buying a house!

Excellent post Jason! Thanks and do keep them coming, very informative.

Thanks for that ant.facts. Appreciate you stopping by :)